The Uber Stock Outlook: Navigating Economic Uncertainty

Table of Contents

Uber's Financial Performance and Growth Prospects

Uber's financial performance is a critical component of any Uber stock outlook analysis. Understanding its revenue streams and profitability, as well as its market position, is essential for assessing its future potential.

Revenue Streams and Profitability

Uber boasts a diversified revenue model, encompassing ride-sharing, Uber Eats (food delivery), and freight services. Analyzing the profitability of each segment provides a nuanced picture of the company's financial health.

-

Recent Quarterly Earnings: Closely monitoring Uber's quarterly earnings reports is vital. Key metrics to track include revenue growth, operating margins, and net income. Significant deviations from previous quarters warrant further investigation. For example, a sudden drop in operating margins might indicate increased operational costs or decreased demand.

-

Revenue Stream Contribution: Each segment contributes differently to overall profitability. Ride-sharing might be more susceptible to economic downturns, while Uber Eats could demonstrate greater resilience. Understanding these individual performances is crucial for a complete Uber stock outlook.

-

Cost-Cutting Measures: Uber, like many companies, has implemented cost-cutting measures to improve profitability. These actions, such as streamlining operations or reducing marketing expenses, can significantly affect its financial performance and should be considered in any Uber stock forecast.

Market Share and Competitive Landscape

Uber's position within the ride-sharing and food delivery markets is fiercely competitive. Analyzing its market share and competitive advantages against rivals like Lyft and DoorDash is paramount.

-

Market Share Trends: Tracking Uber's market share trends reveals its growth trajectory and competitive strength. A declining market share could suggest challenges in retaining customers or competing effectively.

-

Competitive Advantages: Uber's competitive advantages, such as its extensive network, brand recognition, and technological innovations, play a significant role in its stock valuation.

-

Regulatory Changes: The regulatory environment significantly impacts Uber's operations. Changes in regulations, such as those related to driver classification or pricing, can affect its profitability and stock price. Staying informed about regulatory developments is key to a well-informed Uber stock outlook.

Impact of Economic Uncertainty on Uber Stock

Global economic uncertainty significantly influences the Uber stock outlook. Factors like inflation, consumer spending habits, and interest rate hikes play crucial roles.

Inflation and Consumer Spending

Inflation and changes in consumer spending habits directly affect demand for Uber's services.

-

Price Elasticity of Demand: Understanding how price changes impact demand for ride-sharing and food delivery is vital. During economic downturns, consumers might be more sensitive to price increases, potentially reducing demand for Uber's services.

-

Mitigating Reduced Spending: Uber employs strategies to mitigate the impact of reduced consumer spending, such as offering promotions or adjusting pricing. The effectiveness of these strategies is a crucial factor in the Uber stock outlook.

Interest Rate Hikes and Investment Climate

Interest rate hikes by central banks impact stock market valuations and investor sentiment.

-

Interest Rates and Stock Valuations: Higher interest rates generally lead to lower stock valuations, as investors seek safer, higher-yielding investments. This relationship significantly affects the Uber stock outlook.

-

Impact on Uber's Operations: Higher borrowing costs affect Uber's expansion plans and operational expenses. Analyzing Uber's debt levels and its ability to manage higher interest rates is essential.

Long-Term Growth Strategies and Future Outlook for Uber Stock

Uber's long-term growth strategies, including technological innovation and expansion plans, are essential for shaping the Uber stock outlook.

Technological Innovation and Expansion Plans

Uber's investments in technology and its plans for expansion will significantly shape its future performance.

-

Autonomous Vehicles: The development of autonomous vehicles could revolutionize Uber's business model, reducing operational costs and potentially improving efficiency. However, the timeline for widespread adoption and the associated regulatory hurdles are significant uncertainties.

-

Expansion and New Services: Uber's expansion into new markets or the introduction of new service categories, like delivery of other goods beyond food, offer significant growth potential. The success of these expansion efforts will directly impact the Uber stock outlook.

Environmental, Social, and Governance (ESG) Factors

ESG factors are increasingly important for investors, influencing company valuations and investor sentiment.

-

Uber's ESG Initiatives: Uber's efforts in sustainability, diversity, and ethical labor practices are now under greater scrutiny from investors. Positive developments in these areas can enhance the company's reputation and attract ESG-focused investors.

-

Investor Sentiment: Growing investor focus on ESG issues can impact Uber's stock valuation. Companies with strong ESG performance often attract higher valuations.

Conclusion

The Uber stock outlook remains complex and multifaceted. Its financial performance, competitive landscape, the broader economic climate, and its strategic initiatives all significantly influence its stock price. While economic uncertainty poses challenges, Uber's diversification and technological investments offer potential for long-term growth. Careful consideration of all the factors discussed—financial performance, competitive pressures, economic conditions, and long-term strategies—is crucial for investors making decisions about the Uber stock outlook. Conduct thorough research and consult with a financial advisor before making any investment decisions related to the Uber stock outlook. Understanding the Uber stock forecast requires a comprehensive assessment of these interwoven factors. Remember to always monitor the Uber stock price and stay updated on relevant news and financial reports.

Featured Posts

-

Is Angelo Stillers Success A Failure For Bayern Munichs Academy

May 18, 2025

Is Angelo Stillers Success A Failure For Bayern Munichs Academy

May 18, 2025 -

Spectacle Musical Christophe Mali A Onet Le Chateau

May 18, 2025

Spectacle Musical Christophe Mali A Onet Le Chateau

May 18, 2025 -

Did Putins Peace Talks Offer Backfire A Diplomatic Analysis

May 18, 2025

Did Putins Peace Talks Offer Backfire A Diplomatic Analysis

May 18, 2025 -

Survei Median Menunjukkan Dukungan Luas Indonesia Terhadap Negara Palestina Merdeka

May 18, 2025

Survei Median Menunjukkan Dukungan Luas Indonesia Terhadap Negara Palestina Merdeka

May 18, 2025 -

Voyager Technologies Space Defense Firm Files For Ipo

May 18, 2025

Voyager Technologies Space Defense Firm Files For Ipo

May 18, 2025

Latest Posts

-

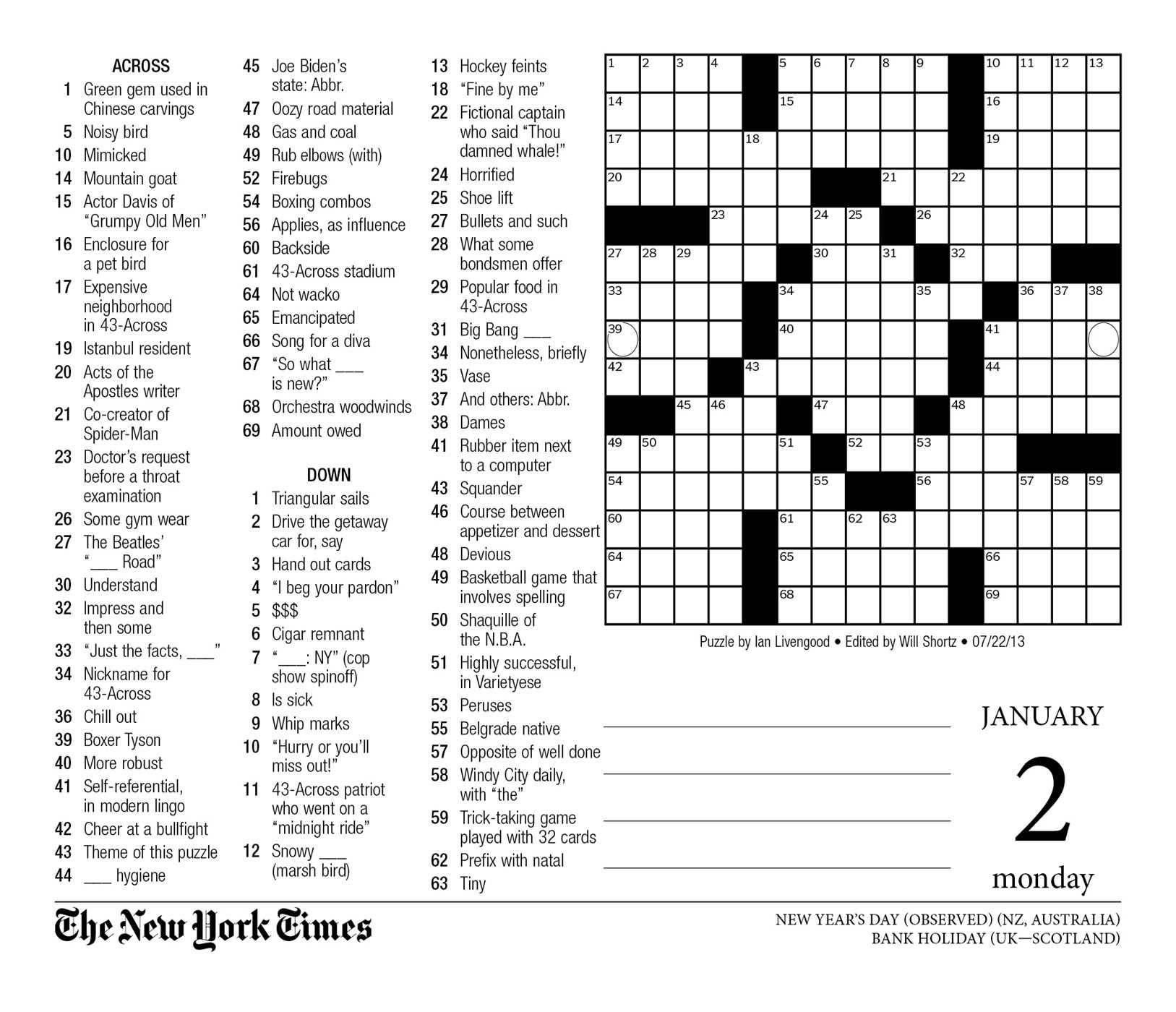

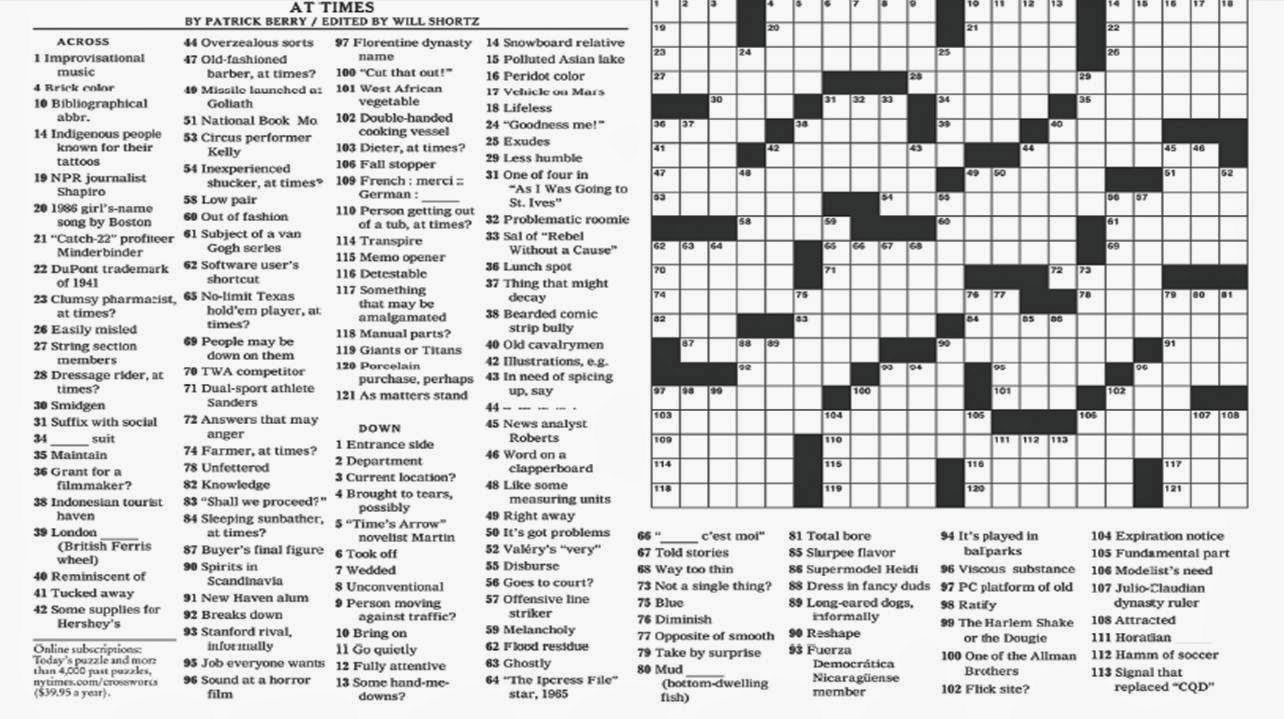

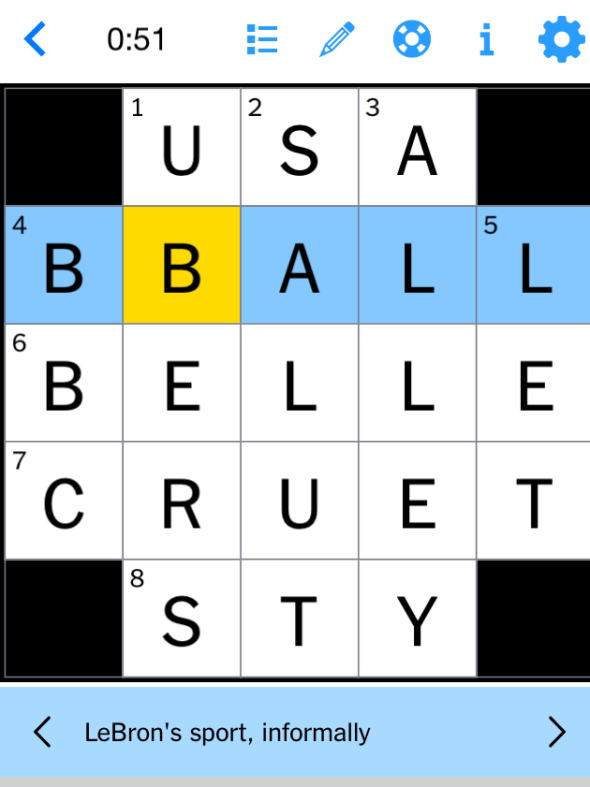

Nyt Mini Crossword April 8 2025 Tuesday Complete Solution Guide

May 19, 2025

Nyt Mini Crossword April 8 2025 Tuesday Complete Solution Guide

May 19, 2025 -

Solve The Nyt Mini Crossword Hints And Answers For April 8 2025

May 19, 2025

Solve The Nyt Mini Crossword Hints And Answers For April 8 2025

May 19, 2025 -

Nyt Mini Crossword Answers Sunday May 11 Complete Clue Guide

May 19, 2025

Nyt Mini Crossword Answers Sunday May 11 Complete Clue Guide

May 19, 2025 -

Nyt Mini Crossword Solutions April 8 2025 Tuesday

May 19, 2025

Nyt Mini Crossword Solutions April 8 2025 Tuesday

May 19, 2025 -

Nyt Mini Crossword March 5 2025 Solutions And Clues

May 19, 2025

Nyt Mini Crossword March 5 2025 Solutions And Clues

May 19, 2025