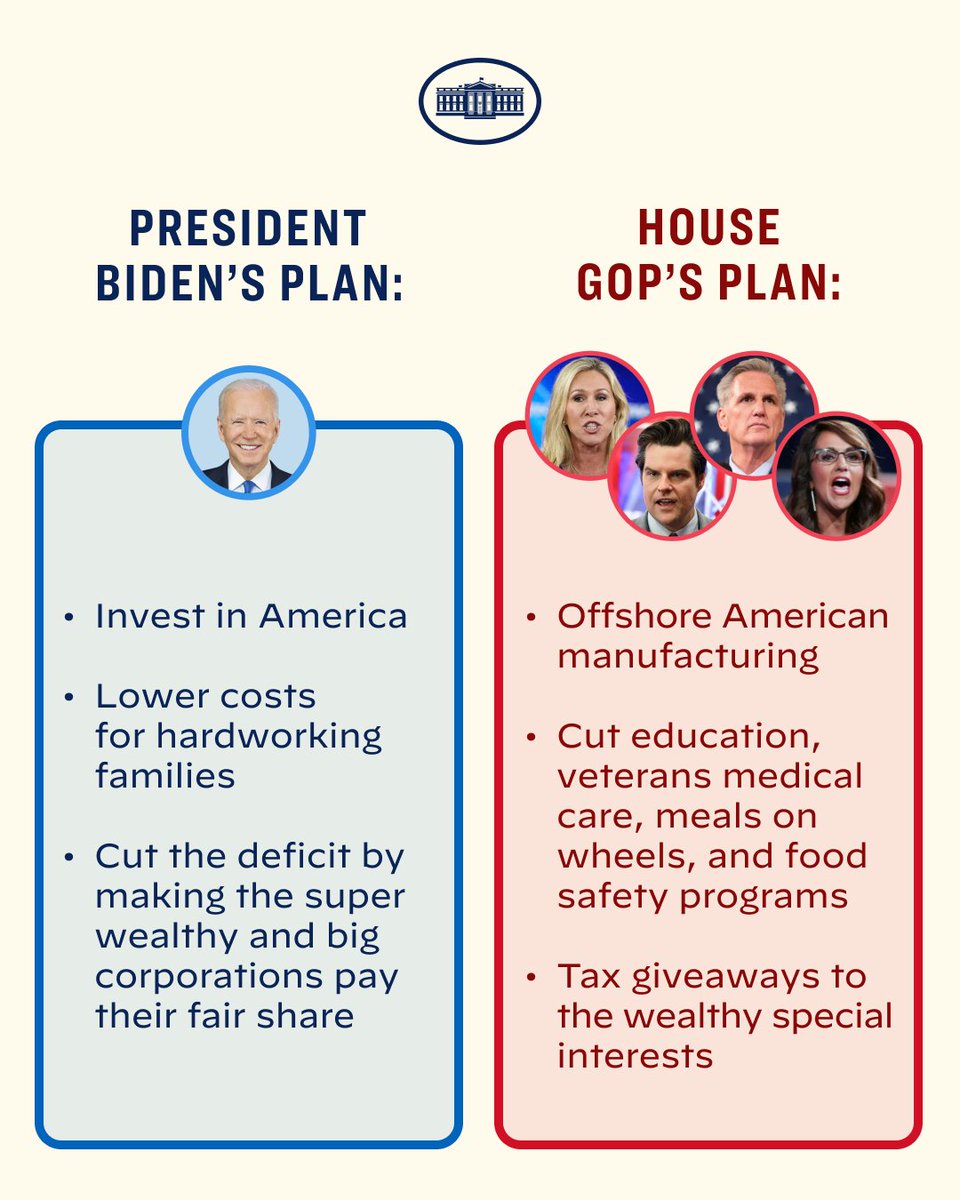

The GOP Tax Plan And The National Deficit: Fact-Based Evaluation

Table of Contents

H2: The 2017 GOP Tax Cuts: A Summary of Key Provisions

The 2017 Tax Cuts and Jobs Act represented a sweeping overhaul of the US tax code. Key provisions included substantial reductions in both corporate and individual income tax rates. These changes aimed to stimulate economic growth through supply-side economics.

- Corporate Tax Rate Cut: The corporate tax rate was slashed from 35% to 21%, a dramatic reduction intended to boost business investment and job creation.

- Individual Income Tax Cuts: Individual tax brackets were also reduced, with significant cuts for higher-income earners. Standard deductions were increased, and the alternative minimum tax (AMT) was modified.

- Pass-Through Business Deduction: A new deduction was introduced for pass-through businesses, such as partnerships and sole proprietorships.

These changes, while intended to stimulate the economy and increase tax revenue through higher economic activity, ultimately resulted in a significant decrease in government revenue in the short term. Keywords: tax cuts, corporate tax rate, individual income tax, tax reform.

H2: Projected vs. Actual Impact on the National Deficit

Initial projections from the Congressional Budget Office (CBO) estimated that the 2017 tax cuts would add significantly to the national debt over the next decade. However, the actual impact exceeded even these projections.

- CBO Projections: The CBO initially projected an increase in the deficit of several trillion dollars over ten years.

- Actual Results: Data from the Treasury Department revealed a greater increase in the deficit than initially predicted. This discrepancy highlights the challenges in accurately forecasting the economic effects of large-scale tax cuts.

[Ideally, insert a chart or graph here visually comparing CBO projections and actual deficit data. Source the data clearly from the CBO and Treasury Department reports.] Keywords: national debt, budget deficit, fiscal impact, CBO projections.

H3: Revenue Projections and Economic Growth

Proponents of the 2017 tax cuts argued that the resulting economic growth would offset the revenue losses through increased tax collections. While GDP growth did occur in the years following the tax cuts, the increase was not sufficient to compensate for the significant revenue reduction caused by the lower tax rates.

- Supply-Side Economics: The argument rested on the principles of supply-side economics, suggesting lower taxes would incentivize investment and job creation, leading to higher overall tax revenue.

- Evidence: Data on GDP growth and tax revenue collected following the tax cuts show that while GDP grew, the increase in tax revenue was not enough to offset the reduction in tax rates. This suggests that the supply-side effects were not as substantial as predicted. Keywords: economic growth, GDP, tax revenue, supply-side economics.

H2: Long-Term Fiscal Implications of the GOP Tax Plan

The 2017 tax cuts have profound long-term fiscal implications. The increased national debt resulting from these cuts will necessitate either future tax increases, spending cuts, or a combination of both to ensure fiscal sustainability.

- Increased Debt Burden: The higher national debt places a significant burden on future generations who will inherit this debt.

- Future Policy Choices: Future policy decisions will be constrained by the increased debt, limiting the government's ability to address other pressing social and economic challenges. Keywords: long-term debt, fiscal sustainability, generational equity.

H2: Alternative Perspectives and Criticisms

It's important to acknowledge alternative perspectives on the impact of the 2017 tax cuts. Some economists argue that the CBO's initial projections underestimated the potential for economic growth stimulated by the tax cuts. Others criticize the methodology used to assess the tax plan's impact, suggesting that alternative models might yield different results. These counterarguments highlight the inherent complexities and uncertainties in economic forecasting. Keywords: economic policy, tax policy debate, fiscal responsibility.

3. Conclusion:

The evidence strongly suggests that the 2017 GOP tax plan significantly contributed to the growth of the national deficit, exceeding initial projections. While proponents argued that economic growth would offset revenue losses, the data indicates that this did not materialize to the extent predicted. The long-term fiscal consequences are considerable, placing a burden on future generations and limiting future policy options. Understanding the complexities of the GOP tax plan and its effect on the national deficit requires careful consideration of factual data. Continue your research and form your own informed opinion on the GOP tax plan and the national deficit.

Featured Posts

-

Challenging The Trans Australia Run World Record

May 21, 2025

Challenging The Trans Australia Run World Record

May 21, 2025 -

Tikkie Uw Gids Voor Probleemloos Bankieren In Nederland

May 21, 2025

Tikkie Uw Gids Voor Probleemloos Bankieren In Nederland

May 21, 2025 -

Ancelotti Nin Yerine Klopp Avantajlar Ve Dezavantajlar

May 21, 2025

Ancelotti Nin Yerine Klopp Avantajlar Ve Dezavantajlar

May 21, 2025 -

Yemen Missile Targeting Ben Gurion Airport Russia Cracks Down On Amnesty Sofrep Update

May 21, 2025

Yemen Missile Targeting Ben Gurion Airport Russia Cracks Down On Amnesty Sofrep Update

May 21, 2025 -

Enjoy The City A Curated List Of Manhattan Outdoor Dining Spots

May 21, 2025

Enjoy The City A Curated List Of Manhattan Outdoor Dining Spots

May 21, 2025

Latest Posts

-

Huuhkajat Avauskokoonpanoon Kolme Muutosta Kaellman Penkille

May 21, 2025

Huuhkajat Avauskokoonpanoon Kolme Muutosta Kaellman Penkille

May 21, 2025 -

Huuhkajat Kaksikko Kaellman Ja Hoskonen Jaettaevaet Puolan Seuran

May 21, 2025

Huuhkajat Kaksikko Kaellman Ja Hoskonen Jaettaevaet Puolan Seuran

May 21, 2025 -

Jalkapallo Kaellman Ja Hoskonen Pois Puolalaisseurasta

May 21, 2025

Jalkapallo Kaellman Ja Hoskonen Pois Puolalaisseurasta

May 21, 2025 -

Huuhkajien Uusi Avauskokoonpano Kaksi Keskikenttaepelaajaa Ja Kaellman Penkillae

May 21, 2025

Huuhkajien Uusi Avauskokoonpano Kaksi Keskikenttaepelaajaa Ja Kaellman Penkillae

May 21, 2025 -

Kaellman Ja Hoskonen Laehtoe Puolasta Vahvistui

May 21, 2025

Kaellman Ja Hoskonen Laehtoe Puolasta Vahvistui

May 21, 2025