The Private Credit Job Hunt: 5 Do's And Don'ts To Remember

Table of Contents

5 Do's for a Successful Private Credit Job Hunt

Do 1: Network Strategically

The private credit industry thrives on relationships. Leveraging your network is crucial for uncovering hidden job opportunities and gaining valuable insights.

- Leverage LinkedIn Effectively: Don't just connect; engage! Comment on posts, participate in relevant groups, and connect with professionals at target private credit firms. Research the backgrounds of individuals working in your desired roles and companies.

- Attend Industry Events and Conferences: Conferences focused on alternative investments, debt financing, and private equity offer unparalleled networking opportunities. Prepare talking points and business cards.

- Informational Interviews are Key: Reach out to professionals in private credit for informational interviews. These conversations provide invaluable insights into the industry, specific firms, and potential career paths. Prepare thoughtful questions beforehand.

- Utilize Alumni Networks and Professional Organizations: Tap into your alumni network and professional organizations like the CFA Institute for connections within the financial industry, potentially leading to private credit opportunities.

- Tailor your Networking Efforts: Don't cast a wide net. Focus your networking efforts on specific firms and roles that align with your career goals and skillset.

Do 2: Highlight Relevant Skills and Experience

Your resume and cover letter are your first impression. Highlighting relevant skills and experience is paramount.

- Emphasize Experience in Financial Modeling, Valuation, and Credit Analysis: Quantify your achievements whenever possible. Instead of saying "Performed financial modeling," say "Developed financial models for $X billion in assets, resulting in a Y% improvement in accuracy."

- Showcase Strong Analytical and Problem-Solving Skills: Provide concrete examples of how you've used your analytical skills to solve complex problems.

- Demonstrate Knowledge of Debt Financing Structures: Showcase your understanding of leveraged loans, high-yield bonds, and other debt instruments common in private credit.

- Tailor your Resume and Cover Letter: Generic applications rarely impress. Customize each application to reflect the specific requirements and company culture of the target firm.

Do 3: Master the Interview Process

The interview is your chance to shine. Thorough preparation is key.

- Prepare for Behavioral and Technical Questions: Anticipate questions about your experience in private credit, financial modeling, and your approach to problem-solving. Practice the STAR method (Situation, Task, Action, Result) to structure your answers.

- Research the Firm Thoroughly: Understand their investment strategy, recent transactions, and company culture. Demonstrate your knowledge during the interview.

- Practice your Answers: Rehearse your answers to common interview questions, focusing on your understanding of private credit markets, risk assessment, and due diligence.

- Ask Insightful Questions: Prepare a few insightful questions to show your interest and understanding of the firm and the role.

Do 4: Showcase your Financial Acumen

Private credit demands strong financial skills. Demonstrate your proficiency.

- Highlight Proficiency in Financial Modeling Software: Mention your expertise in Excel, Argus, or other relevant software packages. Be ready to discuss specific modeling techniques.

- Demonstrate a Strong Understanding of Financial Statements and Credit Metrics: Show your ability to analyze financial statements, calculate key ratios, and interpret credit risk.

- Display Analytical Skills: Explain how you've used data to identify trends, make predictions, and support investment decisions.

- Showcase Experience with Large Datasets and Quantitative Analysis: Highlight any experience working with large datasets and performing complex quantitative analysis.

Do 5: Maintain a Professional Online Presence

Your online presence reflects your professionalism.

- Ensure your LinkedIn Profile is Up-to-Date: Highlight your experience in private credit, showcasing your skills and accomplishments. Use keywords relevant to the field (e.g., "private credit," "credit analyst," "debt financing").

- Curate a Professional Online Presence: Review your social media profiles and ensure they reflect a professional image consistent with your job search.

- Proofread All Online Content Carefully: Typos and grammatical errors can create a negative impression.

5 Don'ts for a Private Credit Job Hunt

Don't 1: Neglect the Importance of Networking

Networking is not optional in private credit.

- Avoid Relying Solely on Online Job Boards: While job boards can be helpful, they are not sufficient. Active networking significantly increases your chances.

- Don't Underestimate the Power of Personal Connections: Leverage your existing network and build new connections within the industry.

- Don't Be Afraid to Reach Out: Even a brief email or LinkedIn message can open doors.

Don't 2: Submit Generic Applications

Each application should be tailored.

- Avoid Sending the Same Resume and Cover Letter: Show the employer you're genuinely interested in their firm and their specific role.

- Tailor Your Application to Each Job Description: Highlight the skills and experience that are most relevant to each specific job.

- Don't Ignore Company Culture and Values: Research the firm's culture and align your application accordingly.

Don't 3: Underestimate Technical Skills

Technical skills are crucial in private credit.

- Don't Overlook the Need for Strong Financial Modeling and Analytical Skills: Emphasize these skills throughout your application process.

- Don't Neglect to Showcase your Proficiency in Relevant Software: List relevant software and be prepared to demonstrate your expertise.

- Don't Shy Away from Demonstrating Your Quantitative Abilities: Highlight your analytical abilities and your comfort working with large datasets.

Don't 4: Appear Unprepared for Interviews

Preparation is essential for success.

- Don't Go into Interviews Without Researching the Firm and the Role: Show your genuine interest by being well-informed.

- Don't Fail to Prepare Answers to Common Interview Questions: Practice your responses to frequently asked questions about private credit and your experience.

- Don't Hesitate to Ask Insightful Questions: Show your enthusiasm and engagement by asking thoughtful questions about the firm and the role.

Don't 5: Ignore Your Online Presence

Your online presence matters.

- Avoid Having a Sloppy or Outdated LinkedIn Profile: Keep your profile updated and professional.

- Don't Neglect to Monitor Your Online Reputation: Be aware of what's publicly visible about you online.

- Don't Present an Unprofessional Image Online: Maintain a consistent professional image across all your online platforms.

Conclusion

Successfully navigating the private credit job hunt requires a strategic combination of skills, preparation, and networking. By following these "dos" and avoiding the "don'ts," you'll significantly increase your chances of securing a rewarding career in private credit. Remember to leverage your network, highlight your skills, master the interview process, and maintain a professional online presence. Start your successful private credit job hunt today!

Featured Posts

-

Postoje Li Sanse Za Popravak Marka Bosnjaka Analiza Kladionica

May 19, 2025

Postoje Li Sanse Za Popravak Marka Bosnjaka Analiza Kladionica

May 19, 2025 -

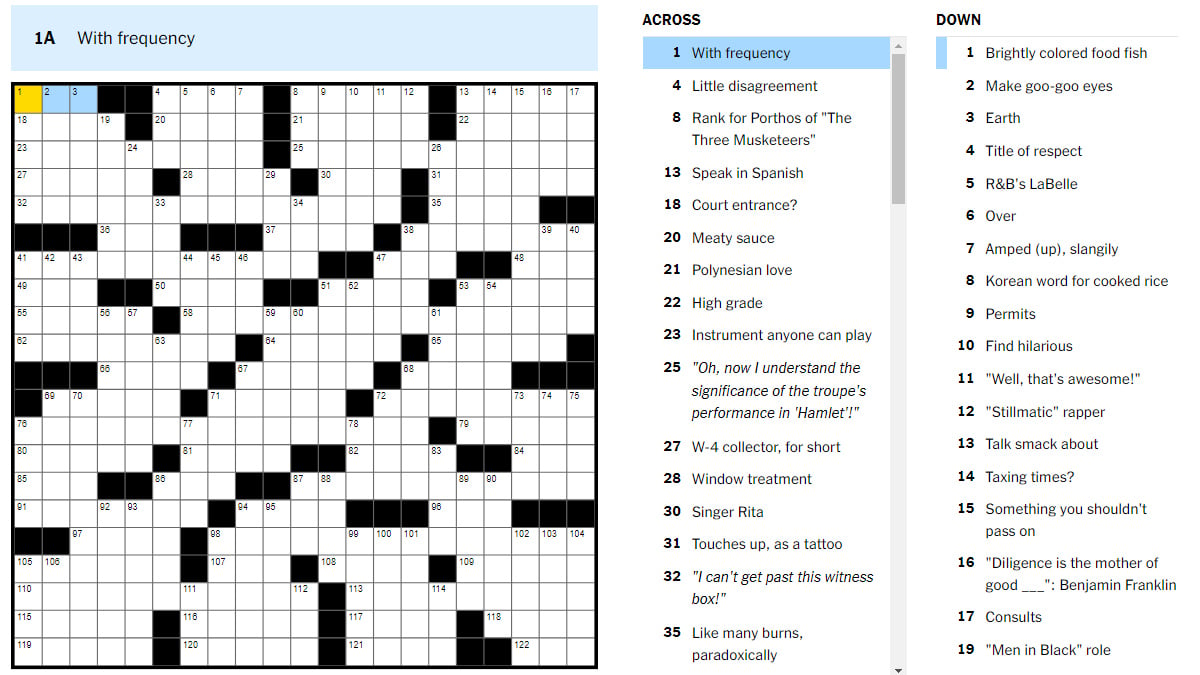

Nyt Mini Crossword April 18th 2025 Answers And Solution Guide

May 19, 2025

Nyt Mini Crossword April 18th 2025 Answers And Solution Guide

May 19, 2025 -

Todays Nyt Mini Crossword Answers March 24 2025

May 19, 2025

Todays Nyt Mini Crossword Answers March 24 2025

May 19, 2025 -

Remote Island Deportation Plan France Faces Backlash Over Migrant Policy

May 19, 2025

Remote Island Deportation Plan France Faces Backlash Over Migrant Policy

May 19, 2025 -

El Rol De Cohep En La Vigilancia Del Proceso Electoral

May 19, 2025

El Rol De Cohep En La Vigilancia Del Proceso Electoral

May 19, 2025

Latest Posts

-

Why Colin Jost Earns Less Than Scarlett Johansson Examining Hollywood Pay Gaps

May 19, 2025

Why Colin Jost Earns Less Than Scarlett Johansson Examining Hollywood Pay Gaps

May 19, 2025 -

Nyt Connections Answers For February 27 Puzzle 627

May 19, 2025

Nyt Connections Answers For February 27 Puzzle 627

May 19, 2025 -

Snl Season 50 Finale A Look At Johansson And Bunnys Performances

May 19, 2025

Snl Season 50 Finale A Look At Johansson And Bunnys Performances

May 19, 2025 -

Colin Jost And Scarlett Johanssons Income Discrepancy Public Reaction And Analysis

May 19, 2025

Colin Jost And Scarlett Johanssons Income Discrepancy Public Reaction And Analysis

May 19, 2025 -

Todays Nyt Connections Hints And Answers February 27 627

May 19, 2025

Todays Nyt Connections Hints And Answers February 27 627

May 19, 2025