The Potential Of Sub-3% Mortgage Rates To Resurrect Canada's Housing Sector

Table of Contents

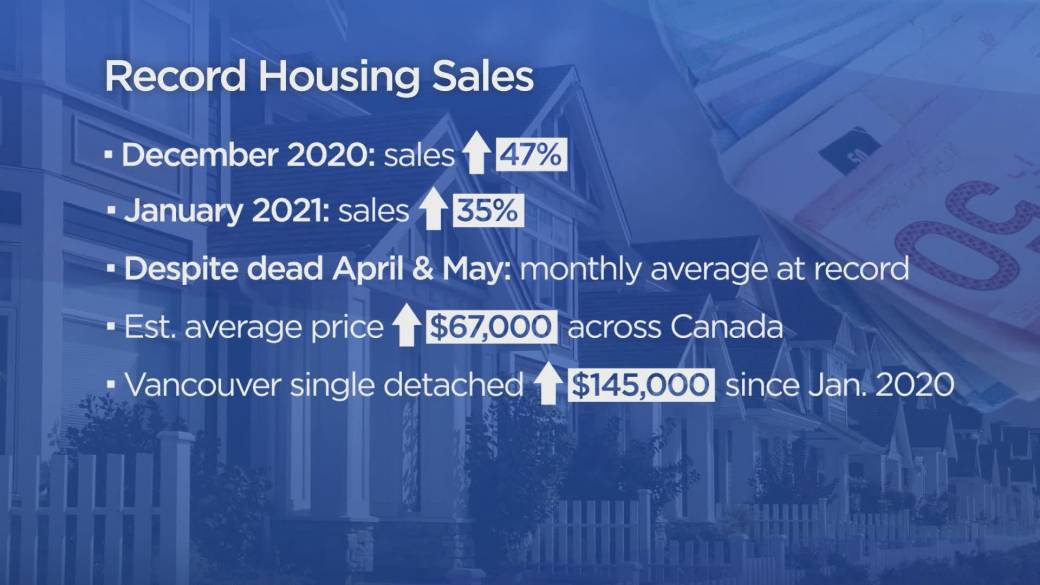

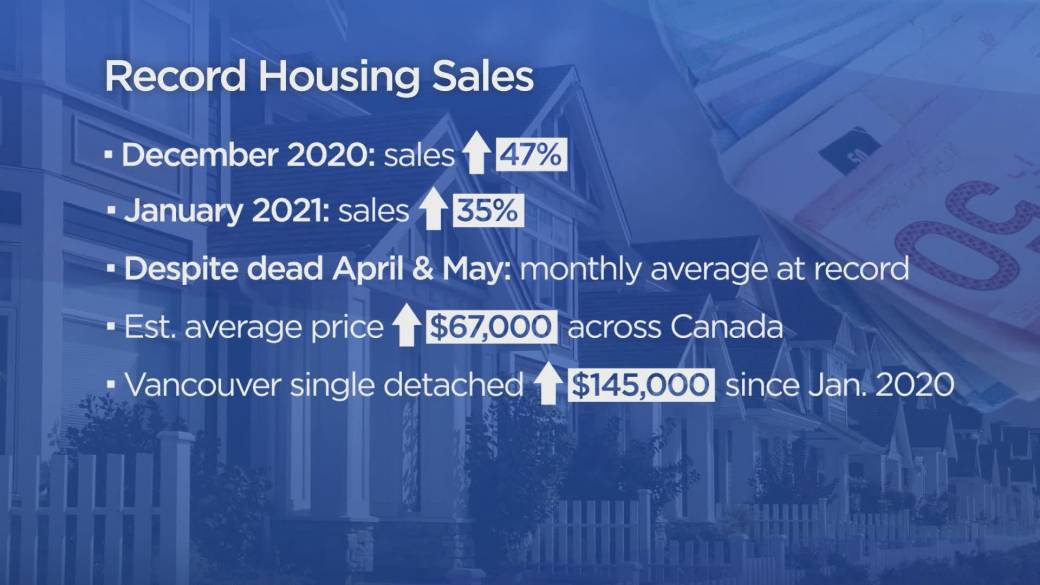

The Current State of Canada's Housing Market

High Interest Rates and Their Impact

The recent history of rising interest rates in Canada has had a profound impact on the housing market. The Bank of Canada's efforts to combat inflation have resulted in significantly higher borrowing costs, making mortgages considerably more expensive. This has led to a noticeable slowdown in the market.

- Decreased sales: Transaction volumes across the country have fallen significantly compared to the peak years.

- Increased inventory (in some areas): While certain areas still experience high demand, others are seeing a rise in unsold properties, a sign of weakening buyer activity.

- Impact on first-time homebuyers: Higher interest rates have priced many first-time homebuyers out of the market, significantly impacting their ability to enter the property ladder.

- Challenges faced by current homeowners: Homeowners with variable-rate mortgages are facing increased monthly payments, impacting their disposable income and overall financial stability.

The Need for a Market Resurgence

A depressed housing market has far-reaching economic consequences. The slowdown ripples through several interconnected industries.

- Job losses in related sectors: The construction industry, real estate agencies, and related businesses are experiencing job losses due to decreased activity.

- Decreased consumer spending: Reduced housing activity affects overall consumer confidence and spending, impacting the broader economy.

- Impact on GDP growth: The housing sector's contribution to Canada's GDP is substantial; reduced activity negatively impacts overall economic growth.

The Potential Impact of Sub-3% Mortgage Rates

Increased Affordability and Buyer Demand

Sub-3% mortgage rates would dramatically increase affordability, making homeownership a realistic possibility for a larger segment of the population.

- Lower monthly payments: Lower interest rates translate directly to significantly lower monthly mortgage payments.

- Increased purchasing power: With lower monthly payments, buyers can afford more expensive properties, thus increasing demand.

- Potential surge in demand: A return to sub-3% mortgage rates could trigger a significant surge in buyer demand, potentially leading to increased competition in certain markets.

- Impact on different housing segments: The impact would likely vary across different housing segments, such as condos and single-family homes, depending on existing market conditions.

Stimulating Economic Activity

The positive ripple effects of sub-3% mortgage rates on the economy could be substantial.

- Increased demand for building materials: A surge in construction activity would lead to increased demand for building materials, boosting related industries.

- Renewed construction projects: Lower borrowing costs would make it more feasible to start new construction projects, creating jobs and stimulating economic growth.

- Job creation in construction and related industries: The renewed construction activity would generate employment opportunities in various sectors, from construction workers to real estate agents.

- Positive impact on GDP: Increased economic activity across various sectors would contribute positively to Canada's GDP growth.

Regional Variations in Impact

The impact of sub-3% mortgage rates would not be uniform across Canada. Regional differences in housing prices, demand, and existing inventory would influence the extent of the market resurgence.

- Differences in housing prices: Areas with already high housing prices might see a more moderate increase in demand compared to regions with more affordable housing options.

- Demand: Areas with higher existing demand would likely see a stronger response to lower mortgage rates.

- Inventory: Regions with limited housing inventory might experience intense competition, leading to potential price increases despite the lower interest rates.

Challenges and Considerations

Inflationary Pressures

While beneficial for the housing market, lower mortgage rates could contribute to inflationary pressures.

- Increased demand leading to higher prices: Increased buyer demand could push housing prices upwards, potentially exacerbating inflation.

- Potential impact on the Bank of Canada's monetary policy: The Bank of Canada might need to adjust its monetary policy to counteract any inflationary pressures caused by lower mortgage rates.

Risk of Housing Bubbles

Sustained periods of low mortgage rates can lead to the formation of housing bubbles.

- Speculative buying: Low interest rates might encourage speculative buying, driving up prices beyond their sustainable levels.

- Potential for unsustainable price increases: Rapid and unsustainable price increases could lead to a market correction in the future, potentially resulting in significant losses for homeowners.

- Long-term market instability: Housing bubbles can create long-term market instability and economic uncertainty.

Government Policies and Regulations

Government policies and regulations play a crucial role in shaping the housing market.

- Tax incentives for homebuyers: Government initiatives to incentivize homeownership can influence market activity.

- Regulations on foreign investment: Policies regulating foreign investment in the housing market can affect housing affordability and price stability.

- Measures to increase housing supply: Government initiatives to increase the housing supply can ease demand pressures and contribute to greater market stability.

Conclusion

Sub-3% mortgage rates hold the potential to significantly revitalize Canada's housing market, boosting affordability, stimulating economic activity, and creating jobs. However, it’s crucial to acknowledge potential risks, including inflationary pressures and the possibility of creating new housing bubbles. Careful consideration of these risks, alongside proactive government policies and responsible lending practices, will be vital in ensuring a healthy and sustainable housing market. Understanding the potential of sub-3% mortgage rates is crucial for navigating the Canadian housing market. Monitor the impact of sub-3% mortgage rates on the Canadian real estate landscape and make informed decisions based on the evolving market conditions.

Featured Posts

-

Angel Has Fallen A Deep Dive Into The Action Thriller

May 13, 2025

Angel Has Fallen A Deep Dive Into The Action Thriller

May 13, 2025 -

Doom The Dark Ages Gameplay Story And More

May 13, 2025

Doom The Dark Ages Gameplay Story And More

May 13, 2025 -

Un Accord Post Brexit Pour Gibraltar Etat Des Negociations

May 13, 2025

Un Accord Post Brexit Pour Gibraltar Etat Des Negociations

May 13, 2025 -

Gibraltar The Lingering Brexit Dispute

May 13, 2025

Gibraltar The Lingering Brexit Dispute

May 13, 2025 -

10 Aktori Spasili Zhivoti V Realniya Zhivot Foto Galeriya

May 13, 2025

10 Aktori Spasili Zhivoti V Realniya Zhivot Foto Galeriya

May 13, 2025