The Goldman Sachs CEO And The Silencing Of Internal Critics

Table of Contents

Allegations of Retaliation Against Internal Critics at Goldman Sachs

Numerous allegations have surfaced regarding retaliation against Goldman Sachs employees who raised concerns about unethical practices or illegal activities. These claims paint a troubling picture of a corporate environment where dissent is not only discouraged but actively punished. This section will detail specific instances where employees who raised concerns about unethical practices or illegal activities allegedly faced retaliation.

-

Examples of alleged retaliation: Reports include instances of demotion, termination, exclusion from lucrative projects, and subtle but impactful forms of marginalization. Employees who spoke up have allegedly been sidelined, their careers effectively stalled or ended for voicing concerns. These actions create a chilling effect, discouraging others from reporting potential wrongdoing.

-

Specific cases or lawsuits: While many allegations remain unproven, several lawsuits have been filed against Goldman Sachs, detailing specific instances of alleged retaliation. These lawsuits often involve detailed accounts of whistleblowers facing significant career setbacks after reporting potential violations of law or company policy. The outcomes of these legal battles will significantly impact the narrative and potentially set legal precedents.

-

Analysis of the legal implications: The legal implications of these actions are far-reaching. Laws protecting whistleblowers vary, but generally prohibit retaliation against employees who report illegal activity. Violations can result in significant financial penalties for the company and potentially criminal charges against individuals involved. The ongoing legal battles surrounding these allegations highlight the serious consequences of silencing internal critics. This includes not only legal ramifications but also reputational damage.

The Role of the Goldman Sachs CEO in Maintaining Corporate Culture

The Goldman Sachs CEO plays a pivotal role in shaping the firm's culture and setting the tone for how dissenting voices are treated. Their actions, statements, and leadership style directly influence whether a culture of open communication and accountability thrives or whether a climate of fear and silence prevails.

-

Examination of the CEO's public statements and actions: Public statements regarding ethical conduct and internal whistleblowing policies offer insight into the CEO's commitment to fostering a transparent workplace. Actions speak louder than words, however. The CEO’s response to allegations of retaliation, whether through internal investigations or public statements, is crucial in determining the company’s commitment to accountability.

-

Analysis of the company's internal policies and procedures for handling complaints: The effectiveness of internal complaint mechanisms is paramount. Robust systems for reporting concerns, coupled with thorough investigations and protection for whistleblowers, are essential for building trust and encouraging open communication. A lack of transparency or a history of inaction in response to complaints will further erode employee confidence.

-

Discussion of the CEO's responsibility to create a culture of transparency and accountability: The CEO bears ultimate responsibility for establishing and maintaining a culture that values ethical conduct and protects whistleblowers. This requires a proactive approach, actively promoting a workplace where employees feel comfortable raising concerns without fear of retribution. This also involves creating clear channels for reporting and investigating allegations swiftly and impartially.

Implications for the Broader Financial Industry and Corporate Governance

The allegations at Goldman Sachs have broader implications for the financial industry and corporate governance as a whole. The silencing of internal critics undermines investor confidence, invites regulatory scrutiny, and challenges established corporate governance standards.

-

Discussion of the importance of strong whistleblower protection laws: Stronger whistleblower protection laws are crucial to encourage reporting of wrongdoing and prevent the suppression of dissent within organizations. These laws must provide adequate safeguards against retaliation and ensure that whistleblowers are not penalized for coming forward. Current laws, while present, often lack sufficient teeth to truly protect whistleblowers from the powerful forces arrayed against them.

-

Analysis of the role of regulatory bodies in overseeing corporate ethical conduct: Regulatory bodies play a critical role in overseeing corporate ethical conduct and investigating allegations of wrongdoing. Effective enforcement and transparent investigations are necessary to maintain public trust and ensure accountability within the financial industry. Independent oversight is crucial to avoid conflicts of interest and ensure thorough investigations.

-

Examination of best practices for fostering ethical corporate cultures: Companies need to adopt robust ethical guidelines, implement effective training programs, and create a culture where ethical conduct is not just expected but actively rewarded. This includes creating strong channels for reporting concerns, ensuring swift and impartial investigations, and offering meaningful protection for whistleblowers.

The Impact on Employee Morale and Productivity

Silencing internal critics creates a toxic work environment that negatively impacts employee morale, productivity, and innovation. Employees may become hesitant to express their opinions, leading to decreased engagement and stifled creativity. The loss of talented employees who leave due to a culture of fear further compounds the problem. This leads to a decline in overall productivity and innovation, ultimately harming the company's long-term success.

Conclusion

This article has examined the serious allegations of the silencing of internal critics at Goldman Sachs, highlighting the potential implications for corporate culture, ethical conduct, and the broader financial industry. The role of the CEO in fostering a culture of accountability is crucial. The potential for systemic issues within Goldman Sachs and other financial institutions necessitates a renewed focus on ethical leadership, robust whistleblower protection, and a commitment to transparency.

The silencing of internal critics at institutions like Goldman Sachs demands increased scrutiny and reform. We need to strengthen protections for whistleblowers and promote a culture of transparency and ethical conduct within all corporations. Let’s demand greater accountability from corporate leaders and work towards ending the silencing of internal critics within the financial industry and beyond. Engage in the conversation surrounding Goldman Sachs and corporate accountability. #GoldmanSachs #CorporateAccountability #WhistleblowerProtection

Featured Posts

-

Alcaraz And Swiateks Winning Starts At Roland Garros

May 28, 2025

Alcaraz And Swiateks Winning Starts At Roland Garros

May 28, 2025 -

Bond Market Instability Assessing The Scale Of The Crisis

May 28, 2025

Bond Market Instability Assessing The Scale Of The Crisis

May 28, 2025 -

Could Rayan Cherki Join Liverpool This Summer

May 28, 2025

Could Rayan Cherki Join Liverpool This Summer

May 28, 2025 -

Hujan Guyur Jawa Tengah Prakiraan Cuaca 23 April 2024

May 28, 2025

Hujan Guyur Jawa Tengah Prakiraan Cuaca 23 April 2024

May 28, 2025 -

Gyoekeres Atigazolasa Az Arsenalhoz Mit Mondanak A Szamok

May 28, 2025

Gyoekeres Atigazolasa Az Arsenalhoz Mit Mondanak A Szamok

May 28, 2025

Latest Posts

-

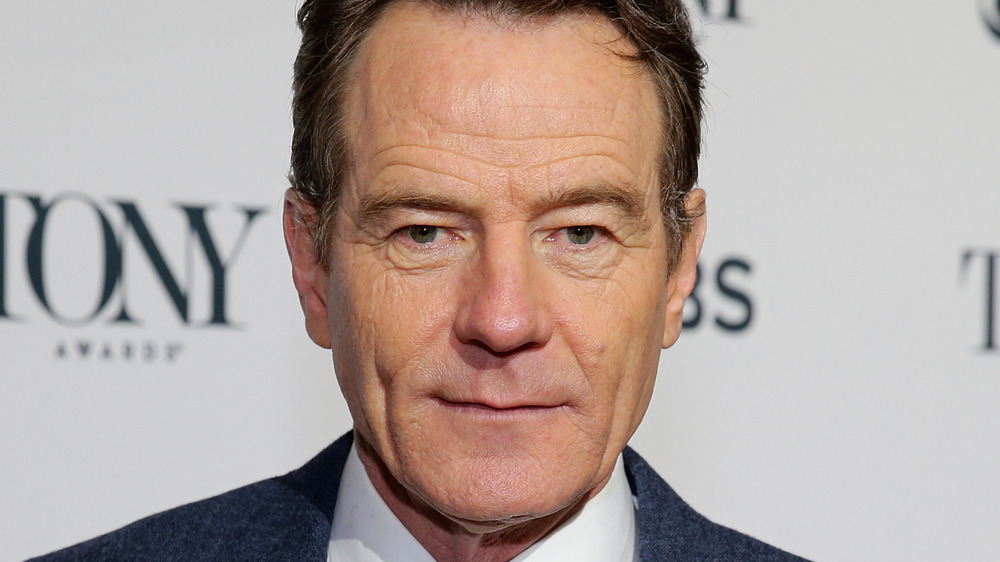

Production Wraps On Lone Wolf A Conspiracy Thriller Starring Lily Gladstone And Bryan Cranston

May 29, 2025

Production Wraps On Lone Wolf A Conspiracy Thriller Starring Lily Gladstone And Bryan Cranston

May 29, 2025 -

The Uncanny Accuracy Of Bryan Cranstons Pete Rose Joke On How I Met Your Mother

May 29, 2025

The Uncanny Accuracy Of Bryan Cranstons Pete Rose Joke On How I Met Your Mother

May 29, 2025 -

Bryan Cranstons How I Met Your Mother Pete Rose Joke A 20 Year Prediction

May 29, 2025

Bryan Cranstons How I Met Your Mother Pete Rose Joke A 20 Year Prediction

May 29, 2025 -

Bryan Cranston Net Worth 2025 How Much Has He Earned

May 29, 2025

Bryan Cranston Net Worth 2025 How Much Has He Earned

May 29, 2025 -

Bryan Cranstons Net Worth In 2025 A Comprehensive Look At His Earnings

May 29, 2025

Bryan Cranstons Net Worth In 2025 A Comprehensive Look At His Earnings

May 29, 2025