The Rise Of Chinese Stocks: Economic Data And US Negotiations Drive Market Growth

Table of Contents

Strong Economic Indicators Fueling Investment in Chinese Stocks

The recent surge in Chinese stocks is intrinsically linked to a series of strong economic indicators showcasing the resilience and growth potential of the Chinese economy. This positive data has significantly boosted investor confidence, attracting both domestic and foreign capital.

Robust GDP Growth and its Impact

- China's GDP growth in Q2 2024 exceeded expectations, registering a [Insert projected/actual GDP growth figure]% increase. (Source: [Cite reputable source]).

- Key sectors driving this growth include technology, consumer goods, and infrastructure development.

- This growth represents a significant improvement compared to [mention previous year's growth rate], demonstrating a clear economic recovery.

This robust GDP growth signifies a healthy and expanding economy, making it an attractive destination for investment. The consistent expansion attracts both foreign direct investment (FDI) seeking high-growth opportunities and domestic investment bolstering existing industries.

Positive Consumer Spending and Retail Sales

- Retail sales figures for [Month/Quarter] show a [Percentage]% increase compared to the same period last year. (Source: [Cite reputable source])

- Consumer confidence indicators are also trending upwards, suggesting sustained consumer spending power.

- Increased disposable incomes and positive sentiment contribute to this robust consumer spending.

The correlation between strong consumer spending and positive stock market performance is undeniable. A healthy consumer market fuels demand for goods and services, thereby driving economic growth and supporting higher stock valuations.

Government Initiatives and Infrastructure Spending

- The Chinese government's ongoing infrastructure investment program continues to stimulate economic activity. Key projects include [mention specific examples, e.g., high-speed rail expansion, renewable energy projects].

- Targeted government policies aimed at supporting specific industries, such as technological innovation, are further enhancing market sentiment.

- These initiatives not only create jobs but also stimulate growth in related sectors, leading to a ripple effect throughout the economy.

Government policy plays a crucial role in shaping market sentiment and driving investment. Clear signals of continued support and strategic infrastructure development create a favorable environment for both short-term and long-term investment in Chinese stocks.

Easing US-China Tensions and Their Effect on Chinese Stock Markets

The improving relationship between the US and China has significantly contributed to the rise of Chinese stocks. Reduced geopolitical uncertainty is a key factor boosting investor confidence.

Progress in Trade Negotiations

- Recent trade talks have resulted in [mention specific agreements or breakthroughs, e.g., partial tariff reductions, agreements on specific trade issues].

- Easing of trade tensions reduces the risk of further economic disruptions, thereby enhancing investor confidence.

- The prospect of more stable trade relations encourages increased investment in Chinese assets.

The reduction in trade friction between the US and China eliminates a major source of uncertainty for investors. This improved outlook encourages both domestic and foreign investment, directly impacting the performance of Chinese stocks.

Improved Diplomatic Relations

- Recent high-level diplomatic exchanges between the US and China suggest a willingness to improve bilateral relations.

- Improved diplomatic relations reduce geopolitical risk and uncertainty, creating a more favorable environment for foreign investment.

- A more predictable political landscape encourages long-term investment strategies.

A stable geopolitical climate is essential for sustainable investment growth. The lessening of tensions and improved diplomatic communication signals a reduced risk profile for investors considering Chinese stocks.

Reduced Geopolitical Uncertainty

- Decreased tensions in the South China Sea and other regional disputes contribute to a less volatile investment climate.

- This reduced geopolitical uncertainty makes Chinese stocks a more attractive proposition for risk-averse investors.

- The perception of decreasing risk encourages diversification into Chinese assets.

The lessening of geopolitical risks reassures investors, leading to increased capital flows into the Chinese stock market. This influx of investment directly contributes to the upward trajectory of Chinese stock prices.

Sector-Specific Analysis of Chinese Stock Market Growth

While the overall market is experiencing growth, certain sectors have outperformed others. Analyzing sector-specific trends provides a more nuanced understanding of the Chinese stock market's trajectory.

Technology Sector Boom

- Leading Chinese tech companies, such as [mention examples, e.g., Alibaba, Tencent], have shown exceptional growth, driven by innovation and domestic demand.

- Government support for technological advancements, including investment in artificial intelligence (AI) and fintech, further fuels the sector’s expansion.

- Increased investment in research and development within the technology sector points to sustained growth.

The burgeoning technology sector is a significant driver of the overall market growth. Continued innovation and government support point to a bright future for this sector.

Growth in Consumer Discretionary Stocks

- The rise of the Chinese middle class is driving significant growth in consumer discretionary stocks.

- Companies involved in e-commerce, entertainment, and luxury goods are experiencing strong sales growth.

- This increase in spending reflects rising disposable incomes and a shift towards a more consumer-driven economy.

The expanding consumer market presents substantial opportunities for growth within the consumer discretionary sector. This sector's performance mirrors the overall health of the Chinese economy.

Performance of other key sectors (Energy, Real Estate etc.)

The energy and real estate sectors have also shown resilience, contributing to the overall positive market trend, although their performance has varied. Further analysis would be needed to fully understand their dynamics.

Conclusion: Investing in the Future of Chinese Stocks

The remarkable rise of Chinese stocks is a direct result of the interplay between strong economic fundamentals and a steadily improving relationship with the US. Positive economic data, including robust GDP growth, increased consumer spending, and government-led initiatives, are creating a favorable environment for investment. Simultaneously, easing US-China tensions are reducing geopolitical uncertainty and boosting investor confidence. Considering both economic indicators and geopolitical factors is crucial when evaluating investment opportunities in Chinese stocks.

With strong economic fundamentals and improving relations with the US, now is a crucial time to consider diversifying your portfolio with carefully selected Chinese stocks. Further research into specific sectors and companies is recommended before making any investment decisions. However, the potential for growth and return on investment in the Chinese stock market is undeniably promising. Understanding the interplay between robust economic data and evolving US negotiations is key to navigating this dynamic market successfully.

Featured Posts

-

Is John Wick 5 Really Over Keanu Reeves Latest News

May 07, 2025

Is John Wick 5 Really Over Keanu Reeves Latest News

May 07, 2025 -

South Bend Hosts Wnba Preseason Game Featuring Notre Dame Legends

May 07, 2025

South Bend Hosts Wnba Preseason Game Featuring Notre Dame Legends

May 07, 2025 -

Palantirs Performance Examining The High Multiple In Context

May 07, 2025

Palantirs Performance Examining The High Multiple In Context

May 07, 2025 -

Dominant First Inning Mariners 14 0 Victory Against Marlins

May 07, 2025

Dominant First Inning Mariners 14 0 Victory Against Marlins

May 07, 2025 -

Chinese Stocks Rise A Detailed Look At The Markets Reaction To Us Talks And Economic Figures

May 07, 2025

Chinese Stocks Rise A Detailed Look At The Markets Reaction To Us Talks And Economic Figures

May 07, 2025

Latest Posts

-

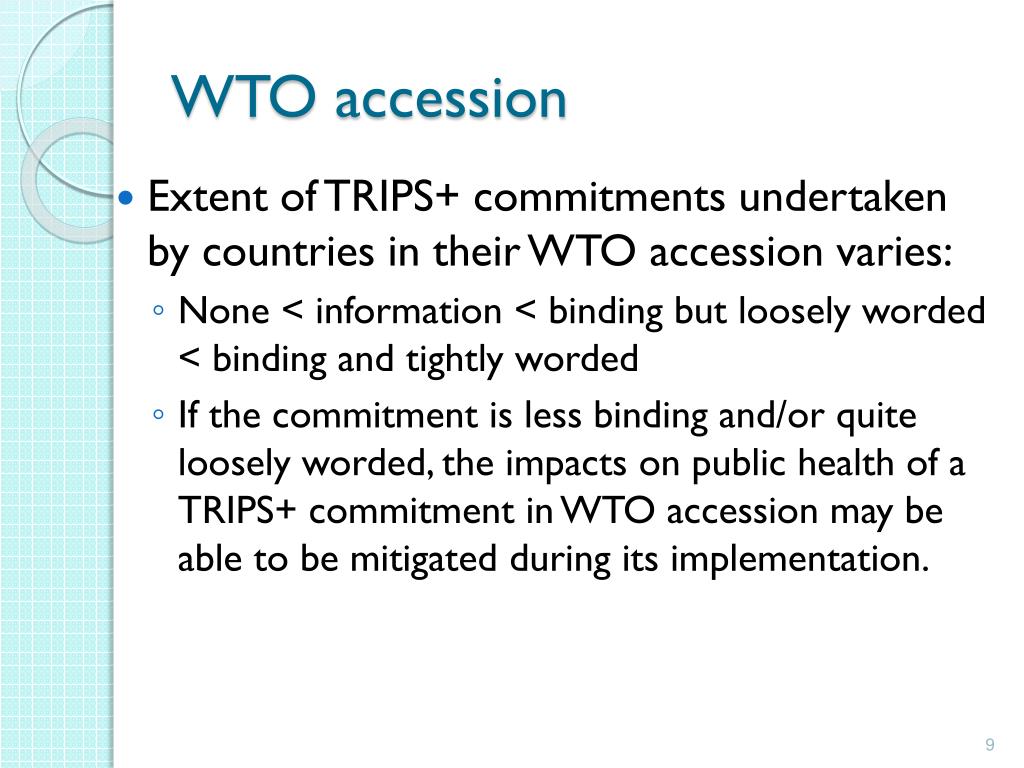

Wto Accession Speed Up A Privilege Based Analysis

May 07, 2025

Wto Accession Speed Up A Privilege Based Analysis

May 07, 2025 -

The Privilege Dilemma Implications For Wto Accession

May 07, 2025

The Privilege Dilemma Implications For Wto Accession

May 07, 2025 -

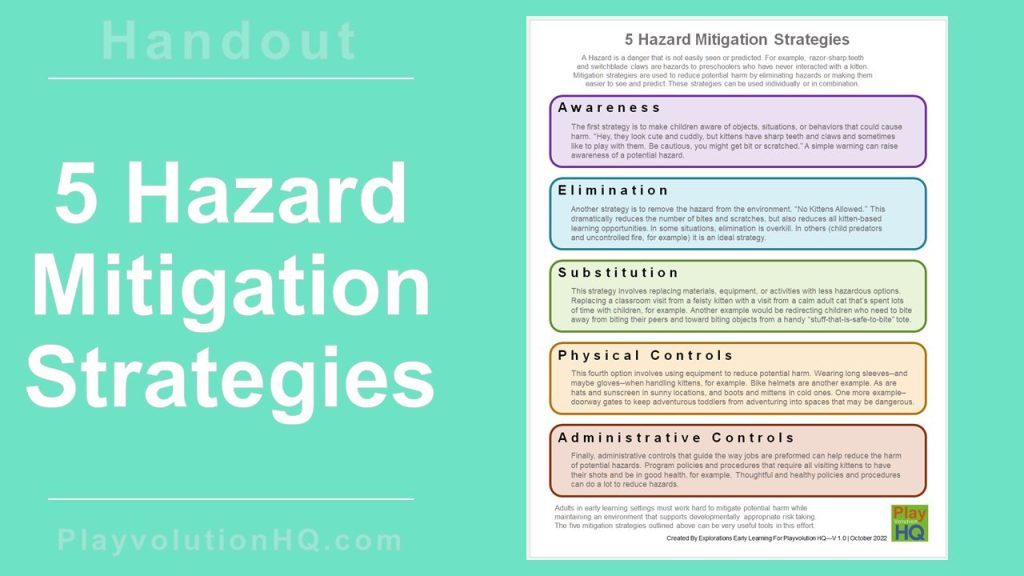

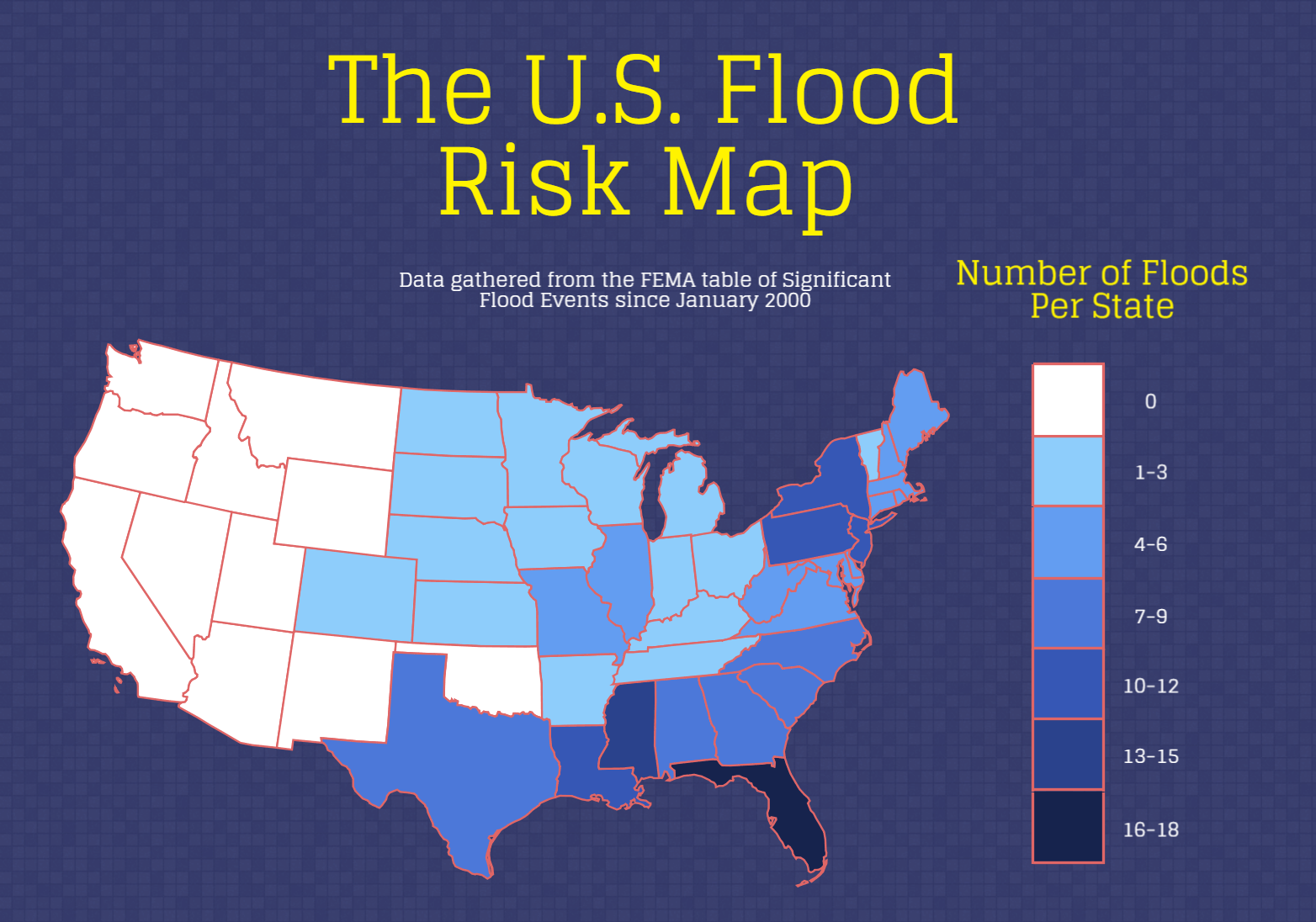

Flood Preparedness For Livestock Mitigation And Response Strategies

May 07, 2025

Flood Preparedness For Livestock Mitigation And Response Strategies

May 07, 2025 -

Protecting Livestock From Flood Damage A Comprehensive Guide

May 07, 2025

Protecting Livestock From Flood Damage A Comprehensive Guide

May 07, 2025 -

Livestock At Risk Understanding The Dangers Of Flooding

May 07, 2025

Livestock At Risk Understanding The Dangers Of Flooding

May 07, 2025