The Real Safe Bet: Low-Risk Investment Options Explained

Table of Contents

High-Yield Savings Accounts and Money Market Accounts

These accounts offer a compelling entry point for risk-averse investors seeking safe investments. Keywords like "high-yield savings accounts," "money market accounts," "FDIC insured," "interest rates," "liquidity," and "accessibility" highlight their key features. The primary advantage is the FDIC insurance (up to $250,000 per depositor, per insured bank), providing a safety net for your principal. While returns might be modest compared to riskier investments like stocks, they offer excellent liquidity and accessibility, making them ideal for emergency funds or short-term savings goals.

- Easily accessible funds: You can withdraw your money quickly and easily whenever needed.

- FDIC insurance protection: Your deposits are insured by the Federal Deposit Insurance Corporation, protecting you from potential bank failures.

- Relatively low interest rates: Interest rates are generally lower than those offered by riskier investments, but they still provide a better return than keeping your money under your mattress.

- Ideal for emergency funds or short-term savings goals: Perfect for building a financial safety net or saving for a short-term purchase.

Certificates of Deposit (CDs)

Certificates of deposit (CDs) represent another cornerstone of low-risk investment strategies. Keywords such as "certificates of deposit," "CDs," "fixed-term deposits," "interest rates," "maturity date," and "CD laddering" are crucial for SEO purposes. CDs offer fixed interest rates for a specified term (the maturity date). The longer the term you commit to, the generally higher the interest rate you'll receive. However, early withdrawal penalties usually apply, which is a key consideration. To mitigate this risk, many investors use a CD laddering strategy, which involves spreading investments across CDs with various maturity dates.

- Predictable returns: You know exactly how much interest you'll earn over the term of the CD.

- FDIC insured (generally): Similar to savings accounts, many CDs are FDIC insured, protecting your principal.

- Penalty for early withdrawal: Withdrawing funds before maturity will incur a penalty, reducing your overall return.

- CD laddering improves liquidity: This strategy allows you to access a portion of your funds regularly without penalty.

Government Bonds

Government bonds, including Treasury bonds and municipal bonds, are frequently cited as some of the safest investments available. Relevant keywords here include "government bonds," "Treasury bonds," "municipal bonds," "bond yields," "low-risk bonds," and "diversification." They're backed by the government, offering a high degree of stability. Treasury bonds are issued by the federal government, while municipal bonds are issued by state and local governments. Municipal bonds often offer tax advantages, depending on your location and tax bracket.

- Considered very low-risk: The backing of the government significantly reduces the risk of default.

- Relatively low returns compared to stocks: While safer, returns are generally lower than those from stocks.

- Offer diversification benefits: Adding government bonds to your portfolio can help reduce overall risk.

- Tax advantages for municipal bonds: The interest earned on municipal bonds is often exempt from federal income tax and, sometimes, state and local taxes.

Low-Volatility Stocks and ETFs

While stocks are inherently riskier than the options discussed above, investing in low-volatility stocks or Exchange-Traded Funds (ETFs) can still be part of a conservative investment strategy. Keywords to focus on include "low-volatility stocks," "ETFs," "index funds," "diversification," "dividend stocks," and "passive investing." These investments tend to experience less price fluctuation than the broader market. Index funds and ETFs provide instant diversification across a range of companies, further mitigating risk. Dividend-paying stocks offer the additional benefit of a regular income stream.

- Lower risk compared to individual high-growth stocks: Less susceptible to dramatic price swings.

- Diversification through index funds and ETFs: Spreading your investment across multiple companies.

- Potential for dividend income: Regular income payments from dividend-paying stocks.

- Requires some market understanding: While considered low-risk relative to other stocks, some basic market knowledge is beneficial.

Understanding Your Risk Tolerance

Before investing in any of these options, it's vital to assess your personal risk tolerance and financial goals. Your risk tolerance is how much investment loss you are comfortable with. A financial advisor can help you determine the best low-risk investment strategy for your specific circumstances. They can assess your financial situation and goals to craft a personalized plan.

Conclusion

Finding the real safe bet involves carefully considering your financial needs and risk tolerance. Low-risk investment options like high-yield savings accounts, CDs, government bonds, and low-volatility stocks and ETFs offer pathways to grow your wealth securely. Remember to diversify your portfolio and consider seeking professional financial advice to create a personalized investment plan that aligns with your goals. Start building your secure financial future with the right low-risk investment options today!

Featured Posts

-

Executive Orders And The Transgender Community Your Stories Matter

May 10, 2025

Executive Orders And The Transgender Community Your Stories Matter

May 10, 2025 -

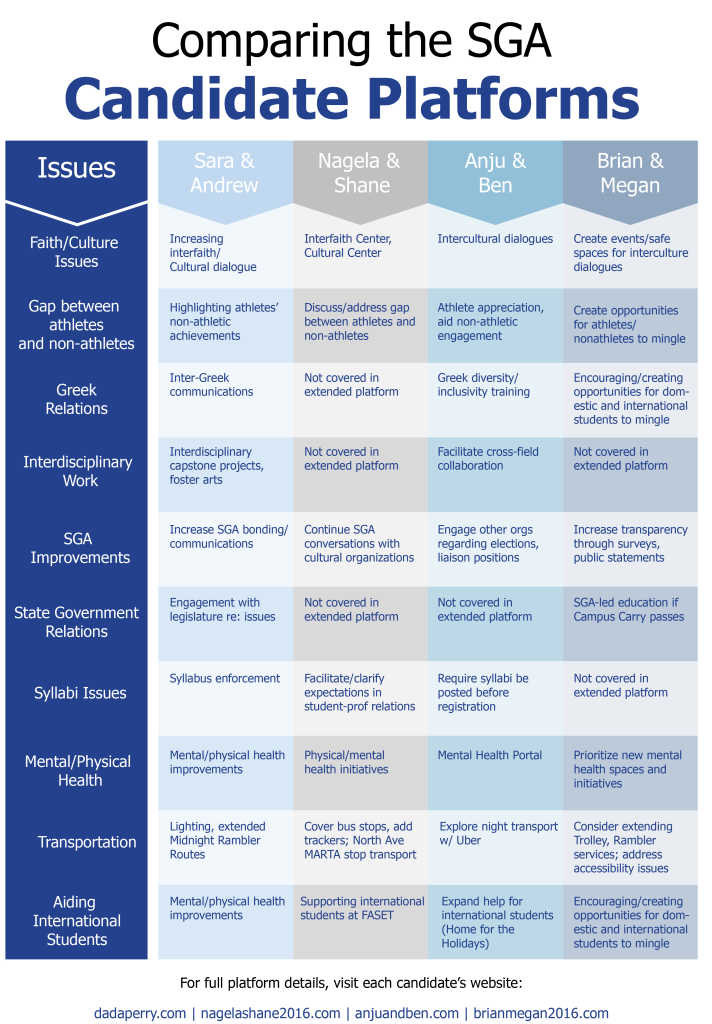

Nl Federal Election 202 Year Candidate Profiles And Platforms

May 10, 2025

Nl Federal Election 202 Year Candidate Profiles And Platforms

May 10, 2025 -

Kiev 9 Maya Makron Starmer Merts I Tusk Ne Pribudut

May 10, 2025

Kiev 9 Maya Makron Starmer Merts I Tusk Ne Pribudut

May 10, 2025 -

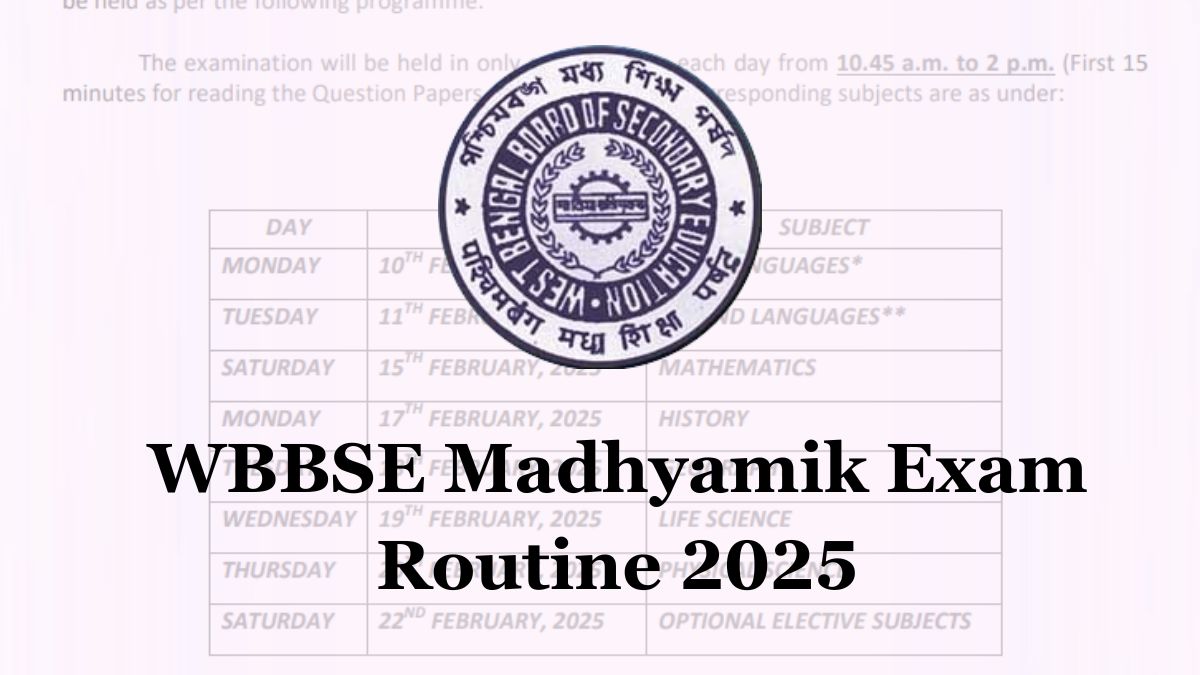

West Bengal Board Madhyamik Merit List 2025

May 10, 2025

West Bengal Board Madhyamik Merit List 2025

May 10, 2025 -

Agression Au Lac Kir A Dijon Le Bilan De La Violence

May 10, 2025

Agression Au Lac Kir A Dijon Le Bilan De La Violence

May 10, 2025