The Future Of Trump's Tax Plan: A Divided Republican Party Weighs In

Table of Contents

Internal Divisions Within the Republican Party on Tax Policy

The Republican party, far from presenting a united front on tax policy, is fractured into distinct factions with differing visions for the future of Trump's tax cuts. These divisions complicate any attempt to predict the plan's long-term trajectory.

-

Fiscal Conservatives: This group prioritizes fiscal responsibility and balanced budgets. They may advocate for repealing or modifying certain tax cuts to reduce the national debt, potentially targeting deductions or loopholes they see as wasteful. They often express concern about the long-term sustainability of the current tax structure.

-

Moderates: Moderates generally support lower taxes but favor a more nuanced approach. They might advocate for targeted tax cuts benefiting middle-class families or small businesses, while potentially raising taxes on higher earners to offset revenue losses. Their focus is on finding a balance between tax cuts and responsible fiscal management.

-

Populist Wing: This faction tends to prioritize tax cuts for working-class Americans and may resist any measures seen as benefiting corporations or the wealthy disproportionately. They might favor simplifying the tax code to make it more accessible and equitable, potentially advocating for increased tax credits or deductions for low- and middle-income individuals.

Specific policy disagreements abound. For example, Senator [insert name of a Republican Senator known for fiscal conservatism] has publicly called for the sunsetting of certain provisions of Trump's tax plan, citing concerns about the national debt, while Representative [insert name of a Republican Representative known for a populist stance] has argued for extending all cuts to benefit working families. These contrasting views highlight the significant ideological divisions within the party.

Economic Impact of Trump's Tax Plan: A Retrospective

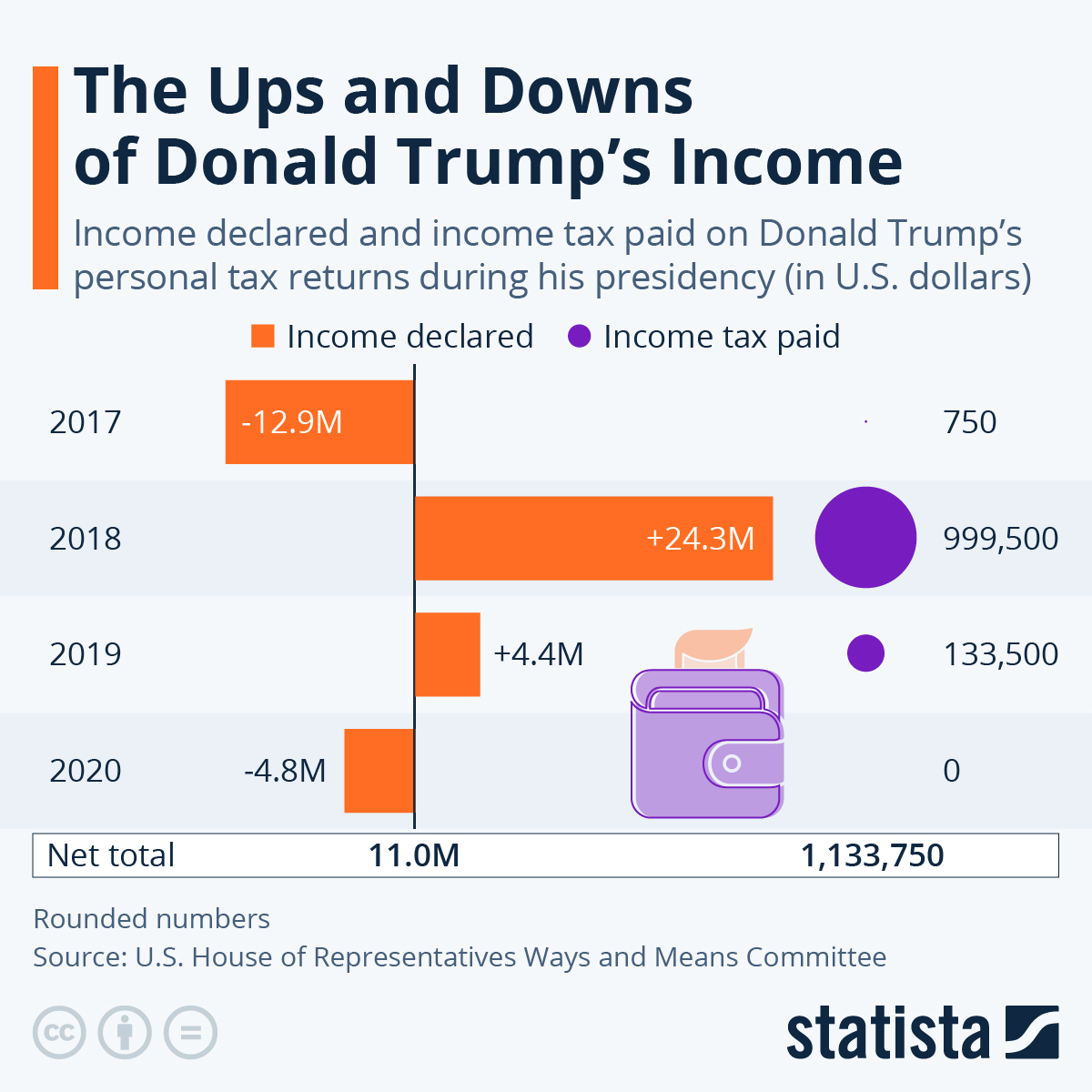

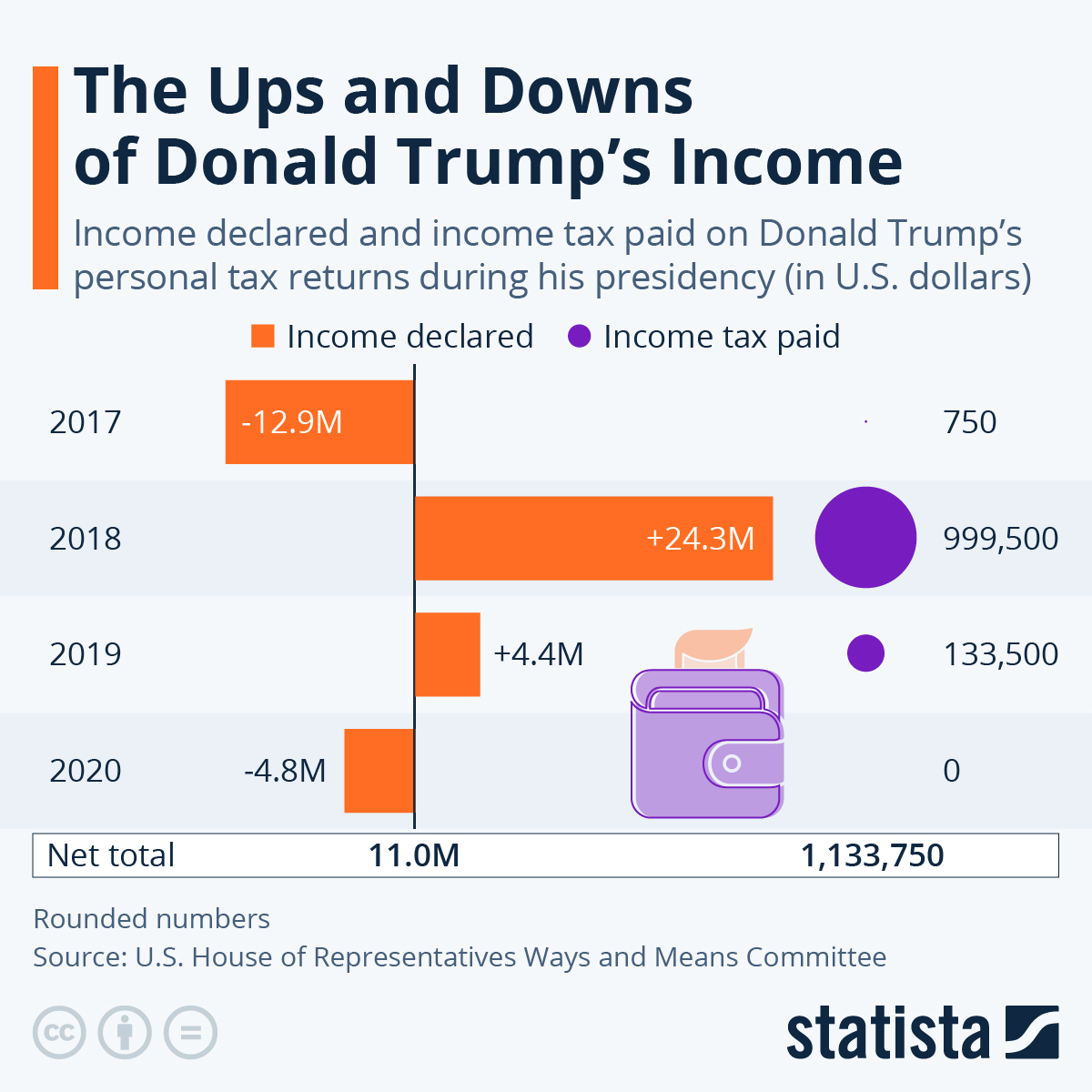

Trump's tax plan, enacted in 2017, significantly lowered corporate and individual income tax rates. While proponents point to increased GDP growth and job creation in the years following its implementation, critics highlight rising income inequality and a substantial increase in the national debt.

-

Positive Impacts (claimed): Supporters often cite increases in GDP growth and job creation immediately following the tax cuts as evidence of the plan’s success. However, disentangling the impact of the tax cuts from other economic factors is difficult.

-

Negative Impacts (claimed): Critics emphasize the plan's contribution to the rising national debt and argue that the tax cuts disproportionately benefited wealthy individuals and corporations, exacerbating income inequality. Data on income distribution and the national debt are often cited to support this perspective.

Analyzing the economic effects requires careful consideration of various economic indicators and a nuanced understanding of the complex interplay of numerous factors. The lack of consensus amongst economists on the true impact further fuels the political debate.

Potential Future Scenarios for Trump's Tax Plan

The future of Trump's tax plan remains highly uncertain, with several plausible scenarios emerging depending on who controls Congress and the Presidency.

-

Scenario 1: Partial Repeal or Modification: A more fiscally conservative Republican-led Congress might seek to modify or partially repeal certain provisions of the tax plan to address concerns about the national debt. This could involve raising taxes on higher earners or phasing out certain tax breaks.

-

Scenario 2: Extension of the Existing Plan with Minor Adjustments: A less ambitious approach might involve extending the current tax cuts with only minor modifications. This scenario requires a degree of bipartisan cooperation and consensus on the current tax system.

-

Scenario 3: Complete Overhaul of the Tax Code: A more radical shift could involve a complete overhaul of the existing tax code, potentially incorporating elements from alternative proposals. This scenario is highly unlikely in the near term, given the significant political challenges involved.

Each scenario presents unique economic consequences and political ramifications. Partial repeal could dampen economic growth in the short term but improve long-term fiscal stability. An extension without adjustments might exacerbate existing inequalities. A complete overhaul would create significant uncertainty and require extensive legislative debate.

The Role of the Biden Administration and the Democrats

The Democratic party's stance on tax policy significantly impacts the future of Trump's tax plan. The Democrats generally favor higher taxes on corporations and wealthy individuals to fund social programs and reduce income inequality.

-

Democratic Proposals: The Biden administration and the Democratic party have proposed various tax increases, including higher corporate tax rates, higher taxes on capital gains, and an increase in the top individual income tax rate.

-

Potential for Bipartisan Compromise: While significant legislative gridlock is possible, there might be limited opportunities for bipartisan compromise on certain tax issues. This would likely involve a smaller-scale modification of existing tax policies rather than a complete overhaul.

-

Upcoming Elections: The outcome of upcoming elections will significantly influence the likelihood of legislative action related to Trump's tax plan. A Democratic sweep could pave the way for more significant tax increases, while Republican control might lead to the extension or minor adjustments to the existing system.

The Uncertain Future of Trump's Tax Plan

In conclusion, the future of Trump’s tax plan is clouded by significant uncertainty. The internal divisions within the Republican party, the mixed economic impacts of the plan, and the contrasting policies proposed by the Democrats create a complex and dynamic situation. The potential scenarios range from minor adjustments to a complete overhaul of the tax code, with each carrying significant economic and political implications. The legacy of Trump's tax reforms will ultimately depend on the evolving political landscape and the ability of policymakers to reach consensus on a sustainable tax policy. Stay informed about the ongoing political developments and their impact on your financial future, as the future of Trump's tax plan, and tax policy in general, remains a topic of intense debate.

Featured Posts

-

Dexter Resurrection The Return Of Fan Favorite Antagonists

May 22, 2025

Dexter Resurrection The Return Of Fan Favorite Antagonists

May 22, 2025 -

Rio Tinto Rebuttal Addressing Andrew Forrests Pilbara Wasteland Concerns

May 22, 2025

Rio Tinto Rebuttal Addressing Andrew Forrests Pilbara Wasteland Concerns

May 22, 2025 -

Exclusive Vybz Kartel On Prison Freedom And New Music

May 22, 2025

Exclusive Vybz Kartel On Prison Freedom And New Music

May 22, 2025 -

Loire Atlantique Quiz De Culture Generale Sur L Histoire Et La Gastronomie

May 22, 2025

Loire Atlantique Quiz De Culture Generale Sur L Histoire Et La Gastronomie

May 22, 2025 -

Abn Amro Zijn Nederlandse Huizen Wel Betaalbaar Een Geen Stijl Analyse

May 22, 2025

Abn Amro Zijn Nederlandse Huizen Wel Betaalbaar Een Geen Stijl Analyse

May 22, 2025

Latest Posts

-

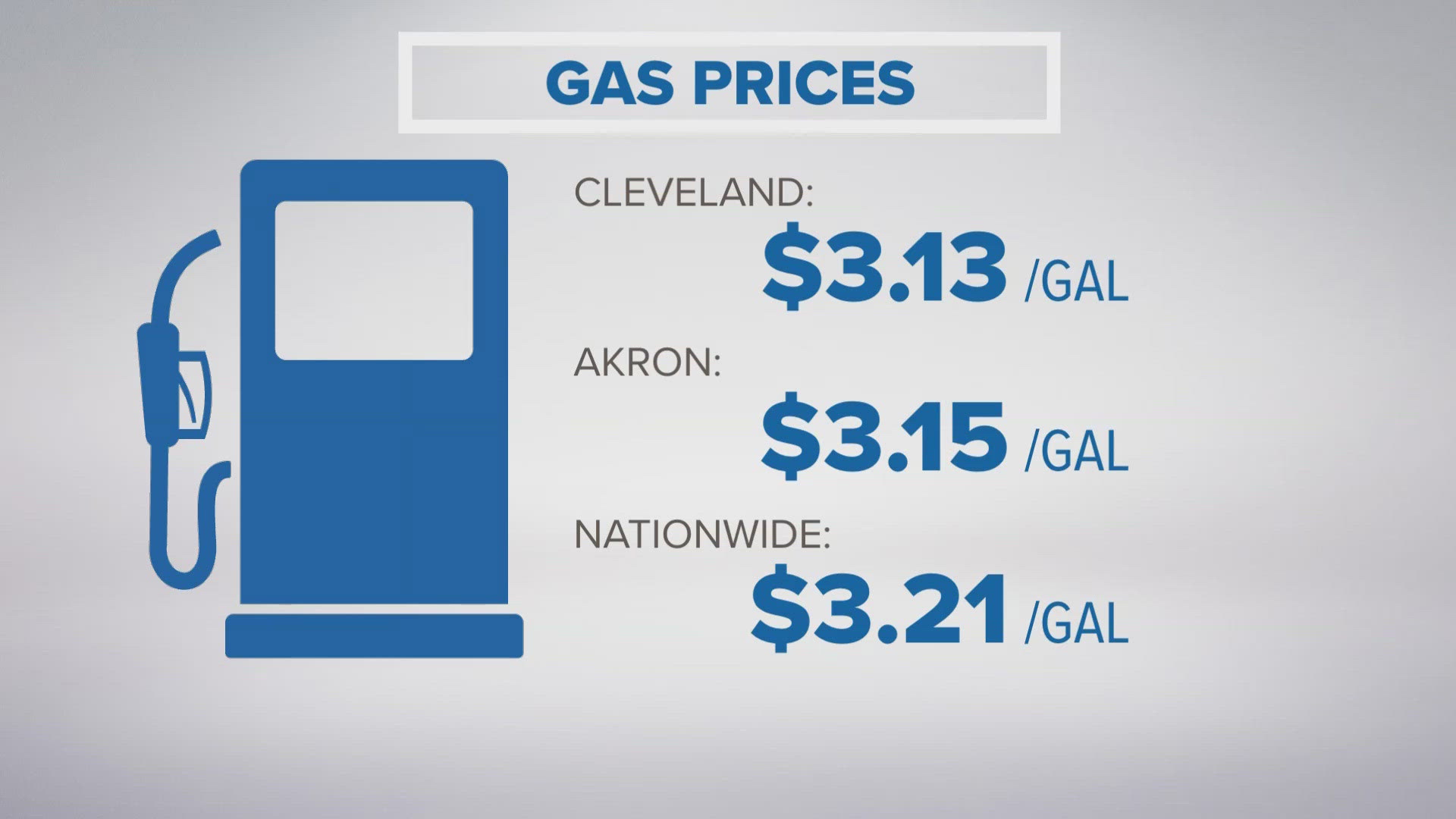

Akron And Cleveland Gas Prices Why The Recent Spike Ohio Gas Buddy Updates

May 22, 2025

Akron And Cleveland Gas Prices Why The Recent Spike Ohio Gas Buddy Updates

May 22, 2025 -

Recent Lancaster City Stabbing Prompts Increased Police Patrols

May 22, 2025

Recent Lancaster City Stabbing Prompts Increased Police Patrols

May 22, 2025 -

Why Are Gas Prices So High In Southeast Wisconsin

May 22, 2025

Why Are Gas Prices So High In Southeast Wisconsin

May 22, 2025 -

Lancaster City Stabbing Incident Victim Information And Police Appeal

May 22, 2025

Lancaster City Stabbing Incident Victim Information And Police Appeal

May 22, 2025 -

Recent Increase In Gas Prices Southeast Wisconsin

May 22, 2025

Recent Increase In Gas Prices Southeast Wisconsin

May 22, 2025