The KRW/USD Forecast: Assessing The Implications Of Trump's Statements On Currency Manipulation

Table of Contents

Understanding Trump's Accusations of Currency Manipulation

Defining Currency Manipulation

Currency manipulation, in economic terms, refers to actions taken by a country's government or central bank to artificially influence the value of its currency in the foreign exchange market. This is often done to gain a competitive advantage in international trade.

- Examples of currency manipulation:

- Direct intervention in the foreign exchange market, buying or selling large quantities of its own currency to affect its price.

- Maintaining artificially low interest rates to discourage foreign investment and weaken the currency.

- Implementing capital controls to restrict the flow of money into and out of the country.

Trump's Past Statements and Actions

During his presidency, Donald Trump frequently criticized several countries, including South Korea, for allegedly manipulating their currencies. These accusations often came in the form of tweets and public statements.

- Specific instances: [Insert links to relevant news articles and official statements showcasing Trump's criticisms of South Korean economic policies and accusations of currency manipulation]. These statements often coincided with periods of heightened trade tensions between the US and South Korea.

Impact of such statements on Market Sentiment

Trump's rhetoric significantly impacted market sentiment towards the South Korean Won. Negative comments often led to increased uncertainty and volatility in the KRW/USD exchange rate.

- Impact on KRW/USD: Negative sentiment can cause investors to sell off Won holdings, leading to a devaluation of the currency against the dollar. The uncertainty surrounding future US trade policies further fueled this volatility.

Analyzing the Current KRW/USD Exchange Rate

Recent Trends and Volatility

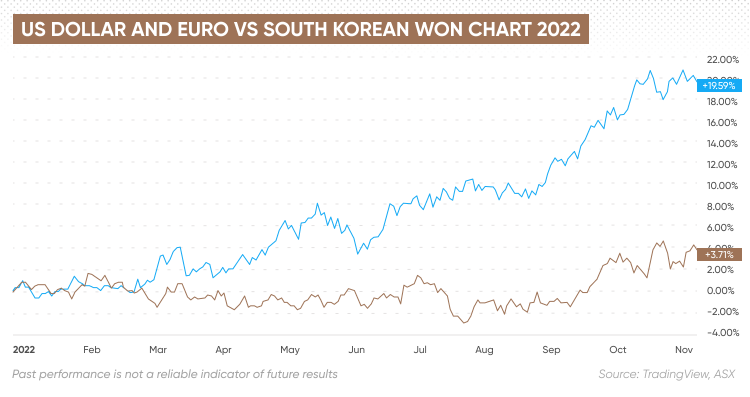

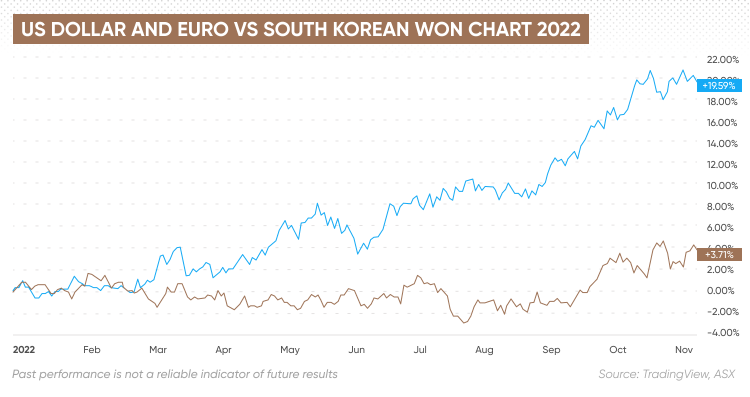

The KRW/USD exchange rate has experienced [describe recent trends – e.g., periods of appreciation and depreciation]. Several factors beyond Trump's statements contribute to these fluctuations. [Insert a chart or graph illustrating the recent trends]. For example, the average exchange rate over the past month was [insert data], while the average over the past year was [insert data].

Key Economic Indicators Affecting KRW/USD

Numerous macroeconomic factors influence the KRW/USD exchange rate:

- Interest rate differentials: Differences between US and South Korean interest rates can significantly impact the flow of capital and thus the exchange rate. Higher interest rates in one country attract foreign investment, strengthening its currency.

- Trade balance: A trade deficit (importing more than exporting) can weaken a country's currency, while a trade surplus strengthens it. South Korea's trade balance with the US is a key factor in the KRW/USD exchange rate.

- Inflation: Higher inflation in South Korea relative to the US can weaken the KRW.

- Political stability: Political uncertainty or instability in either country can lead to increased volatility in the KRW/USD exchange rate.

Geopolitical Factors

Geopolitical events significantly influence the KRW/USD forecast:

- US-China trade relations: Tensions between the US and China indirectly impact South Korea, given its close economic ties with both countries. Increased trade friction can negatively impact the South Korean economy and thus the Won.

- North Korean tensions: Geopolitical risks associated with North Korea's actions can also lead to volatility in the KRW/USD exchange rate.

Forecasting the KRW/USD Exchange Rate: Short-Term and Long-Term Perspectives

Short-Term Forecast

Based on current market conditions and expert opinions, the short-term KRW/USD forecast suggests a range between [insert range] in the next [time period – e.g., three months]. This prediction is based on:

- The current account balance of South Korea

- Interest rate differential between the US and South Korea

- The overall sentiment towards the global economy

Long-Term Forecast

The long-term KRW/USD forecast is subject to greater uncertainty. Several scenarios are possible:

- Scenario 1 (Improved US-South Korea Relations): Improved bilateral relations and increased trade could lead to a stronger Won.

- Scenario 2 (Increased Tensions): Continued trade tensions or geopolitical instability could weaken the Won.

Conclusion: Navigating the KRW/USD Forecast in a Turbulent Landscape

The KRW/USD exchange rate is subject to a complex interplay of factors, including Donald Trump's past statements on currency manipulation, macroeconomic indicators, and geopolitical events. While the short-term KRW/USD forecast offers some insights, the long-term outlook remains uncertain. Staying updated on the KRW/USD forecast requires continuous monitoring of these key economic and political indicators. It’s crucial to consult financial professionals for personalized advice before making any investment decisions based on this KRW/USD forecast or any currency exchange rate prediction. Monitor the KRW/USD exchange rate closely for informed decisions.

Featured Posts

-

Hyundai Profit Surges Past Forecasts Strong N American And Hybrid Vehicle Sales

Apr 25, 2025

Hyundai Profit Surges Past Forecasts Strong N American And Hybrid Vehicle Sales

Apr 25, 2025 -

Activision Blizzard Acquisition Ftcs Appeal And Its Implications

Apr 25, 2025

Activision Blizzard Acquisition Ftcs Appeal And Its Implications

Apr 25, 2025 -

Plan The Perfect Spring Break Okc Parks And Recreation

Apr 25, 2025

Plan The Perfect Spring Break Okc Parks And Recreation

Apr 25, 2025 -

Cellnex Telecom Network Transformation And Uk Market Expansion Plans

Apr 25, 2025

Cellnex Telecom Network Transformation And Uk Market Expansion Plans

Apr 25, 2025 -

Japanese Asset Market Booms As Us Investment Slows

Apr 25, 2025

Japanese Asset Market Booms As Us Investment Slows

Apr 25, 2025

Latest Posts

-

Cara Desain Meja Rias Modern And Sederhana 2025 Tren Terbaru Untuk Rumah Anda

Apr 25, 2025

Cara Desain Meja Rias Modern And Sederhana 2025 Tren Terbaru Untuk Rumah Anda

Apr 25, 2025 -

Childproof Your Makeup Simple Storage Ideas For Teen Proofing

Apr 25, 2025

Childproof Your Makeup Simple Storage Ideas For Teen Proofing

Apr 25, 2025 -

Top Rated Makeup Organisers For A Clutter Free Dressing Table

Apr 25, 2025

Top Rated Makeup Organisers For A Clutter Free Dressing Table

Apr 25, 2025 -

Safe Makeup Storage Protecting Your Cosmetics From Curious Kids

Apr 25, 2025

Safe Makeup Storage Protecting Your Cosmetics From Curious Kids

Apr 25, 2025 -

Ultimate Guide To Makeup Organisers Organise Your Makeup Like A Pro

Apr 25, 2025

Ultimate Guide To Makeup Organisers Organise Your Makeup Like A Pro

Apr 25, 2025