The Hot Venture Capital Secondary Market: Reasons For Explosive Growth

Table of Contents

Increased Demand for Liquidity Among Investors

The burgeoning venture capital secondary market is largely a response to the growing need for liquidity among investors. Venture capital, by its nature, is a long-term investment, often tying up capital for many years before an exit event like an IPO or acquisition. However, several factors are driving investors to seek earlier liquidity than previously typical:

-

Longer Investment Horizons in Venture Capital: Venture capital investments traditionally have extended timelines, sometimes spanning a decade or more before realizing significant returns. This extended timeframe creates a liquidity constraint for some investors.

-

Need for Portfolio Diversification: Investors frequently need to rebalance their portfolios to manage risk and optimize returns. The secondary market offers a mechanism to sell existing VC holdings and diversify into other asset classes.

-

Unexpected Financial Needs or Opportunities: Unforeseen circumstances, such as a personal emergency or the emergence of a highly attractive investment opportunity, can necessitate the quick sale of assets, including venture capital stakes.

-

Investor Portfolio Rebalancing: As portfolios grow, investors often strategically rebalance their assets to align with their risk tolerance and investment goals. The VC secondary market facilitates this rebalancing.

-

Increased Institutional Investor Participation: The growing involvement of institutional investors like pension funds and endowments in venture capital has also heightened the demand for liquidity options. These institutions often have strict liquidity requirements that the secondary market helps satisfy.

Rise of Sophisticated Secondary Market Platforms and Participants

The rise of sophisticated platforms and participants has been instrumental in fueling the growth of the venture capital secondary market. Improved technology and increased regulatory clarity have made secondary transactions more efficient and transparent:

-

Growth of Online Platforms: The development of online platforms has greatly simplified the process of connecting buyers and sellers, creating greater market efficiency and transparency.

-

Emergence of Specialized Secondary Market Funds and Brokers: Specialized funds and brokerage firms dedicated to secondary transactions have emerged, providing expertise and liquidity to the market.

-

Improved Valuation Methodologies: The development of more robust valuation methodologies for private company shares has increased confidence in the pricing of secondary transactions.

-

Increased Regulatory Clarity and Investor Protection: Enhanced regulatory frameworks and investor protections have created a more stable and attractive environment for secondary market activity.

-

Technological Advancements: Technological advancements, including data analytics and sophisticated matching algorithms, have streamlined the process of facilitating secondary transactions.

Attractive Returns and Enhanced Portfolio Management

The venture capital secondary market offers attractive potential returns for both buyers and sellers. This dual appeal is a key factor driving market expansion:

-

Discounted Acquisitions: Buyers can potentially acquire stakes in high-growth companies at prices below their current market valuations, offering attractive upside potential.

-

Portfolio Diversification for Buyers: The secondary market allows buyers to diversify their portfolios beyond primary investments, gaining exposure to a wider range of companies and sectors.

-

Higher Returns Compared to Other Asset Classes: The secondary market can provide higher potential returns compared to more traditional asset classes, attracting significant investment interest.

-

Profit Realization and Capital Reinvestment for Sellers: Sellers can realize profits on their initial investments and reinvest capital into new opportunities, thereby optimizing their capital allocation.

-

Improved Risk Management: The ability to sell portions of a portfolio contributes to improved risk management and diversification, allowing investors to adjust their exposure to various market conditions.

Maturing Venture Capital Ecosystem

The growth of the venture capital secondary market is closely tied to the overall maturation of the venture capital industry itself:

-

Increased Number of Mature Companies: A larger number of venture-backed companies are reaching maturity, creating more opportunities for secondary transactions.

-

Larger Fund Sizes: Larger fund sizes lead to a greater need for liquidity management, driving the demand for secondary market solutions.

-

Greater Institutional Involvement: The increased participation of institutional investors in venture capital further fuels the demand for liquidity options provided by the secondary market.

-

Improved Data and Analytics: Better data and analytics on private company valuations contribute to more accurate pricing and increased confidence in secondary transactions.

-

Standardized Processes and Documentation: The development of standardized processes and documentation for secondary transactions has simplified the transaction process and reduced friction.

Understanding and Leveraging the Venture Capital Secondary Market

The explosive growth of the venture capital secondary market is a result of increased demand for liquidity, the development of sophisticated platforms and participants, attractive returns for both buyers and sellers, and the overall maturation of the venture capital ecosystem. This dynamic market presents significant opportunities but also requires careful consideration of the associated challenges. To fully understand and leverage the potential of this market, further exploration of investment strategies, available platforms, and regulatory considerations is vital. To learn more about navigating the complexities of the venture capital secondary market, subscribe to our newsletter or contact a specialist today for a consultation on VC secondary market investments.

Featured Posts

-

Mlb Scores Twins 6 Mets 3 Minnesota Takes Series Lead

Apr 29, 2025

Mlb Scores Twins 6 Mets 3 Minnesota Takes Series Lead

Apr 29, 2025 -

Watch Lionel Messis Inter Miami Matches Mls Schedule Live Streams And Betting

Apr 29, 2025

Watch Lionel Messis Inter Miami Matches Mls Schedule Live Streams And Betting

Apr 29, 2025 -

The Crucial Role Of Middle Managers In Boosting Employee Performance And Company Profitability

Apr 29, 2025

The Crucial Role Of Middle Managers In Boosting Employee Performance And Company Profitability

Apr 29, 2025 -

Vancouver Festival Tragedy Car Rams Crowd Leaving Many Injured

Apr 29, 2025

Vancouver Festival Tragedy Car Rams Crowd Leaving Many Injured

Apr 29, 2025 -

Securing Dysprosium Supply A Necessary Step For The Future Of Evs

Apr 29, 2025

Securing Dysprosium Supply A Necessary Step For The Future Of Evs

Apr 29, 2025

Latest Posts

-

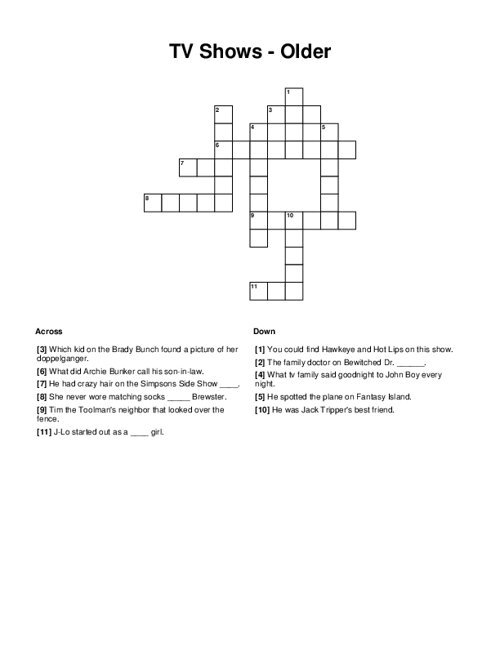

Nostalgia And You Tube How Older Viewers Find Comfort In Familiar Shows

Apr 29, 2025

Nostalgia And You Tube How Older Viewers Find Comfort In Familiar Shows

Apr 29, 2025 -

Why Older Viewers Are Choosing You Tube For Their Entertainment

Apr 29, 2025

Why Older Viewers Are Choosing You Tube For Their Entertainment

Apr 29, 2025 -

You Tube A New Home For Classic Tv Shows And Beloved Programs For Older Audiences

Apr 29, 2025

You Tube A New Home For Classic Tv Shows And Beloved Programs For Older Audiences

Apr 29, 2025 -

You Tube A New Home For Classic Tv Shows And Older Viewers

Apr 29, 2025

You Tube A New Home For Classic Tv Shows And Older Viewers

Apr 29, 2025 -

You Tubes Growing Popularity Among Older Viewers A Resurgence Of Classic Shows

Apr 29, 2025

You Tubes Growing Popularity Among Older Viewers A Resurgence Of Classic Shows

Apr 29, 2025