The Return Of Angry Elon: Impact On Tesla's Performance

Table of Contents

Angry Elon and Stock Market Volatility

The unpredictable nature of Elon Musk's public persona creates significant volatility in Tesla's stock. His actions and statements directly influence investor sentiment, leading to dramatic swings in the company's valuation.

Specific Examples of Controversial Tweets and Actions

Numerous instances showcase the direct link between "Angry Elon" outbursts and Tesla's stock performance.

- August 2018: Musk's infamous "funding secured" tweet regarding taking Tesla private triggered a massive SEC investigation and a significant drop in Tesla's stock price. The ensuing legal battles and fines further eroded investor confidence. [Link to relevant news article]

- Various Dogecoin Tweets: Musk's frequent and often cryptic tweets about Dogecoin have caused significant fluctuations in both Dogecoin's and Tesla's stock prices. These unpredictable endorsements highlight the power of his words to influence market sentiment. [Link to financial data showing correlation]

- Tesla Production Delay Announcements: Public announcements regarding production delays or challenges, often accompanied by controversial statements, have resulted in immediate negative reactions from investors. [Link to relevant news article showing stock price drop after announcement]

The mechanism is clear: negative tweets and actions directly impact investor sentiment. Fear, uncertainty, and doubt (FUD) spread rapidly through the market, leading to sell-offs and price drops. Conversely, positive news or perceived positive actions can quickly reverse this trend.

Short-Term vs. Long-Term Effects on Tesla's Stock Price

While the short-term effects of "Angry Elon" moments are often dramatic, the long-term impact is less clear. While initial stock drops can be significant, Tesla's stock price has historically shown a capacity to recover, driven by the company's underlying innovation and market position. However, repeated incidents could erode investor confidence over time. Analyzing historical data reveals a pattern of sharp drops followed by periods of recovery, but the frequency of these events raises concerns about sustainable long-term growth. [Include chart/graph showing stock price fluctuations over time].

The Brand Image Impact of "Angry Elon"

Elon Musk's persona is inextricably linked to Tesla's brand. While his visionary leadership initially attracted considerable attention and positive press, his increasingly erratic behavior poses a significant challenge to Tesla's carefully cultivated image.

Damage to Tesla's Reputation

Musk's controversial actions and statements can damage Tesla's reputation, leading to:

- Negative social media sentiment: A surge in negative comments and critical articles reflects the impact of "Angry Elon" on public perception.

- Decreased customer trust: Potential customers may hesitate to associate with a brand perceived as volatile and unpredictable.

- Reputational risk: Negative publicity can harm Tesla's long-term brand equity and its ability to attract and retain talent.

Counteracting Negative Publicity

Tesla has employed various PR strategies to mitigate the damage caused by "Angry Elon," including:

- Focusing on product innovation: Highlighing Tesla's technological advancements and the success of its electric vehicles helps to distract from Musk's controversies.

- Emphasizing positive corporate news: Sharing positive developments like production milestones and sales figures can counterbalance negative publicity.

However, the effectiveness of these strategies is debatable. The sheer volume and intensity of "Angry Elon" moments often overshadow any attempts to manage Tesla's public image.

The Paradox of "Angry Elon": Does Controversy Drive Sales?

This is perhaps the most intriguing aspect of the "Angry Elon" phenomenon. While his actions often create negative publicity, they also generate significant media attention and brand awareness, embodying the principle that "all publicity is good publicity."

The Attention Economy and Brand Recognition

Musk's controversial actions, regardless of their negative connotation, keep Tesla in the public consciousness. This constant attention, often through negative news cycles, translates into brand recognition and potentially increased sales. He leverages the attention economy masterfully, even if unintentionally. Think of other controversial figures who have successfully used negative publicity to their advantage.

Separating the Brand from the CEO

The challenge for Tesla lies in separating its brand image from that of its CEO. Musk's personal brand is so intertwined with Tesla's that distinguishing the two becomes incredibly difficult. This dependence poses a significant long-term risk. If Musk's behavior continues to be erratic, it could severely impact Tesla's future success regardless of its product quality and innovation.

Conclusion

The relationship between "Angry Elon" and Tesla's performance is complex. While his controversial actions cause short-term stock volatility and potential damage to the brand, the sheer volume of attention generated might inadvertently boost brand awareness. However, the long-term consequences of this strategy remain uncertain. The ability of Tesla to decouple its brand from its CEO's unpredictable behavior will be crucial to its sustained success. What is the long-term impact of "Angry Elon" on Tesla's future? Share your thoughts in the comments!

Featured Posts

-

Bayern Goalkeeper Neuers Injury Latest Update And Implications For Upcoming Games

May 26, 2025

Bayern Goalkeeper Neuers Injury Latest Update And Implications For Upcoming Games

May 26, 2025 -

Saksikan Siaran Langsung Race Sprint Moto Gp Inggris Pukul 20 00 Wib

May 26, 2025

Saksikan Siaran Langsung Race Sprint Moto Gp Inggris Pukul 20 00 Wib

May 26, 2025 -

Moto Gp Inggris Marquez Tercepat Di Fp 1 Kejutan Dan Masalah Teknis

May 26, 2025

Moto Gp Inggris Marquez Tercepat Di Fp 1 Kejutan Dan Masalah Teknis

May 26, 2025 -

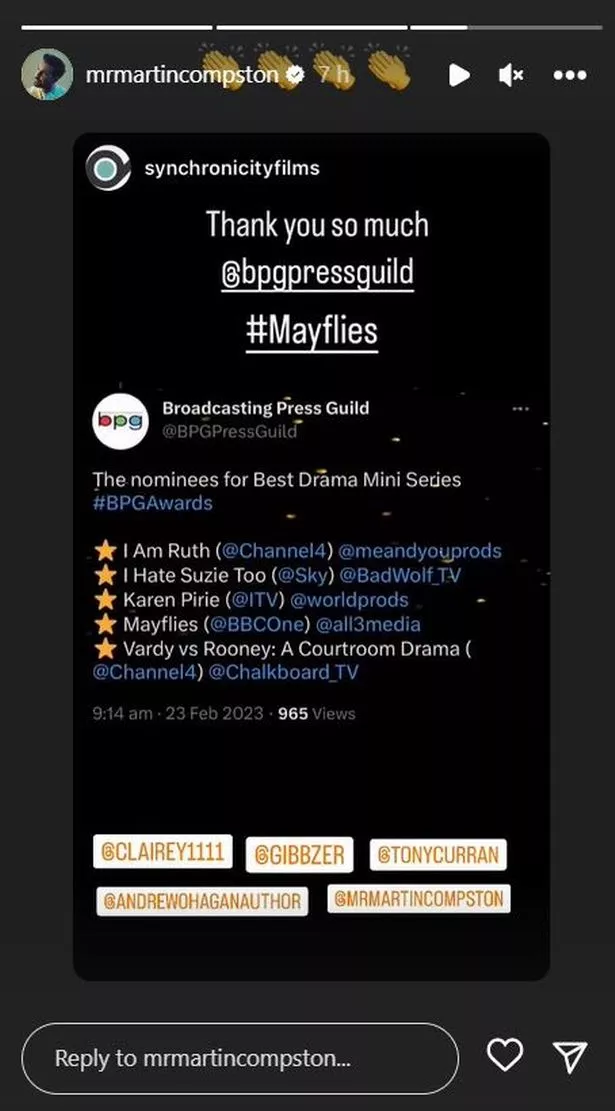

Martin Compstons Glasgow A Cinematic Transformation

May 26, 2025

Martin Compstons Glasgow A Cinematic Transformation

May 26, 2025 -

Melanie Thierry Actrice Francaise Carriere Et Projets

May 26, 2025

Melanie Thierry Actrice Francaise Carriere Et Projets

May 26, 2025

Latest Posts

-

Padres On Deck Atlanta Series And Acunas Return

May 28, 2025

Padres On Deck Atlanta Series And Acunas Return

May 28, 2025 -

2024 Nl West Dodgers And Padres Undefeated Begining

May 28, 2025

2024 Nl West Dodgers And Padres Undefeated Begining

May 28, 2025 -

Nl West Race Heats Up Dodgers And Padres Perfect Starts

May 28, 2025

Nl West Race Heats Up Dodgers And Padres Perfect Starts

May 28, 2025 -

Dodgers And Padres An Unbeaten Start To The Nl West Season

May 28, 2025

Dodgers And Padres An Unbeaten Start To The Nl West Season

May 28, 2025 -

Nl West Showdown Dodgers And Padres Start Strong

May 28, 2025

Nl West Showdown Dodgers And Padres Start Strong

May 28, 2025