The Low Uptake Of 10-Year Mortgages In Canada: An Analysis

Table of Contents

Financial Uncertainty and Risk Aversion

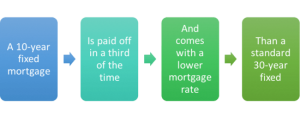

One of the primary reasons for the low adoption of 10-year mortgages in Canada is the inherent financial uncertainty associated with such a long-term commitment. The Canadian economy, like any other, is subject to fluctuations. Interest rates, a key component of mortgage payments, are particularly volatile. A fixed-rate 10-year mortgage might seem attractive initially, but if interest rates rise significantly during the term, refinancing could prove challenging.

- Uncertainty about future income and job security: Job loss or reduced income can severely impact the ability to make mortgage payments over such an extended period.

- Concerns about potential unforeseen expenses: Unexpected home repairs, medical emergencies, or other significant expenses can strain household budgets, making it difficult to meet long-term mortgage obligations.

- Preference for flexibility offered by shorter-term mortgages: Shorter-term mortgages allow borrowers to refinance or renegotiate terms at the end of the term, adapting to changing financial circumstances or interest rate environments. This flexibility is often preferred over the rigidity of a 10-year commitment.

- Limited understanding of the long-term financial implications of a 10-year mortgage: Many Canadians may lack a full grasp of the complex financial implications of a 10-year mortgage, leading to risk aversion and a preference for more familiar, shorter-term options.

The Impact of Prepayment Penalties

Another significant deterrent is the substantial prepayment penalties associated with breaking a 10-year mortgage in Canada. These penalties can be substantial, particularly if interest rates fall significantly after securing the mortgage, making refinancing less attractive. The fear of being locked into an unfavorable rate for a decade significantly discourages many potential borrowers.

- Comparison of prepayment penalties across different mortgage terms: The penalties for breaking a 10-year mortgage are generally much higher than for shorter-term options, significantly impacting the financial flexibility of borrowers.

- Examples of situations where prepayment penalties can become substantial: Unexpected job relocation, unforeseen financial hardship, or a desire to upgrade to a larger home before the 10-year term is up could trigger hefty penalties.

- The role of financial advisors in assessing prepayment risks: A qualified financial advisor can help assess the potential prepayment risks and guide borrowers in making informed decisions about mortgage terms.

Limited Availability and Higher Interest Rates

The availability and pricing of 10-year mortgages in Canada also play a significant role. While some lenders offer these mortgages, they might not be as readily available as shorter-term options. Furthermore, lenders may charge higher interest rates on 10-year mortgages to compensate for the increased risk associated with the longer term.

- A comparison of interest rates for various mortgage terms: A comparative analysis of interest rates reveals a potential premium for 10-year mortgages, further impacting their attractiveness.

- A survey of lenders' offerings of 10-year mortgages: Research shows that a smaller percentage of Canadian lenders offer 10-year mortgages compared to shorter-term options.

- Analysis of lender risk assessments for longer-term mortgages: Lenders assess the risks inherent in longer-term mortgages differently compared to shorter ones, leading to variations in approval criteria and interest rates.

The Role of Consumer Behavior and Misconceptions

Beyond financial considerations, consumer behavior and misconceptions also influence the low uptake of 10-year mortgages in Canada. Risk aversion, lack of awareness about potential benefits, and misunderstanding of the long-term implications play a role.

- Survey data on consumer perceptions of 10-year mortgages: Research suggests many Canadians perceive 10-year mortgages as too risky or complicated.

- Analysis of common misconceptions about long-term mortgages: Misunderstandings about payment management and the potential for early repayment are prevalent.

- The influence of financial literacy on mortgage choices: Higher financial literacy levels are correlated with a better understanding of the implications of various mortgage terms, potentially increasing the adoption of 10-year mortgages among informed borrowers.

Conclusion: Understanding and Addressing the Low Uptake of 10-Year Mortgages in Canada

In conclusion, the low uptake of 10-year mortgages in Canada stems from a complex interplay of financial uncertainty, significant prepayment penalties, limited availability, and consumer behavior influenced by misconceptions. Understanding the financial implications of different mortgage terms is crucial. Before choosing a mortgage term, carefully consider your individual financial situation, risk tolerance, and long-term goals. While 10-year mortgages in Canada may not be suitable for everyone, they can offer significant advantages to those who understand the risks and can manage the long-term commitment. Conduct thorough research on 10-year mortgages in Canada, or consult a financial advisor to determine if a 10-year mortgage is the right choice for you.

Featured Posts

-

Is America Falling Behind Examining Chinas Electric Vehicle Strategy

May 05, 2025

Is America Falling Behind Examining Chinas Electric Vehicle Strategy

May 05, 2025 -

Fitness Trainer Shaun T Responds To Lizzos Ozempic Controversy

May 05, 2025

Fitness Trainer Shaun T Responds To Lizzos Ozempic Controversy

May 05, 2025 -

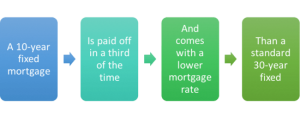

The 2025 Kentucky Derby Pace Scenarios And Their Implications

May 05, 2025

The 2025 Kentucky Derby Pace Scenarios And Their Implications

May 05, 2025 -

Rare Novel Valued At 45 000 Discovered In Bookstore

May 05, 2025

Rare Novel Valued At 45 000 Discovered In Bookstore

May 05, 2025 -

Wb Weather Forecast Thunderstorms Expected In Kolkata And Nearby Areas

May 05, 2025

Wb Weather Forecast Thunderstorms Expected In Kolkata And Nearby Areas

May 05, 2025

Latest Posts

-

Criminal Neglect Mother Charged In Death Of Tortured 16 Year Old

May 05, 2025

Criminal Neglect Mother Charged In Death Of Tortured 16 Year Old

May 05, 2025 -

Alleged Torture Starvation And Beatings Lead To Stepfathers Murder Charge In 16 Year Olds Death

May 05, 2025

Alleged Torture Starvation And Beatings Lead To Stepfathers Murder Charge In 16 Year Olds Death

May 05, 2025 -

Mother Charged In 16 Year Olds Torture Murder Criminal Neglect Allegations

May 05, 2025

Mother Charged In 16 Year Olds Torture Murder Criminal Neglect Allegations

May 05, 2025 -

16 Year Old Stepsons Murder Stepfather Accused Of Brutal Abuse And Neglect

May 05, 2025

16 Year Old Stepsons Murder Stepfather Accused Of Brutal Abuse And Neglect

May 05, 2025 -

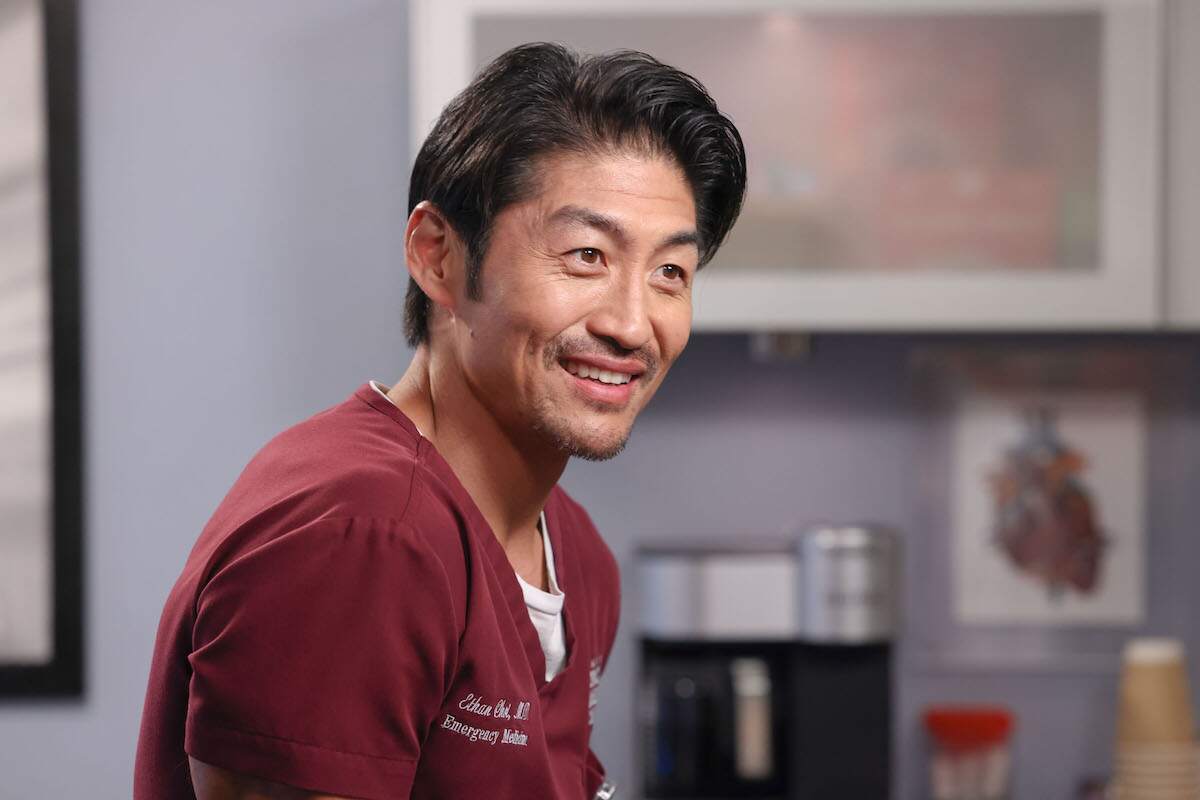

Chicago Med Season 10 Episode 14 Features Brian Tees Return

May 05, 2025

Chicago Med Season 10 Episode 14 Features Brian Tees Return

May 05, 2025