The Swoon And The Pounce: How Individual Investors Capitalized On Market Weakness

Table of Contents

Identifying Opportunities During Market Weakness

Market corrections, while frightening, often create opportunities for astute individual investors. Knowing how to identify these opportunities is key to successfully navigating periods of Individual Investor Market Weakness.

Recognizing Undervalued Assets

Spotting undervalued assets requires a keen eye and a solid understanding of fundamental and technical analysis. During market downturns, even fundamentally strong companies can see their stock prices decline disproportionately.

- Fundamental Analysis: Examine a company's financial statements (income statement, balance sheet, cash flow statement) to assess its profitability, debt levels, and overall financial health. Look for companies with strong fundamentals that are temporarily undervalued due to market sentiment.

- Technical Analysis: Use charts and indicators to identify support levels and potential price reversals. Technical analysis can help you time your entry point more effectively.

- Comparing Price-to-Earnings Ratios (P/E): Compare a company's P/E ratio to its historical average and to its competitors. A lower-than-average P/E ratio could indicate undervaluation.

- Identifying Sectors Resilient to Downturns: Certain sectors, such as consumer staples and healthcare, tend to be more resilient during economic downturns. Focusing on these sectors can help mitigate risk.

For example, consider a consumer staples company with a strong brand and consistent dividend payments. Even during a market correction, its stock price may remain relatively stable, presenting a buying opportunity for the individual investor.

Leveraging Market Volatility

Market volatility, while often perceived as a negative, can be leveraged by individual investors through strategic buying and selling techniques.

- Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals, regardless of the market price, reduces the risk of buying high and selling low.

- Buying the Dip: Identifying temporary dips in the market and strategically purchasing assets at discounted prices.

- Understanding Market Sentiment: Monitoring news and social media to gauge overall market sentiment can help you anticipate potential price movements.

- Using Stop-Loss Orders: Protecting your investments by setting stop-loss orders to automatically sell an asset if its price falls below a certain threshold.

A case study shows an individual investor using dollar-cost averaging during a significant market downturn. By consistently investing a small amount each month, they avoided the emotional pitfalls of timing the market and ultimately benefited from the subsequent market recovery.

Managing Risk During Market Uncertainty

Managing risk is crucial during periods of market uncertainty. Individual investors need to employ strategies that mitigate potential losses while maximizing potential gains.

Diversification Strategies

Diversification is a cornerstone of risk management. Spreading your investments across various asset classes, geographies, and sectors helps reduce the impact of any single investment's underperformance.

- Asset Class Diversification: Invest in a mix of stocks, bonds, real estate, and other asset classes.

- Geographic Diversification: Invest in companies and assets located in different countries to reduce exposure to country-specific risks.

- Sector Diversification: Invest in companies across various sectors to reduce dependence on any single industry.

- Diversification Across Market Caps: Include large-cap, mid-cap, and small-cap stocks in your portfolio.

A well-diversified portfolio for an individual investor facing market weakness might include a mix of large-cap index funds, small-cap value stocks, and a portion allocated to bonds for stability.

Emotional Discipline

Maintaining emotional discipline is perhaps the most challenging aspect of investing during market weakness. Fear and panic can lead to poor investment decisions.

- Avoiding Panic Selling: Resist the urge to sell assets in a panic. Market downturns are temporary; long-term investors should remain focused on their investment goals.

- Sticking to a Long-Term Investment Plan: Adhering to a well-defined investment plan, regardless of short-term market fluctuations, is essential for long-term success.

- Ignoring Short-Term Market Noise: Focus on the long-term fundamentals of your investments rather than being swayed by daily market fluctuations.

- Seeking Professional Advice if Needed: Don't hesitate to seek guidance from a qualified financial advisor if you're struggling to manage your emotions during a market downturn.

Overcoming the psychological challenges of Individual Investor Market Weakness requires self-awareness, discipline, and a long-term perspective.

Utilizing Available Resources & Tools

Accessing reliable information and utilizing effective tools are essential for successful investing during market weakness.

Accessing Reliable Information

Relying on credible sources for market information is vital to make informed investment decisions.

- Reputable Financial News Outlets: Consult established financial news sources for accurate and unbiased market analysis.

- Financial Analysis Websites: Utilize reputable websites providing in-depth financial data and analysis.

- Seeking Advice from Qualified Financial Advisors: Consider seeking professional advice from a registered financial advisor for personalized guidance.

Examples of valuable resources include the Wall Street Journal, Bloomberg, and reputable financial analysis websites offering detailed company information and market insights.

Utilizing Online Brokerage Platforms

Online brokerage platforms offer convenient and cost-effective ways to manage investments.

- Ease of Trading: Many platforms offer easy-to-use interfaces for buying and selling assets.

- Research Tools: Many platforms provide comprehensive research tools, including fundamental and technical analysis data.

- Educational Resources: Some platforms offer educational resources to help investors improve their knowledge and skills.

- Fractional Share Investing: This allows investors to buy parts of shares, making investing more accessible.

Popular user-friendly brokerage platforms include Fidelity, Schwab, and Vanguard, all providing various tools and educational resources to support individual investors.

Conclusion

Market downturns, while unsettling, can present lucrative opportunities for astute individual investors. By identifying undervalued assets, managing risk effectively, and utilizing available resources, investors can successfully navigate periods of market weakness and potentially achieve significant long-term gains. Remember, understanding your risk tolerance and developing a well-defined investment strategy is crucial. Don't let market volatility deter you – learn to identify opportunities and capitalize on Individual Investor Market Weakness to build a strong and resilient portfolio. Start planning your strategy today and seize the next chance to pounce!

Featured Posts

-

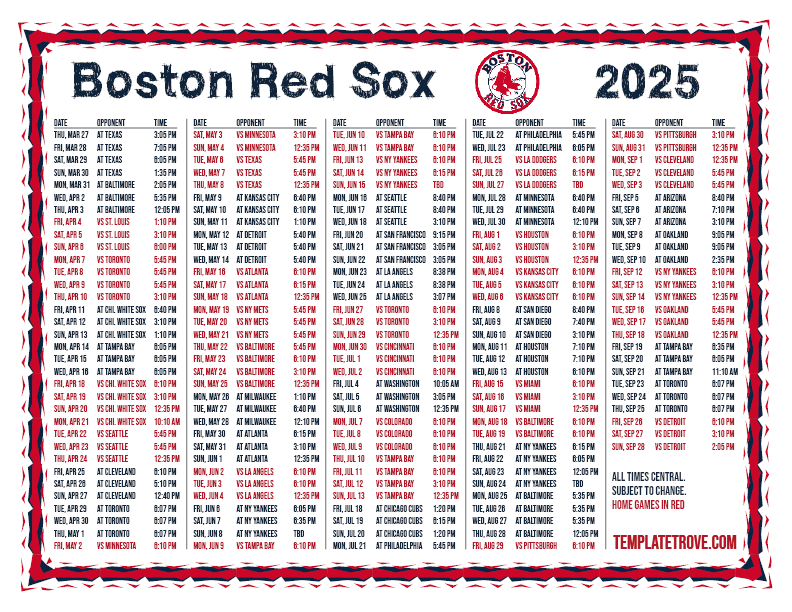

Red Sox 2025 Espns Outfield Projection And What It Means

Apr 28, 2025

Red Sox 2025 Espns Outfield Projection And What It Means

Apr 28, 2025 -

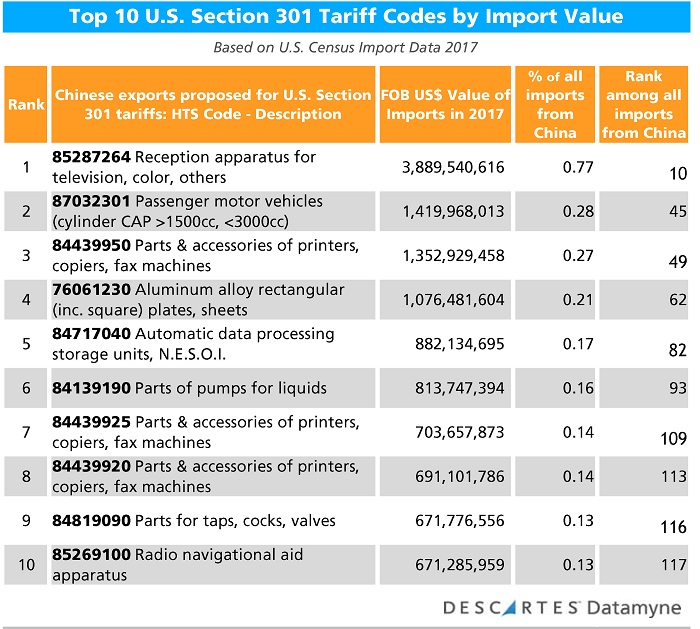

China Adjusts Tariffs New Exemptions For Us Products

Apr 28, 2025

China Adjusts Tariffs New Exemptions For Us Products

Apr 28, 2025 -

Orioles Broadcasters Jinx Broken 160 Game Hit Streak Ends

Apr 28, 2025

Orioles Broadcasters Jinx Broken 160 Game Hit Streak Ends

Apr 28, 2025 -

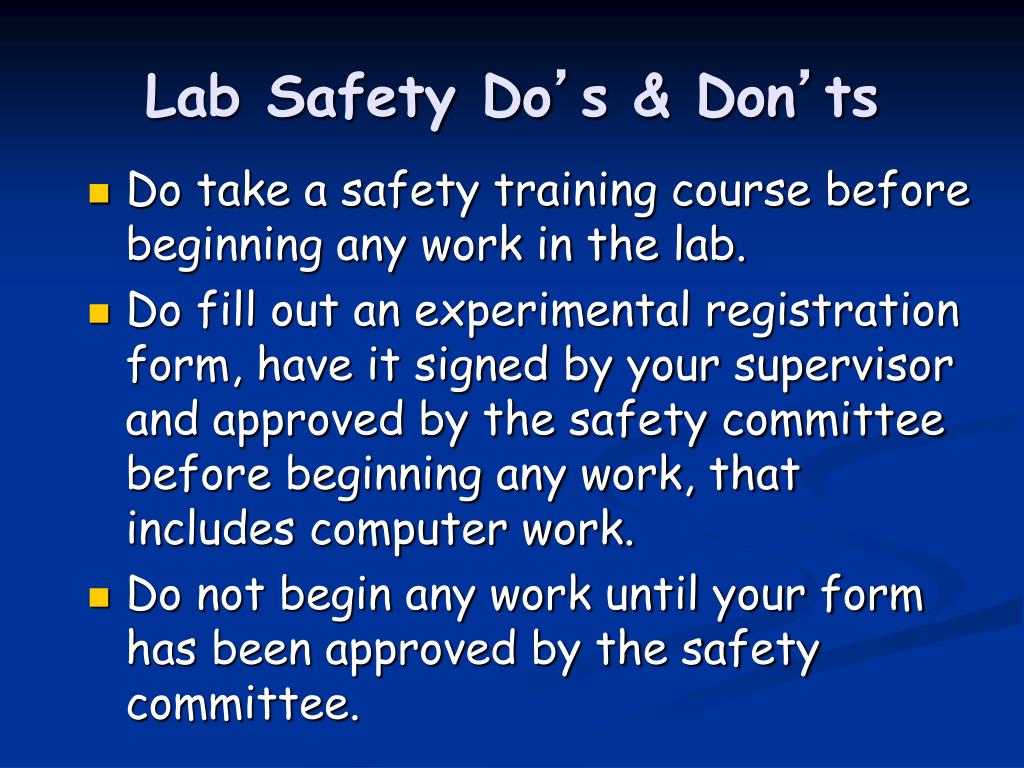

Land Your Dream Private Credit Job 5 Dos And Don Ts To Follow

Apr 28, 2025

Land Your Dream Private Credit Job 5 Dos And Don Ts To Follow

Apr 28, 2025 -

Us Stock Market Rally Fueled By Tech Giants Tesla In The Lead

Apr 28, 2025

Us Stock Market Rally Fueled By Tech Giants Tesla In The Lead

Apr 28, 2025

Latest Posts

-

75

Apr 28, 2025

75

Apr 28, 2025 -

Tecno Universal Tone

Apr 28, 2025

Tecno Universal Tone

Apr 28, 2025 -

Coras Subtle Red Sox Lineup Changes For Doubleheader

Apr 28, 2025

Coras Subtle Red Sox Lineup Changes For Doubleheader

Apr 28, 2025 -

Could Espns Red Sox Outfield Prediction For 2025 Come True

Apr 28, 2025

Could Espns Red Sox Outfield Prediction For 2025 Come True

Apr 28, 2025 -

Slight Lineup Shift For Red Sox Doubleheader Game 1

Apr 28, 2025

Slight Lineup Shift For Red Sox Doubleheader Game 1

Apr 28, 2025