The $TRUMP Coin Short That Earned A White House Dinner Invitation

Table of Contents

Understanding the $TRUMP Coin and its Volatile Market

The $TRUMP Coin, like many other meme coins and politically-themed cryptocurrencies, experienced a rollercoaster ride in its short lifespan. Its initial surge in popularity was fueled by the association with a prominent political figure and the resulting media attention.

The Rise and Fall of $TRUMP Coin:

The initial coin offering (ICO) for $TRUMP Coin saw significant success, attracting investors drawn to the novelty and potential for quick gains. This initial hype was amplified by extensive influencer marketing and media coverage, creating a frenzy around the coin. However, several factors contributed to its dramatic price decline.

- Initial ICO success: The initial offering generated significant buzz and capital inflow.

- Media attention: Extensive coverage in both mainstream and niche media outlets boosted awareness and trading volume.

- Influencer marketing: Promotion by online personalities and social media influencers fueled further price increases.

- Lack of underlying utility: The coin lacked a clear use case or underlying technology, making it purely speculative.

- Regulatory uncertainty: The lack of clear regulatory frameworks for cryptocurrencies added to the inherent risk.

Identifying the Opportunity for a Short Sell:

For astute traders, the $TRUMP Coin's characteristics presented a compelling opportunity for a short sell. A combination of market analysis, technical indicators, and negative news sentiment pointed towards a significant price correction.

- Overvalued price: The coin's price quickly became detached from any intrinsic value, indicating an unsustainable bubble.

- Lack of credible development team: A lack of transparency and credible leadership raised concerns about the project's long-term viability.

- Negative news cycles: Negative press surrounding the coin and its association with political controversies added downward pressure.

- Bearish market sentiment: Overall bearish sentiment in the cryptocurrency market further exacerbated the decline.

- Chart patterns indicating a downward trend: Technical analysis revealed clear bearish patterns, signaling an impending price drop.

Executing the Short Sale Strategy

Successfully shorting the $TRUMP Coin required careful planning and execution, involving the right platform, tools, and risk management techniques.

Choosing the Right Platform and Tools:

Selecting the appropriate cryptocurrency exchange and trading tools was critical for successfully executing the short sale.

- Exchange selection criteria (liquidity, security, fees): Traders needed to choose an exchange with sufficient liquidity to easily enter and exit the position, robust security measures to protect their assets, and competitive fees.

- Short-selling mechanisms (margin trading, CFDs): Access to margin trading or Contracts for Difference (CFDs) allowed traders to leverage their capital and amplify potential profits (and losses).

- Risk management tools (stop-loss orders): Utilizing stop-loss orders was crucial to limit potential losses if the price unexpectedly moved against the trader's position.

Managing Risk and Position Sizing:

Short selling inherently carries significant risk, especially with volatile assets like the $TRUMP Coin. Careful risk management was paramount.

- Diversification: Spreading investments across different assets helped reduce overall portfolio risk.

- Leverage limits: Using leverage responsibly, avoiding excessive borrowing to limit potential losses.

- Stop-loss and take-profit orders: Implementing these orders helps automate risk management and secure profits.

- Risk-reward ratio: Evaluating the potential profit relative to the potential loss before entering a trade.

- Emotional detachment: Maintaining objectivity and avoiding impulsive decisions driven by fear or greed.

The Unexpected Reward: A White House Dinner Invitation

The most intriguing aspect of this story is the connection – or perceived connection – between the successful $TRUMP Coin short sale and a subsequent White House dinner invitation.

The Connection Between the Short Sale and the Dinner Invitation:

The exact nature of the link between the profitable short and the White House dinner remains unclear. Speculation abounds, ranging from pure coincidence to a more intricate network of connections.

- Potential connections (networking, political influence, business relationships): The individual involved may have connections to influential figures who facilitated the invitation.

- Speculation on the nature of the dinner invitation: Was it a purely social event, or was there a deeper political or business agenda?

- Ethics and implications: The circumstances raise questions about potential conflicts of interest and the ethics of profiting from politically charged investments.

Ethical and Legal Considerations:

Short selling, especially in the context of politically sensitive assets like the $TRUMP Coin, raises important ethical and legal considerations.

- Market manipulation concerns: The possibility of artificially influencing the price of the cryptocurrency through coordinated short selling must be considered.

- Insider trading regulations: Any use of non-public information to gain an advantage in trading would be a violation of regulations.

- Transparency in trading activities: Maintaining transparency and ethical conduct in all trading activities is crucial.

Conclusion

The story of the $TRUMP Coin short sale and the subsequent White House dinner invitation is a captivating example of the high-stakes world of cryptocurrency trading. It highlights the extreme volatility of political cryptocurrencies and the potential for both substantial profits and significant losses. While the link between the short sale and the dinner remains somewhat mysterious, the core principles of successful cryptocurrency trading—thorough market analysis, disciplined risk management, and a clear understanding of the underlying asset—remain paramount.

While this story is unique, the underlying principles of market analysis and risk management remain crucial for successful cryptocurrency trading. Learn more about effective strategies for trading volatile assets like the $TRUMP Coin and other political cryptocurrencies. However, consider carefully your risk tolerance before engaging in high-risk investments. Remember that any investment involving the $TRUMP Coin or similar political cryptocurrencies carries a substantial level of risk.

Featured Posts

-

Hrb Antqalat Bayrn Mywnkh Dd Brshlwnt

May 29, 2025

Hrb Antqalat Bayrn Mywnkh Dd Brshlwnt

May 29, 2025 -

Serious Setback Mc Kenna And Philogene Injuries For Ipswich Town

May 29, 2025

Serious Setback Mc Kenna And Philogene Injuries For Ipswich Town

May 29, 2025 -

U S Student Visa Interviews Paused Increased Screening Underway

May 29, 2025

U S Student Visa Interviews Paused Increased Screening Underway

May 29, 2025 -

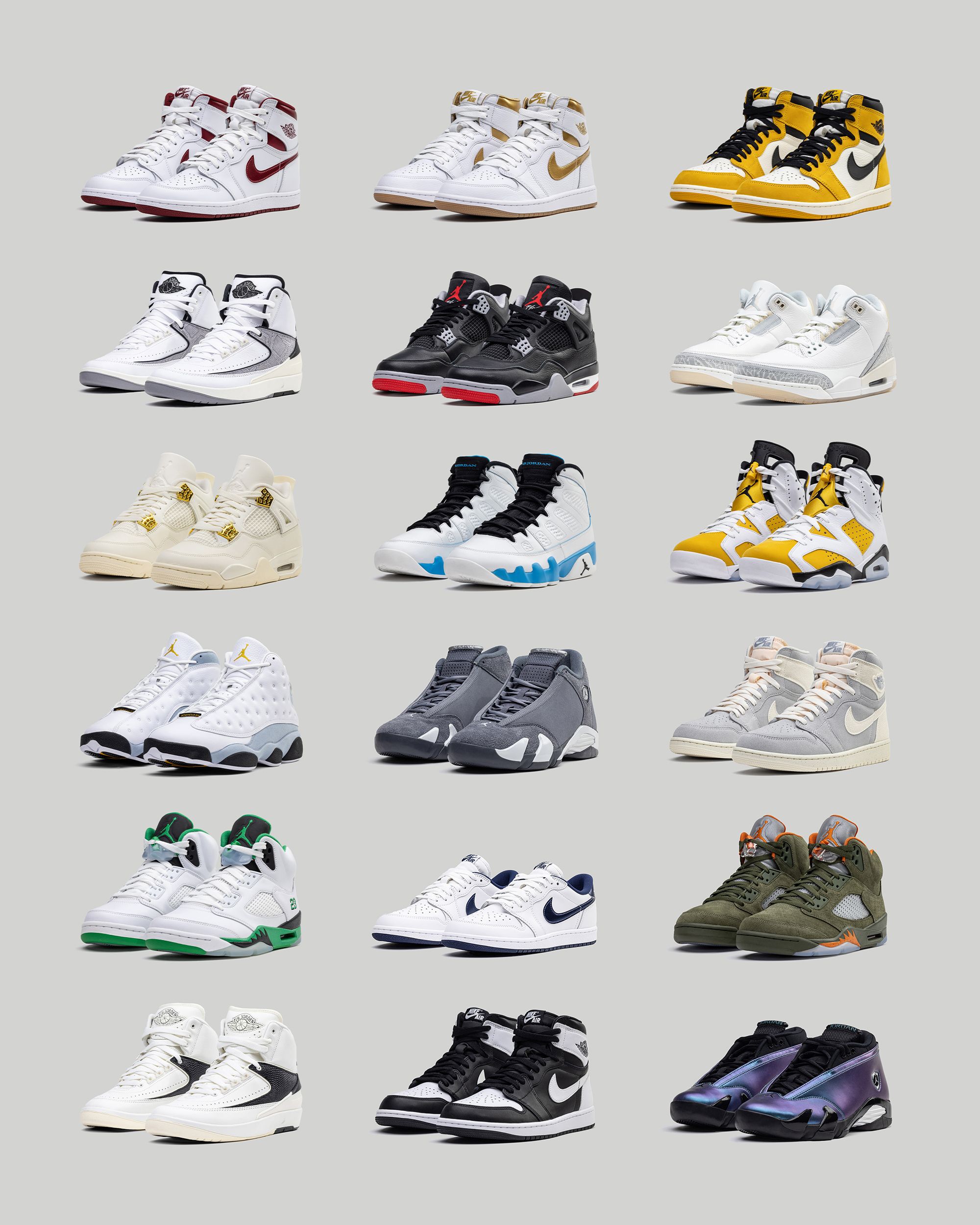

Air Jordan Releases Your May 2025 Sneaker Shopping List

May 29, 2025

Air Jordan Releases Your May 2025 Sneaker Shopping List

May 29, 2025 -

Exploring The Best Of Canadian Music Since 2000

May 29, 2025

Exploring The Best Of Canadian Music Since 2000

May 29, 2025

Latest Posts

-

Auction Alert Banksys Broken Heart Wall On Sale

May 31, 2025

Auction Alert Banksys Broken Heart Wall On Sale

May 31, 2025 -

Banksy Male Or Female Examining The Evidence

May 31, 2025

Banksy Male Or Female Examining The Evidence

May 31, 2025 -

Banksy Print Market Explodes 22 777 000 In Annual Sales

May 31, 2025

Banksy Print Market Explodes 22 777 000 In Annual Sales

May 31, 2025 -

Auction Alert Banksys Broken Heart Wall Art

May 31, 2025

Auction Alert Banksys Broken Heart Wall Art

May 31, 2025 -

The Banksy Effect A 22 7 Million Print Market In 12 Months

May 31, 2025

The Banksy Effect A 22 7 Million Print Market In 12 Months

May 31, 2025