The Impact Of Buffett's Retirement On Berkshire Hathaway's Apple Investment

Table of Contents

H2: Berkshire Hathaway's Apple Holding: A Pre-Retirement Overview

Before Buffett's retirement, Berkshire Hathaway held a massive stake in Apple, solidifying its position as one of Apple's largest shareholders. This investment, built over several years, reflected Buffett's deep confidence in Apple's long-term prospects and its powerful brand. His public endorsements further cemented Apple's image as a sound investment.

- Quantifying the Stake: At its peak, Berkshire Hathaway's Apple holding represented a significant percentage of its overall portfolio – a multi-billion dollar investment that significantly influenced the company's overall performance.

- Historical Performance: The Apple investment yielded substantial returns for Berkshire Hathaway before Buffett's retirement, showcasing the success of Buffett’s investment strategy. This success fueled confidence in his investment approach and further strengthened the importance of Berkshire Hathaway's Apple investment.

- Buffett's Rationale: Buffett frequently praised Apple's strong brand, loyal customer base, and innovative product pipeline, factors he cited as key reasons behind the substantial investment. His admiration for Tim Cook's leadership also played a significant role.

H2: The Potential Impacts of Buffett's Succession on Apple Investment Strategy

The succession plan, transferring leadership to Greg Abel and Ajit Jain, introduces uncertainty regarding future investment decisions. While both Abel and Jain are highly respected within Berkshire Hathaway, their individual investment styles might differ from Buffett’s, leading to potential shifts in the company's investment philosophy.

- Succession and Investment Styles: Greg Abel’s operational background and Ajit Jain's insurance expertise might influence their decision-making concerning the Apple investment. Their approaches may be more data-driven or focused on different sectors, impacting their view of the technology sector.

- Potential Scenarios for Apple: Several scenarios are possible: maintaining the current significant Apple stake, strategically increasing it based on future performance projections, or gradually divesting to diversify the portfolio. The exact course will depend heavily on their assessment of Apple’s future.

- The Role of the Investment Team: Berkshire Hathaway's experienced investment team plays a crucial role. Their recommendations and analysis will significantly inform the decisions made by Abel and Jain regarding the Apple investment and future investment strategy.

H2: Market Reactions and Investor Sentiment Following Buffett's Retirement

The announcement of Buffett's retirement triggered a wave of analysis and speculation across the financial markets. While the immediate market reaction was relatively muted, the long-term implications are subject to ongoing debate and scrutiny.

- Stock Price Fluctuations: While Apple's stock price wasn't dramatically affected immediately after the retirement announcement, the overall market sentiment reflected some level of uncertainty, leading to minor fluctuations.

- Analyst Reports and News Articles: Many financial analysts weighed in, offering diverse opinions on the potential impact on Berkshire Hathaway's investment strategy. These reports reflected a range of perspectives, from cautious optimism to significant concerns.

- Investor Confidence: Maintaining investor confidence will be key. Transparency regarding Berkshire Hathaway's future investment direction and clear communication from the new leadership team will be crucial in reassuring investors and mitigating potential negative reactions.

H3: The Role of Apple's Future Performance

Irrespective of leadership changes at Berkshire Hathaway, Apple's future performance will significantly impact the value of the investment. Apple's continued innovation, competitive landscape, and market trends all play a crucial role.

- Factors Affecting Apple's Growth: Apple's success hinges on continuous innovation in its product lines, maintaining its competitive edge against rivals, and adapting to evolving market trends.

- Apple's Profitability: Maintaining or increasing profitability will be key to supporting the investment's value. Economic factors and consumer spending will impact Apple's future performance significantly.

- Macroeconomic Influences: Global economic conditions, including interest rates and inflation, will influence consumer spending and, consequently, Apple's performance, indirectly impacting Berkshire Hathaway's investment.

3. Conclusion:

Buffett's retirement introduces significant uncertainty regarding the future of Berkshire Hathaway's substantial Apple investment. The succession plan, the new leadership's investment philosophy, market reactions, and Apple's future performance will all play pivotal roles in shaping the outcome. Understanding the interplay of these factors is crucial. The success of the transition will depend on effective succession planning, clear communication, and a well-defined investment strategy.

Call to Action: Understanding the implications of Buffett's retirement on Berkshire Hathaway's Apple investment requires ongoing analysis. Stay informed about the evolving situation by following relevant financial news and expert opinions on Berkshire Hathaway’s investment strategy and Apple's future prospects. Further research into Warren Buffett's legacy and succession planning will provide further insight into this dynamic situation.

Featured Posts

-

Fly Local Explore Global England Airpark And Alexandria International Airport Launch New Campaign

May 25, 2025

Fly Local Explore Global England Airpark And Alexandria International Airport Launch New Campaign

May 25, 2025 -

Us China Trade Surge Deadline Fuels Export Rush

May 25, 2025

Us China Trade Surge Deadline Fuels Export Rush

May 25, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025 -

The Demna Gvasalia Gucci Era Expectations And Predictions

May 25, 2025

The Demna Gvasalia Gucci Era Expectations And Predictions

May 25, 2025 -

Building Bridges Best Of Bangladesh In Europes Second Edition On Collaboration

May 25, 2025

Building Bridges Best Of Bangladesh In Europes Second Edition On Collaboration

May 25, 2025

Latest Posts

-

Addressing The Housing Crisis A Balanced Approach Inspired By Gregor Robertson

May 25, 2025

Addressing The Housing Crisis A Balanced Approach Inspired By Gregor Robertson

May 25, 2025 -

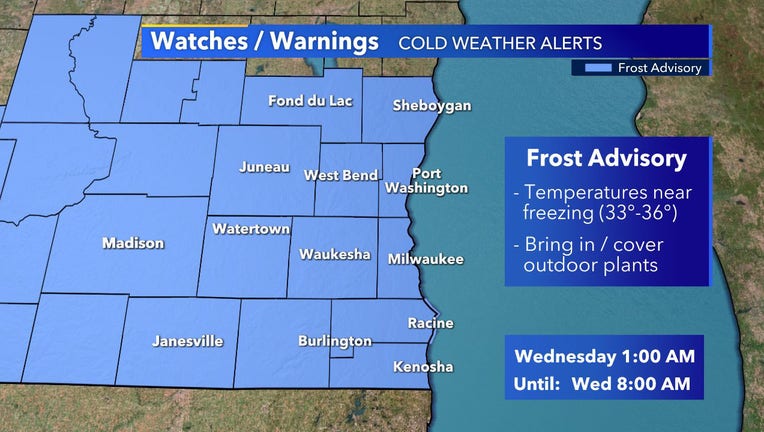

Coastal Flood Advisory Southeast Pa Wednesday Update

May 25, 2025

Coastal Flood Advisory Southeast Pa Wednesday Update

May 25, 2025 -

Potential Canada Post Strike The Risk To Customer Relations

May 25, 2025

Potential Canada Post Strike The Risk To Customer Relations

May 25, 2025 -

The Gregor Robertson Housing Plan A Path To Affordability Without A Market Collapse

May 25, 2025

The Gregor Robertson Housing Plan A Path To Affordability Without A Market Collapse

May 25, 2025 -

Canada Post Strike Threat Impact On Customers And Business

May 25, 2025

Canada Post Strike Threat Impact On Customers And Business

May 25, 2025