The Trade War And Crypto: A Winning Strategy

Table of Contents

Understanding the Impact of Trade Wars on Traditional Markets

Trade wars significantly impact global economies, creating instability that ripples through traditional investment vehicles. Understanding this impact is crucial to developing a robust Trade War Crypto Strategy.

Currency Fluctuations and Market Volatility

Trade wars often lead to significant currency fluctuations, directly impacting investor portfolios. This instability makes traditional investments less predictable and increases risk.

- Increased volatility in stock markets: Uncertainty surrounding trade policies leads to increased market volatility, making it difficult to predict stock prices.

- Decreased investor confidence in established economies: Trade wars erode confidence in the stability of national economies, prompting investors to seek safer havens.

- Devaluation of national currencies: Trade disputes can weaken a nation's currency, reducing the value of investments denominated in that currency.

- Increased risk aversion among investors: The uncertainty associated with trade wars encourages a more risk-averse approach to investing, potentially limiting returns.

Supply Chain Disruptions and Inflation

Trade tariffs and sanctions disrupt global supply chains, leading to shortages and increased prices for goods and services. This inflationary pressure further impacts investment strategies.

- Higher inflation rates due to increased import costs: Tariffs increase the cost of imported goods, leading to higher prices for consumers and businesses.

- Reduced consumer spending due to higher prices: Increased prices reduce consumer purchasing power, potentially slowing economic growth.

- Difficulty in sourcing essential goods and materials: Disruptions to supply chains can make it difficult for businesses to obtain the necessary materials to operate.

- Increased pressure on businesses to relocate operations: Companies may relocate their operations to avoid tariffs and sanctions, impacting employment and investment in certain regions.

Crypto as a Hedge Against Trade War Uncertainty

Cryptocurrencies, with their decentralized nature, offer a potential hedge against the uncertainties created by trade wars. A well-defined Trade War Crypto Strategy can leverage these advantages.

Decentralization and Reduced Dependence on National Economies

Cryptocurrencies operate outside the traditional financial system, providing a degree of insulation from national economic policies and trade disputes.

- Reduced exposure to currency devaluation: Crypto's value isn't tied to a single national currency, mitigating the risk of devaluation.

- Increased accessibility to global markets: Cryptocurrency transactions can occur across borders relatively easily, regardless of trade restrictions.

- Potential for diversification beyond traditional assets: Cryptocurrencies offer a way to diversify investment portfolios beyond stocks, bonds, and real estate.

- Less susceptibility to geopolitical risks: Decentralized cryptocurrencies are less vulnerable to the political and economic turmoil often associated with trade wars.

Portfolio Diversification and Risk Management

Integrating cryptocurrency into a diversified investment portfolio can help mitigate risks associated with trade war volatility. A key component of a successful Trade War Crypto Strategy is robust risk management.

- Reducing reliance on single asset classes: Diversification into cryptocurrencies reduces overexposure to any one asset class, lessening overall portfolio risk.

- Potentially higher returns in a volatile market: Cryptocurrencies can sometimes outperform traditional assets during periods of market uncertainty.

- Improved risk-adjusted returns: Careful allocation to crypto can potentially enhance overall portfolio returns while minimizing risk.

- The need for careful due diligence and risk assessment: Before investing in cryptocurrency, thorough research and understanding of the risks are essential.

Strategies for Navigating the Trade War with Crypto

Developing a sound Trade War Crypto Strategy requires careful planning and execution. Here are some crucial strategies.

Diversifying your Crypto Portfolio

Don't put all your eggs in one basket. Invest across different cryptocurrencies to reduce risk and maximize potential returns. This is a fundamental part of any successful Trade War Crypto Strategy.

- Research various cryptocurrencies and their underlying technologies: Understand the different types of cryptocurrencies and their potential.

- Allocate funds across different market caps and asset classes: Diversify across large-cap, mid-cap, and small-cap cryptocurrencies.

- Regularly review and rebalance your portfolio: Market conditions change, so regular review and rebalancing are crucial.

Secure Storage and Risk Management

Secure storage of your crypto assets is paramount. Understand the risks involved before investing. This is critical to your overall Trade War Crypto Strategy.

- Use reputable hardware or software wallets: Securely store your private keys offline or with trusted providers.

- Employ strong security measures to protect your private keys: Use strong passwords and two-factor authentication.

- Understand the volatility of the cryptocurrency market: Crypto prices can fluctuate significantly.

- Only invest what you can afford to lose: Never invest more than you can comfortably afford to lose.

Long-Term Investing vs. Short-Term Trading

Consider your investment horizon. Long-term holding can mitigate short-term volatility. This is a crucial decision in forming your Trade War Crypto Strategy.

- Develop a long-term investment strategy aligned with your goals: Define your investment goals and timeline.

- Avoid emotional decision-making based on short-term price fluctuations: Stick to your strategy and avoid impulsive trades.

- Understand the potential tax implications of cryptocurrency investments: Consult a tax professional to understand the tax implications in your jurisdiction.

Conclusion

The trade war's impact on traditional markets presents significant challenges, but also underscores the potential benefits of incorporating a well-considered cryptocurrency strategy into your overall financial plan. By understanding the risks and opportunities, diversifying your holdings, and employing secure storage practices, you can potentially navigate the complexities of the trade war and build a more resilient portfolio. Don't wait – start exploring your options with a winning Trade War Crypto Strategy today!

Featured Posts

-

Is The Attorney Generals Fox News Presence A Distraction

May 09, 2025

Is The Attorney Generals Fox News Presence A Distraction

May 09, 2025 -

Palantir And Nato How Ai Is Transforming Public Sector Operations

May 09, 2025

Palantir And Nato How Ai Is Transforming Public Sector Operations

May 09, 2025 -

Jeanine Pirros Biography Education Net Worth And Notable Cases

May 09, 2025

Jeanine Pirros Biography Education Net Worth And Notable Cases

May 09, 2025 -

9 4000 360

May 09, 2025

9 4000 360

May 09, 2025 -

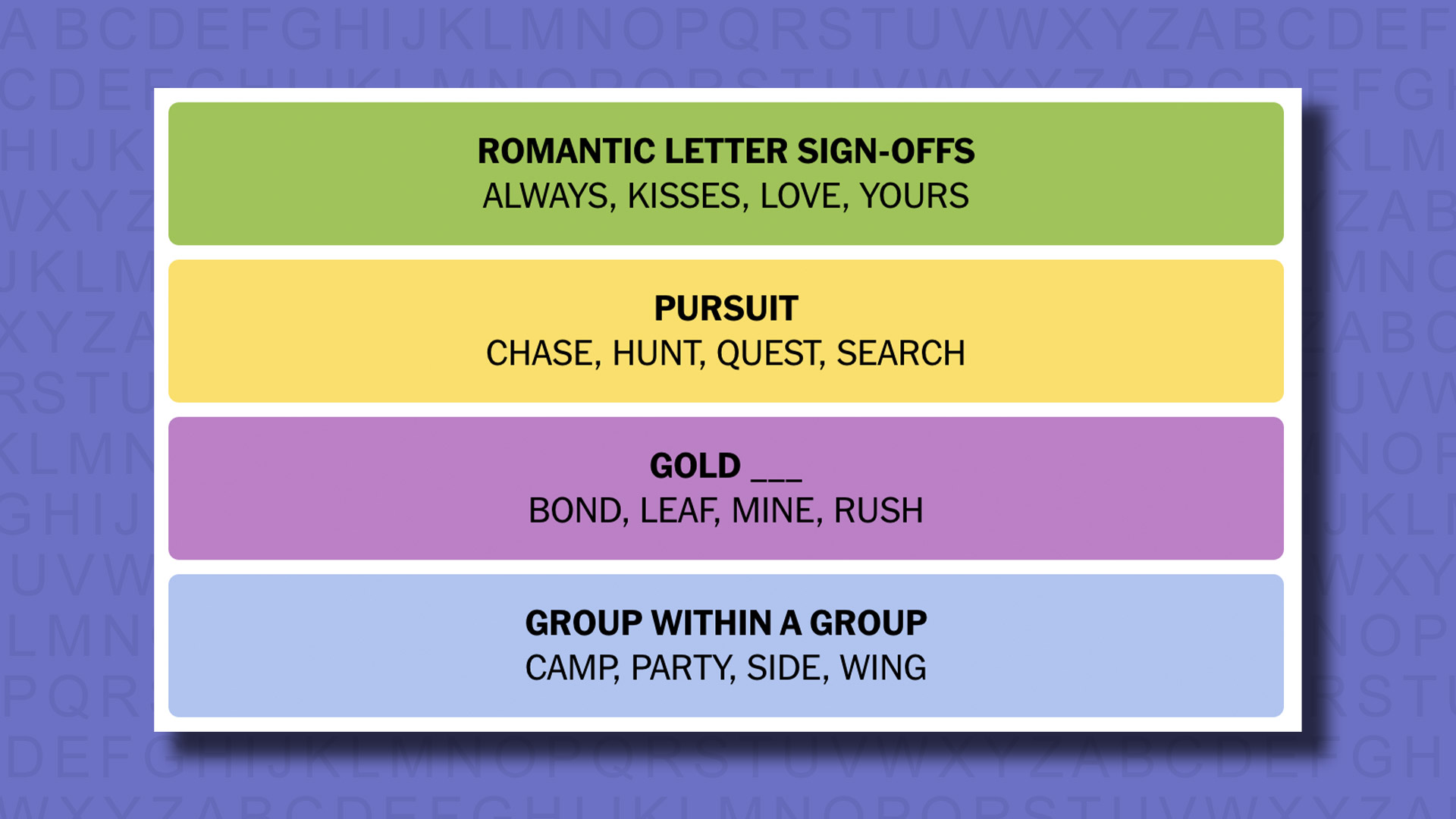

Nyt Strands Game 374 Hints And Solutions For Wednesday March 12

May 09, 2025

Nyt Strands Game 374 Hints And Solutions For Wednesday March 12

May 09, 2025