The Private Equity Power Play: Insights From Four Key Books

Table of Contents

Understanding Private Equity Fundamentals: Venture Deals – A Foundation for Success

Venture Deals, by Brad Feld and Jason Mendelson, serves as an excellent foundational text for anyone interested in private equity. It provides a practical, step-by-step guide to navigating the intricacies of venture capital and private equity deals.

Key takeaways from Venture Deals regarding deal sourcing and due diligence:

- Deal Sourcing: The book emphasizes the importance of networking, attending industry events, and leveraging relationships to uncover promising investment opportunities. It also highlights the use of online resources and databases for deal sourcing.

- Due Diligence: Venture Deals stresses the criticality of thorough due diligence, including financial statement analysis, market research, competitive analysis, and management team assessment. It provides a framework for evaluating the risks and potential returns of a private equity investment.

- Case Studies: The book showcases several case studies, illustrating the application of deal sourcing and due diligence techniques in real-world scenarios. These case studies offer invaluable insights into successful and unsuccessful investments.

Analyzing Financial Statements in Private Equity: Venture Deals's Approach

Venture Deals provides a detailed explanation of key financial ratios and metrics crucial for private equity valuation. The book emphasizes understanding:

- Key Ratios: Return on equity (ROE), return on invested capital (ROIC), debt-to-equity ratio, and other crucial metrics for assessing financial health and profitability.

- Valuation Methodologies: Discounted cash flow (DCF) analysis, comparable company analysis, and precedent transaction analysis are discussed, providing various methods for determining an investment's fair value.

- Identifying Undervalued Assets: The book emphasizes the importance of identifying undervalued assets by carefully analyzing financial statements, understanding market dynamics, and considering potential synergies.

Mastering Private Equity Investment Strategies: Mastering the Private Equity Game – Navigating the Deal Landscape

Mastering the Private Equity Game, by Bruce C. Greenwald, Judd Kahn, Paul D. Sonkin, and Michael A. Van Biema, delves into the strategic aspects of private equity investing. It offers a deep dive into various investment strategies and provides valuable insights for navigating the complex landscape of private equity transactions.

Exploring different investment strategies (e.g., leveraged buyouts, growth equity):

- Leveraged Buyouts (LBOs): The book explains how LBOs utilize significant debt financing to acquire companies, highlighting the potential for high returns but also the increased financial risk. Successful LBOs often involve significant operational improvements post-acquisition.

- Growth Equity: This strategy focuses on investing in high-growth companies with significant expansion potential. Mastering the Private Equity Game details how to identify such companies and the crucial role of management teams in driving growth.

- Case Studies: Real-world case studies demonstrate the application of these strategies, analyzing their successes and failures, and illustrating the crucial role of market timing and risk management.

Risk Management and Portfolio Diversification in Private Equity

Mastering the Private Equity Game underscores the importance of comprehensive risk management and portfolio diversification within a private equity strategy. This involves:

- Identifying Key Risks: Market risks, operational risks, financial risks, and regulatory risks are all detailed, along with methods to assess their potential impact.

- Mitigating Risk: Techniques like stress testing, scenario planning, and due diligence are highlighted as ways to mitigate the various potential risks associated with private equity investing.

- Portfolio Diversification: The book demonstrates how a diversified portfolio can help reduce overall risk and improve returns, providing examples of how to spread investments across different sectors, geographies, and stages of company development.

The Human Capital Element: Private Equity Investing: Principles and Practices – People, Performance, and Profitability

While financial analysis is crucial, Private Equity Investing: Principles and Practices by Robert S. Harris, Timothy L. Harris, and Michael J. Pringle, underscores the critical role of human capital in private equity success.

The role of management teams and operational improvements in private equity success:

- Selecting Strong Management Teams: The book emphasizes the importance of identifying and working with experienced and capable management teams, as they play a vital role in driving operational improvements and value creation.

- Driving Operational Efficiency and Growth: Strategies for improving operational efficiency, such as streamlining processes, enhancing technology, and implementing cost-reduction measures, are explained.

- The Human Element: The book demonstrates how fostering a positive work environment and motivating employees are critical for successful outcomes, emphasizing the importance of the human factor.

Cultural Integration and Change Management in Portfolio Companies

Private Equity Investing: Principles and Practices highlights the challenges and opportunities associated with cultural integration and change management within portfolio companies. Key considerations include:

- Challenges of Integration: Differences in corporate culture, management styles, and employee values can lead to integration challenges, impacting morale and productivity.

- Strategies for Effective Change Management: The book provides a framework for managing change effectively, including clear communication, employee involvement, and effective leadership.

- Lessons Learned: The authors share successful examples and lessons learned regarding successful cultural integrations in portfolio companies.

Exiting Private Equity Investments: The Art of M&A – Maximizing Returns and Value Creation

Successfully exiting investments is critical to maximizing returns in private equity. The Art of M&A by Steven M. Bragg provides valuable insights into this crucial phase.

Different exit strategies (e.g., IPO, sale to strategic buyer, secondary sale):

- Initial Public Offering (IPO): The book describes the process of taking a company public through an IPO, highlighting the advantages (e.g., significant liquidity) and potential drawbacks (e.g., regulatory requirements).

- Sale to Strategic Buyer: Selling a portfolio company to a strategic buyer (e.g., a competitor or a larger company) often involves a higher valuation due to potential synergies. The book explains how to identify and approach suitable strategic buyers.

- Secondary Sale: Selling to another private equity firm is a common exit strategy, transferring ownership and realizing profits. This strategy is discussed, highlighting the factors influencing timing and valuation.

Negotiating and Structuring Exit Transactions

The Art of M&A offers practical advice on navigating the complexities of negotiating and structuring exit transactions. This includes:

- Key Negotiation Points: Valuation, terms of payment, earn-out provisions, and other key contractual provisions are explored.

- Importance of Legal and Financial Structuring: The book stresses the critical role of legal and financial experts in structuring deals to maximize tax efficiency and minimize risk.

- Practical Advice: The authors share practical advice on navigating complex exit transactions and overcoming potential obstacles, providing real-world examples.

Conclusion: Mastering the Private Equity Power Play

This exploration of four key books—Venture Deals, Mastering the Private Equity Game, Private Equity Investing: Principles and Practices, and The Art of M&A—provides a comprehensive overview of the private equity world. From understanding fundamental principles and implementing diverse investment strategies to navigating the human capital aspects and successfully exiting investments, these books offer invaluable insights for both aspiring and seasoned professionals. By studying these texts, you can gain a deeper understanding of the challenges and opportunities within private equity, enabling you to navigate the complexities of deal-making and maximize your returns. Dive deeper into the world of private equity by reading these four essential books and unlock the secrets to success in this dynamic and lucrative field. Begin your journey to mastering the private equity power play today!

Featured Posts

-

30 Year Sentence For Longview Waffle House Killer

May 27, 2025

30 Year Sentence For Longview Waffle House Killer

May 27, 2025 -

Anyasag 40 Ev Felett Lehetseges Es Inspiralo

May 27, 2025

Anyasag 40 Ev Felett Lehetseges Es Inspiralo

May 27, 2025 -

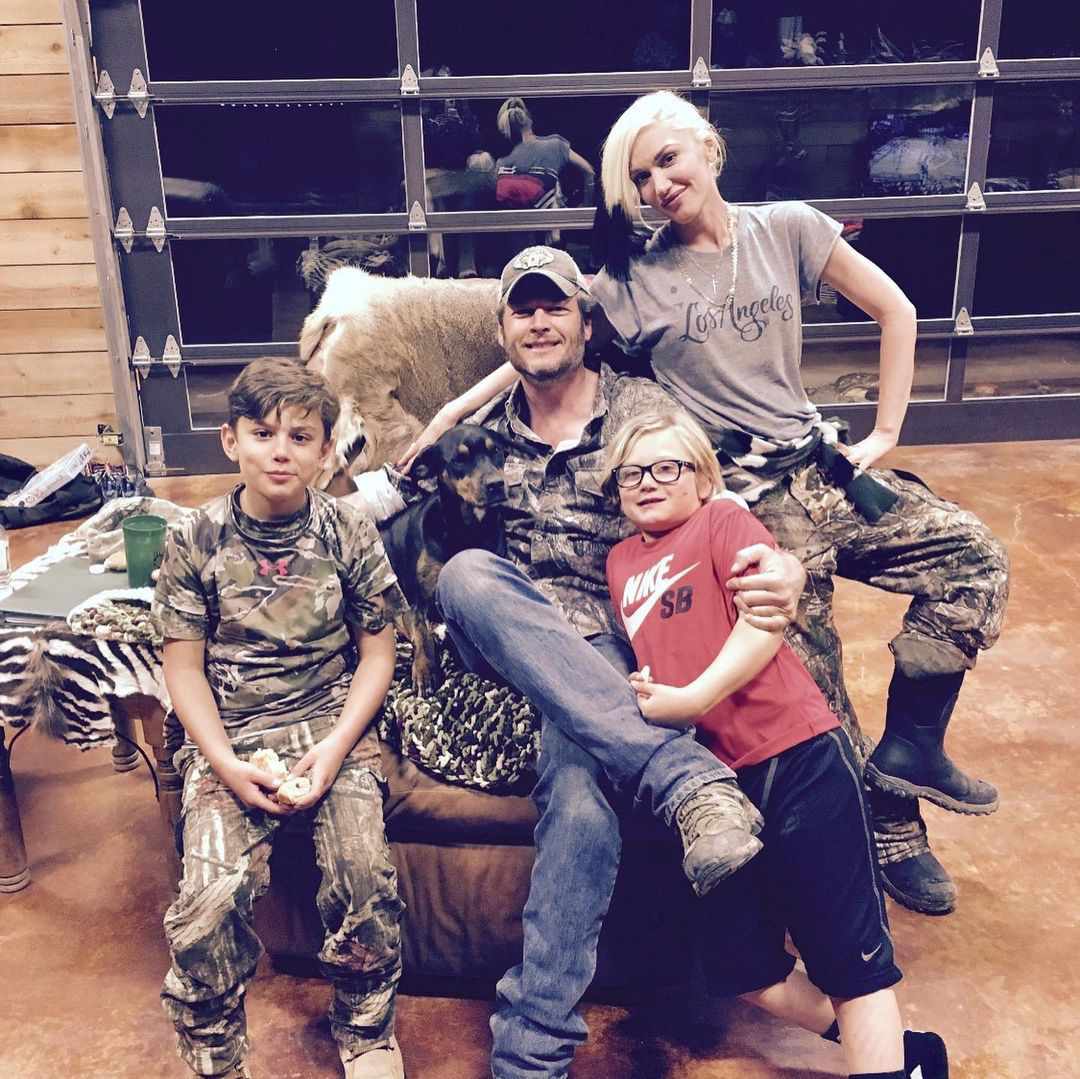

Shelton Stefani Family Vacation An Inside Look

May 27, 2025

Shelton Stefani Family Vacation An Inside Look

May 27, 2025 -

Ramshtayn V Bryussele Germaniya Usilivaet Podderzhku Ukrainy

May 27, 2025

Ramshtayn V Bryussele Germaniya Usilivaet Podderzhku Ukrainy

May 27, 2025 -

Parents De Saint Ouen Deplacement De L Ecole Maternelle Face Aux Problemes De Trafic De Drogue

May 27, 2025

Parents De Saint Ouen Deplacement De L Ecole Maternelle Face Aux Problemes De Trafic De Drogue

May 27, 2025

Latest Posts

-

El Legado Del Ex Numero 3 La Historia Detras De La Frase A Marcelo Rios

May 30, 2025

El Legado Del Ex Numero 3 La Historia Detras De La Frase A Marcelo Rios

May 30, 2025 -

Marcelo Rios Y La Frase Del Ex Numero 3 Un Analisis Profundo

May 30, 2025

Marcelo Rios Y La Frase Del Ex Numero 3 Un Analisis Profundo

May 30, 2025 -

La Inspiracion De Marcelo Rios Revelando La Poderosa Frase Del Ex Numero 3

May 30, 2025

La Inspiracion De Marcelo Rios Revelando La Poderosa Frase Del Ex Numero 3

May 30, 2025 -

Ex Numero 3 Del Mundo La Motivacion Tras La Frase A Marcelo Rios

May 30, 2025

Ex Numero 3 Del Mundo La Motivacion Tras La Frase A Marcelo Rios

May 30, 2025 -

Roland Garros Surprise Defeats For Ruud And Tsitsipas Swiatek Remains Unbeaten

May 30, 2025

Roland Garros Surprise Defeats For Ruud And Tsitsipas Swiatek Remains Unbeaten

May 30, 2025