The Rise Of Disaster Betting: Examining The Case Of The Los Angeles Wildfires

Table of Contents

The Mechanics of Disaster Betting

Disaster betting encompasses a range of financial instruments and activities centered on predicting and profiting from catastrophic events. This isn't simply about placing a bet on whether a wildfire will occur; it's far more nuanced.

Types of Disaster Bets

Several ways exist to bet on disasters:

-

Prediction Markets: These platforms allow users to trade contracts based on the probability of specific disaster-related events, such as the extent of wildfire damage in a particular area or the total insured losses. The price of these contracts fluctuates based on the collective prediction of market participants.

-

Insurance Derivatives: These complex financial instruments derive their value from insurance payouts related to disaster events. Investors can buy or sell these derivatives, effectively betting on the scale of insurance claims. For instance, a derivative could be tied to the total amount of wildfire-related insurance claims in Los Angeles County.

-

Catastrophe Bonds: These are bonds issued by insurance companies or government entities to transfer risk to investors. If a specified disaster occurs, the bondholders may lose some or all of their investment, while the issuer receives the funds to cover losses. These bonds, while not strictly "bets," represent a form of disaster-linked investment.

-

Examples of specific bets placed on the LA wildfires: While precise data on specific bets remains largely confidential due to privacy concerns and the unregulated nature of some markets, news reports suggest a significant increase in trading activity on prediction markets related to the intensity and geographical reach of the fires. (Note: Specific examples would require extensive research and verification from reliable sources due to the sensitive nature of this data.)

-

Odds-setting process and risk assessment models: Odds are typically determined by sophisticated algorithms and risk assessment models that consider factors such as historical data, weather patterns, geographic location, and fuel conditions. These models are constantly refined using machine learning and predictive analytics.

-

Role of data and predictive analytics: Access to real-time data, including satellite imagery, weather forecasts, and social media sentiment, significantly impacts the odds and trading activity within disaster betting markets.

The Ethical and Legal Implications of Disaster Betting

Disaster betting raises significant ethical and legal concerns.

Moral Concerns

- Profiting from human suffering: The most prominent ethical concern revolves around the potential for individuals to profit directly from the suffering and losses experienced by wildfire victims and the broader community.

- Exacerbating existing inequalities: Those with the financial resources to participate in disaster betting markets disproportionately benefit, potentially widening the gap between the wealthy and those most vulnerable to disaster impacts.

- Arguments for and against legalization and regulation: Arguments for regulation often focus on protecting vulnerable populations and preventing market manipulation. Conversely, opponents argue that it could stifle innovation and limit access to risk management tools.

- Potential for market manipulation and insider trading: The potential for manipulating markets through the spread of misinformation or the use of privileged information raises serious concerns regarding market integrity.

- Psychological impact on those affected: The knowledge that individuals are profiting from their misfortune may exacerbate the psychological trauma experienced by disaster survivors.

Legal Framework

- Relevant laws concerning gambling and securities trading: The legal status of disaster betting is ambiguous, falling into a gray area between gambling regulations and securities laws. Jurisdictional differences further complicate the picture.

- Potential legal challenges to disaster betting platforms: Legal challenges could arise from consumer protection laws, anti-fraud statutes, or regulations related to market manipulation.

- Ongoing legislative efforts: Given the growing prominence of disaster betting, legislative efforts to clarify and regulate this emerging market are likely to increase.

The Los Angeles Wildfires as a Case Study

The Los Angeles wildfires provide a compelling case study. While obtaining specific data on betting activity related to these wildfires presents challenges, the events undeniably increased interest in disaster betting markets.

Specific Examples

(Note: Due to the sensitive nature of the topic and the lack of publicly available data on specific bets, concrete examples are difficult to provide without compromising privacy. Further research is needed to ethically and responsibly explore this area.)

- Impact of wildfire severity and prediction accuracy on betting patterns: As the wildfire’s severity and scale became clearer, it is likely that trading activity and the prices of related contracts shifted significantly.

- Influence of media coverage: Media coverage of the wildfires played a role in shaping public perception and influencing betting activity.

- Role of social media: Social media platforms were crucial in disseminating information, but also potentially contributing to the spread of misinformation, impacting betting patterns.

The Future of Disaster Betting

The future of disaster betting hinges on technological advancements and regulatory developments.

Technological Advancements

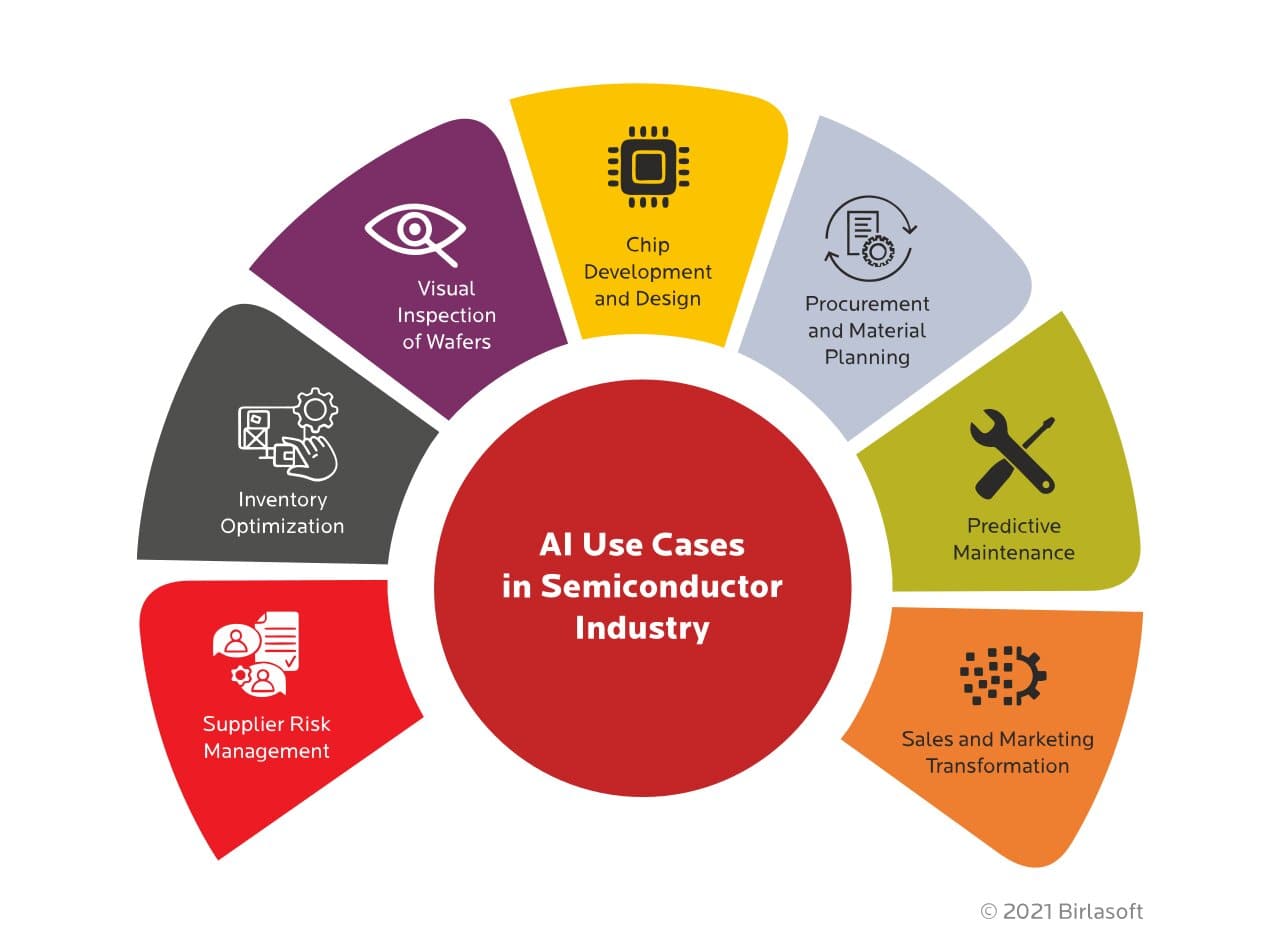

- Sophisticated prediction models: Advances in AI, machine learning, and data analytics are likely to lead to more accurate and sophisticated prediction models, potentially increasing the efficiency and sophistication of disaster betting markets.

- Increasing accessibility of platforms: The growth of online platforms and the decreasing cost of accessing data will likely make disaster betting more accessible.

- Impact of climate change: The growing frequency and intensity of extreme weather events fueled by climate change will likely significantly increase the size and importance of disaster betting markets.

Regulatory Landscape

- Increased government oversight: Governments are likely to respond to the growing prevalence of disaster betting by implementing stricter regulations and increasing oversight.

- International cooperation: Given the cross-border nature of many disaster betting platforms, international cooperation will be necessary to effectively regulate this market.

- Industry self-regulation: Industry players may also adopt self-regulatory measures to enhance market transparency and ethical conduct.

Conclusion: The Future of Disaster Betting and the Los Angeles Wildfires

The rise of disaster betting presents a complex ethical and legal challenge. While it offers potential benefits in risk management and financial innovation, the ethical implications of profiting from human suffering are undeniable. The Los Angeles wildfires serve as a potent reminder of the need for careful consideration of the responsible use of data and the potential for market manipulation. Further research into ethical considerations in disaster betting and the development of robust regulatory frameworks are crucial. The future of disaster betting markets hinges on our ability to strike a balance between innovation and the protection of vulnerable populations. We must engage in a broader conversation about the future of disaster betting markets, ensuring that responsible disaster betting practices are implemented to prevent exploitation and minimize harm. Let us collectively explore the ethical implications and ensure that technological advancements in prediction and financial instruments are used responsibly and ethically in this sensitive domain.

Featured Posts

-

Trumps Response To Kyiv Attacks A Break From His Usual Stance On Putin

Apr 25, 2025

Trumps Response To Kyiv Attacks A Break From His Usual Stance On Putin

Apr 25, 2025 -

Analyzing Trumps Role In The Canadian Election Debate

Apr 25, 2025

Analyzing Trumps Role In The Canadian Election Debate

Apr 25, 2025 -

Unlocking Podcast Potential Ais Role In Transforming Repetitive Documents

Apr 25, 2025

Unlocking Podcast Potential Ais Role In Transforming Repetitive Documents

Apr 25, 2025 -

Choosing The Right Makeup Organiser Keep Your Cosmetics Clutter Free

Apr 25, 2025

Choosing The Right Makeup Organiser Keep Your Cosmetics Clutter Free

Apr 25, 2025 -

Okc Metro Ice And Snow Chances A Digital Exclusive With David Payne

Apr 25, 2025

Okc Metro Ice And Snow Chances A Digital Exclusive With David Payne

Apr 25, 2025

Latest Posts

-

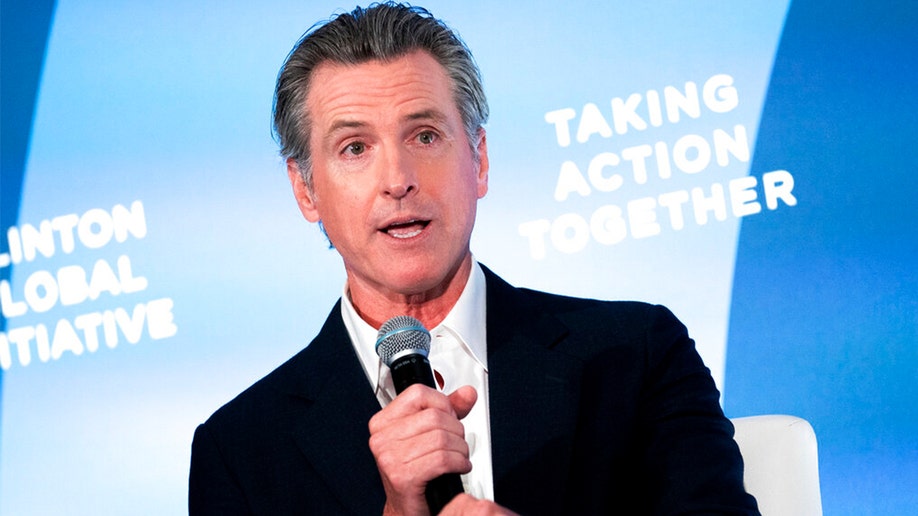

Dave Portnoy Unloads On Gavin Newsom The Full Story

Apr 26, 2025

Dave Portnoy Unloads On Gavin Newsom The Full Story

Apr 26, 2025 -

Portnoy Slams Newsom A Detailed Look At The Controversy

Apr 26, 2025

Portnoy Slams Newsom A Detailed Look At The Controversy

Apr 26, 2025 -

Understanding The Controversy Surrounding Gavin Newsom

Apr 26, 2025

Understanding The Controversy Surrounding Gavin Newsom

Apr 26, 2025 -

Newsoms Policies A Balanced Perspective

Apr 26, 2025

Newsoms Policies A Balanced Perspective

Apr 26, 2025 -

The Deeply Unfair Debate Newsoms Policy On Transgender Participation In Sports

Apr 26, 2025

The Deeply Unfair Debate Newsoms Policy On Transgender Participation In Sports

Apr 26, 2025