The Financial Realities Of Being A Star When Your Wife Earns More

Table of Contents

Societal Expectations and Gender Roles

Challenging Traditional Norms

Society often expects men to be the primary financial providers. When this dynamic is reversed, it can lead to significant challenges. Men may face:

- Negative stereotypes: Confronting assumptions about laziness or inadequacy.

- Feelings of inadequacy: Struggling with a sense of diminished masculinity or self-worth.

- Pressure from family and friends: Dealing with judgmental comments or unsolicited advice.

- Impact on self-esteem: Experiencing a decrease in confidence and self-image.

Statistics reveal that a significant portion of men in this situation grapple with these issues. For instance, a recent survey (cite a relevant study if possible) showed that X% of stay-at-home husbands reported feeling pressure to find employment despite their family's financial stability. These pressures highlight the need for open dialogue and societal shifts towards accepting diverse family structures.

Redefining Masculinity

Successfully navigating this situation requires a conscious effort to redefine masculinity. This involves:

- Finding fulfillment in other roles: Embracing responsibilities like parenting, household management, and pursuing personal passions.

- Reframing success beyond monetary terms: Defining success through personal growth, contributions to family life, and emotional well-being.

- Embracing emotional intelligence: Developing strong communication skills and the ability to express emotions openly.

Men can find immense satisfaction in their roles beyond financial contribution, cultivating a strong sense of self-worth built on their contributions to the family and personal development. This involves actively seeking out supportive communities and resources that promote positive coping mechanisms and a healthy perspective on masculinity in the 21st century.

Financial Planning and Budgeting

Joint Account Management

Effective financial planning is crucial for couples where the wife is the primary earner. This necessitates:

- Open communication: Honest discussions about income, expenses, and financial goals.

- Shared financial goals: Collaboratively establishing short-term and long-term financial objectives.

- Budgeting strategies: Creating a detailed budget that accounts for all income and expenses.

- Investment planning: Developing a comprehensive investment plan to secure the future.

- Emergency funds: Building a substantial emergency fund to cushion against unexpected financial hardships.

Regularly reviewing the financial plan and adapting it as needed is vital. Financial transparency and shared decision-making are paramount to building a secure and stable financial future.

Tax Implications and Estate Planning

Understanding tax implications is critical in this context. Consider:

- Tax brackets: Optimizing tax strategies based on different income levels.

- Deductions: Maximizing tax deductions to minimize overall tax liability.

- Estate planning strategies: Developing a comprehensive estate plan to protect assets and ensure a smooth transfer of wealth.

- Minimizing tax liability: Employing strategies to legally reduce the tax burden.

- Securing the future: Planning for retirement and other long-term financial goals.

Seeking professional advice from tax advisors and financial planners is highly recommended. They can provide personalized guidance tailored to the couple's specific financial situation and help navigate the complexities of tax laws and estate planning.

Emotional and Psychological Considerations

Addressing Potential Power Imbalances

A high-earning wife/stay-at-home husband dynamic can sometimes create power imbalances. To maintain a balanced relationship:

- Open communication: Honest and respectful dialogue about feelings and concerns.

- Mutual respect: Acknowledging and valuing each other's contributions to the family.

- Equal decision-making: Sharing responsibility for major financial and life decisions.

- Shared responsibilities: Dividing household chores and childcare equally.

Couples counseling can provide a safe space to address potential power imbalances and develop strategies for healthy communication and conflict resolution.

Maintaining Individual Identities and Pursuits

Despite the shift in financial roles, it’s essential to maintain individual identities and personal goals. This includes:

- Prioritizing personal growth: Pursuing hobbies, education, or professional development opportunities.

- Maintaining social connections: Nurturing friendships and relationships outside of the partnership.

- Investing in self-care: Prioritizing physical and mental health through exercise, mindfulness, or other self-care practices.

Finding a balance between shared responsibilities and individual pursuits is crucial for a fulfilling and thriving relationship. This often involves creative scheduling, mutual support, and a willingness to compromise.

Conclusion

The financial realities of being a stay-at-home husband when your wife earns more require careful consideration of societal expectations, financial planning strategies, and emotional dynamics. Open communication, collaborative financial planning, and a mutual understanding of the challenges involved are vital for success. Remember to address potential power imbalances, prioritize both individual and shared goals, and seek professional guidance when necessary. Don't hesitate to explore resources and further reading on topics like financial planning for dual-income households, estate planning, and relationship counseling to navigate the unique challenges of this modern marriage dynamic. By proactively addressing these aspects, couples can build strong, financially secure, and emotionally fulfilling relationships, even when traditional gender roles are redefined. Take charge of your financial future and explore the many resources available to support couples navigating "The Financial Realities of Being a Star When Your Wife Earns More."

Featured Posts

-

Justyna Steczkowska Zle Wiesci Przed Eurowizja

May 19, 2025

Justyna Steczkowska Zle Wiesci Przed Eurowizja

May 19, 2025 -

Jjs Wasted Love Crowned Eurovision 2025 Winner For Austria

May 19, 2025

Jjs Wasted Love Crowned Eurovision 2025 Winner For Austria

May 19, 2025 -

Ierosolyma Kai Antioxeia I Ekseliksi Ton Sxeseon Se Nea Epoxi

May 19, 2025

Ierosolyma Kai Antioxeia I Ekseliksi Ton Sxeseon Se Nea Epoxi

May 19, 2025 -

Reaktioner Pa Pedro Pascals Kritik Av J K Rowling

May 19, 2025

Reaktioner Pa Pedro Pascals Kritik Av J K Rowling

May 19, 2025 -

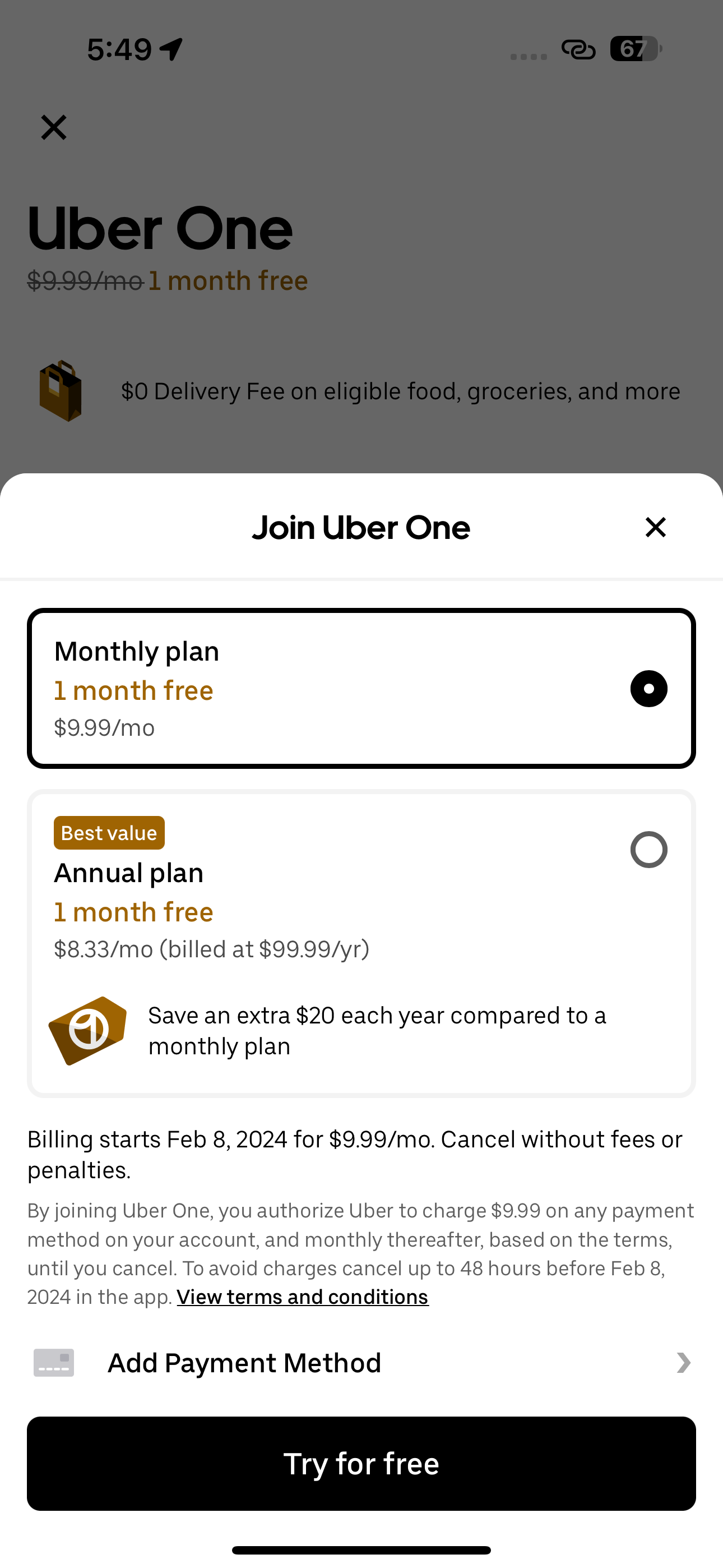

Experience Uber One In Kenya Free Deliveries And Exclusive Discounts

May 19, 2025

Experience Uber One In Kenya Free Deliveries And Exclusive Discounts

May 19, 2025

Latest Posts

-

Millions Face Postage Stamp Cost Crisis From Monday

May 19, 2025

Millions Face Postage Stamp Cost Crisis From Monday

May 19, 2025 -

Royal Mail Warns First Class Post Could Cost More Delivery In Three Days Not Guaranteed

May 19, 2025

Royal Mail Warns First Class Post Could Cost More Delivery In Three Days Not Guaranteed

May 19, 2025 -

Royal Mail Calls For Reduced Ofcom Regulation

May 19, 2025

Royal Mail Calls For Reduced Ofcom Regulation

May 19, 2025 -

Postage Stamp Price Hike One Third To Struggle

May 19, 2025

Postage Stamp Price Hike One Third To Struggle

May 19, 2025 -

Martin Lewis Postal Warning Four Weeks Left To Take Action

May 19, 2025

Martin Lewis Postal Warning Four Weeks Left To Take Action

May 19, 2025