The Real Safe Bet: Investing In Stability

Table of Contents

Understanding the Importance of Stability in Investing

Minimizing Risk vs. Maximizing Returns

The investment world presents a classic trade-off: minimizing risk often means accepting lower returns, while maximizing returns usually involves taking on greater risk. Investing in stability doesn't mean sacrificing all potential growth; it's about achieving controlled, sustainable gains over the long term.

- High-Risk Investments: Penny stocks, speculative cryptocurrencies, and options trading often promise high returns but carry substantial risk of significant losses.

- Lower-Risk Investments: Government bonds, index funds, and blue-chip stocks generally offer more stability, although returns might be more modest.

Understanding your risk tolerance is crucial. Are you comfortable with the potential for short-term losses in pursuit of higher long-term returns, or do you prioritize preserving capital and achieving steady growth? Diversification, spreading your investments across different asset classes, is a key risk mitigation strategy for any investment approach.

Long-Term Financial Goals and Stability

Investing in stability is particularly important when considering long-term financial goals. Whether you're planning for retirement, funding your children's education, or saving for a down payment on a house, a stable investment strategy is essential.

- Retirement Planning: Consistent, steady growth from stable investments allows for a more predictable and secure retirement income.

- Education Funding: A stable investment approach ensures that funds are available when needed for educational expenses, mitigating the risk of market downturns impacting your child's future.

- Home Purchase: A stable investment strategy provides the financial security needed for a significant purchase like a home, allowing you to avoid relying on volatile market gains.

Consistent, steady growth, even if seemingly slower in the short term, often surpasses the cumulative returns of highly volatile investments over the long run, making it the preferred approach for achieving long-term financial goals.

Investment Strategies for Stability

Diversification Across Asset Classes

Diversification is a cornerstone of investing in stability. By spreading your investments across different asset classes, you reduce the impact of poor performance in any single area.

- Stocks: Offer potential for higher returns but also greater volatility. Consider index funds for diversification within the stock market.

- Bonds: Generally considered less volatile than stocks, bonds provide a steady income stream. Government bonds are particularly low-risk.

- Real Estate: Can provide both income (rental properties) and appreciation in value, but requires significant capital investment and management.

- Cash and Cash Equivalents: Provide liquidity and safety, although returns may be low.

Proper asset allocation, determining the ideal proportion of each asset class in your portfolio, is key to achieving a stable investment portfolio tailored to your risk tolerance and goals.

Blue-Chip Stocks and Dividend Investing

Established, financially sound companies (blue-chip stocks) and dividend-paying stocks contribute to a stable investment strategy.

- Blue-Chip Stocks: Companies like Johnson & Johnson, Procter & Gamble, and Coca-Cola have a long history of consistent performance and provide relative stability.

- Dividend Investing: Dividend-paying stocks provide a regular stream of income, supplementing capital appreciation. Dividend reinvestment, using dividends to purchase more shares, accelerates long-term growth.

Researching the historical performance and financial health of potential investments is crucial before incorporating them into your portfolio.

Real Estate Investment Trusts (REITs)

REITs offer another avenue for investing in stability. These companies own and operate income-producing real estate, offering investors a relatively stable income stream.

- How REITs Work: REITs pool money from investors to acquire and manage income-generating properties. Investors receive dividends based on the REIT's profits.

- Advantages: REITs provide diversification beyond traditional stocks and bonds, offer passive income, and often have a lower correlation with the overall stock market.

- Potential Risks: REITs are subject to market fluctuations and interest rate changes.

Thorough research into the specific REIT and its underlying assets is necessary to assess its risk profile.

Managing Your Investments for Stability

Regular Portfolio Review and Rebalancing

Consistent monitoring and adjustments are crucial for maintaining a balanced and stable portfolio.

- Regular Review: Aim for at least an annual portfolio review to assess performance and make necessary adjustments.

- Rebalancing: Rebalancing involves selling some assets that have performed well and buying assets that have underperformed, bringing your portfolio back to its target asset allocation.

Market fluctuations can impact your portfolio balance; rebalancing helps mitigate risk and maintain your desired level of stability.

Seeking Professional Advice

Consider consulting a financial advisor for personalized guidance on investing in stability.

- Personalized Strategies: A financial advisor can create a customized investment plan tailored to your specific financial goals, risk tolerance, and time horizon.

- Risk Management: They can help you assess and manage risk effectively.

Understanding your own risk tolerance and financial goals is paramount before making investment decisions; a professional can provide invaluable support in this process.

Conclusion

Investing in stability is not about avoiding growth; it's about achieving sustainable, long-term financial security. By diversifying your portfolio across various asset classes, including blue-chip stocks, dividend-paying stocks, and potentially REITs, and by regularly reviewing and rebalancing your investments, you can build a strong foundation for your financial future. Seeking professional guidance can further enhance your ability to navigate the investment landscape and achieve your long-term objectives. Take the first step towards building a stable investment portfolio today. Secure your financial future through stable investments and start planning for a more secure tomorrow. The journey towards financial independence begins with understanding the real safe bet: investing in stability.

Featured Posts

-

Woman 23 Claims To Be Madeleine Mc Cann Dna Test Results Unveiled

May 09, 2025

Woman 23 Claims To Be Madeleine Mc Cann Dna Test Results Unveiled

May 09, 2025 -

Beyonces Tour Boosts Cowboy Carter Streams A Detailed Look

May 09, 2025

Beyonces Tour Boosts Cowboy Carter Streams A Detailed Look

May 09, 2025 -

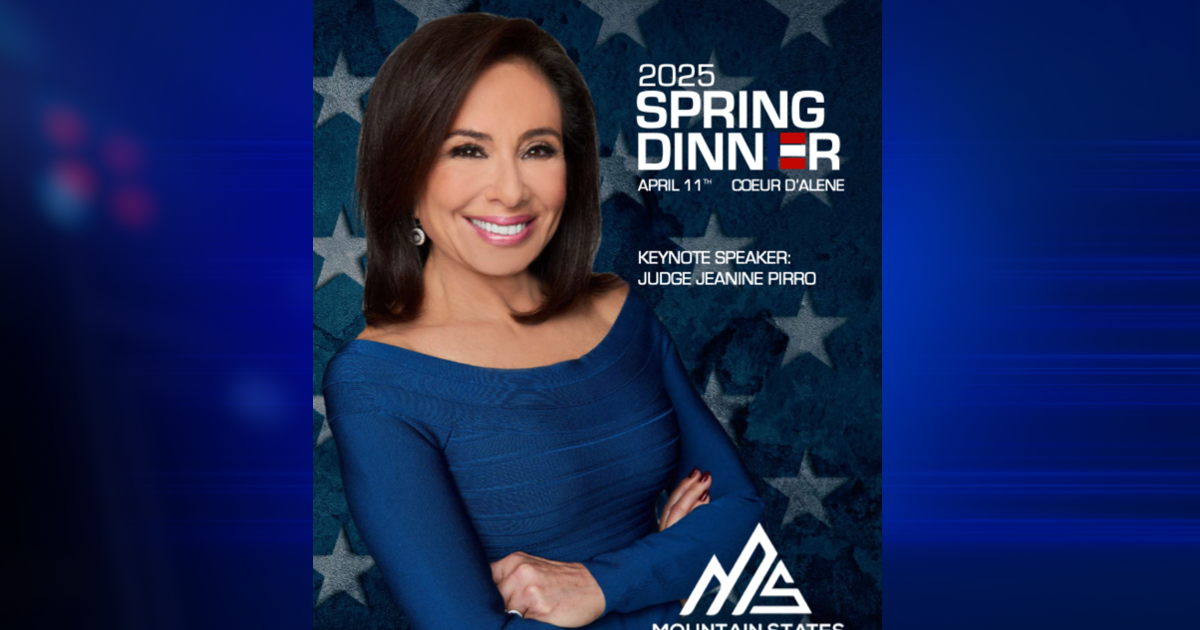

When And Where To See Jeanine Pirro In North Idaho

May 09, 2025

When And Where To See Jeanine Pirro In North Idaho

May 09, 2025 -

Strictly Come Dancing Wynne Evans On Return Rumours And The Truth

May 09, 2025

Strictly Come Dancing Wynne Evans On Return Rumours And The Truth

May 09, 2025 -

Lidery Frantsii Britanii Germanii I Polshi Ne Posetyat Kiev 9 Maya

May 09, 2025

Lidery Frantsii Britanii Germanii I Polshi Ne Posetyat Kiev 9 Maya

May 09, 2025