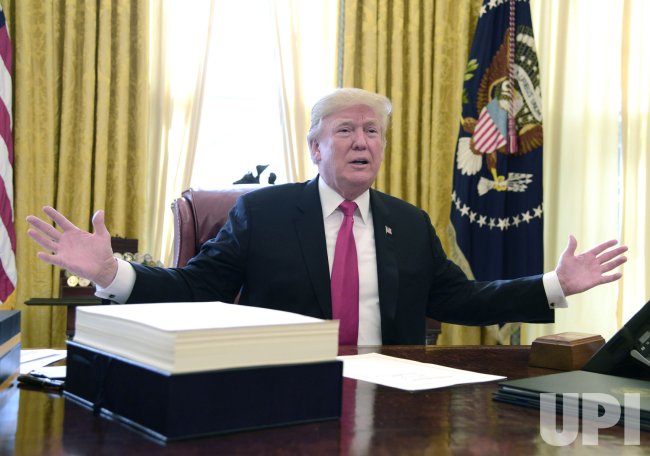

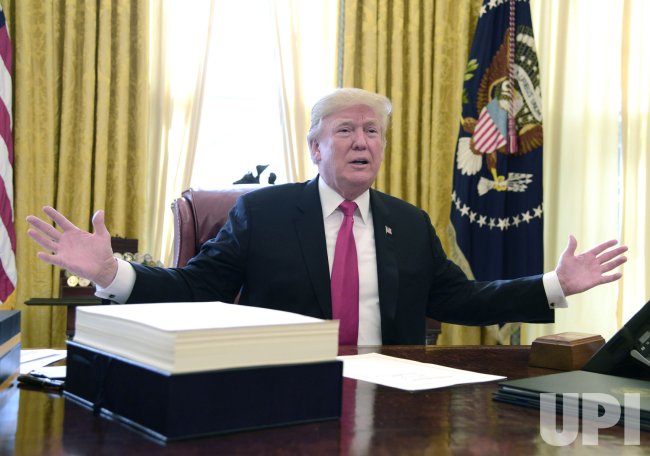

The Trump Tax Cut Bill: What The House Republicans Proposed

Table of Contents

Individual Income Tax Rate Reductions

The bill proposed significant reductions in individual income tax rates, aiming to simplify the tax code and boost economic activity. This core component of the Trump Tax Cut Bill aimed to stimulate the economy through increased disposable income.

Proposed Changes to Brackets and Rates:

The proposed changes to the Trump Tax Cut Bill significantly altered the existing tax bracket system.

- Lowered top marginal tax rate: The highest tax bracket saw a substantial reduction, aiming to incentivize investment and entrepreneurship among high-income earners.

- Consolidated existing tax brackets: The number of tax brackets was reduced, simplifying the tax code and making it theoretically easier for individuals to understand their tax liability. This simplification was a key selling point of the Trump Tax Cut Bill.

- Increased standard deduction: The standard deduction was raised, providing tax relief for many lower and middle-income taxpayers. This change affected a wider swathe of the population compared to the top marginal tax rate reduction.

Impact on Different Income Groups:

The impact of the proposed Trump Tax Cut Bill varied significantly across different income levels.

- Potential increase in after-tax income for high-income earners: High-income earners benefited the most from the reduced top marginal tax rate and other provisions.

- Moderate benefits for middle-income families: Middle-income families experienced some tax relief, primarily through the increased standard deduction.

- Limited impact or potential negative impact for low-income individuals: Low-income individuals either saw limited benefits or potentially faced negative consequences depending on the elimination or modification of certain deductions and credits, which will be discussed further below.

Corporate Tax Rate Reduction

The most significant change proposed in the Trump Tax Cut Bill was a dramatic reduction in the corporate tax rate. This was a central element of the Republican economic strategy.

Proposed Corporate Tax Rate:

The bill proposed a significant reduction in the corporate tax rate from 35% to 21%.

- Specific percentage reduction proposed: This sharp reduction aimed to make American businesses more competitive globally.

- Rationale behind the proposed reduction: The argument was that a lower corporate tax rate would attract foreign investment, stimulate domestic investment, encourage job creation, and ultimately boost economic growth. This was a key justification for the Trump Tax Cut Bill's corporate provisions.

Potential Economic Consequences:

The effects of this corporate tax rate reduction were subject to considerable debate.

- Stimulation of business investment: Proponents argued that the lower tax rate would lead to increased investment in equipment, technology, and expansion.

- Increased corporate profits: Lower taxes naturally translate to higher after-tax profits for corporations.

- Potential for job creation: Increased investment and profits were expected to lead to increased hiring and job creation.

- Impact on the national deficit: Critics argued that the tax cut would significantly increase the national debt due to lower government revenue. This was a major point of contention surrounding the Trump Tax Cut Bill.

Changes to Deductions and Credits

The Trump Tax Cut Bill also included changes to various deductions and credits, affecting different segments of the population.

Elimination or Modification of Deductions:

Several deductions were targeted for elimination or modification.

- Specific deductions affected: A notable example was the state and local tax (SALT) deduction, which was significantly limited. Other deductions were also impacted, leading to varied consequences.

- Reasoning behind the changes: The rationale behind these changes often involved arguments of revenue generation and tax code simplification. These changes were controversial and heavily debated.

Impact on Homeowners and State/Local Governments:

The changes to deductions had a disproportionate impact on certain groups.

- Increased tax burden for homeowners in high-tax states: The limitation of the SALT deduction particularly affected homeowners in high-tax states, increasing their overall tax burden.

- Reduced revenue for state and local governments: The reduced SALT deduction also negatively impacted state and local governments, reducing their revenue streams.

Overall Economic Impact and Projections

The projected economic effects of the Trump Tax Cut Bill were widely debated.

Projected Economic Growth:

Economists offered varying predictions based on the proposed changes.

- GDP growth estimates: Estimates for GDP growth varied significantly, depending on the underlying economic model used.

- Job creation estimates: Similar to GDP growth, projections of job creation under the Trump Tax Cut Bill also varied.

Debt and Deficit Implications:

The impact on the national debt and deficit was a major concern.

- Short-term and long-term effects on the national debt: The tax cuts were projected to increase the national debt both in the short-term and long-term.

- Potential for increased government borrowing: To offset the revenue loss from the tax cuts, the government was expected to increase its borrowing.

Conclusion

The Trump Tax Cut Bill, as proposed by House Republicans, represented a significant overhaul of the American tax system. While proponents argued it would stimulate economic growth and create jobs by lowering individual and corporate tax rates, critics raised concerns about its potential to exacerbate income inequality and increase the national debt. Understanding the intricacies of the "Trump Tax Cut Bill," including its proposed changes to individual and corporate taxes, deductions, and credits, is critical to informed civic engagement. Further research and analysis are encouraged to fully grasp the long-term implications of this ambitious legislative proposal. Continue learning about the intricacies of the Trump Tax Cut Bill to better understand its impact on your financial future.

Featured Posts

-

Understanding The 2025 Nba Draft Lottery Odds The Cooper Flagg Factor

May 13, 2025

Understanding The 2025 Nba Draft Lottery Odds The Cooper Flagg Factor

May 13, 2025 -

In Memoriam Recent Obituaries For Local Residents

May 13, 2025

In Memoriam Recent Obituaries For Local Residents

May 13, 2025 -

Gibraltar Investment Opportunities Highlighted At Sidoti Small Cap Conference

May 13, 2025

Gibraltar Investment Opportunities Highlighted At Sidoti Small Cap Conference

May 13, 2025 -

Gaza Hostage Crisis A Prolonged Nightmare For Families

May 13, 2025

Gaza Hostage Crisis A Prolonged Nightmare For Families

May 13, 2025 -

Funeral For Teenager Killed In School Stabbing

May 13, 2025

Funeral For Teenager Killed In School Stabbing

May 13, 2025