The Saudi ABS Market Revolution: Regulatory Changes And Future Outlook

Table of Contents

Key Regulatory Changes Driving the Saudi ABS Market Transformation

Recent amendments to Saudi Arabia's regulatory framework are significantly reshaping the Saudi ABS market. These changes, primarily driven by the Capital Market Authority (CMA), aim to enhance transparency, attract foreign investment, and promote the growth of the Saudi Arabian ABS market. Key regulatory changes include:

-

Amendments to the Capital Market Law: The revised Capital Market Law has streamlined the process for ABS issuance, reducing bureaucratic hurdles and making it more attractive for both domestic and international issuers. This includes clarifying the legal framework for securitization and improving investor protection mechanisms.

-

New Regulations Concerning Securitization: The CMA has introduced specific regulations governing securitization transactions, clarifying the eligibility criteria for assets to be securitized and establishing clear standards for the structuring and issuance of ABS. This provides much-needed clarity and reduces ambiguity for market participants.

-

Enhanced Credit Rating Agency Requirements: The new regulations place greater emphasis on the role of credit rating agencies, demanding higher standards of transparency and independence. This increases investor confidence in the quality and reliability of the ABS being issued.

-

Expanded Eligible Asset Classes: The regulatory changes have broadened the range of assets eligible for securitization. This now includes a wider variety of financial instruments, such as auto loans, mortgages, consumer receivables, and other eligible assets, opening up new avenues for ABS issuance.

-

Increased Transparency and Disclosure: A significant focus of the new regulations is enhanced transparency and disclosure. Issuers are now required to provide more detailed information to investors, fostering greater accountability and reducing information asymmetry. This includes improved reporting standards and increased scrutiny of underlying assets.

Impact of Regulatory Changes on Market Participants

The regulatory changes are having a profound impact on various market participants within the Saudi ABS market. This includes:

-

Financial Institutions: Banks and other financial institutions are adapting their strategies to comply with the new regulations. This has involved adjusting their internal processes, enhancing their risk management capabilities, and developing new product offerings. Many banks see increased opportunities for utilizing ABS to manage their balance sheets more efficiently.

-

Investors: Both local and international investors are increasingly interested in the Saudi ABS market due to the improved regulatory framework. This increased interest is driven by the enhanced transparency and the potential for higher returns. Foreign institutional investors are now more confident in participating due to greater regulatory certainty.

-

Cost of Capital: While some initial costs are associated with compliance, the overall impact on the cost of capital for ABS issuers is expected to be positive in the long term. This is largely due to increased investor confidence and the greater depth and liquidity of the market.

-

Specialized Asset Managers and Investment Banks: The growth of the Saudi ABS market has created new opportunities for specialized asset managers and investment banks to provide advisory services, structuring expertise, and investment management solutions. This specialized knowledge becomes increasingly valuable in the increasingly complex ABS market.

Growth Drivers and Future Outlook for the Saudi ABS Market

Several factors point towards significant future growth in the Saudi ABS market:

-

Strong Economic Growth: Saudi Arabia's ongoing economic diversification and ambitious Vision 2030 plan are driving substantial growth across various sectors, fueling demand for credit and creating a larger pool of assets for securitization.

-

Growth in Specific Asset Classes: The market is likely to see significant growth in sectors like mortgages, consumer finance, and auto loans, reflecting the increasing penetration of these financial products in the Saudi Arabian economy.

-

Technological Innovation: The adoption of fintech solutions and advancements in data analytics are poised to further enhance the efficiency and transparency of the Saudi ABS market. This will improve credit scoring, risk assessment, and overall market operations.

-

Government Initiatives: Government support for the development of the financial sector and initiatives aimed at boosting domestic capital markets are significant catalysts for the growth of the Saudi ABS market. These initiatives will encourage further investments in the sector.

-

Potential Challenges: Credit risk and market volatility remain potential challenges. However, the improved regulatory framework aims to mitigate these risks through robust oversight and enhanced transparency.

Conclusion

The Saudi ABS market is experiencing a period of significant transformation, driven by crucial regulatory reforms. These changes are simultaneously creating both challenges and substantial growth opportunities for market participants. The future outlook is positive, fueled by Saudi Arabia’s ambitious economic diversification plans and the increased sophistication of its financial sector. Understanding the intricacies of this evolving market is key to navigating its complexities and capitalizing on the numerous opportunities available. Stay informed about the latest regulatory developments and investment opportunities in the dynamic Saudi ABS market. Learn more about the latest updates and trends in the Saudi ABS market by visiting [link to relevant resource/report].

Featured Posts

-

Trust Care Healths Mental Health Portfolio Expansion What You Need To Know

May 02, 2025

Trust Care Healths Mental Health Portfolio Expansion What You Need To Know

May 02, 2025 -

People Betting On La Wildfires A Disturbing Trend

May 02, 2025

People Betting On La Wildfires A Disturbing Trend

May 02, 2025 -

Sony Revives Classic Play Station Console Themes On Ps 5

May 02, 2025

Sony Revives Classic Play Station Console Themes On Ps 5

May 02, 2025 -

Extended Fortnite Outage Chapter 6 Season 2 Release Uncertain

May 02, 2025

Extended Fortnite Outage Chapter 6 Season 2 Release Uncertain

May 02, 2025 -

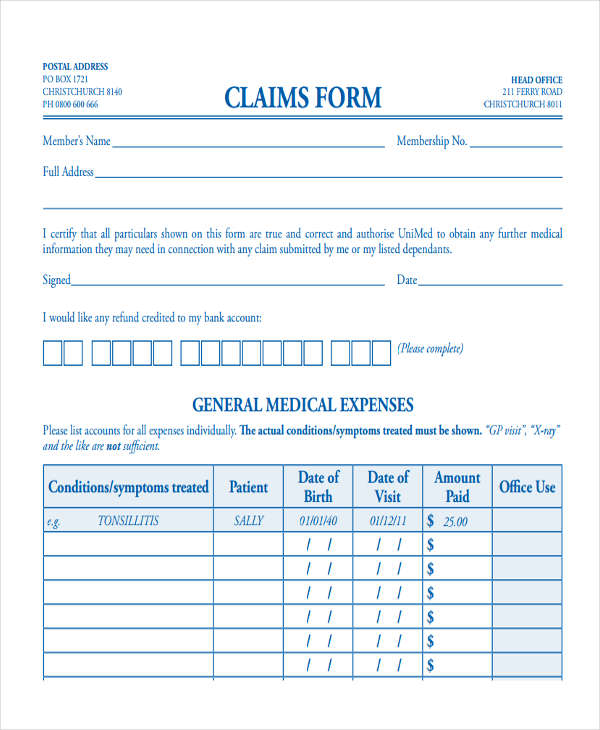

Low Mental Health Claim Rates Exploring The Impact Of Cost And Stigma

May 02, 2025

Low Mental Health Claim Rates Exploring The Impact Of Cost And Stigma

May 02, 2025

Latest Posts

-

Following Celeb Traitors Daisy May And Charlie Coopers Next Tv Venture

May 02, 2025

Following Celeb Traitors Daisy May And Charlie Coopers Next Tv Venture

May 02, 2025 -

New Bbc Show Daisy May And Charlie Cooper Team Up Again

May 02, 2025

New Bbc Show Daisy May And Charlie Cooper Team Up Again

May 02, 2025 -

Two Stars Exit From Celebrity Traitors Uk Explained

May 02, 2025

Two Stars Exit From Celebrity Traitors Uk Explained

May 02, 2025 -

Celebrity Traitors Major Setback For Bbc Show

May 02, 2025

Celebrity Traitors Major Setback For Bbc Show

May 02, 2025 -

Celebrity Traitors Uk Early Departures Shock Fans

May 02, 2025

Celebrity Traitors Uk Early Departures Shock Fans

May 02, 2025