The Future Of CoreWeave Stock: Predictions And Projections

Table of Contents

H2: CoreWeave's Competitive Advantages in the Cloud Computing Market

CoreWeave has carved a niche for itself in the competitive cloud computing market by focusing on a key differentiator: GPU-accelerated computing. This specialization gives it a significant edge in rapidly growing sectors like AI, machine learning, and high-performance computing.

H3: Specialized Infrastructure and Expertise

CoreWeave's infrastructure is optimized for demanding workloads, unlike general-purpose cloud providers. This translates to:

- High-performance computing capabilities: CoreWeave offers unparalleled processing power, crucial for AI model training and other computationally intensive tasks.

- Optimized infrastructure for specific workloads: Their infrastructure is specifically designed to maximize efficiency for AI/ML, gaming, and cryptocurrency mining, minimizing latency and maximizing throughput.

- Strong partnerships with key players: Collaborations with leading hardware and software providers ensure CoreWeave stays at the cutting edge of technology. These partnerships provide access to the latest advancements and enhance their offerings.

H3: Growth Potential in High-Demand Sectors

CoreWeave is ideally positioned to capitalize on the explosive growth of several high-demand sectors:

- AI and Machine Learning: The market for AI and ML services is projected to reach hundreds of billions of dollars in the coming years, offering substantial growth opportunities for CoreWeave.

- Gaming: The increasing popularity of cloud gaming presents a significant market for CoreWeave's high-performance computing capabilities.

- Cryptocurrency Mining: Although volatile, cryptocurrency mining remains a significant consumer of computing power, providing a substantial revenue stream for CoreWeave.

H3: Strategic Partnerships and Acquisitions

CoreWeave's strategic partnerships and potential for future acquisitions are key drivers of its future growth:

- Key Partnerships: Collaborations with leading technology companies provide access to cutting-edge technologies and expand their market reach. These strategic alliances are crucial for long-term sustainability and growth.

- Potential Acquisition Targets: Acquisitions of smaller companies with complementary technologies or expertise could significantly enhance CoreWeave's capabilities and market share.

- Impact on Revenue and Market Share: Successful partnerships and acquisitions will directly translate to increased revenue and a stronger market position for CoreWeave.

H2: Financial Performance and Valuation of CoreWeave Stock

Analyzing CoreWeave's financial performance is crucial for assessing the future of its stock.

H3: Revenue Growth and Profitability

While specific financial details may not be publicly available for a private company, CoreWeave's rapid growth in a high-demand market suggests a strong revenue trajectory and increasing profitability. Analyst reports and industry projections can provide valuable insights into these figures.

- Revenue figures: While exact numbers may be limited, observing industry trends can help estimate revenue growth potential.

- Profit margins: High demand for their specialized services points towards healthy profit margins.

- Key financial ratios: Analyzing key financial ratios will provide a deeper understanding of CoreWeave's financial health.

- Analyst estimates: Independent analyst reports provide external perspectives on CoreWeave's financial prospects.

H3: Stock Price Analysis and Valuation Metrics

Once CoreWeave goes public, its stock price will be determined by market forces. However, pre-IPO valuations provide insight into its potential.

- Current stock price (if applicable): Monitor the stock price for real-time updates on market sentiment.

- Historical stock price performance (if applicable): Past performance is not indicative of future results, but it provides valuable context.

- Analyst price targets: Analyst predictions about future price targets will influence investor decisions.

- Potential upside: Based on growth projections, there is significant potential for upside in CoreWeave's stock price.

H3: Risk Factors and Potential Challenges

Investing in CoreWeave stock involves risks:

- Competition: The cloud computing market is intensely competitive; maintaining its edge will be crucial for CoreWeave.

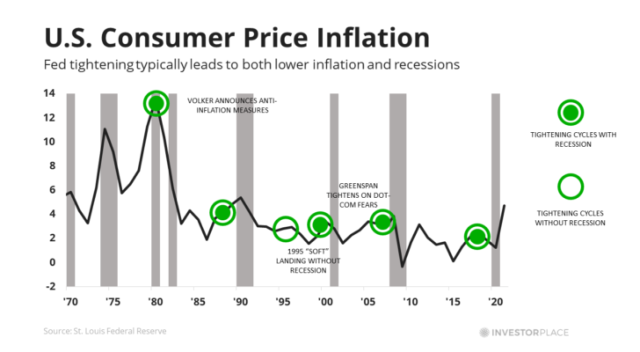

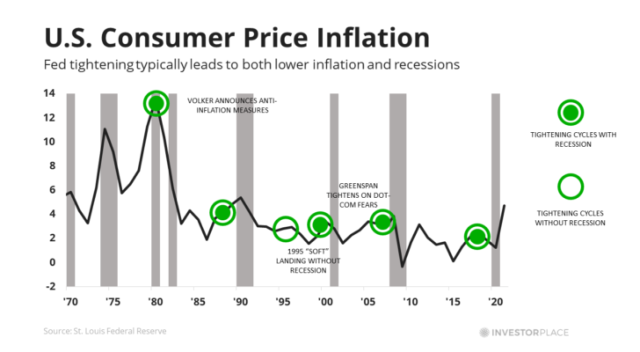

- Economic downturn: A broader economic slowdown could negatively impact demand for cloud services.

- Regulatory changes: Changes in regulations could impact CoreWeave's operations and profitability.

- Technological disruptions: Rapid technological advancements could render CoreWeave's technology obsolete.

H2: Predictions and Projections for CoreWeave Stock

Based on the analysis above, we offer the following predictions:

H3: Short-Term Outlook (Next 6-12 Months)

We predict a positive short-term outlook for CoreWeave stock, driven by continued growth in AI/ML and other key markets. However, market volatility and unforeseen events could impact this trajectory.

- Expected stock price movement: Positive growth is anticipated, but specific numbers are difficult to predict without public financial data.

- Key factors influencing the prediction: Strong demand, strategic partnerships, and successful execution of its business plan are key factors.

H3: Long-Term Outlook (Next 3-5 Years)

We project strong long-term growth for CoreWeave stock, fueled by the continued expansion of the cloud computing market and CoreWeave’s specialized services.

- Long-term stock price expectations: Significant growth is expected, but the exact magnitude depends on many variables.

- Key assumptions underlying the prediction: Continued technological innovation, successful market penetration, and strong financial management are key assumptions.

3. Conclusion

CoreWeave’s unique position in the rapidly expanding cloud computing market, its focus on GPU-accelerated computing, and its strategic partnerships position it for significant growth. While investing in any stock carries inherent risks, CoreWeave's strong competitive advantages and potential for expansion make it an intriguing prospect. Based on our analysis, we believe CoreWeave stock offers substantial long-term potential. Conduct thorough research and consider your own risk tolerance before making any investment decisions. Invest in CoreWeave stock wisely, understanding the potential rewards and risks involved. Remember that this is not financial advice.

Featured Posts

-

Cybersecurity Failure Costs Marks And Spencer 300 Million

May 22, 2025

Cybersecurity Failure Costs Marks And Spencer 300 Million

May 22, 2025 -

Groeiend Autobezit Drijft Occasionverkoop Bij Abn Amro Omhoog

May 22, 2025

Groeiend Autobezit Drijft Occasionverkoop Bij Abn Amro Omhoog

May 22, 2025 -

Reyting Finansovikh Kompaniy Ukrayini 2024 Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus U Liderakh

May 22, 2025

Reyting Finansovikh Kompaniy Ukrayini 2024 Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus U Liderakh

May 22, 2025 -

The Goldbergs A Critical Analysis Of The Shows Humor

May 22, 2025

The Goldbergs A Critical Analysis Of The Shows Humor

May 22, 2025 -

Liverpool Fc Under Klopp From Doubts To Belief A Retrospective

May 22, 2025

Liverpool Fc Under Klopp From Doubts To Belief A Retrospective

May 22, 2025

Latest Posts

-

Matthew Stafford Injury Update Forces Steelers To Re Evaluate Qb Strategy

May 22, 2025

Matthew Stafford Injury Update Forces Steelers To Re Evaluate Qb Strategy

May 22, 2025 -

House Of The Dragon Star Milly Alcock On Seeking Acting Guidance

May 22, 2025

House Of The Dragon Star Milly Alcock On Seeking Acting Guidance

May 22, 2025 -

Milly Alcocks House Of The Dragon Acting Coach The Full Story

May 22, 2025

Milly Alcocks House Of The Dragon Acting Coach The Full Story

May 22, 2025 -

House Of The Dragon Milly Alcocks Acting Coach Revelation

May 22, 2025

House Of The Dragon Milly Alcocks Acting Coach Revelation

May 22, 2025 -

Kenny Picketts Homecoming Game A Winning Performance In Pittsburgh

May 22, 2025

Kenny Picketts Homecoming Game A Winning Performance In Pittsburgh

May 22, 2025