The New Normal: Preparing Your Portfolio For Increased Stock Volatility

Table of Contents

Understanding the Current Market Volatility

Identifying the Drivers of Volatility

Increased market uncertainty stems from a confluence of factors. Understanding these drivers is the first step in effective portfolio management during periods of high stock volatility.

- Inflation: Persistent inflation erodes purchasing power and forces central banks to raise interest rates, impacting corporate profitability and investor sentiment. For example, the recent surge in inflation has led to significant market corrections in various sectors.

- Geopolitical Events: Global conflicts and political instability create uncertainty, triggering market fluctuations. The war in Ukraine, for instance, significantly impacted energy prices and global supply chains, contributing to market volatility.

- Interest Rate Hikes: Central banks raising interest rates to combat inflation can slow economic growth, impacting corporate earnings and investor confidence. The Federal Reserve's recent interest rate increases have already influenced stock valuations.

These factors, and others, contribute to a more volatile market environment, making robust portfolio management strategies more crucial than ever.

Assessing Your Risk Tolerance

Before implementing any strategy, it's vital to understand your personal risk tolerance. Your risk tolerance dictates your investment approach during periods of market volatility.

- Low Risk Tolerance: Investors with low risk tolerance may prefer investments with lower potential returns but greater stability, such as government bonds or high-quality dividend stocks.

- Medium Risk Tolerance: A balanced approach involving a mix of stocks and bonds is suitable for moderate risk tolerance. Diversification across different sectors is key.

- High Risk Tolerance: Investors comfortable with higher risk may allocate a larger portion of their portfolio to stocks, including growth stocks and emerging markets, understanding the potential for greater volatility.

Take a risk assessment questionnaire to better understand your profile: [Link to a reputable risk assessment tool]. Understanding your risk profile is fundamental to effective portfolio optimization during volatile times.

Diversifying Your Portfolio to Mitigate Risk

Diversification is a cornerstone of effective risk management in a volatile market. Spreading your investments across different asset classes and geographic regions reduces the impact of any single investment's poor performance.

Asset Allocation Strategies

A well-diversified portfolio includes a mix of various asset classes:

- Stocks (Equities): Offer high growth potential but also higher volatility. Diversify across different sectors (technology, healthcare, consumer staples, etc.) and market caps (large, mid, small).

- Bonds (Fixed Income): Generally considered less volatile than stocks, providing stability and income. Diversify across maturities and credit ratings.

- Real Estate: Can offer diversification benefits and potential for long-term appreciation, but liquidity can be an issue.

- Commodities: Including commodities (gold, oil, etc.) can provide a hedge against inflation and other economic uncertainties.

A well-balanced portfolio might include a mix of all these asset classes, adjusted based on your risk tolerance and investment goals.

Geographic Diversification

Investing internationally further reduces risk. Global events can disproportionately impact specific markets.

- Developed Markets: Offer established economies and generally lower volatility than emerging markets.

- Emerging Markets: Higher growth potential but greater volatility.

- International Diversification: Reduces dependence on any single country's economic performance.

For example, investing in both US and European stocks reduces the impact of an economic downturn in just one region.

Implementing Defensive Investment Strategies

Defensive investment strategies aim to minimize losses during market downturns.

Identifying Recession-Proof Investments

Certain sectors tend to perform relatively well during economic downturns:

- Consumer Staples: Companies producing essential goods (food, beverages, household products) often see stable demand regardless of economic conditions. Examples include Procter & Gamble and Coca-Cola.

- Utilities: Demand for utilities (electricity, water, gas) remains relatively consistent.

- Healthcare: Demand for healthcare services is generally less sensitive to economic fluctuations.

These defensive stocks can provide a buffer during periods of high stock volatility.

Utilizing Defensive Investment Techniques

Several techniques can help mitigate volatility:

- Dollar-Cost Averaging (DCA): Investing a fixed amount at regular intervals, regardless of market price. This reduces the impact of buying high and selling low.

- Value Investing: Identifying undervalued companies with strong fundamentals. Value stocks often outperform during market corrections.

- Hedging: Using financial instruments (options, futures) to protect against potential losses.

These strategies, combined with diversification, can strengthen your portfolio’s resilience.

Regularly Monitoring and Adjusting Your Portfolio

Consistent monitoring and adjustments are vital for effective portfolio management in a volatile market.

The Importance of Portfolio Rebalancing

Rebalancing involves adjusting your portfolio’s asset allocation back to your target allocation. This ensures you aren't overexposed to any single asset class after market fluctuations.

- Rebalancing Frequency: The frequency depends on your risk tolerance and investment goals; it could be annually, semi-annually, or even quarterly.

- Portfolio Tracking Software: Use software to monitor your portfolio's performance and simplify the rebalancing process.

Rebalancing helps maintain your desired risk level and take advantage of market opportunities.

Staying Informed About Market Trends

Staying updated on economic news and market trends is crucial for informed decision-making.

- Reputable News Sources: Follow reputable financial news sources and avoid emotional reactions to short-term market fluctuations.

- Financial Analysis: Utilize financial analysis websites and reports to gain insights into market trends and company performance.

Informed decision-making is key to navigating increased stock volatility successfully.

Conclusion

Navigating increased stock volatility requires a proactive and well-informed approach. By understanding the drivers of volatility, diversifying your portfolio, employing defensive investment strategies, and consistently monitoring your investments, you can better protect your assets and position yourself for long-term success. Don't let increased stock volatility derail your financial goals. Start preparing your portfolio today by implementing the strategies discussed in this article. Learn more about effective portfolio management techniques and strategies to navigate increased stock market volatility. Take control of your financial future.

Featured Posts

-

Kot Kellog I Ukraina Smi Osveschayut Vizit 20 Fevralya

Apr 25, 2025

Kot Kellog I Ukraina Smi Osveschayut Vizit 20 Fevralya

Apr 25, 2025 -

Who Do You Remember From April 1999

Apr 25, 2025

Who Do You Remember From April 1999

Apr 25, 2025 -

Bundesliga Bayern Wins Extends Lead To Six Points But Performance Raises Concerns

Apr 25, 2025

Bundesliga Bayern Wins Extends Lead To Six Points But Performance Raises Concerns

Apr 25, 2025 -

Cellnex Telecom Network Transformation And Uk Market Expansion Plans

Apr 25, 2025

Cellnex Telecom Network Transformation And Uk Market Expansion Plans

Apr 25, 2025 -

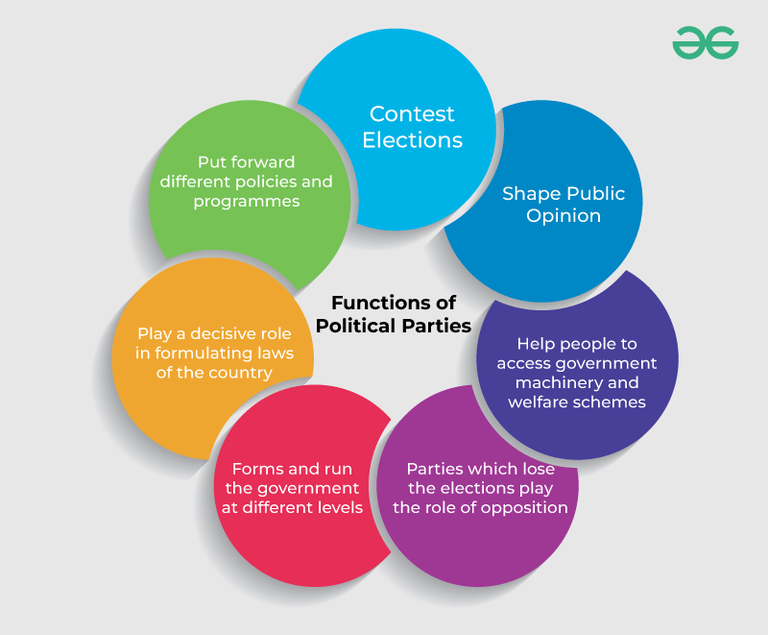

The Tough Times Test Analyzing The Responses Of Political Parties

Apr 25, 2025

The Tough Times Test Analyzing The Responses Of Political Parties

Apr 25, 2025

Latest Posts

-

The Ethics Of Betting On The Los Angeles Wildfires And Similar Events

Apr 26, 2025

The Ethics Of Betting On The Los Angeles Wildfires And Similar Events

Apr 26, 2025 -

Are We Normalizing Disaster Betting The Los Angeles Wildfires Example

Apr 26, 2025

Are We Normalizing Disaster Betting The Los Angeles Wildfires Example

Apr 26, 2025 -

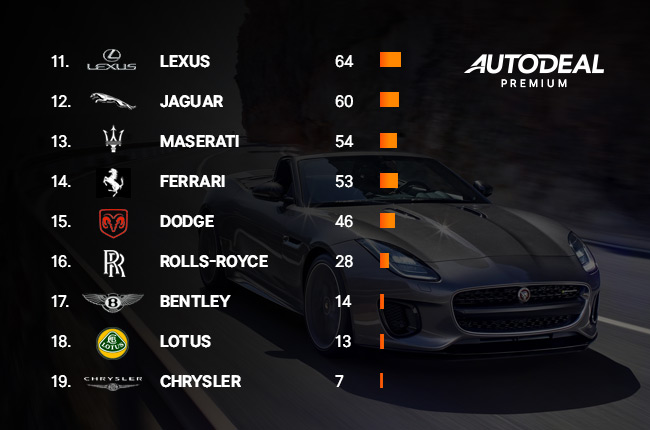

The China Factor Analyzing The Difficulties Faced By Premium Car Brands

Apr 26, 2025

The China Factor Analyzing The Difficulties Faced By Premium Car Brands

Apr 26, 2025 -

Gambling On Catastrophe The Los Angeles Wildfires And The Future Of Disaster Betting

Apr 26, 2025

Gambling On Catastrophe The Los Angeles Wildfires And The Future Of Disaster Betting

Apr 26, 2025 -

Navigating The Chinese Market The Struggles Of Bmw Porsche And Other Auto Brands

Apr 26, 2025

Navigating The Chinese Market The Struggles Of Bmw Porsche And Other Auto Brands

Apr 26, 2025