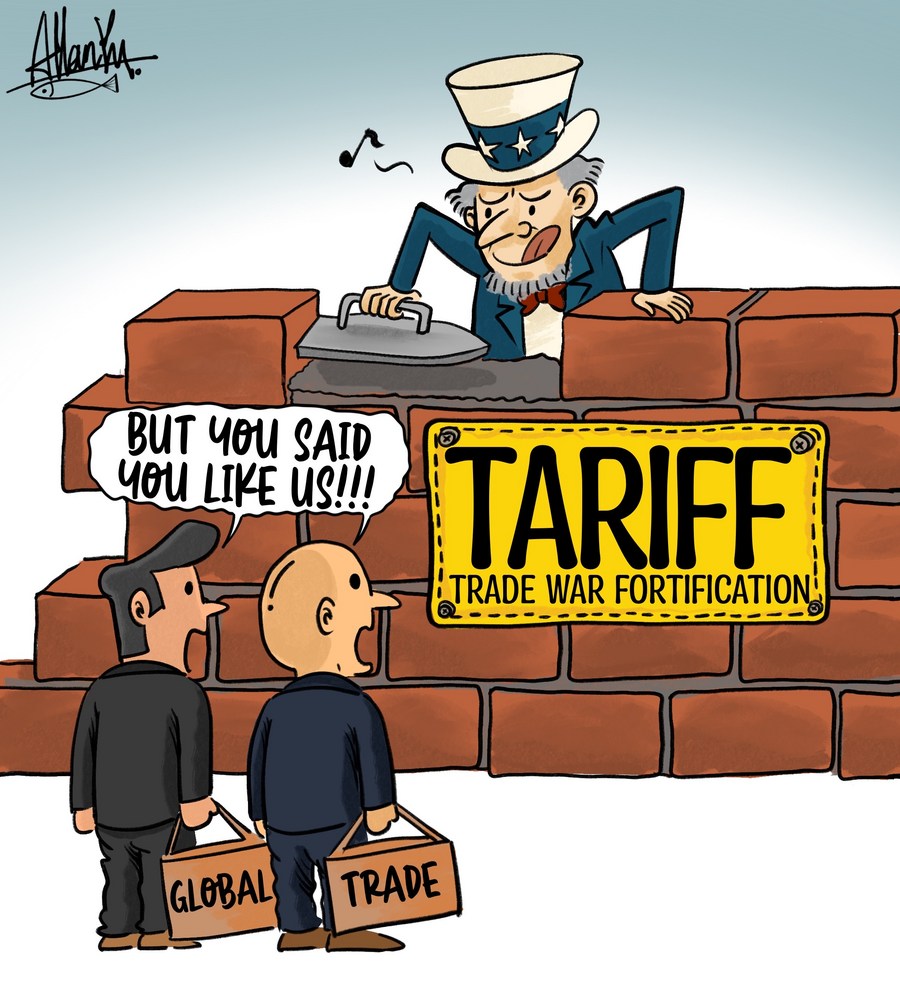

The Trump Tariff Impact: Toyota's Heavy Burden Compared To Other Automakers

Table of Contents

Toyota's Unique Vulnerability to Trump Tariffs

Toyota's susceptibility to the Trump tariffs stemmed from two key factors: its high dependence on imports and its relatively less diversified global supply chain.

High Dependence on Imports

- High percentage of vehicles imported from Japan: A significant portion of Toyota's US sales consisted of vehicles directly imported from its Japanese manufacturing plants.

- Reliance on Japanese-sourced parts: Even for vehicles assembled in the US, Toyota relied heavily on parts sourced from Japan, increasing its vulnerability to tariffs on imported components.

- Limited domestic production capacity compared to competitors like Ford and GM: Unlike Ford and GM, which had significantly larger US manufacturing footprints, Toyota's domestic production capacity was comparatively smaller.

This import reliance wasn't a random occurrence. It was a strategic choice rooted in Toyota's historical investments and manufacturing strategies. Decades of focus on lean manufacturing in Japan, coupled with established supply chains, meant a significant shift in production would require substantial capital investment and time. The sudden imposition of Trump tariffs on imported cars exposed this vulnerability. Estimates suggest that X% of Toyota's vehicles sold in the US were directly imported, and Y% of its parts were sourced from Japan (replace X and Y with actual figures if available, citing the source). This high degree of Toyota import dependency left the company significantly exposed to tariff increases.

Lack of Diversification

- Less diversified global supply chain compared to competitors: Unlike some competitors who had established manufacturing bases in Mexico and the US, reducing their reliance on a single source country, Toyota’s supply chain remained more concentrated.

- Vulnerability to trade disruptions: This lack of tariff diversification strategy meant Toyota was significantly more vulnerable to trade disruptions and policy changes like the Trump tariffs.

Toyota's global manufacturing footprint, while efficient, lacked the geographical diversification seen in competitors like Honda and Nissan. This resulted in a higher concentration of risk, making the impact of tariffs on Toyota production considerably more severe. A comparative analysis of manufacturing locations would reveal this disparity further, highlighting the strategic disadvantage faced by Toyota.

Comparative Analysis: Toyota vs. Other Automakers

Comparing Toyota's experience to other automakers reveals the varying impact of the Trump tariffs based on differing strategies and manufacturing footprints.

Ford and GM's Strategic Advantage

- Significant US manufacturing presence: Ford and GM benefited from extensive US manufacturing facilities, enabling them to produce more vehicles domestically and reduce their dependence on imports.

- Access to North American-sourced parts: Their robust North American supply chains allowed them to source parts regionally, minimizing the tariff impact on imported components.

- Ability to absorb tariff costs more effectively: Their larger scale and established domestic operations enabled them to absorb the increased costs associated with tariffs more effectively than Toyota.

Ford and GM's established US operations acted as a buffer against the Trump tariffs, allowing them to potentially leverage the situation to gain market share. Their established domestic production levels, significantly higher than Toyota's, allowed them to mitigate the Ford tariff impact and GM tariff strategy more effectively.

Honda and Nissan's Response

- Different levels of import reliance compared to Toyota: Honda and Nissan, while also importing vehicles and parts, had a lower degree of dependence on Japanese imports compared to Toyota.

- Varying strategies for mitigating tariff effects: Their responses included price increases, adjustments to production volumes, and a push towards increased domestic production.

Honda and Nissan's responses to the Trump tariffs varied depending on their specific circumstances. While both faced challenges, their lesser reliance on Japanese imports compared to Toyota resulted in a less dramatic Honda tariff impact and Nissan tariff response. Analyzing their strategies provides valuable insights into mitigating the effects of trade barriers. Comparing these responses directly to comparing Toyota tariff impact to other automakers sheds light on the different approaches to managing trade risks.

The Long-Term Consequences for Toyota

The Trump tariffs forced Toyota to reassess its long-term strategies, leading to significant adjustments in its production and market approach.

Shifting Production Strategies

- Investment in US manufacturing: To lessen its reliance on imports, Toyota increased investment in its US manufacturing facilities.

- Exploring alternative supply chains: The company also began exploring and diversifying its supply chains, reducing its dependence on Japanese parts.

- Adjustments to vehicle pricing and models: Toyota adjusted vehicle pricing to account for increased costs, and also modified its model offerings to better suit the changing market dynamics.

These shifts in Toyota production shift represent a significant strategic realignment, driven by the need to reduce vulnerability to future trade disruptions. This Toyota's long-term tariff strategy involved substantial capital investment and organizational changes, demonstrating the lasting impact of the tariffs. Understanding the future impact of tariffs on Toyota requires continued monitoring of these developments.

Impact on Consumer Prices and Market Share

- Analysis of price increases for Toyota vehicles: The tariffs led to price increases for several Toyota models, affecting consumer affordability and purchasing decisions.

- Changes in market share: The price increases and reduced competitiveness affected Toyota's market share, although the extent of this impact varied across different vehicle segments.

- Consumer response to higher prices: Consumer response to higher prices varied, with some buyers opting for less expensive alternatives, further impacting Toyota’s sales figures.

The impact of the tariffs on Toyota price increase and subsequent Toyota market share changes was significant. The consumer impact of tariffs on Toyota requires further analysis to fully understand the long-term effects on brand loyalty and market perception.

Conclusion

The Trump tariff impact on Toyota revealed a significant vulnerability stemming from its high dependence on imports and less diversified global supply chain compared to competitors. While other automakers faced challenges, Toyota’s experience highlights the crucial role of strategic manufacturing and diversification in navigating trade policy changes. Understanding the Trump tariff impact on Toyota is key for investors, policymakers, and the automotive industry as a whole. To learn more about the long-term effects of trade policies on the auto industry, continue exploring the complex implications of Trump tariffs on imported cars.

Featured Posts

-

Eric Antoine En Couple Devoilement De Sa Vie Sentimentale Et Sa Relation Avec Une Personnalite M6

May 12, 2025

Eric Antoine En Couple Devoilement De Sa Vie Sentimentale Et Sa Relation Avec Une Personnalite M6

May 12, 2025 -

Henry Cavill As Wolverine World War Hulk Fan Casting Speculation

May 12, 2025

Henry Cavill As Wolverine World War Hulk Fan Casting Speculation

May 12, 2025 -

Refugee Outings Cancelled Fabers New Policy

May 12, 2025

Refugee Outings Cancelled Fabers New Policy

May 12, 2025 -

Marjolein Fabers Legal Response To Altered Photo At Demonstration

May 12, 2025

Marjolein Fabers Legal Response To Altered Photo At Demonstration

May 12, 2025 -

Ufcs Shevchenko On Fiorot I Dont Care About Her

May 12, 2025

Ufcs Shevchenko On Fiorot I Dont Care About Her

May 12, 2025

Latest Posts

-

Lids I Barnli Obezbedi A Mesto Vo Premier Ligata

May 13, 2025

Lids I Barnli Obezbedi A Mesto Vo Premier Ligata

May 13, 2025 -

The Music Of Cp Music Productions A Father Son Legacy

May 13, 2025

The Music Of Cp Music Productions A Father Son Legacy

May 13, 2025 -

Lids Una Ted I Barnli Se Vrakjaat Vo Premier Ligata

May 13, 2025

Lids Una Ted I Barnli Se Vrakjaat Vo Premier Ligata

May 13, 2025 -

Discover Cp Music Productions A Father And Son Musical Journey

May 13, 2025

Discover Cp Music Productions A Father And Son Musical Journey

May 13, 2025 -

Cp Music Productions The Father Son Duo Redefining Musical Collaboration

May 13, 2025

Cp Music Productions The Father Son Duo Redefining Musical Collaboration

May 13, 2025