The Impact Of Trump's First 100 Days On Elon Musk's Financial Status

Table of Contents

Donald Trump's ascendance to the presidency in 2017 and Elon Musk's already established dominance in the aerospace and electric vehicle industries created a potent mix. Musk's companies – SpaceX, a pioneering space exploration firm, and Tesla, a revolutionary electric car manufacturer – are both highly sensitive to shifts in government policy and overall economic sentiment. Therefore, Trump’s first 100 days in office, a period characterized by significant policy changes, provided a crucial lens through which to examine the impact on Musk’s vast financial interests. This analysis will explore the multifaceted relationship between Trump's early policy decisions and their subsequent effect on Musk's businesses.

Regulatory Changes and Their Effect on Tesla

Impact of Environmental Policies

Trump's early stance on environmental regulations, most notably his withdrawal from the Paris Agreement, initially sparked concerns about Tesla's future. The Paris Agreement had established a global framework for reducing greenhouse gas emissions, a framework that directly aligned with Tesla’s mission.

- Policy Change: Withdrawal from the Paris Agreement signaled a potential shift away from environmentally friendly policies.

- Effect on Tesla: This raised questions about the long-term demand for electric vehicles and potentially impacted investor confidence in Tesla.

- Stock Price Shift: While the immediate impact on Tesla's stock price was not catastrophic, it did contribute to increased market volatility. The uncertainty surrounding future environmental regulations created a climate of speculation.

However, the impact was more nuanced than a simple negative correlation. Trump's administration also pursued other policies that indirectly benefitted Tesla, such as tax cuts that helped reduce the overall cost of production.

Changes in Tax Policy and Their Implications

Trump's tax cuts, implemented in late 2017, had a potentially significant positive effect on Tesla’s financial health.

- Tax Change: The Tax Cuts and Jobs Act of 2017 reduced the corporate tax rate.

- Impact on Tesla's Bottom Line: This lowered Tesla's tax burden and improved its profitability. This benefit was particularly significant given Tesla's high capital expenditure and ongoing investments in research and development.

- Broader Implications: Lower taxes across the board created a more favorable business environment, which in turn positively influenced investor confidence in the electric vehicle industry as a whole. The specific financial implications for Tesla are complex and require a deeper dive into their financial statements for the period.

Financial analysts offered varied interpretations, with some arguing that the impact was overshadowed by other market factors.

The Influence on SpaceX and Government Contracts

Space Exploration Policy Shifts

Trump's administration expressed a strong commitment to space exploration, potentially benefiting SpaceX.

- Policy Shift: Increased emphasis on NASA funding and a renewed focus on lunar exploration.

- Impact on SpaceX Contracts: SpaceX, already a major contractor for NASA, benefited from increased contract opportunities and funding. This boosted SpaceX’s revenue and solidified its position as a key player in the emerging space industry.

- Credible Sources: Reports from NASA and the Department of Defense confirmed a rise in allocated funding for space-related initiatives.

While the overall impact was positive, the long-term effects of policy changes within the space exploration sector on SpaceX remained to be seen.

International Relations and Their Impact on SpaceX

Trump’s “America First” approach to international relations introduced some uncertainties for SpaceX's global ambitions.

- Geopolitical Shifts: Trump's trade policies and shifting alliances potentially impacted SpaceX’s international collaborations and supply chains.

- Challenges and Opportunities: While some partnerships might have faced challenges, opportunities also arose in regions less reliant on established alliances.

- Analysis of Impact: The long-term implications of Trump’s international policies remained complex and required detailed examination.

Market Sentiment and Investor Confidence

The Overall Economic Climate

The economic climate during Trump's first 100 days played a crucial role in shaping investor sentiment.

- Economic Indicators: Factors such as stock market performance and GDP growth directly impacted valuations of Musk's companies. The general economic optimism that followed Trump's election victory initially created a positive environment.

- Relationship to Valuation: Positive economic indicators boosted investor confidence and consequently, the stock prices of Tesla and SpaceX. However, this was not a constant trend and periods of uncertainty emerged.

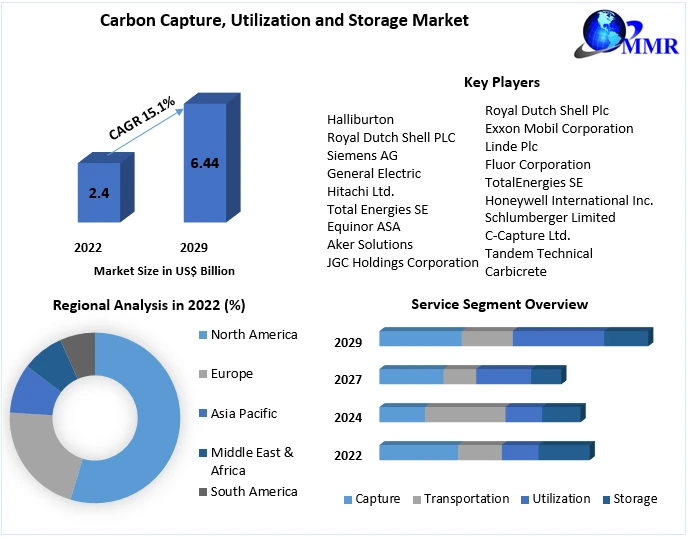

- Charts and Graphs: Examination of market indices and Tesla/SpaceX stock prices during this period provides visual evidence of the correlation between economic conditions and market valuation.

The initial economic optimism later fluctuated, illustrating the dynamic nature of market forces.

Trump's Public Statements and Their Influence

Trump's public comments concerning Musk and his companies sometimes influenced market reactions.

- Public Statements: Specific examples include tweets or public remarks mentioning Tesla or SpaceX, or expressing opinions regarding electric vehicles.

- Effects on Stock Prices: Such statements could generate both positive and negative market reactions, often causing short-term volatility in stock prices.

- News Articles and Financial Reports: Analyzing news coverage of these statements and their subsequent impact on the stock market helps assess their influence.

While Trump's pronouncements had a noticeable influence on public perception, determining their exact long-term impact on Musk’s financial status necessitates further extensive analysis.

Conclusion: Summarizing the Impact of Trump's First 100 Days on Elon Musk's Financial Status

The Impact of Trump's First 100 Days on Elon Musk's Financial Status was multifaceted. While Trump's environmental policies initially raised concerns regarding Tesla's future, subsequent tax cuts positively impacted the company's profitability. SpaceX benefitted from the administration's increased focus on space exploration, leading to greater contract opportunities. However, the overall economic climate and Trump's occasional public statements contributed to market volatility, impacting the stock prices of both companies. A balanced assessment indicates that the net effect on Musk's financial status during this initial period was likely positive, although this was not without fluctuations and uncertainties created by the administration's policies. The long-term effects, however, are significantly more intricate to ascertain. Learn more about the impact of Trump's presidency on Elon Musk by exploring further research and analyses from reputable financial sources.

Featured Posts

-

Mulher Presa No Reino Unido Afirma Ser Madeleine Mc Cann

May 09, 2025

Mulher Presa No Reino Unido Afirma Ser Madeleine Mc Cann

May 09, 2025 -

Chinas Automotive Market Obstacles And Opportunities For Premium Brands Like Bmw And Porsche

May 09, 2025

Chinas Automotive Market Obstacles And Opportunities For Premium Brands Like Bmw And Porsche

May 09, 2025 -

Jessica Tarlov And Jeanine Pirro Clash Over Canada Trade War

May 09, 2025

Jessica Tarlov And Jeanine Pirro Clash Over Canada Trade War

May 09, 2025 -

Aoc Fact Checks Jeanine Pirro A Point By Point Analysis

May 09, 2025

Aoc Fact Checks Jeanine Pirro A Point By Point Analysis

May 09, 2025 -

Bayern Munich Vs Fc St Pauli A Comprehensive Match Preview

May 09, 2025

Bayern Munich Vs Fc St Pauli A Comprehensive Match Preview

May 09, 2025