The FTC's Antitrust Claims Against Meta: Analyzing The WhatsApp And Instagram Acquisitions

Table of Contents

The FTC's Case Against Meta's Acquisition of WhatsApp

Allegations of Stifling Competition

The FTC argues that Meta's acquisition of WhatsApp in 2014 was an anti-competitive move designed to eliminate a potential competitor in the mobile messaging market. The core of their argument centers on the idea that WhatsApp posed a significant threat to Facebook Messenger's market dominance.

- WhatsApp posed a significant threat to Facebook Messenger's market share: At the time of the acquisition, WhatsApp boasted a rapidly expanding user base, presenting a credible challenge to Facebook Messenger's hegemony.

- The acquisition prevented the development of a robust competitive landscape in mobile messaging: By eliminating a major competitor, Meta allegedly prevented the emergence of a more diverse and innovative mobile messaging ecosystem. This lack of competition potentially stifled innovation and reduced consumer choice.

- Meta leveraged its market power to eliminate a potential challenger: The FTC asserts that Meta, with its substantial resources and existing market dominance, used its power to acquire WhatsApp, preventing a fair and open competition.

Impact on Consumers

The FTC contends that the WhatsApp acquisition ultimately harmed consumers by limiting innovation and potentially leading to higher prices or reduced features.

- Less competition can lead to stagnant innovation and fewer choices for users: A less competitive market can result in reduced incentives for innovation, potentially leading to fewer choices and less compelling features for users.

- Users might face higher costs or reduced quality of service: Without the pressure of competition, a dominant player might be less inclined to invest in improving service or keeping prices competitive.

- The elimination of a strong competitor prevented the development of better features: The competition between Facebook Messenger and WhatsApp could have potentially spurred significant improvements and innovation in mobile messaging technology, benefits that consumers were deprived of due to the acquisition.

The FTC's Case Against Meta's Acquisition of Instagram

Allegations of Monopolization

The FTC similarly claims that Meta's acquisition of Instagram in 2012 was a strategic move to neutralize a growing rival in the photo-sharing and social networking market.

- Instagram was a rapidly growing competitor to Facebook: At the time of the acquisition, Instagram's user base was expanding rapidly, representing a potential threat to Facebook's dominance in the social media landscape.

- The acquisition prevented Instagram from becoming a significant threat to Facebook's dominance: By acquiring Instagram, Meta allegedly preemptively eliminated a major potential competitor that could have eroded its market share.

- This acquisition further consolidated Meta's market power: This acquisition, coupled with the WhatsApp acquisition, allowed Meta to significantly consolidate its power and control within the social media market.

Impact on Innovation

The FTC argues that the Instagram acquisition stifled innovation by removing a strong, independent competitor that could have pushed for better features and services.

- Reduced competition leads to less incentive for innovation: Without the pressure of competition, Meta had less incentive to continually improve its platforms and offer innovative features.

- Consumers may have missed out on innovative features and services: A thriving competitive environment often results in faster technological advancement and better services for consumers, something the FTC argues was impeded by the acquisition.

- The acquisition may have led to less diverse offerings in the social media landscape: The elimination of a strong independent competitor like Instagram potentially reduced the diversity of offerings in the social media market.

Legal Arguments and Potential Outcomes

Antitrust Laws and Precedents

The FTC's case relies heavily on established antitrust laws designed to prevent monopolies and promote competition, primarily the Sherman Act and Clayton Act. The success of the case hinges on demonstrating that the acquisitions substantially lessened competition.

- Sherman Act and Clayton Act are central to the FTC’s case: These acts prohibit anti-competitive practices, such as mergers that create monopolies.

- Previous antitrust cases involving tech giants will influence the outcome: Precedents set in previous antitrust cases, particularly those involving large technology companies, will significantly influence the judge's decision.

- Expert testimony on market dynamics and competitive effects: The case will likely involve extensive expert testimony concerning market dynamics, competitive effects, and the impact of the acquisitions on consumers.

Potential Outcomes and Implications

The potential outcomes of this lawsuit are significant and far-reaching. They could include:

- Divestiture: The court might order Meta to divest itself of either WhatsApp or Instagram, effectively unwinding the acquisitions.

- Fines and other penalties for anti-competitive behavior: Meta could face substantial financial penalties for violating antitrust laws.

- Setting a precedent for future antitrust cases involving large tech companies: The outcome will significantly influence how regulators approach future mergers and acquisitions in the technology sector, impacting future antitrust enforcement.

Conclusion

The FTC's antitrust claims against Meta concerning its acquisitions of WhatsApp and Instagram are crucial for understanding the ongoing debate surrounding the power and influence of large technology companies. The allegations of stifling competition and harming consumers raise important questions about the impact of mega-mergers on the digital landscape. The outcome of this case will have far-reaching consequences, setting a precedent for future antitrust enforcement and influencing how regulators approach mergers and acquisitions in the tech industry. Understanding the FTC's antitrust claims against Meta, and the details surrounding the WhatsApp and Instagram acquisitions, is crucial for anyone concerned about maintaining a competitive and innovative social media environment. Stay informed about developments in this crucial case regarding FTC antitrust laws and the future of Meta's acquisitions.

Featured Posts

-

Informe Sobre La Salud De Jose Mujica Cuidados Paliativos Y Su Familia

May 14, 2025

Informe Sobre La Salud De Jose Mujica Cuidados Paliativos Y Su Familia

May 14, 2025 -

Is Kanye West Moving On New Romance Rumors Surface

May 14, 2025

Is Kanye West Moving On New Romance Rumors Surface

May 14, 2025 -

Indulge Your Senses Lindt Opens In Central London

May 14, 2025

Indulge Your Senses Lindt Opens In Central London

May 14, 2025 -

Global Trade Wars Chill Tech Ipo Market

May 14, 2025

Global Trade Wars Chill Tech Ipo Market

May 14, 2025 -

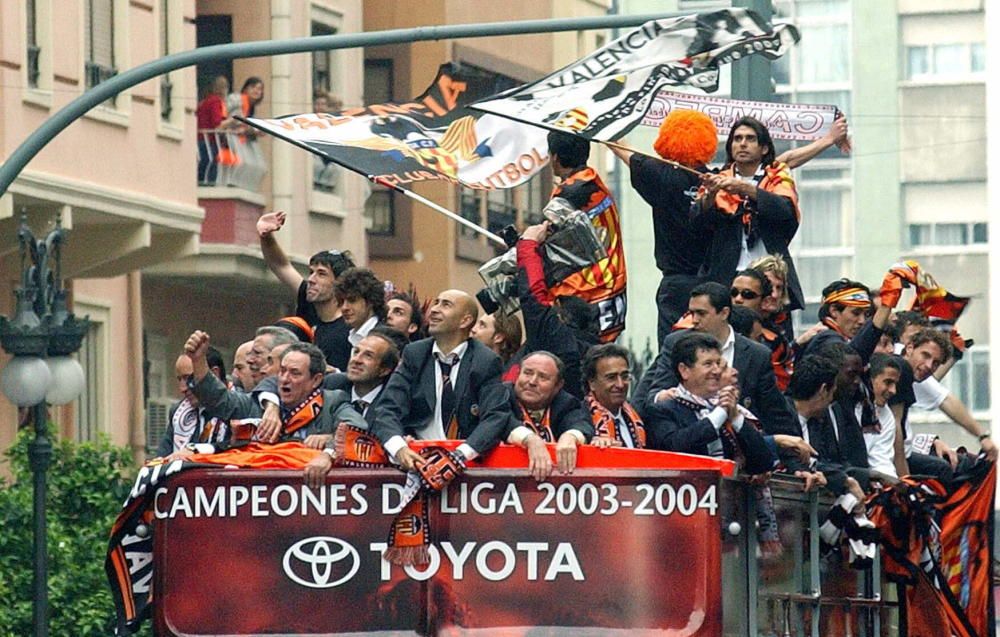

5 Clasicos Inolvidables Valencia Sevilla

May 14, 2025

5 Clasicos Inolvidables Valencia Sevilla

May 14, 2025