The Impact Of Elon Musk's Actions On Dogecoin's Price

Table of Contents

Elon Musk's Tweets and their Ripple Effect on Dogecoin

Elon Musk's Twitter account has become, for better or worse, a powerful tool shaping Dogecoin's price. His tweets, often cryptic or whimsical, have repeatedly triggered significant price fluctuations. A simple mention of "Doge" can send the price soaring, while a critical tweet can lead to a sharp decline. This demonstrates the immense power of social media influence in the cryptocurrency market and highlights the vulnerability of Dogecoin to social media manipulation.

Analyzing the sentiment behind his tweets reveals a clear correlation between positive messaging and price increases, and vice-versa. Neutral tweets often have less impact. Let's examine some key examples:

-

Example 1: A tweet simply stating "Doge" or including a Dogecoin meme often results in an immediate, often substantial, price surge. The increase can range from a few percentage points to double-digit gains within hours.

-

Example 2: Conversely, a negative tweet or even a perceived slight can trigger a sharp price drop, sometimes wiping out substantial gains made previously. For example, any mention of selling Dogecoin or a joke about the coin could cause a significant downturn.

-

Example 3: Any news regarding potential SpaceX/Dogecoin integration, even if just speculation, creates massive volatility, reflecting the hope (and fear) surrounding this potential synergy.

(Insert chart/graph here illustrating Dogecoin price movements correlated with specific Elon Musk tweets. Source the data used.)

The sheer unpredictability of these price swings underscores the risks associated with Dogecoin price volatility and highlights the need for cautious and informed investment strategies in the crypto market.

Musk's Endorsements and their Influence on Dogecoin's Market Cap

Beyond tweets, Musk's public endorsements of Dogecoin have significantly boosted its market capitalization. Appearances on Saturday Night Live (SNL), interviews, and other public pronouncements have all had a measurable impact on investor confidence and trading volume.

-

SNL appearance and its effect on Dogecoin price: Musk's hosting of SNL and the subsequent mention (or lack thereof) of Dogecoin had a dramatic impact on its price. The price initially surged, driven by anticipation, but then experienced a significant correction as his performance and comments failed to meet some investors' expectations.

-

Interviews mentioning Dogecoin and subsequent price changes: Any interview where Musk favorably mentions Dogecoin typically results in an immediate price increase and increased trading activity. The media amplification of these appearances further fuels this effect.

-

Impact on investor confidence and trading volume: Musk's endorsements undoubtedly play a significant role in shaping public perception. Positive endorsements increase investor confidence, leading to higher trading volumes and price appreciation. Conversely, negative sentiment can trigger sell-offs.

The role of media coverage cannot be understated. Major news outlets reporting on Musk's actions amplify their impact, reaching a wider audience and influencing the broader cryptocurrency market. The combination of Musk's endorsements and media coverage creates a powerful force shaping Dogecoin's market cap and overall perception.

SpaceX and Dogecoin: Exploring Potential Synergies and their Price Implications

Speculation around the potential integration of Dogecoin into SpaceX services, for example, as a payment method, remains a significant driver of Dogecoin's price. While no concrete plans have been announced, the mere possibility fuels significant speculative investment.

-

Speculation around SpaceX accepting Dogecoin: The persistent rumors and speculation surrounding SpaceX accepting Dogecoin as payment for merchandise or services continually ignite price surges.

-

Impact of any potential announcement on the Dogecoin price: A formal announcement of SpaceX integrating Dogecoin would likely cause a massive and unpredictable price jump, potentially attracting significant mainstream investment.

-

Wider implications for crypto adoption: Successful integration by a company of SpaceX's stature would be a huge step for cryptocurrency adoption, legitimizing Dogecoin and potentially boosting the entire crypto market.

This potential integration signifies the broader implications of Elon Musk’s influence on the future of Dogecoin. The speculative nature of this synergy emphasizes the crucial need for discerning investors to approach such situations with caution and a well-informed understanding of the risks involved.

Regulatory Scrutiny and the Future of Elon Musk's Influence on Dogecoin

The significant price swings caused by Elon Musk's actions have naturally attracted regulatory scrutiny. The potential for market manipulation raises concerns, and the consequences could include SEC investigations and penalties.

-

SEC investigations and potential penalties: The SEC's ongoing scrutiny of Musk's actions regarding Dogecoin highlights the potential legal risks associated with his influence. Any finding of market manipulation could result in substantial fines and other penalties.

-

Impact of regulatory uncertainty on Dogecoin’s price: The uncertain regulatory landscape surrounding Musk’s activities creates additional volatility for Dogecoin’s price. Clearer regulations could potentially stabilize the market, but this remains uncertain.

-

Long-term outlook for Dogecoin’s price independence from Musk: The long-term health of Dogecoin depends on its ability to establish its value independently of Musk’s influence. This will require increased adoption and utility beyond the speculative element currently driven by his actions.

The future of Dogecoin’s price stability hinges on a reduction in reliance on Elon Musk's actions. Addressing the regulatory risk and promoting independent growth are crucial for Dogecoin's long-term sustainability.

Conclusion: Understanding the Complex Relationship Between Elon Musk and Dogecoin's Price

In conclusion, Elon Musk's tweets, endorsements, and the speculative potential of SpaceX integration demonstrably and significantly affect Dogecoin's price. His influence drives much of the cryptocurrency's inherent volatility. The unpredictable nature of his actions, coupled with the amplification of the media, creates a unique and risky investment landscape. Informed decision-making is crucial in this volatile market. Before investing in Dogecoin, conduct thorough research, understand the inherent risks of cryptocurrency price volatility, and stay informed about Elon Musk's actions and their potential impact on the Dogecoin price. Further reading on Elon Musk’s influence on the crypto market and the dynamics of cryptocurrency price volatility is strongly recommended.

Featured Posts

-

90 Let Sergeyu Yurskomu Vospominaniya O Zhizni I Tvorchestve

May 25, 2025

90 Let Sergeyu Yurskomu Vospominaniya O Zhizni I Tvorchestve

May 25, 2025 -

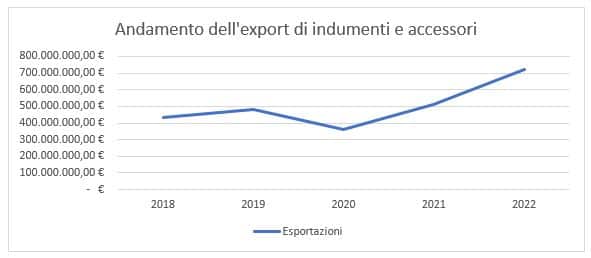

L Impatto Dei Dazi Sulle Tendenze Moda Negli Stati Uniti

May 25, 2025

L Impatto Dei Dazi Sulle Tendenze Moda Negli Stati Uniti

May 25, 2025 -

Thlyl Adae Daks 30 Tjawz Dhrwt Mars Lawl Mrt Fy Awrwba

May 25, 2025

Thlyl Adae Daks 30 Tjawz Dhrwt Mars Lawl Mrt Fy Awrwba

May 25, 2025 -

The Fall From Grace 17 Celebrities Whose Images Were Tarnished Instantly

May 25, 2025

The Fall From Grace 17 Celebrities Whose Images Were Tarnished Instantly

May 25, 2025 -

New Ferrari Flagship Showroom Opens In Bangkok

May 25, 2025

New Ferrari Flagship Showroom Opens In Bangkok

May 25, 2025

Latest Posts

-

Lewis Hamilton And Former Teammate A Heartwarming Moment In F1 Testing

May 25, 2025

Lewis Hamilton And Former Teammate A Heartwarming Moment In F1 Testing

May 25, 2025 -

Zheng Qinwens Historic Win Upsets Sabalenka At Italian Open

May 25, 2025

Zheng Qinwens Historic Win Upsets Sabalenka At Italian Open

May 25, 2025 -

Rekordnye Podiumy Mercedes Vklad Lyuisa Khemiltona I Dzhordzha Rassela

May 25, 2025

Rekordnye Podiumy Mercedes Vklad Lyuisa Khemiltona I Dzhordzha Rassela

May 25, 2025 -

300 Podiumov Mercedes Analiz Dostizheniy Komandy I Pilotov

May 25, 2025

300 Podiumov Mercedes Analiz Dostizheniy Komandy I Pilotov

May 25, 2025 -

Yubileyniy Podium Mercedes Zasluga Rassela I Dostizheniya Khemiltona

May 25, 2025

Yubileyniy Podium Mercedes Zasluga Rassela I Dostizheniya Khemiltona

May 25, 2025