The Semiconductor Surge: Did Investors Miss Out On Leveraged ETF Gains?

Table of Contents

Understanding the Semiconductor Boom

The semiconductor industry's recent boom is driven by several powerful forces. Increased demand across various sectors is a primary factor. The rise of 5G technology, the proliferation of artificial intelligence (AI) applications, the expansion of the Internet of Things (IoT), and the increasing sophistication of automotive electronics are all fueling insatiable appetite for advanced semiconductors. These technological advancements demand higher-performance chips, leading to further growth.

- Increased demand from various sectors: From smartphones and computers to data centers and autonomous vehicles, the need for sophisticated semiconductors is skyrocketing.

- Supply chain disruptions and shortages: Recent global events have highlighted the vulnerability of the semiconductor supply chain, leading to shortages and price increases, further boosting profitability for established players.

- Government initiatives and investments in semiconductor manufacturing: Recognizing the strategic importance of semiconductors, governments worldwide are investing heavily in domestic manufacturing capacity, fostering industry growth.

- Technological advancements leading to higher performance chips: The continuous drive for smaller, faster, and more energy-efficient chips necessitates ongoing innovation and investment, creating a positive feedback loop of growth.

These semiconductor growth drivers have created a fertile ground for investment, leading many to explore options like semiconductor ETFs.

Leveraged ETFs: A High-Risk, High-Reward Approach

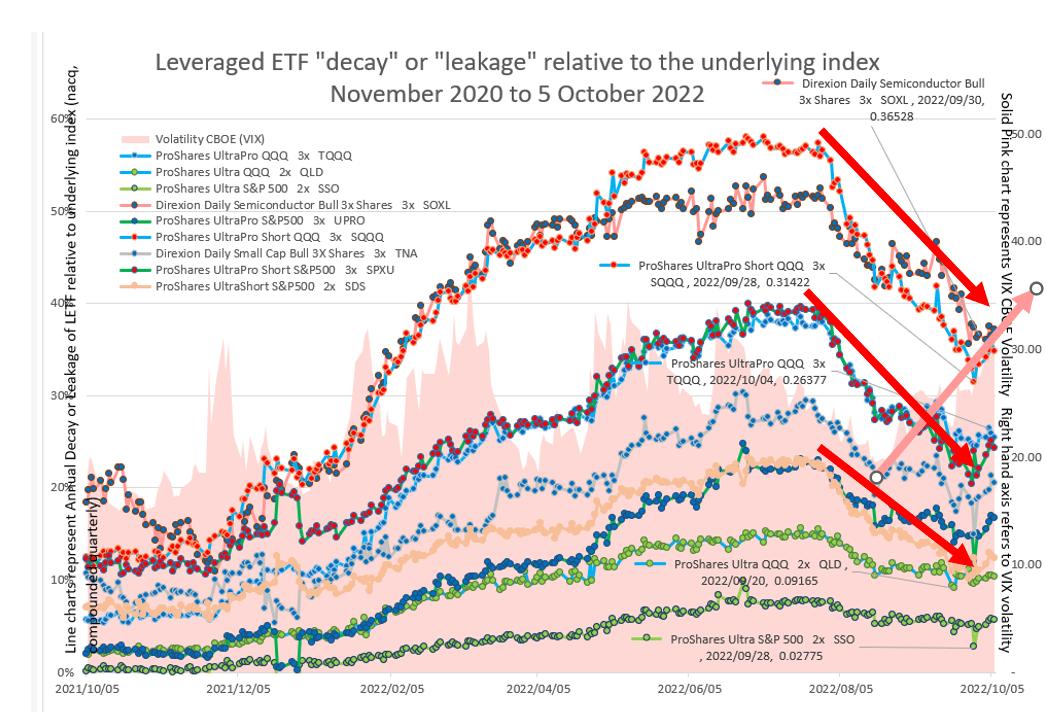

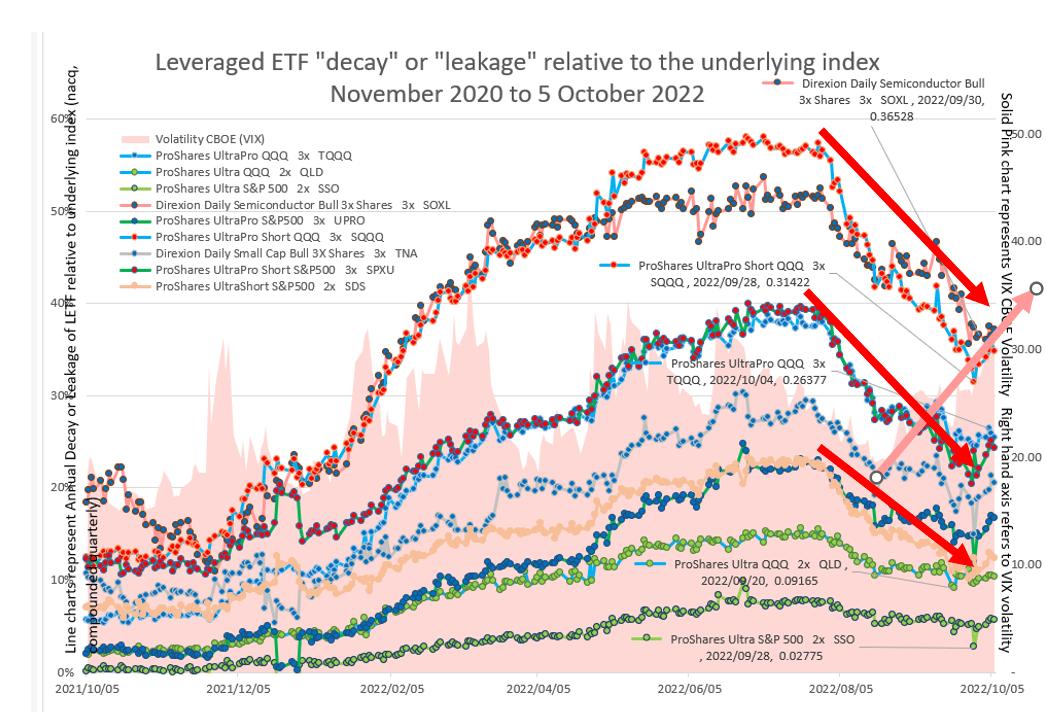

Leveraged ETFs aim to deliver magnified returns (or losses) compared to the underlying index. They achieve this through various financial instruments and strategies, often involving derivatives. However, it's crucial to understand their mechanics. Leveraged ETFs typically reset their leverage daily, meaning their performance isn't simply a multiple of the underlying index's performance over longer periods. This daily resetting can lead to significant deviations over time, especially in volatile markets.

- Definition and mechanics of leveraged ETFs: A 2x leveraged semiconductor ETF, for example, aims to deliver double the daily return of a specific semiconductor index.

- Examples of leveraged semiconductor ETFs: (Disclaimer: This is not financial advice. Always conduct thorough research and consult a financial advisor before investing in any ETF.) While specific ticker symbols would require up-to-date information, research readily available options on reputable financial platforms. Look for ETFs tracking relevant semiconductor indices.

- Advantages: Potential for amplified gains in bull markets: During periods of strong growth, like the recent semiconductor surge, leveraged ETFs can offer substantial returns.

- Disadvantages: Amplified losses in bear markets, volatility, time decay: The same leverage that magnifies gains also magnifies losses. Volatility significantly impacts performance, and time decay can erode returns over longer periods.

Understanding these leveraged ETF risks is paramount.

Analyzing the Performance of Semiconductor Leveraged ETFs

Analyzing the performance of specific leveraged semiconductor ETFs during the recent surge requires accessing historical data from reputable financial sources. (Note: Charts and graphs would be included here in a published article). By comparing the returns of leveraged semiconductor ETFs to those of their non-leveraged counterparts, investors can observe the impact of leverage.

- Compare returns to those of non-leveraged semiconductor ETFs: This comparison reveals the extent to which leverage amplified both gains and losses.

- Discuss potential outperformance and downside risks: While leverage can boost returns in bull markets, it can lead to substantial losses during downturns.

- Analyze factors influencing performance (market conditions, ETF specific strategies): Market conditions, the specific index tracked by the ETF, and the ETF's investment strategy all play a role in performance.

This analysis helps illustrate the risk/return profile of these investments.

Long-Term Investment Strategies vs. Short-Term Gains

The choice between long-term and short-term investment strategies in semiconductor ETFs depends significantly on your risk tolerance and financial goals.

- Suitability for different investor risk profiles: Leveraged ETFs are generally considered unsuitable for risk-averse investors due to their volatility.

- Considerations for long-term growth vs. short-term capital gains: Long-term investors may prefer non-leveraged ETFs for steady growth, while short-term traders might consider leveraged ETFs (with the understanding of the heightened risk).

- Importance of diversification in your portfolio: Diversification is crucial to mitigate risk regardless of your investment timeline. Don't put all your eggs in one basket, especially in a volatile sector like semiconductors.

A well-diversified portfolio is key for managing risk effectively.

Beyond Leveraged ETFs: Alternative Semiconductor Investments

Investing in the semiconductor industry doesn't solely involve leveraged ETFs.

- Pros and cons of each alternative investment approach: Individual semiconductor stocks offer potentially higher returns but also carry greater risk. Sector-specific mutual funds provide diversification within the semiconductor industry but may offer lower returns than individual stocks.

- Considerations for different investor goals: Your investment goals should guide your choice of investment vehicles. Are you seeking high growth, moderate growth with lower risk, or income generation?

- Due diligence needed before any investment decision: Thorough research and potentially professional financial advice are essential before investing in any asset class.

Careful consideration of these alternatives is crucial.

Conclusion

The semiconductor industry’s recent surge has presented significant investment opportunities. Leveraged ETFs, while offering the potential for amplified gains, also carry substantial risks. Careful consideration of your risk tolerance, investment timeline, and a thorough understanding of leveraged ETF mechanics are crucial before investing. While some investors may have profited handsomely from the semiconductor surge using leveraged ETFs, others may have experienced substantial losses. It's important to conduct thorough research and consider a diversified investment strategy that includes various semiconductor investment options, including direct stock purchases or mutual funds, to achieve your financial goals. Don't miss out on future opportunities—research carefully and consider the potential of semiconductor ETFs and other investment avenues to align with your financial goals. Remember to always seek professional financial advice before making any investment decisions.

Featured Posts

-

Inter Napoli Atalanta De Race Om De Scudetto Resterende Wedstrijden

May 13, 2025

Inter Napoli Atalanta De Race Om De Scudetto Resterende Wedstrijden

May 13, 2025 -

Espns Nba Draft Lottery Coverage Overhaul A Detailed Look

May 13, 2025

Espns Nba Draft Lottery Coverage Overhaul A Detailed Look

May 13, 2025 -

Madrid Open Sabalenka Triumphs Over Gauff

May 13, 2025

Madrid Open Sabalenka Triumphs Over Gauff

May 13, 2025 -

Kostyuk I Kasatkina Znak Primireniya Ili Politicheskiy Zhest

May 13, 2025

Kostyuk I Kasatkina Znak Primireniya Ili Politicheskiy Zhest

May 13, 2025 -

The Wild Summer Of Chris And Meg

May 13, 2025

The Wild Summer Of Chris And Meg

May 13, 2025