The Most Profitable Dividend Strategy Is Surprisingly Simple

Table of Contents

Understanding Dividend Investing Basics

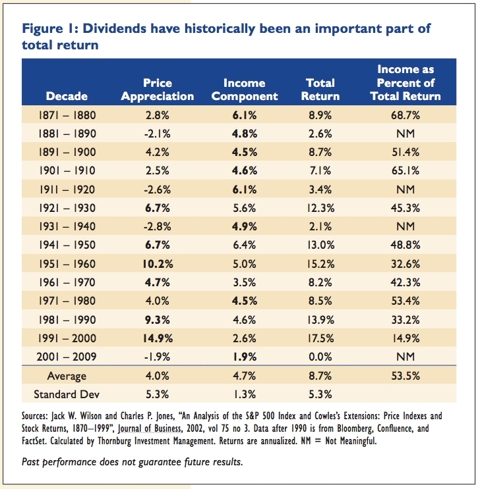

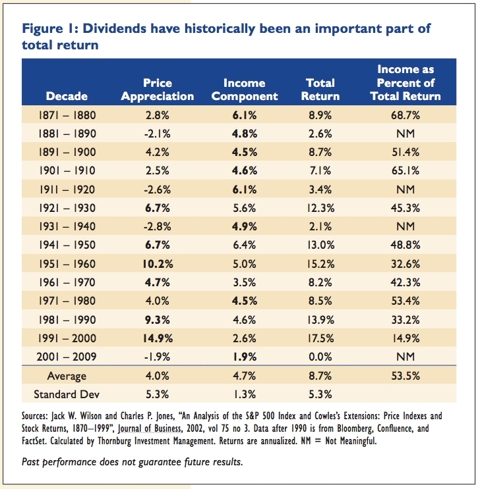

Dividend investing involves buying stocks in companies that regularly pay out a portion of their profits to shareholders. This passive income stream is a significant advantage, but dividend investing offers more than just regular payments. It also provides the potential for capital appreciation as the value of your shares increases over time.

-

Definition and Advantages: Dividends are essentially cash payments made by a company to its shareholders, typically quarterly. Advantages include:

- Regular Income Stream: Provides a consistent flow of cash, useful for retirement planning or supplementing income.

- Capital Appreciation: The value of the underlying stock can increase, providing further returns.

- Reduced Risk (Potentially): Mature, dividend-paying companies often exhibit greater stability than high-growth stocks.

-

Types of Dividend Stocks: There are various types, each with different characteristics:

- Blue-Chip Stocks: Established, large companies with a history of consistent dividend payments (e.g., Coca-Cola, Johnson & Johnson). These often offer lower growth but higher stability.

- Growth Stocks: Companies that reinvest profits to fuel expansion, often paying smaller dividends or none at all initially. These can offer higher growth potential but less immediate income.

- Income Stocks: Companies prioritizing dividend payouts, often offering higher dividend yields but potentially lower growth. These are ideal for investors seeking high current income.

-

Key Metrics for Evaluating Dividend Stocks: Before investing, analyze these key metrics:

- Dividend Yield: The annual dividend per share divided by the share price (e.g., a $1 dividend on a $20 stock has a 5% yield). Higher yields can be attractive but also indicate higher risk.

- Payout Ratio: The percentage of earnings paid out as dividends. A sustainable payout ratio is generally below 70%.

- Dividend Growth Rate: The rate at which the company increases its dividend payments over time. Consistent dividend growth is a positive sign of financial health.

The Power of Dividend Reinvestment (DRIP)

Dividend Reinvestment Plans (DRIPs) are a powerful tool for accelerating wealth creation. DRIPs allow you to automatically reinvest your dividend payments back into the same stock, buying additional shares without brokerage fees.

-

How DRIP Works: When a dividend is paid, instead of receiving the cash, it is automatically used to purchase more shares of the company's stock.

-

Benefits of DRIP:

- Compounding Returns: Reinvesting dividends allows for compounding, accelerating the growth of your investment significantly over time.

- Lower Transaction Costs: Avoids brokerage fees associated with individual purchases.

- Dollar-Cost Averaging: DRIPs contribute to a dollar-cost averaging strategy, mitigating the impact of market volatility.

-

Finding Stocks with DRIP Plans: Many companies offer DRIPs directly, and you can often find information on their investor relations websites. Your brokerage may also offer DRIP services.

Building a Diversified Dividend Portfolio

Diversification is crucial in mitigating risk. Don't put all your eggs in one basket!

-

Importance of Diversification: Spreading your investments across various sectors, industries, and market caps reduces the impact of any single company's underperformance.

-

Asset Allocation Strategies: Consider:

- Sector Diversification: Invest in companies from different sectors (e.g., technology, healthcare, consumer goods) to reduce sector-specific risks.

- Market Cap Diversification: Include both large-cap (established companies) and mid-cap/small-cap (growth potential) stocks for a balanced portfolio.

- Value vs. Growth: Balance investments in value stocks (undervalued companies) and growth stocks to capitalize on both income and growth opportunities.

-

Practical Tips for Building a Diversified Portfolio:

- Dividend ETFs or Mutual Funds: These offer instant diversification across multiple stocks, simplifying portfolio construction.

- Gradual Investment: Build your portfolio gradually over time, adding new positions as you can afford them.

Long-Term Holding: The Secret to Maximizing Profits

The most profitable dividend strategy relies heavily on a long-term perspective.

- Benefits of Long-Term Investing: Long-term holding allows you to ride out market fluctuations and benefit fully from the power of compounding. Short-term market noise is largely irrelevant in a long-term dividend strategy.

- Importance of Patience and Discipline: Resist the urge to panic sell during market downturns. Stay focused on your long-term goals.

- Strategies for Dealing with Market Downturns:

- Maintain Regular Contributions: Continue investing regularly, even during market dips, to benefit from dollar-cost averaging.

- Rebalance Your Portfolio: Periodically review and rebalance your portfolio to maintain your desired asset allocation.

Tax Implications of Dividend Income

Understanding the tax implications of dividend income is essential for maximizing your after-tax returns.

- Understanding Tax Brackets and Rates: Dividends are taxed as ordinary income, but qualified dividends receive preferential tax rates in some jurisdictions.

- Tax-Efficient Investing Strategies: Consider tax-advantaged accounts like retirement accounts (401(k), IRA) to minimize your overall tax burden. Consult a tax advisor for personalized advice.

Unlocking the Most Profitable Dividend Strategy

The most profitable dividend strategy is surprisingly simple: combine dividend reinvestment (DRIP), a diversified portfolio, and a long-term holding approach. This powerful combination delivers consistent income, long-term growth, and reduced risk. By carefully selecting dividend-paying stocks and utilizing DRIPs, you can generate passive income and build significant wealth over time. Remember, patience and discipline are your greatest allies in this strategy.

Start building your own portfolio today and discover the power of the most profitable dividend strategy! Research dividend stocks, open a brokerage account, or consult a financial advisor to get started. Don't delay your path to financial freedom; embrace the simplicity and power of a well-structured dividend investment plan.

Featured Posts

-

Mtv Movie And Tv Awards Cancelled For 2025 Official Confirmation

May 11, 2025

Mtv Movie And Tv Awards Cancelled For 2025 Official Confirmation

May 11, 2025 -

62 Salh Tam Krwz Ky Nyy Mhbt Kya Yh Sch He

May 11, 2025

62 Salh Tam Krwz Ky Nyy Mhbt Kya Yh Sch He

May 11, 2025 -

Mullers Last Home Game Bayern Secure Bundesliga Victory

May 11, 2025

Mullers Last Home Game Bayern Secure Bundesliga Victory

May 11, 2025 -

Bundesliga Champions Bayern Munich A Winning Send Off For Mueller

May 11, 2025

Bundesliga Champions Bayern Munich A Winning Send Off For Mueller

May 11, 2025 -

Choosing The Next Pope Weighing The Strengths Of Nine Leading Candidates

May 11, 2025

Choosing The Next Pope Weighing The Strengths Of Nine Leading Candidates

May 11, 2025