The Lasting Influence Of 'Liberation Day' Tariffs On Stock Investments

Table of Contents

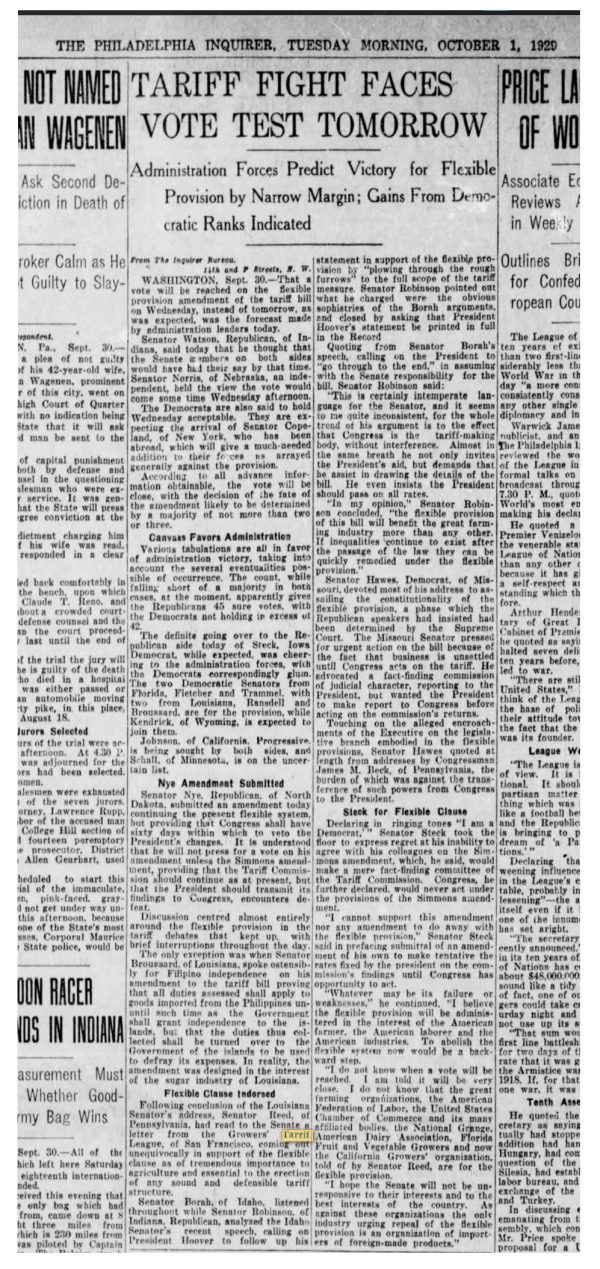

Immediate Market Reactions to Liberation Day Tariffs

Initial Volatility and Sectoral Impacts

The immediate aftermath of the Liberation Day Tariffs announcement was marked by significant market volatility. Investor sentiment plummeted, leading to widespread panic selling, especially within sectors heavily reliant on imports. Conversely, certain export-oriented industries initially saw a surge in demand.

- Specific examples of stock price fluctuations: Shares in the automotive industry, heavily reliant on imported parts, experienced sharp declines, while companies specializing in agricultural exports saw temporary boosts. The textile sector, facing increased competition from cheaper imports, also suffered considerable losses.

- Investor sentiment and panic selling: The uncertainty surrounding the long-term implications of the tariffs fueled a wave of panic selling. Investors, unsure of how the new trade policy would affect their portfolios, rushed to liquidate assets.

- Short-term gains/losses for different investor profiles: Short-term investors, particularly those with heavily diversified portfolios, experienced significant losses in the immediate aftermath. Long-term investors, however, had the opportunity to buy undervalued stocks at discounted prices.

Long-Term Effects on Specific Industries

Winners and Losers

The long-term effects of the Liberation Day Tariffs varied significantly across industries. Some sectors thrived under the protectionist measures, while others struggled to adapt to the new economic landscape.

- Industries that benefited from protectionism: Domestic manufacturers of goods previously subject to heavy import competition experienced a resurgence, benefiting from reduced foreign competition and increased demand.

- Industries that struggled due to increased import costs: Industries reliant on imported raw materials or components faced significant cost increases, leading to reduced profitability and, in some cases, business closures. This impacted supply chains and ultimately the consumer, who paid higher prices.

- Industry restructuring and adaptation strategies: Companies responded in various ways – some invested in automation and technological upgrades to boost efficiency and reduce reliance on imports, while others diversified their supply chains to mitigate risks associated with future trade policy changes.

The Role of Government Policy in Mitigating Tariff Impacts

Government Intervention and Support Measures

Recognizing the potential negative consequences of the Liberation Day Tariffs, the government implemented several measures to mitigate their impact and support affected industries.

- Subsidies or tax breaks offered to affected industries: Targeted subsidies and tax breaks were offered to help struggling industries offset increased costs and maintain employment levels.

- Regulatory changes to support domestic production: Regulatory changes aimed at boosting domestic production were introduced, fostering a more favorable environment for local businesses.

- Evaluation of the effectiveness of government intervention: The effectiveness of government intervention is a subject of ongoing debate. While some measures proved successful in providing temporary relief, others failed to fully compensate for the negative consequences of the tariffs.

Lessons Learned and Implications for Future Tariff Policies

Predicting Market Responses to Future Tariffs

The Liberation Day Tariffs provided valuable insights into the complexities of predicting market reactions to significant trade policy shifts. The experience highlighted the interconnectedness of global markets and the potential for unforeseen consequences.

- Predictability of market reactions to tariff changes: Predicting the exact impact of tariffs is difficult, as it depends on various factors, including the specific industries affected, the overall economic climate, and the government's response.

- Importance of considering long-term economic consequences: The experience underscored the need for policymakers to consider the long-term economic consequences of tariff changes, going beyond immediate gains or losses. A holistic view, considering downstream effects, is crucial.

- Recommendations for policymakers to mitigate future tariff-related market shocks: Policymakers should adopt a more nuanced approach, considering the potential for unintended consequences and employing strategies to mitigate negative impacts on various stakeholders. Transparent communication and stakeholder engagement are essential.

Conclusion

The Liberation Day Tariffs left an enduring mark on stock investments, demonstrating the significant and often unpredictable consequences of major trade policy changes. The immediate market volatility, the long-term impact on specific industries, and the role of government intervention all highlight the complexities of navigating a globalized economy subject to tariff fluctuations. Key takeaways include the difficulty in predicting precise market reactions, the importance of considering long-term effects, and the need for proactive government policies to mitigate negative consequences. Understanding the lasting influence of Liberation Day Tariffs and similar trade policies is crucial for informed stock market investments. Further research into academic studies on trade policy impacts, government reports on tariff effects, and analyses from reputable financial institutions will help investors navigate future economic uncertainties caused by tariff changes.

Featured Posts

-

Lahwr Hayykwrt Awr Dley Edaltwn Ke Jjz Kw Sht Ky Bymh Shwlt

May 08, 2025

Lahwr Hayykwrt Awr Dley Edaltwn Ke Jjz Kw Sht Ky Bymh Shwlt

May 08, 2025 -

Understanding The Papal Election Process The Conclave Explained

May 08, 2025

Understanding The Papal Election Process The Conclave Explained

May 08, 2025 -

Surge In Dwp Home Visits Impact On Benefit Claimants

May 08, 2025

Surge In Dwp Home Visits Impact On Benefit Claimants

May 08, 2025 -

Former Okc Thunder Rare Double Performance Records

May 08, 2025

Former Okc Thunder Rare Double Performance Records

May 08, 2025 -

Broadcoms Proposed V Mware Price Hike A 1050 Increase For At And T

May 08, 2025

Broadcoms Proposed V Mware Price Hike A 1050 Increase For At And T

May 08, 2025