The Future Of XRP: Predictions And Analysis

Table of Contents

XRP's Current Market Position and Technological Advantages

Market Capitalization and Trading Volume

XRP consistently ranks among the top cryptocurrencies by market capitalization, though its position fluctuates depending on market conditions. Analyzing its trading volume on major exchanges like Binance, Coinbase, and Kraken provides valuable insights into its liquidity and overall market presence. While its trading volume can be substantial, it's important to note periods of high volatility and the influence of major news events on trading activity.

- Market Cap Comparison: XRP's market cap is often compared to that of Bitcoin (BTC), Ethereum (ETH), and other established cryptocurrencies. Its relative position within this ranking is a key indicator of its overall market standing.

- Trading Volume Fluctuations: Understanding the factors driving XRP's trading volume fluctuations, such as news announcements, regulatory updates, and broader market trends, is crucial for assessing its short-term and long-term prospects.

- Partnerships and Integrations: Strategic partnerships and integrations with financial institutions and payment processors can significantly influence XRP's market position and adoption rate. These collaborations often lead to increased trading volume and market capitalization.

Technological Innovations and Scalability

The XRP Ledger (XRPL) offers several technological advantages over other blockchain networks. Its speed, low transaction fees, and energy efficiency are key differentiators. The XRPL employs a unique consensus mechanism, enabling fast transaction processing and high throughput, unlike the slower, more energy-intensive consensus mechanisms used by some other cryptocurrencies.

- Consensus Mechanism: The XRPL's consensus mechanism ensures rapid and secure transaction validation, contributing to its scalability.

- Transaction Throughput: Compared to Bitcoin or Ethereum, the XRPL boasts significantly higher transaction throughput, enabling it to handle a larger volume of transactions per second.

- Energy Efficiency: XRPL's energy consumption is considerably lower than that of Proof-of-Work blockchains like Bitcoin, making it a more environmentally friendly option.

Regulatory Landscape and Legal Battles

SEC Lawsuit and its Implications

The ongoing SEC lawsuit against Ripple Labs, the company behind XRP, significantly impacts the cryptocurrency's future. The SEC alleges that XRP is an unregistered security, a claim Ripple vehemently denies. The outcome of this lawsuit will likely determine XRP's regulatory status in the US and potentially globally.

- Arguments Presented: Both sides have presented compelling arguments, and the legal battle is complex. Understanding the nuances of these arguments is crucial for forming an informed opinion on the potential outcomes.

- Potential Outcomes: The lawsuit could result in a dismissal, a settlement, or a ruling against Ripple. Each outcome will have profound consequences for XRP's price and adoption. A favorable ruling could lead to a price surge, while an unfavorable ruling could severely impact its value.

- Impact on Price and Adoption: The uncertainty surrounding the lawsuit contributes to XRP's price volatility. A clear resolution, regardless of the outcome, could bring greater price stability and potentially encourage wider adoption.

Global Regulatory Trends and XRP Adoption

Global regulatory frameworks for cryptocurrencies are still evolving. The regulatory landscape varies significantly across different jurisdictions, impacting XRP's adoption by financial institutions and its overall market acceptance.

- Jurisdictional Differences: Some countries are more welcoming to cryptocurrencies than others. Understanding these differences is key to anticipating future adoption trends.

- Regulatory Clarity: Greater regulatory clarity, either through positive rulings or the establishment of clear frameworks, could significantly boost XRP's adoption rate.

- Impact on Price: Regulatory developments often directly influence XRP's price. Positive regulatory news tends to drive prices up, while negative news can have the opposite effect.

Future Price Predictions and Adoption Scenarios

Analyst Forecasts and Price Projections

Predicting XRP's future price is challenging due to the inherent volatility of the cryptocurrency market and the ongoing legal uncertainty. However, various analysts offer price projections based on their analysis of market trends, technological developments, and regulatory factors.

- Range of Predictions: Price predictions range from optimistic forecasts anticipating substantial price increases to more conservative or pessimistic views.

- Rationale Behind Predictions: It's essential to understand the underlying assumptions and factors that influence these predictions.

- Influence of News and Events: Major news events, like the SEC lawsuit's progression, significantly impact analyst forecasts.

Potential Use Cases and Mass Adoption

XRP's potential use cases extend beyond simple speculation. Its speed and low transaction fees make it attractive for various applications, particularly in cross-border payments and remittances. Decentralized finance (DeFi) projects could also leverage XRP's capabilities.

- Cross-Border Payments: XRP's efficiency could revolutionize international money transfers, making them faster, cheaper, and more transparent.

- Remittances: Migrant workers could benefit significantly from XRP's low fees and rapid transaction speeds when sending money to their families back home.

- DeFi Integration: Integrating XRP into DeFi platforms could unlock new opportunities and enhance liquidity within decentralized financial systems.

- Challenges to Adoption: Competition from other cryptocurrencies and regulatory hurdles remain significant obstacles to mass adoption.

Conclusion

The future of XRP is intertwined with the outcome of the SEC lawsuit and the broader regulatory landscape for cryptocurrencies. While its technological advantages are undeniable, the legal uncertainty introduces significant risk. Analyst predictions vary widely, reflecting the inherent volatility of the market. However, XRP's potential for use cases, particularly in cross-border payments, remains significant. To make informed decisions about XRP investment, staying informed about the ongoing legal battle and conducting your own in-depth XRP analysis is crucial. Stay informed about the future of XRP and conduct your own in-depth XRP analysis to make informed decisions.

Featured Posts

-

Kashmirs Cat Community Responds To Online Viral Trend

May 01, 2025

Kashmirs Cat Community Responds To Online Viral Trend

May 01, 2025 -

Levenslang Versus Tbs De Zaak Fouad L Verklaard

May 01, 2025

Levenslang Versus Tbs De Zaak Fouad L Verklaard

May 01, 2025 -

Neersteekincident Van Mesdagkliniek De Rol Van Malek F

May 01, 2025

Neersteekincident Van Mesdagkliniek De Rol Van Malek F

May 01, 2025 -

Ahdaf Haland Tughyr Trtyb Hdafy Aldwry Alinjlyzy

May 01, 2025

Ahdaf Haland Tughyr Trtyb Hdafy Aldwry Alinjlyzy

May 01, 2025 -

Bangladesh Nrc Calls For Action Against Anti Muslim Conspiracies

May 01, 2025

Bangladesh Nrc Calls For Action Against Anti Muslim Conspiracies

May 01, 2025

Latest Posts

-

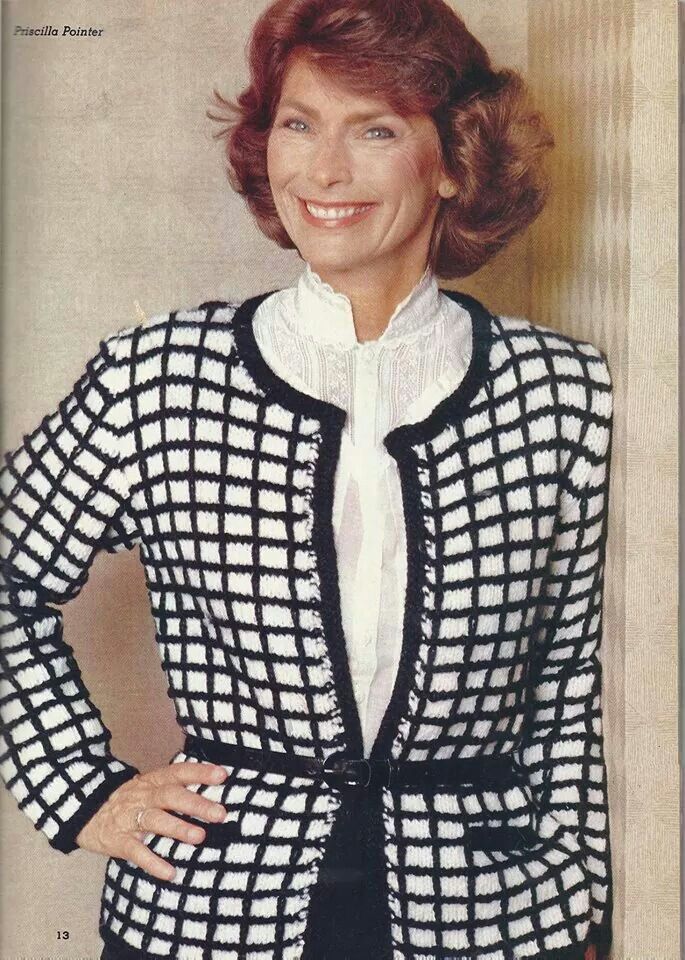

Veteran Actress Priscilla Pointer Amy Irvings Mother Dead At 100

May 01, 2025

Veteran Actress Priscilla Pointer Amy Irvings Mother Dead At 100

May 01, 2025 -

Priscilla Pointer Carrie Actress And Amy Irvings Mother Passes Away At 100

May 01, 2025

Priscilla Pointer Carrie Actress And Amy Irvings Mother Passes Away At 100

May 01, 2025 -

100 Year Old Actress Priscilla Pointer Known For Carrie Passes Away

May 01, 2025

100 Year Old Actress Priscilla Pointer Known For Carrie Passes Away

May 01, 2025 -

Death Of Priscilla Pointer Actress And Mother Of Amy Irving Aged 100

May 01, 2025

Death Of Priscilla Pointer Actress And Mother Of Amy Irving Aged 100

May 01, 2025 -

Actress Priscilla Pointer Star Of Carrie Dead At 100

May 01, 2025

Actress Priscilla Pointer Star Of Carrie Dead At 100

May 01, 2025