The Posthaste Impact: How Bond Market Turmoil Affects The Global Economy

Table of Contents

Understanding Bond Market Dynamics and Their Global Reach

Bond markets form the bedrock of global finance, facilitating the borrowing and lending of capital on a massive scale. They play a crucial role in channeling savings into productive investments, supporting government spending, and fostering economic growth. However, the very nature of these markets makes them susceptible to periods of turmoil. Different types of bonds, such as government bonds (often considered relatively safe), corporate bonds (carrying higher risk), and municipal bonds, each react differently to shifts in economic conditions, contributing to overall market instability.

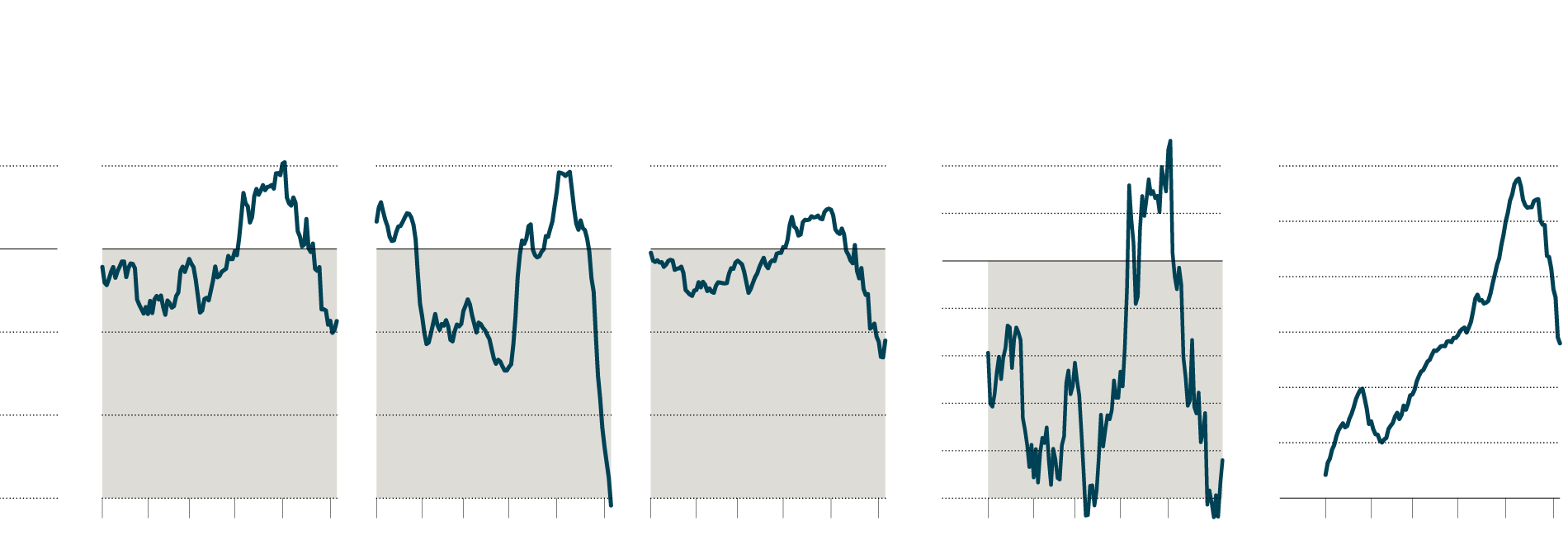

- Bond Yields and Interest Rates: Bond yields represent the return an investor receives on a bond. They are inversely related to bond prices and are significantly influenced by prevailing interest rates. When interest rates rise, bond yields generally rise, and bond prices fall, potentially causing market turmoil.

- Inflationary Pressures: Inflation erodes the purchasing power of future payments promised by bonds, impacting their value. High inflation often leads to increased interest rates, fueling bond market volatility and impacting fixed income investments.

- Interconnected Global Bond Markets: Bond markets are deeply interconnected internationally. Events in one market can quickly trigger reactions in others, creating a domino effect that can spread global bond market instability. This interconnectedness underscores the global nature of interest rate risk.

The Ripple Effects of Bond Market Turmoil on Economic Growth

Bond market instability directly impacts investor confidence and capital flows. When investors perceive increased risk, they may pull back from investments, leading to decreased capital flows and a slowdown in economic activity. This can manifest in several ways:

- Rising Borrowing Costs: Rising bond yields translate into higher borrowing costs for businesses and governments. This can stifle investment, hinder economic expansion, and potentially trigger a recession. The impact of fiscal policy is significantly altered in times of bond market turmoil.

- Uncertainty and Reduced Spending: Uncertainty stemming from bond market volatility can negatively impact consumer and business spending. Individuals and firms may postpone investments and purchases, leading to decreased aggregate demand and slowing economic growth.

- Past Crises as Case Studies: History provides numerous examples. The 1997-98 Asian financial crisis and the 2008 global financial crisis both involved significant bond market turmoil that severely impacted economic growth globally, illustrating the potential for widespread capital flows reversals.

Impact on Emerging Markets and Developing Economies

Emerging markets and developing economies are particularly vulnerable to bond market shocks. These economies often rely heavily on foreign capital inflows to finance their development. Bond market turmoil can lead to:

- Capital Flight: Investors may withdraw their investments from emerging markets, seeking safer havens in developed economies, leading to capital flight.

- Currency Depreciation: This outflow of capital can cause a sharp depreciation in the local currency, making it more expensive to repay foreign debt.

- Debt Crises: A combination of currency depreciation and capital flight can trigger debt crises, potentially destabilizing entire economies. The resulting sovereign debt issues can have long-lasting repercussions.

Navigating Bond Market Volatility: Strategies for Mitigation

Mitigating the risks associated with bond market turmoil requires proactive strategies at the individual, business, and governmental levels:

- Diversification: Diversifying investment portfolios across different asset classes can help reduce exposure to bond market volatility.

- Hedging Strategies: Employing hedging strategies, such as interest rate swaps, can help protect against interest rate risk.

- Government Intervention: Governments can play a crucial role in stabilizing bond markets through regulatory measures and fiscal interventions.

- Robust Risk Management: Strong risk management practices are essential for businesses and financial institutions to navigate periods of uncertainty. This includes stress testing and scenario planning.

Mitigating the Posthaste Impact of Bond Market Turmoil

Bond market turmoil presents a significant threat to global economic stability. Understanding the dynamics of these markets, the interconnectedness of global finance, and the potential for widespread impact is crucial. By implementing effective strategies for risk management and staying informed about market trends, individuals, businesses, and governments can better navigate future periods of bond market instability and bond market fluctuations. To further enhance your understanding, consider exploring resources from reputable financial institutions and economic research organizations. Staying informed is the first step in mitigating the risks associated with bond market volatility.

Featured Posts

-

Cat Deeleys Denim Midi Dress This Mornings Cowboy Trend

May 23, 2025

Cat Deeleys Denim Midi Dress This Mornings Cowboy Trend

May 23, 2025 -

Holly Willoughbys Departure Another Itv Countdown Begins

May 23, 2025

Holly Willoughbys Departure Another Itv Countdown Begins

May 23, 2025 -

The Impact Of Self Love On Appearance Vybz Kartels Experience With Skin Bleaching

May 23, 2025

The Impact Of Self Love On Appearance Vybz Kartels Experience With Skin Bleaching

May 23, 2025 -

This Morning Cat Deeley Explains Absence From Mother In Laws Funeral

May 23, 2025

This Morning Cat Deeley Explains Absence From Mother In Laws Funeral

May 23, 2025 -

Aleksandrova Pobezhdaet Samsonovu V Pervom Kruge Turnira V Shtutgarte

May 23, 2025

Aleksandrova Pobezhdaet Samsonovu V Pervom Kruge Turnira V Shtutgarte

May 23, 2025

Latest Posts

-

Bangkok Post Ferrari Day Unveils New Flagship Facility

May 24, 2025

Bangkok Post Ferrari Day Unveils New Flagship Facility

May 24, 2025 -

Jymypaukku Tuukka Taponen F1 Kuljettajaksi

May 24, 2025

Jymypaukku Tuukka Taponen F1 Kuljettajaksi

May 24, 2025 -

F1 Yllaetys Taponen Rattiin Taenae Vuonna

May 24, 2025

F1 Yllaetys Taponen Rattiin Taenae Vuonna

May 24, 2025 -

Bangkok Post Ferrari Opens Flagship Facility

May 24, 2025

Bangkok Post Ferrari Opens Flagship Facility

May 24, 2025 -

Jymypaukku Muhii Tuukka Taponen F1 Autoon Jo Taenae Vuonna

May 24, 2025

Jymypaukku Muhii Tuukka Taponen F1 Autoon Jo Taenae Vuonna

May 24, 2025