The Forerunner's Dilemma: Exploring Options When An IPO Isn't Imminent

Table of Contents

Re-evaluating the IPO Timeline: Identifying Roadblocks and Opportunities

The path to an IPO isn't always linear. Several factors can delay the process, creating what we call the Forerunner's Dilemma. Understanding these roadblocks is the first step to formulating a strategic response.

Factors delaying an IPO can include:

- Insufficient revenue growth: Failing to meet projected revenue targets can significantly impact investor confidence and delay IPO plans. This requires a thorough analysis of your revenue streams and strategies for accelerating growth.

- Unfavorable market sentiment: Economic downturns, industry-specific challenges, or broader market volatility can create an unfavorable environment for IPOs. Timing is critical in this case.

- Need for further product development: A product that isn't fully developed or lacks market validation may deter investors. Focusing on product-market fit and iterative development is key.

- Regulatory compliance issues: Meeting all necessary regulatory requirements can be a lengthy and complex process. Proactive compliance planning is essential.

- Weak financial performance: Consistent losses, high debt levels, or inefficient operations can make a company unattractive to potential investors. Financial health is paramount.

However, these delays also present opportunities for strategic adjustments. Companies facing the Forerunner's Dilemma can use this time to:

- Improve financials: Implement cost-cutting measures, boost revenue streams, and enhance profitability.

- Strengthen the team: Recruit key talent, develop leadership capabilities, and foster a strong company culture.

- Refine the product: Address shortcomings, enhance user experience, and increase market competitiveness.

Alternative Funding Strategies: Beyond Venture Capital and Private Equity

While venture capital and private equity are common funding sources, they aren't the only options for companies facing the Forerunner's Dilemma. Several alternative funding strategies can provide the necessary capital to continue growth and prepare for a future IPO.

Consider these alternatives:

- Debt Financing: Bank loans, mezzanine financing, and revenue-based financing offer capital without equity dilution but come with interest payments. Mezzanine financing, a hybrid of debt and equity, can be particularly appealing in this context.

- Strategic Partnerships: Joint ventures and licensing agreements can provide access to new markets, technologies, and resources. This can bolster your value proposition prior to an IPO.

- Crowdfunding: Equity crowdfunding allows you to raise capital directly from the public, while rewards-based crowdfunding can generate early revenue and build brand awareness.

- Government Grants & Incentives: Research grants and tax credits can provide crucial funding, especially for companies in high-growth sectors.

- Revenue-based financing: This increasingly popular option provides funding based on a percentage of future revenue, reducing the pressure of immediate repayment.

Each funding option has its pros and cons regarding dilution, control, and interest rates. Carefully weigh these factors when choosing the best strategy for your specific circumstances.

Strategic Acquisitions and Mergers: A Path to Liquidity

Being acquired by a larger company offers a potential path to liquidity for founders and investors, even without an immediate IPO. This can resolve the Forerunner's Dilemma by offering a swift exit strategy.

Potential Benefits:

- Accelerated growth: Access to the acquirer's resources and market presence can rapidly expand your market share.

- Access to resources and technologies: Leverage the acquirer's expertise, technology, and infrastructure.

- Enhanced brand recognition: Benefit from the acquirer's established brand reputation and customer base.

- Immediate liquidity: Receive immediate financial returns for your equity stake.

Potential Drawbacks:

- Loss of autonomy: You'll relinquish control over your company's direction.

- Cultural integration challenges: Merging different corporate cultures can be difficult and disruptive.

The M&A process involves due diligence, negotiation strategies, and a thorough valuation process. Seeking expert advice is crucial to ensure a favorable outcome.

Optimizing Operations for Long-Term Growth and Enhanced IPO Readiness

Even without an imminent IPO, focusing on operational efficiency and long-term growth strengthens your company's value and attractiveness to future investors. This proactive approach addresses the core of the Forerunner's Dilemma.

Key Strategies:

- Cost optimization: Identify and eliminate unnecessary expenses to improve profitability.

- Revenue diversification: Reduce reliance on single revenue streams and explore new market opportunities.

- Talent acquisition and retention: Build a strong team to drive growth and innovation.

- Strengthen corporate governance: Ensure transparency and compliance to enhance investor confidence.

- Improve key performance indicators (KPIs): Focus on metrics relevant to IPO readiness, such as revenue growth, profitability, and customer acquisition cost.

Maintaining Investor Confidence During the "Forerunner's Dilemma"

Transparent communication with investors is paramount during this phase. Regular updates on the company's progress, strategic shifts, and financial performance are vital for maintaining trust and confidence. Proactive communication can significantly mitigate the risks associated with the Forerunner's Dilemma. Highlighting continuous improvement and demonstrating a clear path forward are key to reassuring investors.

Conclusion

The "Forerunner's Dilemma" presents challenges but also opportunities for strategic growth. By exploring alternative funding, considering M&A opportunities, and optimizing operations, companies can navigate this phase effectively. Remember, while an IPO might not be imminent, strategic planning and proactive management can pave the way for future success. Don't let the Forerunner's Dilemma stall your progress – proactively explore your options and chart a course towards your ultimate goals. Consider seeking expert advice to effectively tackle your specific Forerunner's Dilemma and make informed decisions regarding your pre-IPO strategy.

Featured Posts

-

Suits La Premiere Unraveling The Season Finales Twist

May 14, 2025

Suits La Premiere Unraveling The Season Finales Twist

May 14, 2025 -

Hohburkersdorf Lagebericht Entwarnung Fuer Die Saechsische Schweiz Osterzgebirge

May 14, 2025

Hohburkersdorf Lagebericht Entwarnung Fuer Die Saechsische Schweiz Osterzgebirge

May 14, 2025 -

Nigerias World Cup Qualification Musas Urgent Plea

May 14, 2025

Nigerias World Cup Qualification Musas Urgent Plea

May 14, 2025 -

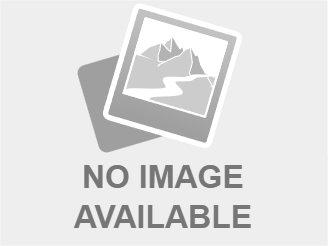

How Every Mlb Team Can Reach The 2025 Playoffs A Realistic Roadmap

May 14, 2025

How Every Mlb Team Can Reach The 2025 Playoffs A Realistic Roadmap

May 14, 2025 -

Il Duro Scontro Tra Alessia Marcuzzi E Mara Venier Reazioni Indignate

May 14, 2025

Il Duro Scontro Tra Alessia Marcuzzi E Mara Venier Reazioni Indignate

May 14, 2025