The Posthaste Effect: How Bond Market Instability Impacts The Global Economy

Table of Contents

The Mechanics of Bond Market Instability

Understanding bond market instability requires grasping the relationship between bond prices and yields. Bond yields represent the return an investor receives on a bond, inversely related to its price. When bond prices fall, yields rise, and vice-versa. Several factors contribute to instability:

- Rising Interest Rates: Central bank interest rate hikes increase borrowing costs, making existing bonds less attractive, pushing their prices down and yields up. This is a core mechanism driving the Posthaste Effect.

- Inflationary Pressures: High inflation erodes the real return on bonds, prompting investors to demand higher yields to compensate for the loss of purchasing power.

- Geopolitical Risks: Global events like wars, political instability, or trade disputes increase risk aversion, leading investors to flock to safer assets, driving down bond prices in riskier markets.

- Changes in Investor Sentiment: Shifts in investor confidence, driven by economic news or market speculation, can cause rapid price swings in the bond market. Fear and uncertainty are key drivers of volatility here.

- Sovereign Debt Crises: When a government struggles to repay its debt, its bonds become less attractive, leading to increased yields and potentially a wider crisis of confidence.

These factors collectively impact investor confidence. A decline in confidence leads to increased risk aversion, further exacerbating bond market volatility and its global consequences. This domino effect is a critical aspect of understanding the Posthaste Effect's influence.

Impact on Economic Growth

Bond market instability significantly impacts economic growth through several channels:

- Higher Borrowing Costs: Increased bond yields translate to higher borrowing costs for businesses and consumers, dampening investment and consumer spending. This reduced demand directly impacts economic growth.

- Impact on Investment and Capital Expenditure: Businesses facing higher borrowing costs are less likely to invest in expansion or new projects, slowing economic growth and job creation.

- Recession Risk: Severe bond market instability can trigger a credit crunch, restricting access to credit and leading to a sharp economic slowdown, potentially resulting in a recession. This is a significant risk factor associated with the Posthaste Effect.

The Ripple Effect: Impact on Other Financial Markets

The instability in the bond market doesn't exist in isolation; it ripples through other financial markets:

- Stock Market Volatility: Bond markets and stock markets are highly correlated. Increased bond yields often lead to lower stock valuations, resulting in increased stock market volatility. A risk-off sentiment sweeps across markets.

- Currency Fluctuations: Bond market instability can trigger capital flight as investors seek safer havens, leading to currency fluctuations and potentially currency crises. The "flight to safety" dynamic is frequently observed.

- Emerging Market Crisis: Emerging markets are particularly vulnerable to bond market instability, as capital flows out to developed markets in times of uncertainty, leading to financial crises in these countries. This highlights the global reach of the Posthaste Effect.

Government Responses to Bond Market Instability

Governments employ various measures to address bond market instability:

- Monetary Policy: Central banks may intervene through quantitative easing (QE), purchasing bonds to increase their prices and lower yields. Interest rate cuts can also stimulate borrowing and investment.

- Fiscal Policy: Governments can implement fiscal stimulus packages, such as increased government spending or tax cuts, to boost economic activity and counter recessionary pressures.

The effectiveness of these measures varies depending on the severity of the instability and the specific economic context. However, prompt and decisive action is often crucial in mitigating the worst effects of the Posthaste Effect.

Case Studies: Examining Past Instances of Bond Market Instability

Historical examples, such as the 1998 Asian Financial Crisis, the 2008 Global Financial Crisis, and the European sovereign debt crisis, illustrate the devastating consequences of bond market instability. These crises highlight the interconnectedness of global financial markets and the systemic risk associated with bond market turmoil. Analyzing these events provides valuable lessons for preventing and managing future crises.

Conclusion: Understanding and Mitigating the Posthaste Effect

Bond market instability has a significant and far-reaching impact on the global economy, affecting economic growth, other financial markets, and requiring coordinated government responses. The interconnectedness of global financial markets means that instability in one area can rapidly spread, underscoring the importance of monitoring bond markets closely. Understanding the dynamics of bond yields, interest rates, and investor sentiment is crucial for navigating this complex landscape. To mitigate the Posthaste Effect, staying informed about bond market developments, understanding financial risk management principles, and seeking professional financial advice for investment strategies during volatile times is essential. Further resources on bond market analysis and the global economic outlook are readily available to enhance your understanding. Invest wisely, stay informed, and navigate the complexities of the global financial system effectively.

Featured Posts

-

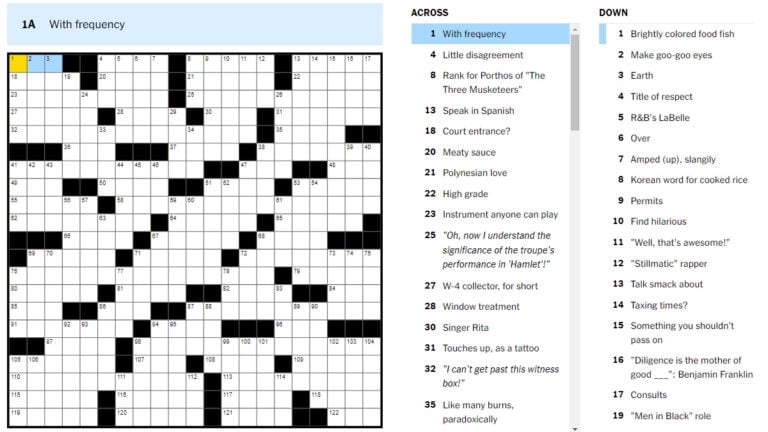

Nyt Mini Crossword Answers March 16 2025 Full Solution Guide

May 24, 2025

Nyt Mini Crossword Answers March 16 2025 Full Solution Guide

May 24, 2025 -

Pobeditel Evrovideniya 2014 Konchita Vurst Istoriya Kaming Auta I Ambitsii

May 24, 2025

Pobeditel Evrovideniya 2014 Konchita Vurst Istoriya Kaming Auta I Ambitsii

May 24, 2025 -

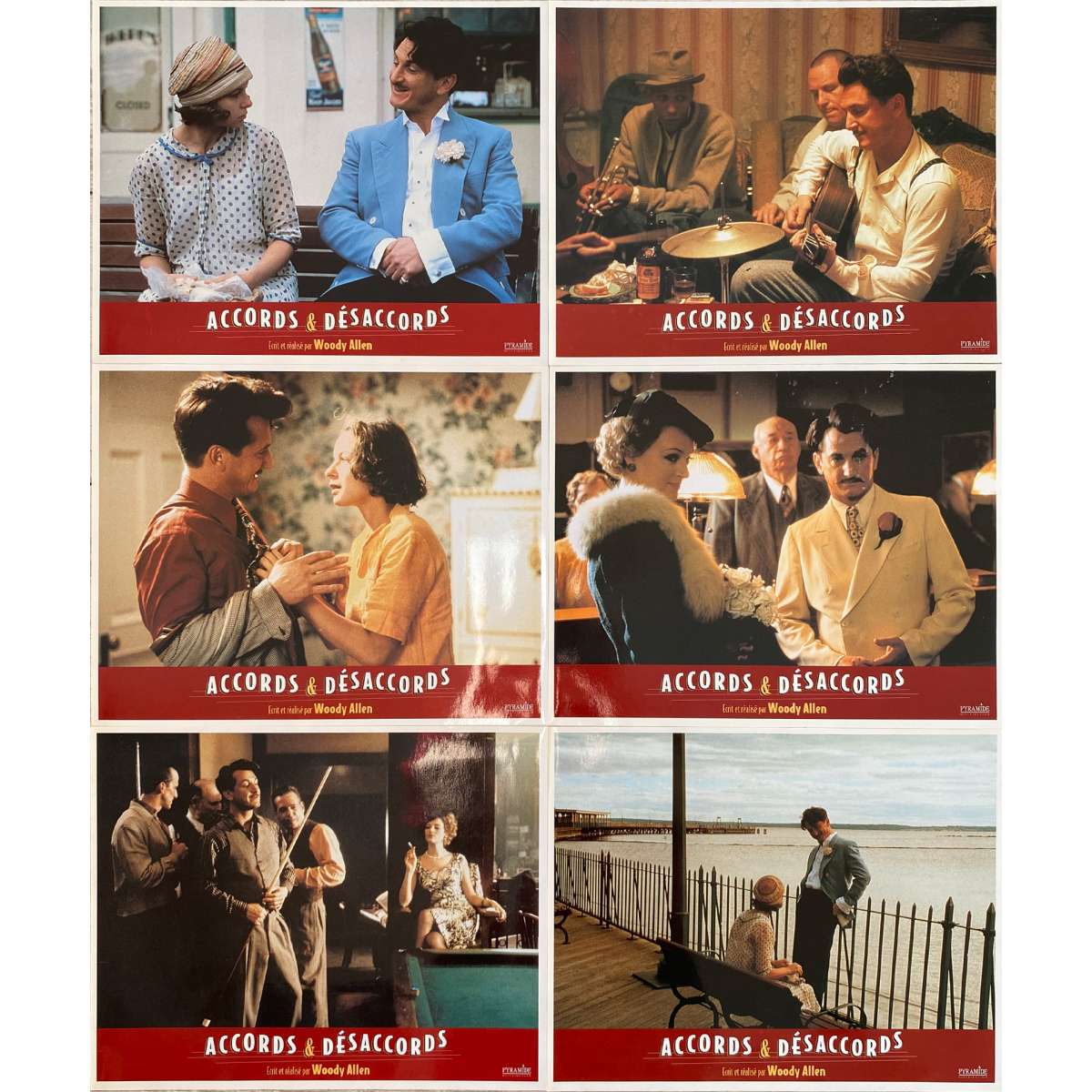

Sean Penns Allegiance To Woody Allen A Persistent Me Too Issue

May 24, 2025

Sean Penns Allegiance To Woody Allen A Persistent Me Too Issue

May 24, 2025 -

700 000 Property Profit Nicki Chapmans Escape To The Country Investment Strategy

May 24, 2025

700 000 Property Profit Nicki Chapmans Escape To The Country Investment Strategy

May 24, 2025 -

Unexpected Today Show Change Savannah Guthries Co Host Absence

May 24, 2025

Unexpected Today Show Change Savannah Guthries Co Host Absence

May 24, 2025

Latest Posts

-

Jonathan Groff Supported By Lea Michele And Fellow Actors At Broadway Premiere

May 24, 2025

Jonathan Groff Supported By Lea Michele And Fellow Actors At Broadway Premiere

May 24, 2025 -

Etoile Gideon Glick And Jonathan Groff Reunite In Hilarious Spring Awakening Scene

May 24, 2025

Etoile Gideon Glick And Jonathan Groff Reunite In Hilarious Spring Awakening Scene

May 24, 2025 -

Broadways Best Celebrate Jonathan Groffs New Show

May 24, 2025

Broadways Best Celebrate Jonathan Groffs New Show

May 24, 2025 -

Couple Fights Over Joe Jonas His Reaction Is Going Viral

May 24, 2025

Couple Fights Over Joe Jonas His Reaction Is Going Viral

May 24, 2025 -

Broadways Best Celebrate Jonathan Groff Photos From The Just In Time Opening Night

May 24, 2025

Broadways Best Celebrate Jonathan Groff Photos From The Just In Time Opening Night

May 24, 2025