The Future Of Canada: Addressing Over-reliance On U.S. Investment

Table of Contents

The Current State of U.S. Investment in Canada

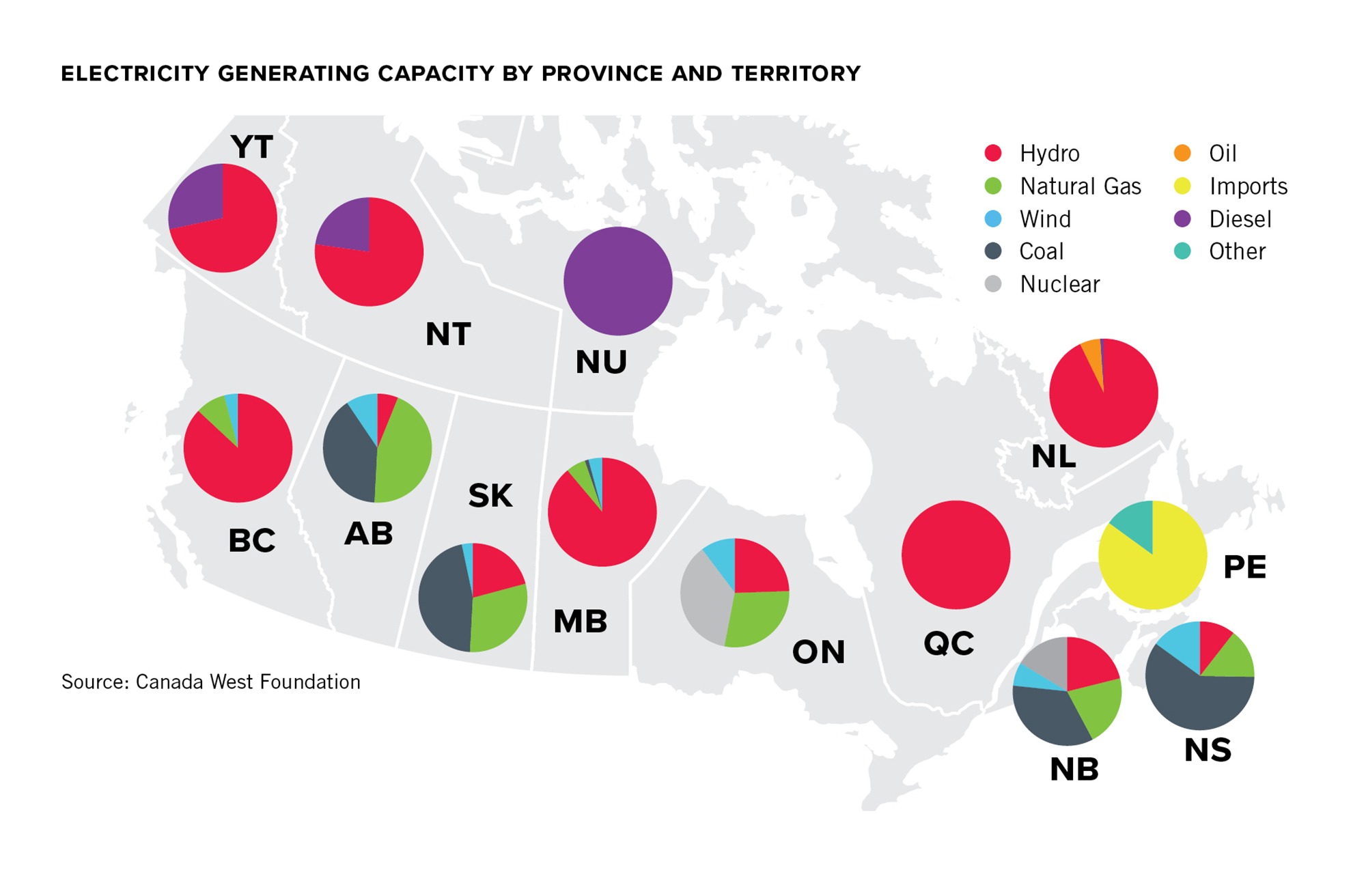

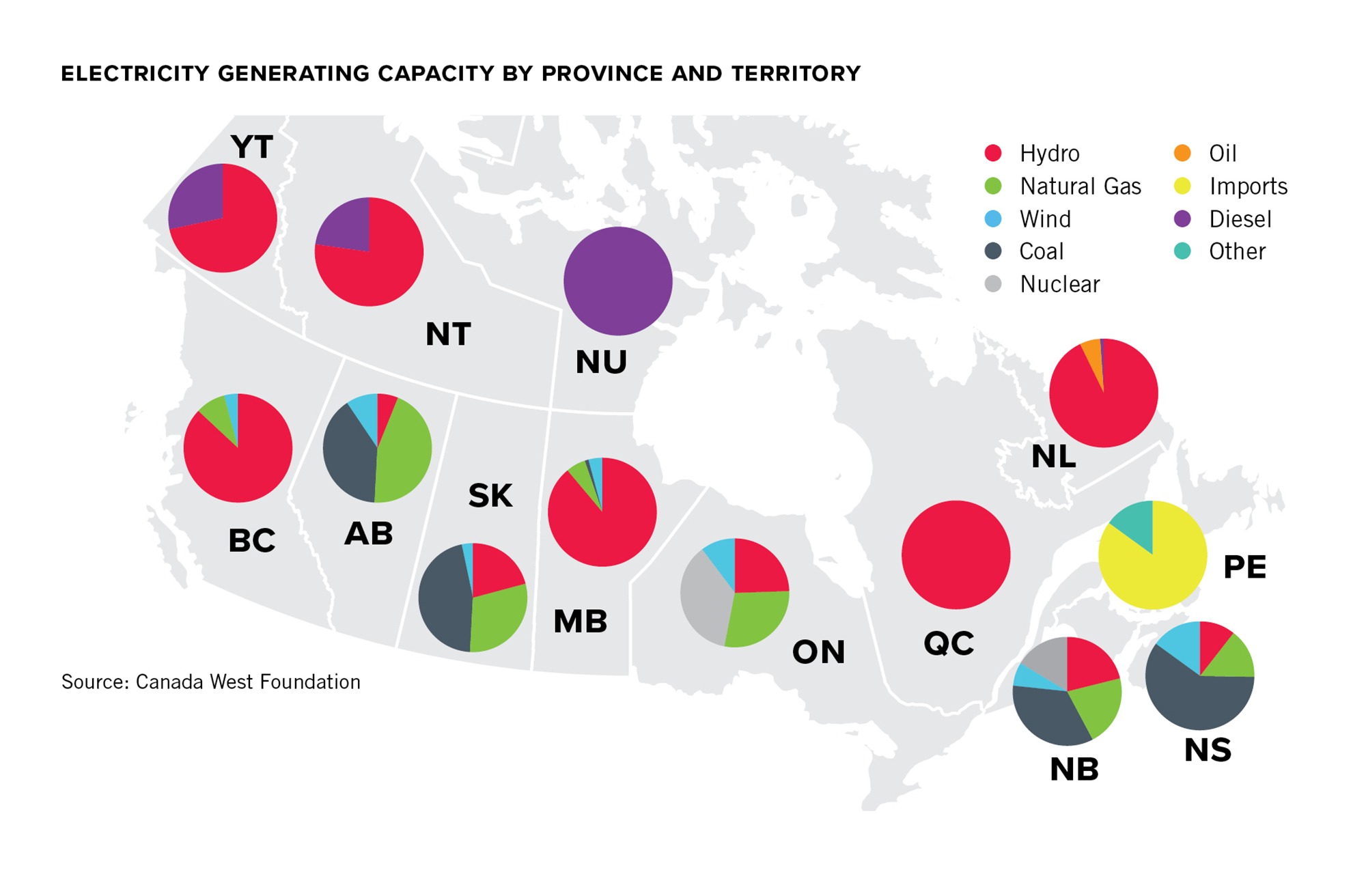

U.S. investment plays a significant role in the Canadian economy, particularly in key sectors like energy, finance, and technology. This substantial influx of capital fuels economic growth, creates jobs, and contributes significantly to Canada's GDP. However, understanding the extent of this reliance is crucial for future planning.

Statistics paint a clear picture: U.S. investment accounts for a substantial percentage of total foreign direct investment (FDI) in Canada. This impact manifests in various ways, from boosting GDP growth to creating numerous high-paying jobs across diverse industries. For example, the energy sector, a cornerstone of the Canadian economy, heavily relies on U.S. investment in exploration, extraction, and infrastructure development. Similarly, the Canadian financial services industry sees considerable participation from U.S. financial institutions.

- Percentage of foreign investment originating from the U.S.: While the exact percentage fluctuates, a significant portion of foreign investment in Canada consistently originates from the U.S., making it a dominant player.

- Key sectors heavily reliant on U.S. investment: Energy, finance, technology, and manufacturing are key sectors heavily reliant on U.S. investment.

- Examples of major U.S. companies operating in Canada: Numerous Fortune 500 companies have significant operations in Canada, demonstrating the scale of U.S. investment and its integration into the Canadian economic fabric.

Risks Associated with Over-reliance on U.S. Investment

While U.S. investment has undeniably fueled Canadian economic growth, an over-reliance presents significant economic and political vulnerabilities. Dependence on a single major investor creates exposure to economic downturns in the U.S., potentially triggering ripple effects throughout the Canadian economy. Trade disputes between the two countries could also negatively impact Canadian businesses reliant on U.S. markets and investment.

- Impact of U.S. economic recessions on the Canadian economy: Historical data reveals a strong correlation between U.S. recessions and economic slowdowns in Canada, highlighting the interconnectedness of the two economies.

- Potential negative effects of U.S. trade policies on Canadian businesses: Changes in U.S. trade policies can significantly impact Canadian businesses exporting to the U.S. or relying on U.S. supply chains.

- Examples of past economic challenges stemming from U.S. investment fluctuations: Examining past periods of reduced U.S. investment in Canada demonstrates the potential negative consequences for economic growth and employment.

Strategies for Diversifying Investment Sources

Mitigating the risks associated with over-reliance on U.S. investment requires a proactive approach to diversify investment sources. This involves actively attracting investment from other countries in Asia, Europe, and beyond, while simultaneously fostering domestic investment and entrepreneurship. Government policies play a crucial role in this endeavor.

- Targeted investment promotion campaigns in key international markets: Canada needs to actively market itself as an attractive investment destination to potential investors globally.

- Government initiatives supporting Canadian startups and small businesses: Strong domestic investment is key. Government support for innovation and entrepreneurship creates a more resilient and less externally dependent economy.

- Incentives for foreign direct investment from diverse geographical regions: Tax incentives, streamlined regulations, and other attractive policies can incentivize FDI from various sources.

Promoting Innovation and Technology to Attract Global Investment

Investing in research and development (R&D) is paramount to attracting technology-focused investments. A robust R&D ecosystem, coupled with a highly skilled workforce, makes Canada a more appealing destination for innovative companies seeking growth opportunities. Investing in education and training programs that produce a highly skilled workforce is crucial to compete globally for high-value investment.

Strengthening Canada's Global Economic Partnerships

Strengthening trade agreements and fostering closer economic ties with countries beyond the U.S. is another crucial element of diversification. This involves actively pursuing new trade deals and engaging in collaborative initiatives with international organizations to expand market access and attract diverse investment streams.

Conclusion

Over-reliance on U.S. investment in Canada presents significant risks to the nation's long-term economic stability. The potential negative impacts of U.S. economic downturns and trade policy shifts necessitate a strategic shift towards diversification. By implementing the strategies outlined above – actively seeking investment from diverse global sources, fostering domestic innovation, and strengthening international partnerships – Canada can build a more resilient and diversified economy. Investing in diversification strategies related to U.S. investment in Canada is crucial for the nation's future economic security. The future of Canadian prosperity depends on proactively addressing this dependence and building a more balanced and robust economic foundation.

Featured Posts

-

Bring Her Back Trailer Sally Hawkins Terrifies In Talk To Me

May 29, 2025

Bring Her Back Trailer Sally Hawkins Terrifies In Talk To Me

May 29, 2025 -

Could Jonathan Tah Be Manchester Uniteds Next Defensive Signing

May 29, 2025

Could Jonathan Tah Be Manchester Uniteds Next Defensive Signing

May 29, 2025 -

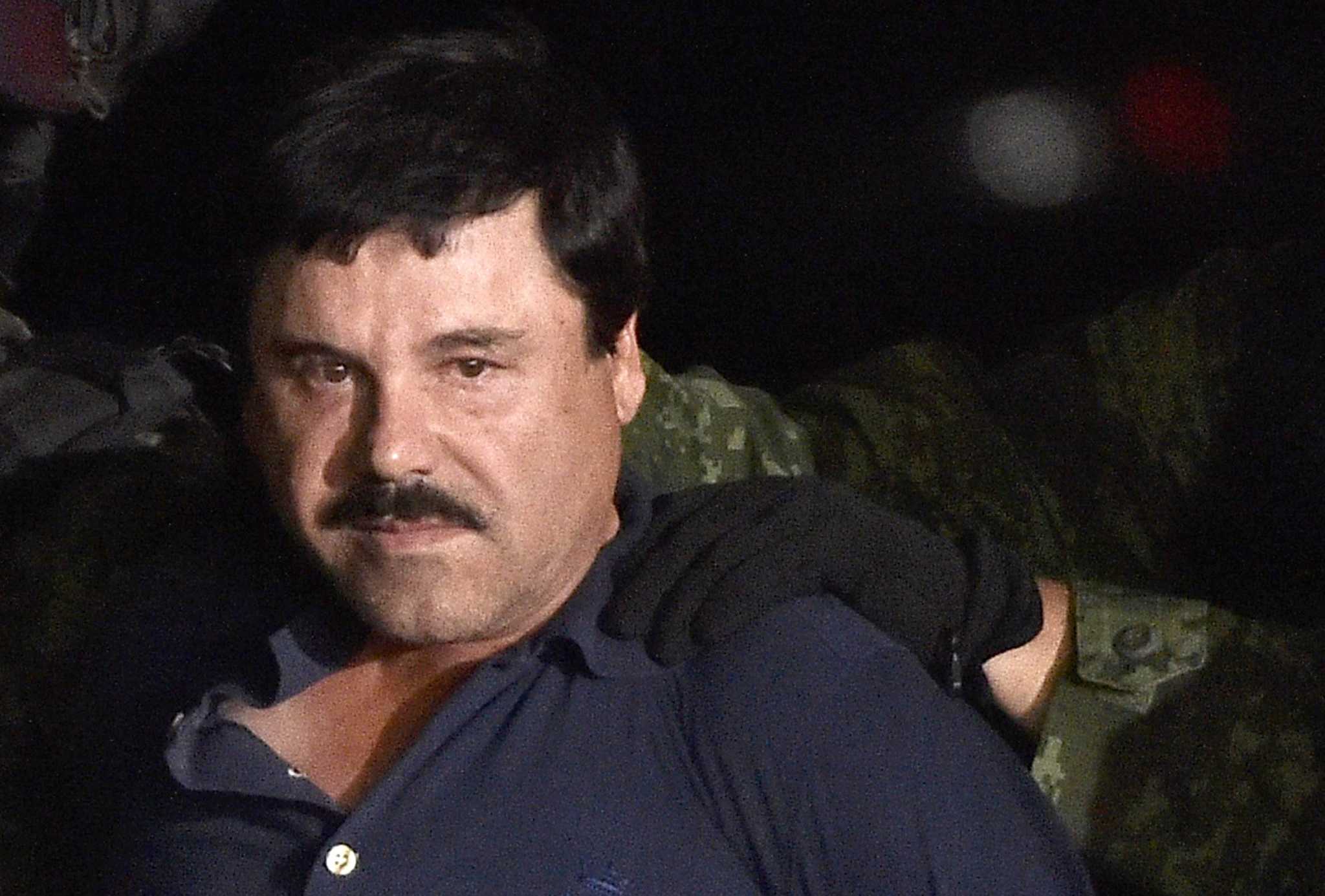

Us Prosecutors Spare El Chapos Son The Death Penalty

May 29, 2025

Us Prosecutors Spare El Chapos Son The Death Penalty

May 29, 2025 -

Pulheim Grossbaustellen Und Verkehrsbehinderungen

May 29, 2025

Pulheim Grossbaustellen Und Verkehrsbehinderungen

May 29, 2025 -

Real Madrid Mbappe Vinicius Jr E Mais Dois Jogadores Sob Investigacao Da Uefa

May 29, 2025

Real Madrid Mbappe Vinicius Jr E Mais Dois Jogadores Sob Investigacao Da Uefa

May 29, 2025

Latest Posts

-

Bernard Kerik A Look At His Family Life With Hala Matli And Their Children

May 31, 2025

Bernard Kerik A Look At His Family Life With Hala Matli And Their Children

May 31, 2025 -

Unattributed Banksy The Paintings Provenance And Upcoming Auction

May 31, 2025

Unattributed Banksy The Paintings Provenance And Upcoming Auction

May 31, 2025 -

Investigating A Reported Banksy In Westcliff Bournemouth

May 31, 2025

Investigating A Reported Banksy In Westcliff Bournemouth

May 31, 2025 -

Death Of Bernard Kerik Remembering The 9 11 Nyc Police Commissioner

May 31, 2025

Death Of Bernard Kerik Remembering The 9 11 Nyc Police Commissioner

May 31, 2025 -

A Collectors Portfolio Banksy Screenprints And Bespoke Tool

May 31, 2025

A Collectors Portfolio Banksy Screenprints And Bespoke Tool

May 31, 2025