This AI Quantum Computing Stock: A Dip Buying Opportunity

Table of Contents

Understanding the Current Market Dip for XYZQ

Several factors contribute to the current dip in XYZQ's stock price. Understanding these factors is crucial to assessing whether this represents a genuine buying opportunity.

Macroeconomic Factors Affecting the Stock

Broader macroeconomic trends significantly impact the tech sector, and AI quantum computing stocks are no exception.

- High Interest Rates: Increased interest rates make borrowing more expensive, impacting capital investment in growth sectors like quantum computing.

- Inflationary Pressures: Persistent inflation erodes purchasing power and can lead to decreased consumer and business spending, affecting demand for cutting-edge technologies.

- Overall Market Sentiment: Negative market sentiment, often driven by economic uncertainty, can trigger sell-offs across various sectors, including AI quantum computing.

These factors negatively influence investor sentiment, leading to reduced valuations for growth stocks like XYZQ, creating a potential buying opportunity for long-term investors willing to weather the storm. The impact is magnified for companies still in their growth phase, relying heavily on future projections rather than immediate profits.

Company-Specific News and Events

Recent news and events surrounding XYZQ also played a role in its price fluctuation.

- Delayed Product Launch: A recent announcement of a slight delay in a key product launch may have spooked some investors.

- Increased Competition: The emergence of a strong competitor in the AI quantum computing space has introduced additional competitive pressure.

- Positive Research & Development Update: Conversely, a recent positive update regarding significant advancements in their R&D could potentially counteract some negative sentiments.

Analyzing the relative impact of these events requires careful consideration, understanding the long-term implications versus short-term market reactions. The delayed product launch, for example, while potentially disappointing, might not necessarily negate the company's long-term potential.

Technical Analysis of XYZQ's Price Action

A brief look at technical indicators suggests potential for a rebound.

- Support Levels: The stock price has found support at a key technical level, indicating potential resistance to further decline.

- Moving Averages: The 50-day moving average is approaching the 200-day moving average, a potential "golden cross" signaling a bullish trend reversal. (Illustrative chart would be inserted here)

While technical analysis shouldn't be the sole basis for investment decisions, these indicators, when considered alongside fundamental analysis, can provide valuable insight into potential short-term price movements.

Why XYZQ Could Be a Strong Long-Term Investment

Despite the current dip, XYZQ possesses several attributes that make it a compelling long-term investment.

The Potential of AI Quantum Computing

AI quantum computing represents a technological revolution with the potential to disrupt numerous industries.

- Drug Discovery and Development: Quantum computing can significantly accelerate drug discovery and development processes.

- Materials Science: Designing new materials with improved properties for various applications.

- Financial Modeling: Developing more accurate and efficient financial models for risk management and investment strategies.

XYZQ is uniquely positioned to benefit from this growth, leveraging its proprietary algorithms and cutting-edge technology.

XYZQ's Competitive Advantages

XYZQ holds several key competitive advantages:

- Strong Intellectual Property Portfolio: A robust patent portfolio protects its innovative technologies.

- Experienced Leadership Team: A team of highly skilled professionals with extensive experience in quantum computing and AI.

- Strategic Partnerships: Collaborations with leading research institutions and industry partners.

These advantages position XYZQ favorably against its competitors in the rapidly evolving AI quantum computing landscape.

XYZQ's Financial Health and Growth Prospects

While still a growth company, XYZQ demonstrates promising financial health and growth prospects.

- Strong Revenue Growth: Consistent year-over-year revenue growth, despite market headwinds.

- Strategic Investments in R&D: Significant investments in research and development, indicating a long-term commitment to innovation.

- Positive Future Projections: Analysts predict substantial revenue growth in the coming years.

These metrics suggest a strong foundation for long-term growth and return on investment.

Risk Assessment and Mitigation Strategies

Investing in XYZQ, or any AI quantum computing stock, carries inherent risks.

Potential Downsides and Risks

- Technological Hurdles: The technology is still in its early stages, and significant technological challenges remain.

- Intense Competition: The field is attracting significant investment and competition.

- Regulatory Uncertainty: Regulatory changes could impact the development and adoption of AI quantum computing technologies.

Diversification and Risk Management

To mitigate these risks:

- Diversify your portfolio: Don't put all your eggs in one basket. Invest in a diversified portfolio across different asset classes.

- Dollar-cost averaging: Invest a fixed amount of money at regular intervals, regardless of price fluctuations.

- Long-term investment horizon: Maintain a long-term perspective, allowing time for the technology and the company to mature.

By employing these strategies, investors can potentially reduce their exposure to the risks associated with investing in XYZQ.

Conclusion: Is This AI Quantum Computing Stock a Dip Buying Opportunity?

The current dip in XYZQ's stock price presents a complex scenario. While macroeconomic headwinds and company-specific news have contributed to the decline, the long-term potential of AI quantum computing and XYZQ's competitive advantages remain compelling. The risk is undeniably high, given the volatility of the sector, but the potential rewards could be equally significant. Considering the technical indicators suggesting a potential rebound and the company's strong fundamentals, we believe this dip might represent a strategic buying opportunity for long-term investors with a high risk tolerance. However, it's crucial to conduct thorough due diligence, consult with a financial advisor, and make investment decisions aligned with your personal risk profile. Consider investing in this promising AI quantum computing stock, but remember to carefully weigh the potential rewards against the inherent risks involved. Learn more about XYZQ and its potential for growth before making any investment decisions.

Featured Posts

-

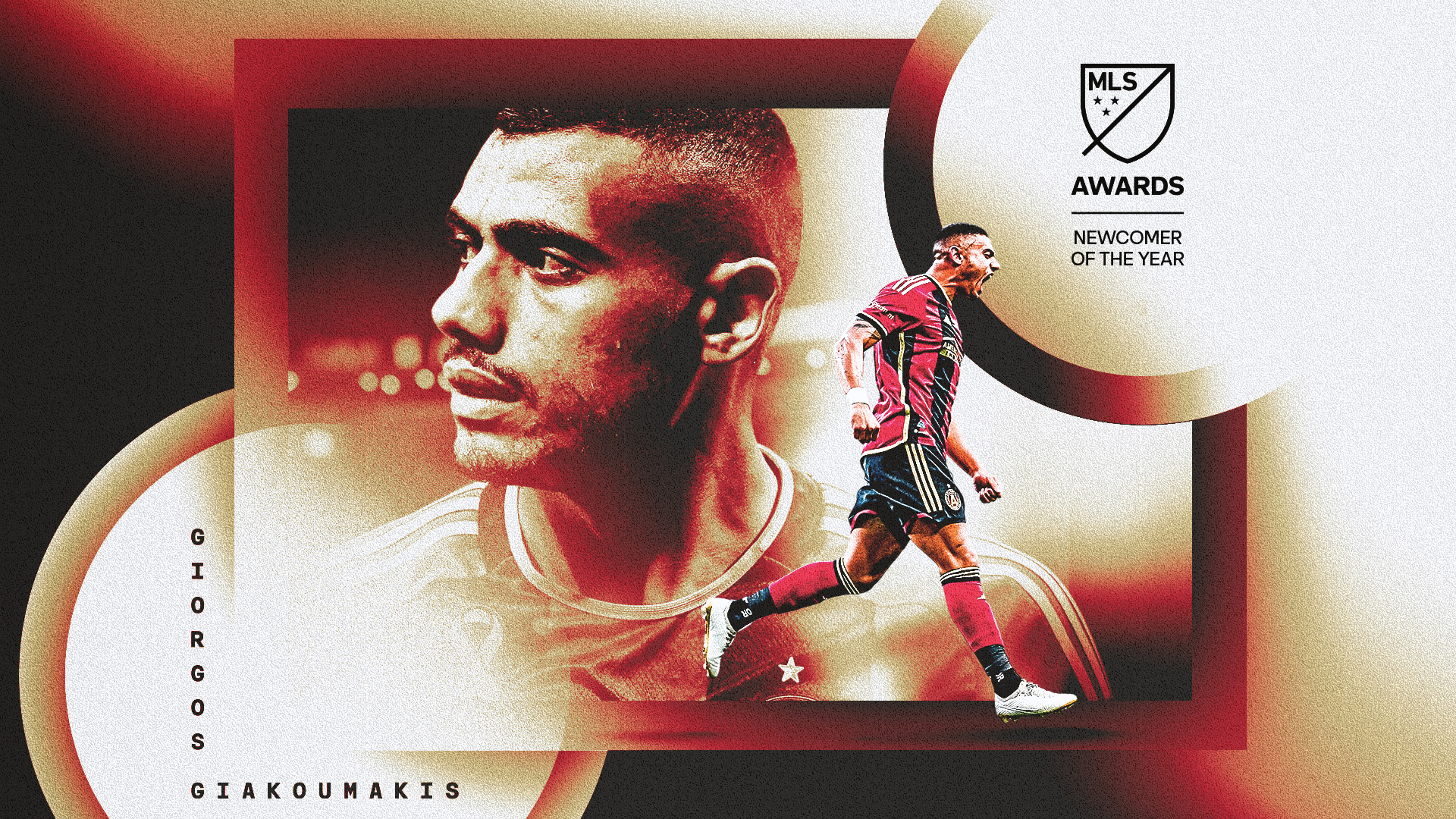

Giorgos Giakoumakis Diminished Mls Transfer Value A Deeper Look

May 20, 2025

Giorgos Giakoumakis Diminished Mls Transfer Value A Deeper Look

May 20, 2025 -

Trump Administration Aerospace Deals Big Promises Unclear Deliverables

May 20, 2025

Trump Administration Aerospace Deals Big Promises Unclear Deliverables

May 20, 2025 -

Suomi Ruotsi Naein Huuhkajien Avauskokoonpano Muuttuu

May 20, 2025

Suomi Ruotsi Naein Huuhkajien Avauskokoonpano Muuttuu

May 20, 2025 -

Ewdt Ajatha Krysty Bfdl Tqnyat Aldhkae Alastnaey

May 20, 2025

Ewdt Ajatha Krysty Bfdl Tqnyat Aldhkae Alastnaey

May 20, 2025 -

Commission Recommends End To Daily Canada Post Home Mail Delivery

May 20, 2025

Commission Recommends End To Daily Canada Post Home Mail Delivery

May 20, 2025