The Future Of XRP: SEC Case Fallout, ETF Potential, And Ripple's Next Chapter

Table of Contents

The SEC Lawsuit Fallout and its Ripple Effects on XRP

The SEC's lawsuit against Ripple Labs has cast a long shadow over XRP, creating significant uncertainty. Understanding the impact of this legal battle is crucial for predicting the future of XRP.

Impact on Price and Trading Volume

The SEC lawsuit has undeniably impacted XRP's price and trading volume.

- Pre-lawsuit price: XRP enjoyed relatively high prices before the lawsuit was filed.

- Post-lawsuit lows: The announcement of the lawsuit sent XRP's price plummeting, hitting significant lows.

- Recent price movements: Since the lawsuit, XRP's price has experienced volatility, correlating with court developments and market sentiment. (Insert relevant price chart here)

- Trading volume changes on major exchanges: Trading volume also fluctuated significantly, reflecting the uncertainty surrounding the legal outcome. (Insert relevant trading volume chart here)

Keywords: XRP price prediction, XRP price chart, SEC lawsuit impact, XRP trading volume

Ripple's Legal Strategy and Potential Outcomes

Ripple's defense strategy centers on arguing that XRP is not a security. The potential outcomes are multifaceted:

- Key arguments in Ripple's defense: Ripple emphasizes XRP's decentralized nature and its use in facilitating cross-border payments.

- Possible court decisions: A complete victory for Ripple could significantly boost XRP's price. A partial win, clarifying certain aspects of XRP's regulatory status, might provide more clarity but less of a dramatic price impact. A loss could result in further price declines and regulatory uncertainty.

- Expert opinions on the case's outcome: Legal experts offer varied opinions, highlighting the complexity of the case and the difficulty in predicting the outcome.

- Regulatory implications: The ruling will set a precedent that could impact other cryptocurrencies, influencing future regulatory frameworks.

Keywords: Ripple SEC lawsuit update, Ripple legal strategy, XRP regulatory uncertainty, Ripple defense.

Long-Term Regulatory Implications for XRP and Crypto

The SEC v. Ripple case holds significant implications for the entire cryptocurrency industry.

- Potential impact on other cryptocurrencies: The outcome could influence how other cryptocurrencies are classified and regulated.

- Effects on investor confidence: A clear ruling, regardless of the outcome, could potentially restore investor confidence or further erode it, depending on the decision.

- Influence on future regulatory frameworks: The case will undoubtedly shape the approach regulators take towards crypto assets in the future.

Keywords: Crypto regulation, SEC crypto regulations, XRP regulation, future of crypto.

The Potential for an XRP ETF and its Market Impact

The possibility of an XRP ETF is another significant factor in considering the future of XRP.

The ETF Application Process and its Challenges

Securing ETF approval is a rigorous process, presenting challenges for XRP.

- SEC approval process: The SEC has a stringent approval process for ETFs, including evaluating the underlying asset's suitability.

- Requirements for ETF listing: XRP would need to meet various criteria before being considered for an ETF.

- Potential obstacles specific to XRP: The ongoing SEC lawsuit represents a major obstacle.

- Comparison to other crypto ETFs: The approval process for other crypto ETFs can offer some insight into the potential hurdles XRP may face.

Keywords: XRP ETF application, XRP ETF approval, crypto ETF, SEC ETF approval process.

Market Implications of XRP ETF Approval

Approval of an XRP ETF would likely have significant market repercussions:

- Price surge predictions: Many anticipate a substantial price increase if an XRP ETF is approved.

- Increased trading volume: Increased institutional and retail investor interest would drive up trading volume.

- Potential for institutional investment: ETFs provide a convenient way for institutional investors to gain exposure to XRP.

- Impact on retail investor participation: ETFs can make investing in XRP more accessible to retail investors.

Keywords: XRP ETF price prediction, XRP liquidity, institutional investment in XRP, XRP adoption.

Ripple's Next Chapter: Innovation and Strategic Partnerships

Ripple's continued innovation and strategic partnerships are key to its—and by extension, XRP's—long-term success.

Ripple's Technological Advancements

Ripple is actively developing its technology and expanding the capabilities of the XRP Ledger.

- New products and features: Ripple continuously enhances its products and services, improving efficiency and functionality.

- Improvements to the XRP Ledger: The XRP Ledger is being continually optimized for speed, scalability, and security.

- Focus on scalability and efficiency: Addressing scalability concerns is crucial for broader adoption.

- Partnerships with other companies: Strategic partnerships broaden Ripple's reach and influence.

Keywords: XRP Ledger, Ripple technology, RippleNet, blockchain technology, Ripple partnerships.

Expansion into New Markets and Strategic Alliances

Ripple is actively pursuing global expansion and strategic alliances.

- Focus on international payments: Ripple aims to streamline cross-border payments using XRP.

- Partnerships with financial institutions: Collaborations with banks and financial institutions are key to adoption.

- Expansion into new markets: Ripple is actively targeting new geographic markets.

- Development of new use cases for XRP: Exploring diverse use cases beyond payments is vital for growth.

Keywords: Ripple international payments, Ripple partnerships, XRP use cases, Ripple market expansion.

Conclusion: The Future of XRP Remains Uncertain, but Hopeful

The future of XRP hinges on the outcome of the SEC lawsuit, the potential for ETF approval, and Ripple's ongoing innovation. While uncertainty remains, the potential for growth is significant. The ongoing developments surrounding Ripple, XRP, and the broader regulatory landscape for cryptocurrencies are all crucial to monitor. Stay informed about the latest news and continue to research the cryptocurrency market to make informed decisions. The future of XRP remains dynamic, making continued monitoring crucial for investors and enthusiasts alike.

Featured Posts

-

Dalys Late Show England Edges France In Six Nations Thriller

May 02, 2025

Dalys Late Show England Edges France In Six Nations Thriller

May 02, 2025 -

Kshmyr Agha Syd Rwh Allh Mhdy Ky Bharty Palysy Pr Skht Nkth Chyny

May 02, 2025

Kshmyr Agha Syd Rwh Allh Mhdy Ky Bharty Palysy Pr Skht Nkth Chyny

May 02, 2025 -

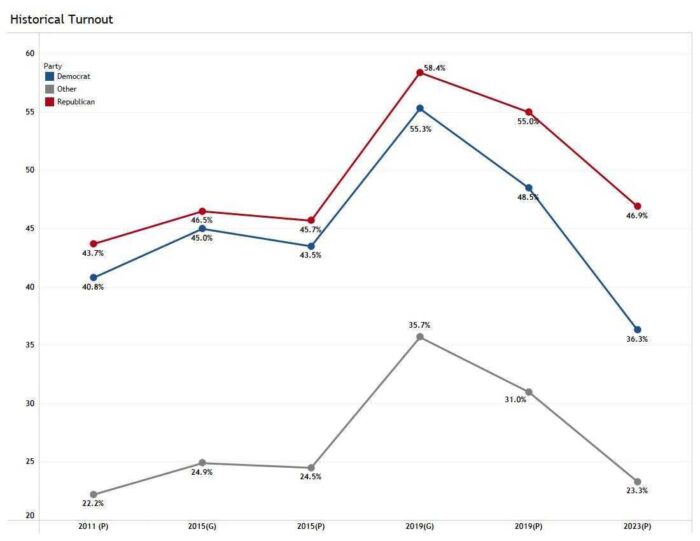

Florida And Wisconsin Turnout A Deep Dive Into The Current Political Landscape

May 02, 2025

Florida And Wisconsin Turnout A Deep Dive Into The Current Political Landscape

May 02, 2025 -

Facelifts Fan Concerns Over Celebritys Changed Appearance

May 02, 2025

Facelifts Fan Concerns Over Celebritys Changed Appearance

May 02, 2025 -

Nikki Burdine Announces New Projects With Former Co Host Neil Orne

May 02, 2025

Nikki Burdine Announces New Projects With Former Co Host Neil Orne

May 02, 2025

Latest Posts

-

Sos From Aid Ship Headed To Gaza Drone Attack Near Malta Reported

May 03, 2025

Sos From Aid Ship Headed To Gaza Drone Attack Near Malta Reported

May 03, 2025 -

Gaza Bound Aid Ship Issues Sos Following Drone Attack Claim

May 03, 2025

Gaza Bound Aid Ship Issues Sos Following Drone Attack Claim

May 03, 2025 -

Astwl Alhryt Yterd Lhjwm Israyyly Ksr Alhsar En Ghzt Fy Khtr

May 03, 2025

Astwl Alhryt Yterd Lhjwm Israyyly Ksr Alhsar En Ghzt Fy Khtr

May 03, 2025 -

Aid Ship Sos Drone Attack Allegations Near Malta

May 03, 2025

Aid Ship Sos Drone Attack Allegations Near Malta

May 03, 2025 -

Alhsar Ela Ghzt Hjwm Israyyly Ysthdf Sfynt Mn Astwl Alhryt

May 03, 2025

Alhsar Ela Ghzt Hjwm Israyyly Ysthdf Sfynt Mn Astwl Alhryt

May 03, 2025