The Future Of XRP: Analyzing The Implications Of SEC Actions And ETF Applications

Table of Contents

H2: The Ripple-SEC Lawsuit and its Fallout

The legal battle between Ripple Labs and the SEC has cast a long shadow over XRP, significantly impacting its price and market sentiment. Understanding the lawsuit's intricacies is crucial for predicting the future of XRP.

H3: The SEC's Case Against Ripple

The SEC's core argument hinges on classifying XRP as an unregistered security, alleging that Ripple's distribution and sales constituted an illegal securities offering. This argument relies heavily on the "Howey Test," a legal framework used to determine whether an investment constitutes a security.

-

Bullet points:

- The court's partial ruling favored Ripple, stating that institutional sales of XRP did not constitute securities.

- The SEC argued that XRP sales to the general public did constitute securities.

- The ruling created uncertainty for XRP holders, particularly those who acquired XRP through various channels.

- The decision caused significant price volatility for XRP.

-

Details: The SEC's case rests on whether XRP sales meet the criteria of the Howey Test, specifically concerning the expectation of profit from the efforts of others. Ripple counters that XRP is a decentralized, functional currency, not a security. The ongoing debate over the applicability of the Howey Test to cryptocurrencies remains central to the case and its broader implications for the crypto industry. The potential for appeals significantly impacts the long-term outcome.

H3: Ripple's Defense and its Potential Outcomes

Ripple's defense centers on the argument that XRP is a decentralized digital asset, akin to other cryptocurrencies like Bitcoin and Ethereum, not a security issued by Ripple Labs.

-

Bullet points:

- Ripple emphasizes XRP's decentralized nature and its use in cross-border payments.

- They highlight the significant amount of XRP already in circulation and argue against the SEC's characterization of it as an investment contract.

- Possible outcomes include a complete victory for Ripple, a partial victory (as seen in the initial ruling), a settlement, or a complete defeat.

-

Details: The outcome of this case will likely set a crucial precedent for how other cryptocurrencies are regulated in the US. A Ripple victory could foster greater regulatory clarity and potentially boost XRP's adoption. Conversely, a loss could lead to increased regulatory uncertainty and stifle innovation in the crypto space.

H2: The Rise of XRP ETFs and Their Significance

The emergence of XRP ETF applications signifies a potential turning point for XRP's market position. If approved, ETFs could dramatically increase institutional interest and liquidity.

H3: Understanding XRP Exchange-Traded Funds (ETFs)

XRP ETFs would allow investors to gain exposure to XRP through traditional brokerage accounts, similar to investing in stocks.

-

Bullet points:

- ETFs offer diversification and accessibility, making XRP investment easier for institutional and retail investors.

- The approval process for ETFs involves rigorous regulatory scrutiny by agencies like the SEC.

- Several companies have filed for XRP ETFs, though approval remains uncertain.

-

Details: The approval of an XRP ETF would significantly improve XRP's liquidity and increase its accessibility to a broader range of investors. This could potentially lead to higher trading volume and price appreciation. However, the rejection of these applications could signal continued regulatory uncertainty and hinder XRP's growth.

H3: The Implications of ETF Approval (or Rejection)

The approval (or rejection) of XRP ETFs will profoundly impact XRP’s future.

-

Bullet points:

- Approval: Increased institutional investment, potentially leading to higher prices and greater market capitalization. Enhanced legitimacy and wider adoption. Increased regulatory scrutiny.

- Rejection: Continued limited institutional participation, dampened price appreciation, and potential for prolonged uncertainty about the regulatory future of XRP.

-

Details: ETF approval would likely attract significant institutional investment, potentially pushing XRP's price higher and solidifying its position in the cryptocurrency market. Conversely, rejection could signal lingering regulatory hurdles and discourage institutional involvement, impacting price and adoption.

H2: Predicting the Future Trajectory of XRP

Several interconnected factors will shape XRP's future trajectory.

H3: Factors Influencing XRP's Price

The price of XRP will be influenced by a complex interplay of factors.

-

Bullet points:

- Regulatory clarity: Positive regulatory developments regarding cryptocurrencies in general and XRP specifically will boost investor confidence.

- Technological advancements: Improvements to XRP's underlying technology will enhance its scalability and functionality.

- Market adoption: Increased adoption by businesses and individuals will drive demand and potentially increase the price.

- Competition: The competitive landscape within the cryptocurrency market will influence XRP's market share.

-

Details: XRP's potential as a cross-border payment solution is a key factor driving its adoption. Strategic partnerships and collaborations will be essential in expanding its reach. The overall sentiment towards cryptocurrencies will also play a crucial role.

H3: Potential Long-Term Scenarios for XRP

Predicting the future is inherently challenging, but we can outline some potential scenarios.

-

Bullet points:

- Best-case scenario: Resolution of the SEC lawsuit in Ripple's favor, coupled with ETF approval, leading to significant price appreciation and widespread adoption.

- Worst-case scenario: An unfavorable ruling in the SEC lawsuit and rejection of ETF applications, resulting in decreased price and limited adoption.

- Most likely scenario: A compromise or settlement in the SEC lawsuit and eventual ETF approval, resulting in moderate growth and increased institutional interest.

-

Details: While a best-case scenario is certainly possible, it's important to remain realistic about the challenges ahead. A balanced assessment suggests that moderate growth is more likely than either extreme, provided that regulatory uncertainty is resolved.

3. Conclusion:

The future of XRP remains uncertain, heavily influenced by the ongoing Ripple-SEC lawsuit and the outcome of pending ETF applications. While the legal battle presents significant challenges, the potential benefits of ETF approval could propel XRP's growth and adoption. Investors should carefully consider the risks and rewards before investing in XRP. Continued monitoring of regulatory developments and market trends is crucial for navigating the evolving landscape of this promising cryptocurrency. Stay informed about the latest developments regarding the future of XRP and make informed decisions about your investment strategy. Understanding the nuances of the XRP landscape, including the implications of SEC actions and ETF applications, is key to navigating its volatile but potentially rewarding future.

Featured Posts

-

Trg Sv Petra Papez Francisek Deli Blagoslov Svetu

May 07, 2025

Trg Sv Petra Papez Francisek Deli Blagoslov Svetu

May 07, 2025 -

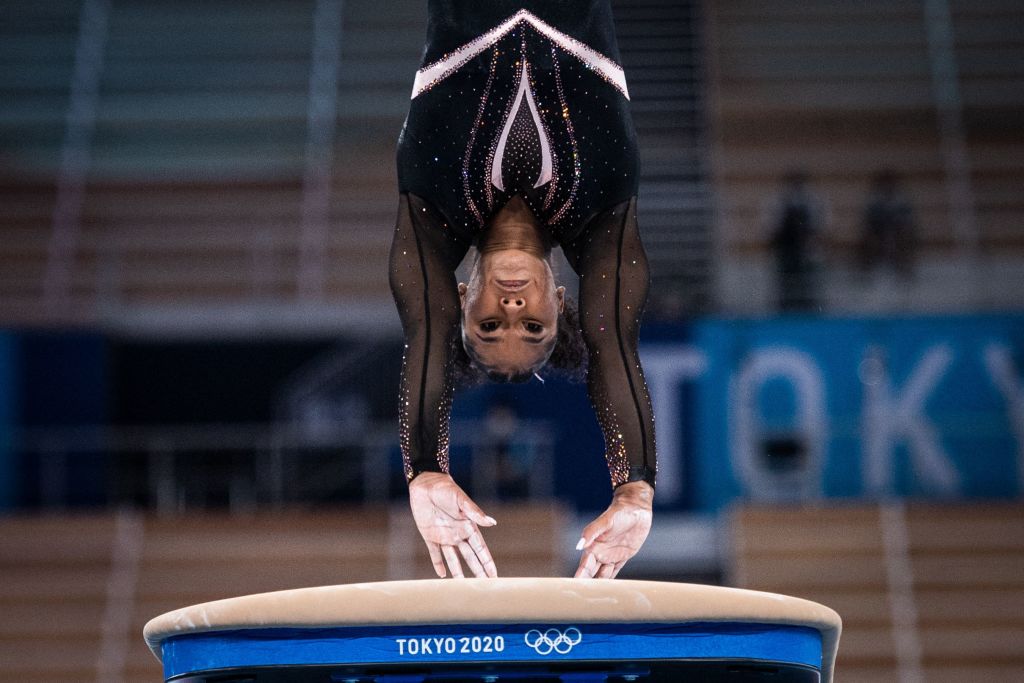

Gimnastas Laguneras Triunfan En El Torneo De Simone Biles

May 07, 2025

Gimnastas Laguneras Triunfan En El Torneo De Simone Biles

May 07, 2025 -

Analyzing Trae Youngs Travel A Closer Look At A Disputed Play

May 07, 2025

Analyzing Trae Youngs Travel A Closer Look At A Disputed Play

May 07, 2025 -

Seattle Mariners Respond To Inflammatory Remarks By Yankees Broadcaster

May 07, 2025

Seattle Mariners Respond To Inflammatory Remarks By Yankees Broadcaster

May 07, 2025 -

Donovan Mitchell Leads Cavaliers To Victory Against Brooklyn Nets

May 07, 2025

Donovan Mitchell Leads Cavaliers To Victory Against Brooklyn Nets

May 07, 2025

Latest Posts

-

Xrp Etf Risks High Supply And Lack Of Institutional Interest

May 08, 2025

Xrp Etf Risks High Supply And Lack Of Institutional Interest

May 08, 2025 -

Xrp Etf Disappointing Prospects Due To Supply And Low Institutional Demand

May 08, 2025

Xrp Etf Disappointing Prospects Due To Supply And Low Institutional Demand

May 08, 2025 -

Should You Invest In Xrp After Its 400 Price Increase

May 08, 2025

Should You Invest In Xrp After Its 400 Price Increase

May 08, 2025 -

400 Xrp Gains In 3 Months Time To Buy Or A Risky Investment

May 08, 2025

400 Xrp Gains In 3 Months Time To Buy Or A Risky Investment

May 08, 2025 -

Ripples Xrp Rallies A Reaction To The Presidents Trump Related Post

May 08, 2025

Ripples Xrp Rallies A Reaction To The Presidents Trump Related Post

May 08, 2025