The State Of The US Economy Under Biden: Causes And Consequences

Table of Contents

Biden's Economic Policies and Their Impact

The Biden administration's economic agenda has been ambitious, marked by significant legislative initiatives aimed at stimulating growth and addressing long-standing infrastructure needs. However, the impact of these policies has been multifaceted and subject to ongoing debate.

The American Rescue Plan (ARP): Stimulus and Inflation

The American Rescue Plan, a $1.9 trillion stimulus package enacted in March 2021, aimed to provide COVID-19 relief and boost the economy. Its goals included providing direct payments to individuals, supporting state and local governments, and expanding unemployment benefits.

- Positive Impacts: The ARP undeniably contributed to job creation, preventing a deeper economic downturn following the pandemic. Businesses received crucial support, preventing widespread closures.

- Negative Impacts: Critics argue the ARP contributed significantly to inflation by injecting a large amount of money into the economy at a time when supply chains were already strained. The increased national debt is another significant concern.

- Data Points:

- Job growth saw a surge in the months following the ARP's passage.

- Inflation reached a 40-year high in 2022, partially attributed to increased demand fueled by the stimulus.

- The national debt increased substantially, raising concerns about long-term fiscal sustainability.

Infrastructure Investment and Jobs Act (IIJA): Long-Term Growth vs. Short-Term Costs

The Infrastructure Investment and Jobs Act (IIJA), a bipartisan bill signed into law in 2021, allocates billions of dollars to upgrade America's infrastructure. This includes investments in roads, bridges, public transportation, broadband internet, and the electric grid.

- Potential for Long-Term Growth: The IIJA aims to create millions of jobs, boost productivity, and enhance the country's competitiveness through modernized infrastructure. This is a long-term investment expected to yield significant returns.

- Short-Term Costs and Inflationary Pressures: The immediate costs of these projects could contribute to inflationary pressures in the short term, especially considering the already elevated prices of materials and labor.

- Examples and Estimates:

- The IIJA is funding thousands of road and bridge repair projects nationwide.

- Millions of jobs are projected to be created over the next decade due to IIJA projects.

- The total cost of the IIJA is estimated to be in the trillions of dollars over several years.

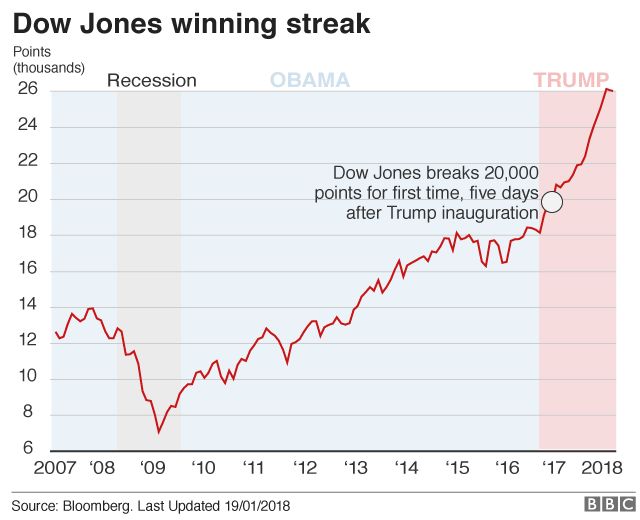

Inflation and the Federal Reserve's Response

Inflation has been a major economic challenge during the Biden administration. High inflation erodes purchasing power, impacting consumers and businesses alike.

- Inflation's Impact: Rising prices for essential goods and services have strained household budgets and reduced consumer spending. Businesses struggle with rising input costs.

- Federal Reserve's Response: The Federal Reserve has responded by raising interest rates to cool down the economy and curb inflation. This is a standard monetary policy tool.

- Consequences of Interest Rate Hikes: While interest rate hikes aim to control inflation, they also risk slowing economic growth and potentially increasing unemployment.

- Data Points:

- Inflation rates have fluctuated but remain elevated above the Federal Reserve's target.

- The Federal Reserve has implemented several interest rate increases.

- Economic indicators, such as GDP growth and unemployment rates, are closely monitored for signs of a slowdown.

External Factors Affecting the US Economy Under Biden

Beyond domestic policy, several external factors have significantly influenced the US economy under President Biden.

Global Supply Chain Disruptions

Global supply chain disruptions, exacerbated by the pandemic, have contributed to higher prices and economic uncertainty.

- Impact on Inflation: Bottlenecks in shipping, manufacturing, and logistics have limited the availability of goods, driving up prices.

- Administration's Efforts: The administration has taken steps to address these issues, including efforts to improve port efficiency and invest in domestic manufacturing.

- Examples: Shortages of semiconductors, increased shipping costs, and delays in the delivery of goods are examples of supply chain issues.

The War in Ukraine and Energy Prices

The war in Ukraine has had a profound impact on global energy markets, leading to a surge in energy prices worldwide.

- Impact on US Economy: Higher energy prices contribute to inflation, impacting businesses and consumers. It increases the cost of transportation and manufacturing.

- Administration's Response: The administration has sought to increase domestic energy production and explore alternative energy sources.

- Data Points: Energy prices have significantly increased since the start of the war. This has contributed to higher inflation rates in the US.

Global Economic Slowdown

The possibility of a global recession poses a significant threat to the US economy.

- Potential Impact: A global recession could reduce demand for US exports, impacting job growth and economic output.

- Administration's Preparedness: The administration is monitoring global economic indicators and developing strategies to mitigate the impact of a potential downturn.

- Economic Indicators: Slowing GDP growth in other major economies and increased concerns about inflation are indicators of a potential global slowdown.

Conclusion

The state of the US economy under Biden is a complex picture shaped by both domestic policies and significant global events. While the American Rescue Plan provided crucial stimulus and the Infrastructure Investment and Jobs Act promises long-term benefits, inflation fueled partly by the stimulus, supply chain disruptions, and the war in Ukraine have presented significant challenges. The Federal Reserve's response to inflation through interest rate hikes carries its own risks to economic growth. Understanding the interplay of these factors is crucial for interpreting the current economic climate. Attributing specific outcomes solely to the administration's policies is an oversimplification. Understanding the state of the US economy under Biden requires ongoing analysis. Stay informed and participate in the conversation about the future direction of our nation's financial well-being.

Featured Posts

-

Fortnite Chapter 4 Season 4 New Icon Skin Unveiled

May 03, 2025

Fortnite Chapter 4 Season 4 New Icon Skin Unveiled

May 03, 2025 -

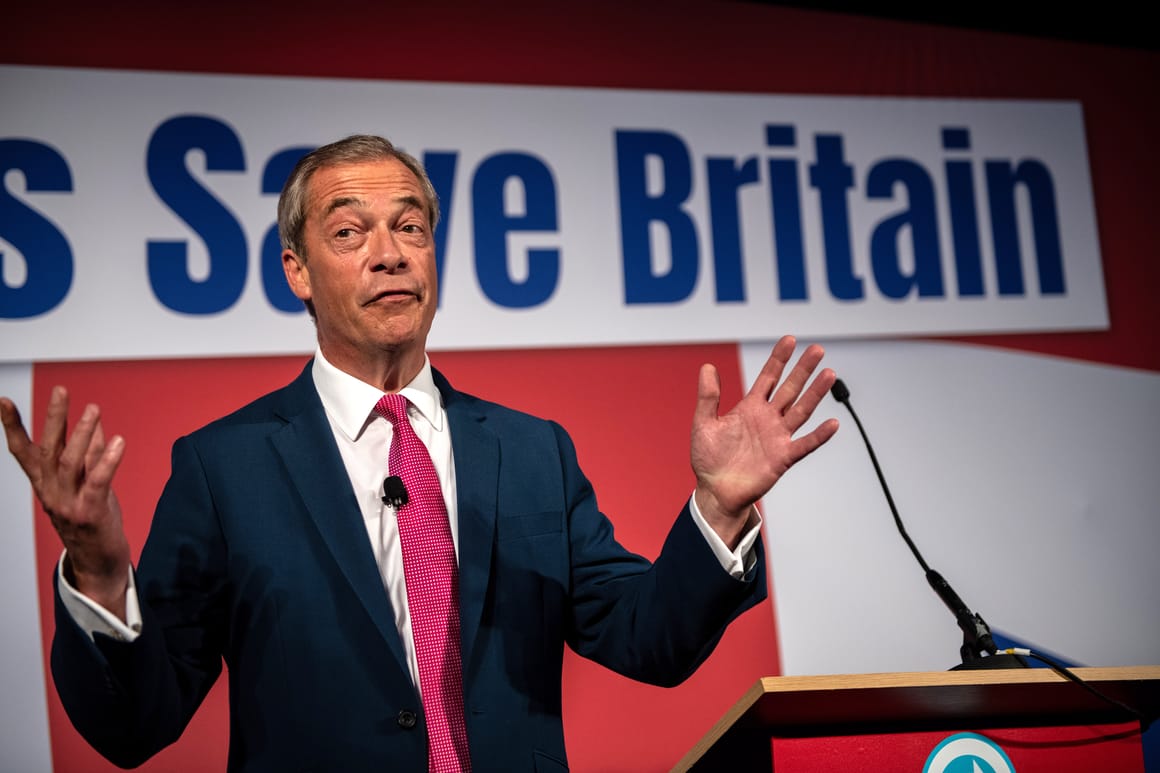

Nigel Farages Shrewsbury Visit Flat Cap G And Ts And Tory Criticism

May 03, 2025

Nigel Farages Shrewsbury Visit Flat Cap G And Ts And Tory Criticism

May 03, 2025 -

Alwde Yzdad Khtwrt Jw 24 Yhdhr Slah Mn Mghamrath

May 03, 2025

Alwde Yzdad Khtwrt Jw 24 Yhdhr Slah Mn Mghamrath

May 03, 2025 -

The 2024 Scottish Election Farages Bold Prediction For The Snp

May 03, 2025

The 2024 Scottish Election Farages Bold Prediction For The Snp

May 03, 2025 -

Nat West Reaches Settlement With Nigel Farage Over Account Closure

May 03, 2025

Nat West Reaches Settlement With Nigel Farage Over Account Closure

May 03, 2025

Latest Posts

-

La Rencontre Emouvante D Emmanuel Macron Avec Des Victimes De L Armee Israelienne

May 04, 2025

La Rencontre Emouvante D Emmanuel Macron Avec Des Victimes De L Armee Israelienne

May 04, 2025 -

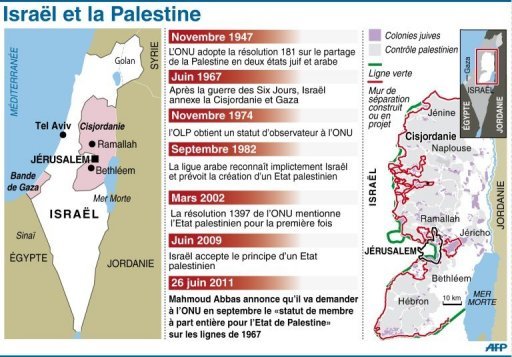

Positions Divergentes Sur L Etat Palestinien Macron Et Netanyahu S Opposent

May 04, 2025

Positions Divergentes Sur L Etat Palestinien Macron Et Netanyahu S Opposent

May 04, 2025 -

Emmanuel Macron Et Les Victimes De L Armee Israelienne Une Rencontre Marquante

May 04, 2025

Emmanuel Macron Et Les Victimes De L Armee Israelienne Une Rencontre Marquante

May 04, 2025 -

Netanyahu Juge L Initiative De Macron Sur L Etat Palestinien Prejudiciable

May 04, 2025

Netanyahu Juge L Initiative De Macron Sur L Etat Palestinien Prejudiciable

May 04, 2025 -

L Etat Palestinien Netanyahu Accuse Macron De Grave Erreur

May 04, 2025

L Etat Palestinien Netanyahu Accuse Macron De Grave Erreur

May 04, 2025