The Impact Of Trump's Trade War: A Wall Street Perspective

Table of Contents

Initial Market Reactions and Volatility

The announcement of tariffs triggered immediate market responses, characterized by increased volatility and uncertainty. Investors grappled with the implications of potential trade disruptions and retaliatory measures. The initial reactions were mixed, with some sectors experiencing sharp declines while others showed surprising resilience.

- Stock Market Fluctuations: The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all experienced significant fluctuations in the period surrounding tariff announcements. Sectors heavily reliant on international trade, such as manufacturing and agriculture, were particularly vulnerable.

- Increased Trading Volume: Investor anxiety fueled a surge in trading volume as market participants scrambled to adjust their portfolios. This heightened volatility presented both opportunities and risks for savvy traders.

- Short-Term Gains and Losses: While some investors profited from short-term market swings, others faced substantial losses, highlighting the inherent risks associated with navigating periods of heightened trade uncertainty. Sophisticated strategies, such as hedging and options trading, played a crucial role in mitigating these risks.

Long-Term Effects on Specific Sectors

The Trump trade war's impact varied significantly across different sectors. While some industries thrived in the altered landscape, others faced considerable hardship. Understanding these sector-specific effects is crucial for evaluating the trade war's lasting legacy.

- Manufacturing: The US manufacturing sector faced a double-edged sword. While some domestic manufacturers benefited from reduced competition, others struggled with increased input costs due to tariffs on imported raw materials. Supply chain disruptions also hampered production.

- Agriculture: The agricultural sector bore the brunt of retaliatory tariffs imposed by other countries. Farmers experienced decreased exports and lower prices for their products, leading to significant economic hardship in many farming communities.

- Technology: The technology sector faced complexities. While some companies benefited from reduced competition in specific areas, others saw their supply chains disrupted and faced higher costs for imported components.

- Supply Chain Disruptions: The trade war significantly disrupted global supply chains, forcing companies to re-evaluate their sourcing strategies and potentially relocate production facilities. This led to increased costs and complexity in the long term.

- Inflation and Consumer Prices: Tariffs contributed to increased prices for certain goods, impacting inflation and the cost of living for consumers. This factor played a significant role in shaping consumer sentiment and overall economic growth. Keywords: trade war impact, sector analysis, supply chain, inflation.

The Role of Geopolitical Factors

The Trump trade war extended far beyond economic considerations, significantly impacting global relations and international cooperation. The imposition of tariffs sparked retaliatory measures from various countries, escalating tensions and reshaping global trade dynamics.

- US-China Relations: The trade war dramatically strained the relationship between the US and China, leading to a period of heightened geopolitical uncertainty. This uncertainty had a cascading effect on global markets.

- EU and Other Trading Partners: The trade war's effects rippled across the globe, affecting the US's relationship with the European Union, Canada, Mexico, and other key trading partners.

- WTO Implications: The trade war challenged the authority and effectiveness of the World Trade Organization (WTO), raising questions about the future of multilateral trade agreements.

- Political Instability: The heightened geopolitical tensions amplified market volatility, making it more challenging for investors to predict future market trends. Keywords: geopolitics, international trade, WTO, trade agreements.

Wall Street's Adaptation Strategies

Financial institutions and investors had to adapt swiftly to the changing economic landscape created by the Trump trade war. This involved re-evaluating investment strategies, diversifying portfolios, and strengthening risk management practices.

- Diversification Strategies: Investors sought to diversify their portfolios to mitigate the risks associated with trade uncertainty, shifting allocations away from sectors heavily exposed to trade tensions.

- Risk Management Techniques: Sophisticated hedging strategies and risk mitigation tools became crucial for managing the increased volatility and uncertainty in the markets.

- Alternative Investment Strategies: The search for stability led to an increased interest in alternative investment strategies, including private equity and real estate, perceived as less susceptible to trade war effects.

- Portfolio Management Techniques: Portfolio management techniques adapted to incorporate geopolitical risks and sector-specific vulnerabilities into investment decisions. Keywords: investment strategies, risk management, portfolio diversification.

Understanding the Lasting Legacy of Trump's Trade War: A Wall Street Perspective

The Trump trade war had a significant and lasting impact on the global economy and Wall Street, prompting shifts in investment strategies, reshaping global supply chains, and altering geopolitical relationships. Understanding these long-term consequences is essential for navigating future market uncertainties and making informed investment decisions. The lingering effects on various sectors, the altered global trade landscape, and the re-evaluation of risk management strategies are all critical elements to consider. To further your understanding of the Trump trade war and its ongoing consequences, we encourage you to explore additional resources on the subject. For in-depth analyses of sector-specific impacts or insights into the future of global trade, consider researching reputable financial news sources and academic studies. Keywords: Trump trade war, long-term impacts, Wall Street, economic consequences, global trade.

Featured Posts

-

Where To Buy The Nike Air Max 95 Og Big Bubble Triple Black And Wolf Grey Hm 8755 001

May 29, 2025

Where To Buy The Nike Air Max 95 Og Big Bubble Triple Black And Wolf Grey Hm 8755 001

May 29, 2025 -

From Trump Coin Short To White House Dinner A Crypto Traders Story

May 29, 2025

From Trump Coin Short To White House Dinner A Crypto Traders Story

May 29, 2025 -

Hujan Di Bandung Simak Prakiraan Cuaca Jawa Barat 26 Maret

May 29, 2025

Hujan Di Bandung Simak Prakiraan Cuaca Jawa Barat 26 Maret

May 29, 2025 -

Mathurins Injury Impacts Pacers Kings Matchup

May 29, 2025

Mathurins Injury Impacts Pacers Kings Matchup

May 29, 2025 -

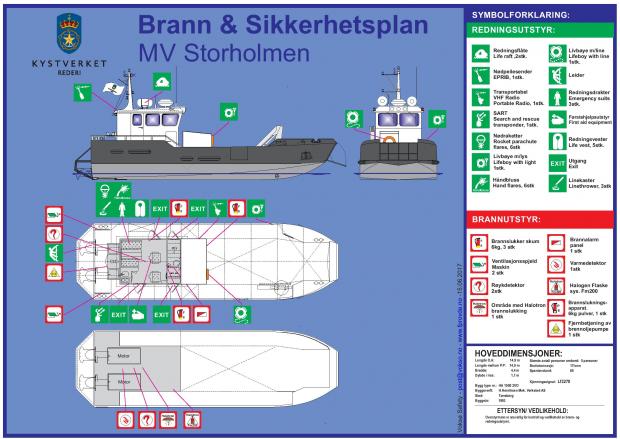

Brann I Fire Bater I Oslo Nyhetsvarsel

May 29, 2025

Brann I Fire Bater I Oslo Nyhetsvarsel

May 29, 2025

Latest Posts

-

Katastrophenschutz Am Bodensee Uebungsszenario In Hard Simuliert Ernstfall

May 31, 2025

Katastrophenschutz Am Bodensee Uebungsszenario In Hard Simuliert Ernstfall

May 31, 2025 -

Bodensee Katastrophenuebung Einsatzkraefte Trainieren In Hard Fuer Den Ernstfall

May 31, 2025

Bodensee Katastrophenuebung Einsatzkraefte Trainieren In Hard Fuer Den Ernstfall

May 31, 2025 -

Womans Basement Holds A Puzzling Surprise For Plumber

May 31, 2025

Womans Basement Holds A Puzzling Surprise For Plumber

May 31, 2025 -

Constance Lloyd Wilde Paying The Price For Oscars Genius

May 31, 2025

Constance Lloyd Wilde Paying The Price For Oscars Genius

May 31, 2025 -

Katastrophenfall Am Bodensee Grossuebung Der Einsatzkraefte In Hard

May 31, 2025

Katastrophenfall Am Bodensee Grossuebung Der Einsatzkraefte In Hard

May 31, 2025