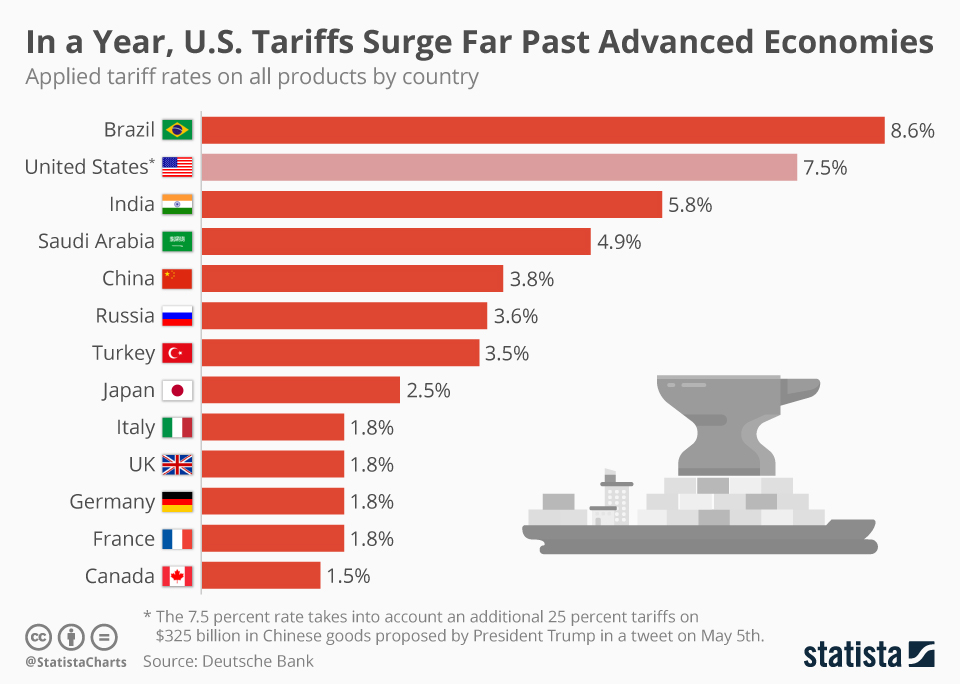

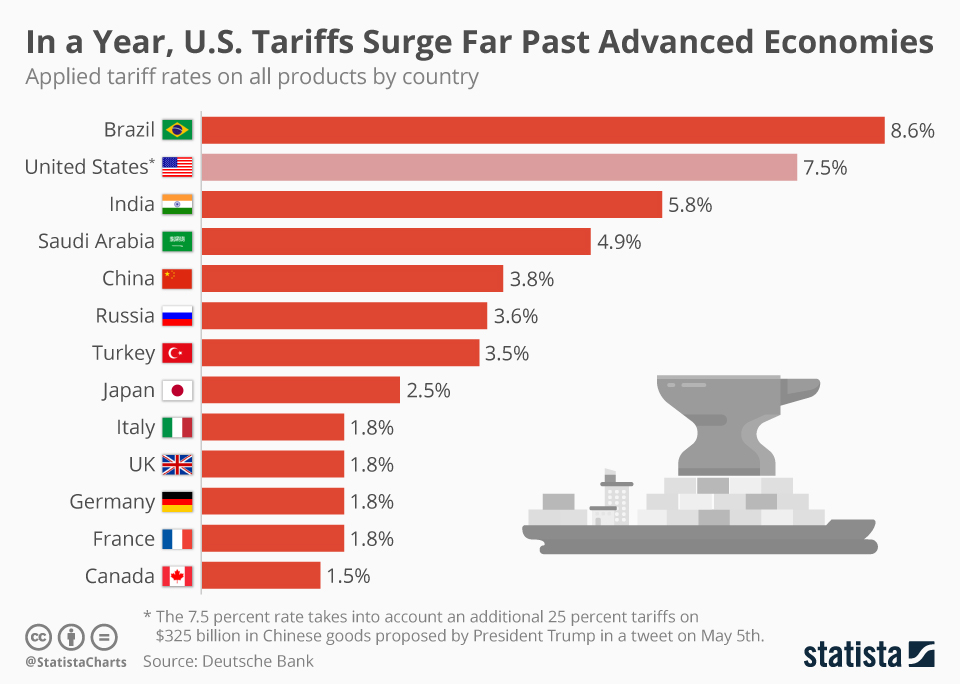

The Future Of US-Asia Trade: Tariffs And The Evolving Dynamic With China

Table of Contents

The Impact of US Tariffs on Asian Economies

The US-China trade war, initiated with the imposition of tariffs, triggered a chain reaction across Asian economies. China's response to these economic sanctions was swift and multifaceted.

China's Response to Tariffs

- Retaliatory Tariffs: China implemented retaliatory tariffs on US goods, impacting various sectors including agriculture and manufacturing. This led to decreased exports for US companies and increased prices for American consumers.

- Trade Diversification: Facing trade barriers with the US, China actively sought to diversify its trading partners, strengthening economic ties with countries in Southeast Asia, Africa, and Latin America. This "trade diversion" strategy aimed to reduce reliance on the US market.

- Domestic Economic Adjustments: China focused on bolstering its domestic consumption and promoting technological self-reliance to lessen its dependence on exports to the US. This involved significant investments in domestic industries and infrastructure.

The impact wasn't limited to China. Countries like Vietnam and South Korea, deeply integrated into global supply chains, experienced both benefits and drawbacks. While some benefited from diverted trade, others faced disruptions and uncertainty. The "tariff impact Asia" was widespread and complex.

Ripple Effects Across Asia

The US tariffs on Chinese goods created significant ripple effects across the Asian economic landscape. Supply chain disruptions were widespread, affecting industries beyond those directly targeted by the tariffs.

- Southeast Asia's Manufacturing Sector: Countries like Vietnam and Malaysia saw increased investment and manufacturing activity as companies sought to relocate production away from China to avoid US tariffs. This "regional trade" shift, however, also led to increased competition and strain on regional infrastructure.

- ASEAN Trade: The Association of Southeast Asian Nations (ASEAN) experienced both positive and negative impacts, with some members benefiting from increased investment while others faced competition and challenges in adjusting to the changing trade dynamics. The resulting "global trade imbalances" further complicated the economic landscape.

Shifting Geopolitical Landscape and its Influence on US-Asia Trade

The evolving geopolitical landscape significantly impacts US-Asia trade relationships. The rise of regional trade agreements and increasing strategic competition with China are reshaping the playing field.

The Rise of Regional Trade Agreements

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Regional Comprehensive Economic Partnership (RCEP) are prominent examples of regional trade pacts that are fundamentally changing the dynamics of "bilateral trade agreements."

- CPTPP and RCEP: These agreements establish large free trade zones, reducing tariffs and promoting trade among member countries. The CPTPP includes several Asian nations but notably excludes the US. RCEP encompasses a vast region, including China and several ASEAN countries.

- Impact on US Competitiveness: The rise of these trade blocs presents challenges to US businesses, potentially diminishing their competitiveness in the Asian market if they are not part of these agreements. The creation of these "trade blocs" necessitates a strategic reassessment of US trade policy.

The US's Strategic Competition with China and its implications for trade

Geopolitical tensions between the US and China are inextricably linked to trade policies. "Geopolitical risk" is a primary consideration for businesses operating in the region.

- Indo-Pacific Economic Framework (IPEF): The IPEF is a US initiative aimed at strengthening economic partnerships in the Indo-Pacific region, partly as a counterbalance to China's growing influence. It focuses on areas like supply chain resilience, digital trade, and clean energy, but it lacks the tariff reductions that characterize traditional trade agreements.

- Investment Restrictions: National security concerns are driving increased scrutiny of foreign investment, potentially leading to restrictions on trade and investment flows between the US and certain Asian countries, particularly those viewed as strategically important or vulnerable to Chinese influence.

Opportunities and Challenges for US Businesses in the Evolving Asian Market

Navigating the complex landscape of US-Asia trade requires strategic planning and adaptability. US businesses face significant challenges, but also significant opportunities.

Navigating Tariff Uncertainty

The unpredictable nature of trade policies necessitates proactive risk management strategies for US businesses operating in or seeking to enter the Asian market.

- Supply Chain Resilience: Diversifying supply chains, moving away from over-reliance on any single country, is becoming increasingly crucial. This "supply chain resilience" strategy helps mitigate risks associated with trade disputes or unexpected disruptions.

- Market Diversification: Exploring new markets beyond China and focusing on emerging markets in Southeast Asia and beyond is another effective strategy. This "market diversification" approach reduces risk and provides access to growing consumer bases.

- Lobbying Efforts: Engaging in political advocacy and lobbying efforts to influence trade policy decisions is a key aspect of "risk management" for businesses aiming to secure favorable trade conditions.

Emerging Markets and Growth Potential

While challenges exist, the Asian market offers significant opportunities for US businesses, particularly in rapidly developing economies.

- High-Growth Sectors: Sectors like technology, renewable energy, healthcare, and e-commerce offer promising investment opportunities in many Asian countries.

- Market Entry Strategies: Carefully evaluating market entry strategies, considering factors such as local regulations, consumer preferences, and cultural nuances, is crucial for success in these diverse markets. The potential for "economic growth Asia" remains vast and offers lucrative avenues for US businesses.

Conclusion: The Future of US-Asia Trade: A Call to Action

The future of US-Asia trade is undeniably dynamic. Tariffs have profoundly impacted trade relationships, but the evolving geopolitical landscape and the emergence of new trade agreements are reshaping the playing field. The challenges are significant – navigating tariff uncertainty, adapting to shifting geopolitical dynamics, and mitigating supply chain disruptions. Yet, equally significant are the opportunities: accessing emerging markets, fostering partnerships within new regional trade frameworks, and pursuing investment in high-growth sectors. Understanding the future of US-Asia trade requires continuous monitoring of geopolitical developments, proactive risk management strategies, and strategic engagement. Developing strategies for successful US-Asia trade necessitates engagement, adaptation, and a forward-looking approach. Stay informed, explore new market opportunities, and advocate for policies that promote sustainable and mutually beneficial trade relationships. Only through proactive engagement can businesses and policymakers effectively navigate the complexities of US-Asia trade and unlock the vast potential of this dynamic region.

Featured Posts

-

The Blue Books Comeback Why This Old School Exam Method Is Back

May 27, 2025

The Blue Books Comeback Why This Old School Exam Method Is Back

May 27, 2025 -

Taylor Swifts Reputation Taylors Version The Long Awaited Announcement

May 27, 2025

Taylor Swifts Reputation Taylors Version The Long Awaited Announcement

May 27, 2025 -

New Details Emerge Why Carrie Underwood Targeted Taylor Swift According To A Source

May 27, 2025

New Details Emerge Why Carrie Underwood Targeted Taylor Swift According To A Source

May 27, 2025 -

Morata Names Osimhen Among The Worlds Top Strikers

May 27, 2025

Morata Names Osimhen Among The Worlds Top Strikers

May 27, 2025 -

Osimhens Double Leads Galatasaray Past Sivasspor

May 27, 2025

Osimhens Double Leads Galatasaray Past Sivasspor

May 27, 2025

Latest Posts

-

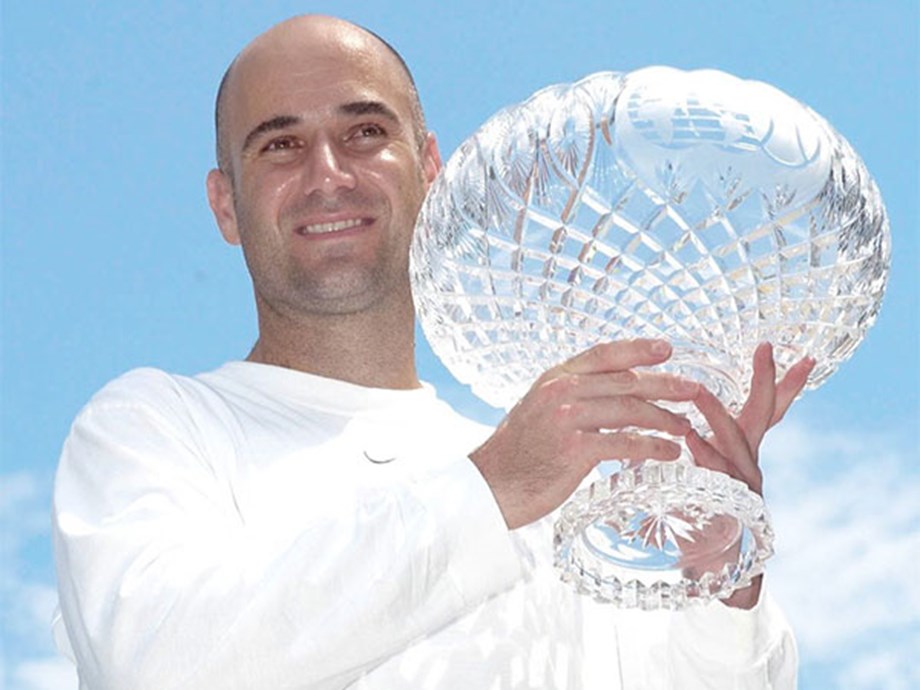

Agassi Schimba Raqueta De La Tenis La Pickleball

May 30, 2025

Agassi Schimba Raqueta De La Tenis La Pickleball

May 30, 2025 -

Agassi Recuerda A Rios Su Principal Rival Sudamericano

May 30, 2025

Agassi Recuerda A Rios Su Principal Rival Sudamericano

May 30, 2025 -

Revenirea Lui Andre Agassi Un Nou Capitol In Cariera Sa Sportiva

May 30, 2025

Revenirea Lui Andre Agassi Un Nou Capitol In Cariera Sa Sportiva

May 30, 2025 -

Steffi Graf Entdeckt Neuen Sport Ehe Geheimnis Mit Andre Agassi

May 30, 2025

Steffi Graf Entdeckt Neuen Sport Ehe Geheimnis Mit Andre Agassi

May 30, 2025 -

Prima Partida De Pickleball A Lui Andre Agassi

May 30, 2025

Prima Partida De Pickleball A Lui Andre Agassi

May 30, 2025