Thoma Bravo Acquires Boeing's Jeppesen Unit For $5.6 Billion

Table of Contents

Thoma Bravo's Strategic Acquisition: Why Jeppesen?

Thoma Bravo, known for its strategic investments in software and data companies, saw immense value in Jeppesen. This acquisition aligns perfectly with their investment strategy, focusing on high-growth sectors ripe for digital transformation.

Keywords: Thoma Bravo strategy, Jeppesen value, aviation data market, digital transformation, software solutions

-

Thoma Bravo's Focus: Thoma Bravo's history demonstrates a clear preference for companies leveraging data and software to improve operational efficiency. Jeppesen, a leader in aviation data and digital solutions, fits this profile perfectly. Their portfolio already includes several technology companies, and this acquisition further strengthens their technological expertise.

-

Jeppesen's Market Dominance: Jeppesen holds a dominant position in the aviation data market, providing critical navigation databases, flight planning software, and other essential tools for airlines, pilots, and air navigation service providers. Their extensive data assets represent a significant source of recurring revenue and future growth potential for Thoma Bravo.

-

Synergies and Portfolio Integration: The acquisition creates potential synergies with other companies within Thoma Bravo's portfolio. Integrating Jeppesen's technology could lead to cross-selling opportunities, enhanced product offerings, and improved operational efficiencies across their various investments.

-

Strengthening Market Presence: This acquisition significantly strengthens Thoma Bravo's presence in the technology-driven aviation market, giving them a foothold in a sector poised for continued growth driven by increasing digitalization and the demand for improved efficiency and safety.

Implications for the Aviation Industry

The Thoma Bravo acquisition of Jeppesen has wide-ranging implications for the aviation industry, affecting various stakeholders.

Keywords: Jeppesen impact, aviation industry, flight safety, navigation systems, competition, market disruption

-

Competitive Landscape: The acquisition could potentially alter the competitive landscape of the aviation data and navigation services market. Existing competitors may face increased pressure, leading to intensified innovation and potentially more competitive pricing.

-

Impact on Airlines, Pilots, and ANSPs: Airlines, pilots, and air navigation service providers (ANSPs) will be closely watching for any changes in service offerings, pricing, or technological advancements resulting from the acquisition. Improved technology and integration could lead to increased operational efficiency and enhanced flight safety.

-

Innovation and Flight Safety: Thoma Bravo's investment could stimulate innovation within Jeppesen, leading to improvements in flight safety and operational efficiency. Increased investment in research and development could result in more advanced navigation systems and data analytics tools.

-

Potential for Service Alterations: While immediate changes are unlikely, the acquisition could lead to changes in pricing structures, service packages, or the integration of new technologies. The long-term impact on service quality and accessibility remains to be seen.

The Future of Jeppesen Under Thoma Bravo's Ownership

The future trajectory of Jeppesen under Thoma Bravo's ownership is anticipated to be one of significant growth and technological advancement.

Keywords: Jeppesen future, Thoma Bravo plans, growth strategy, investment, innovation, technology upgrades

-

Growth and Development Plans: Thoma Bravo is likely to invest heavily in Jeppesen's growth and development, focusing on expanding its product offerings, enhancing its technological capabilities, and potentially pursuing acquisitions of complementary businesses.

-

R&D Investments: Expect significant investments in research and development to create next-generation navigation systems, enhance data analytics capabilities, and improve the overall user experience for pilots and air traffic controllers.

-

Synergies with Portfolio Companies: Integration with other Thoma Bravo portfolio companies in related sectors could unlock further synergies, resulting in the development of comprehensive solutions for the aviation industry.

-

Employee Impact: While job security remains uncertain in the short term, the long-term outlook suggests an environment focused on growth and expansion, potentially leading to new job opportunities and career advancement.

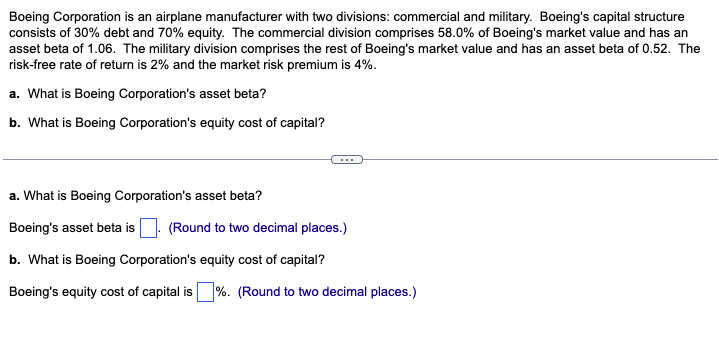

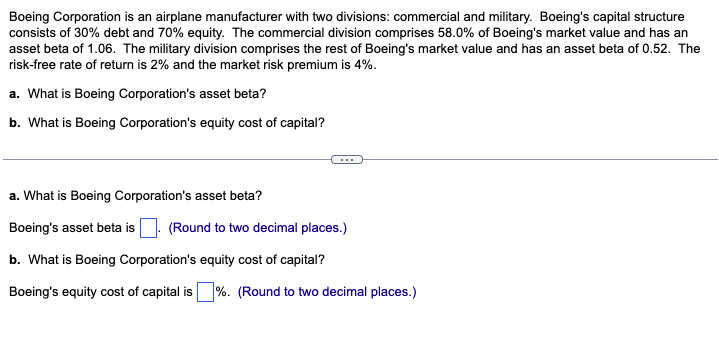

Financial Aspects of the Deal

The $5.6 billion acquisition of Jeppesen is a significant financial undertaking with implications for both Thoma Bravo and Boeing.

Keywords: $5.6 billion acquisition, financial details, deal structure, private equity funding, Boeing divestment

-

Financial Terms: The exact financial terms of the deal, including financing methods and specific purchase price details, may not be publicly disclosed entirely. However, the sheer size of the transaction highlights the value Thoma Bravo places on Jeppesen's assets and market position.

-

Boeing's Divestment Rationale: Boeing's decision to divest Jeppesen likely reflects a strategic shift towards focusing on its core aerospace businesses. This move allows Boeing to streamline its operations and allocate resources to its other key priorities.

-

Financial Benefits: The acquisition benefits Thoma Bravo by adding a high-growth, cash-generating asset to its portfolio. For Boeing, it provides a significant capital injection and allows them to concentrate on core competencies.

-

Regulatory Approvals: The deal will likely require regulatory approvals from various authorities to ensure compliance with antitrust laws and other relevant regulations. The completion of the acquisition hinges on receiving these necessary approvals.

Conclusion

The Thoma Bravo acquisition of Boeing's Jeppesen unit for $5.6 billion represents a watershed moment in the aviation industry. This deal underscores the increasing importance of aviation data and the power of private equity investment to fuel innovation and growth within this vital sector. The long-term impact of this acquisition will undoubtedly reshape the competitive landscape and drive advancements in flight safety and efficiency.

Call to Action: Stay informed on the latest developments in the aviation industry and the continuing impact of this major Thoma Bravo acquisition. Follow our blog for more insights into the future of Jeppesen and the broader aviation data market. Learn more about the Thoma Bravo acquisition and its significance for the future of aviation navigation.

Featured Posts

-

Boire Moins D Alcool Les Avantages De Dry January Et De La Tournee Minerale Pour Votre Sante

Apr 23, 2025

Boire Moins D Alcool Les Avantages De Dry January Et De La Tournee Minerale Pour Votre Sante

Apr 23, 2025 -

Hollywood Shut Down Double Strike Impacts Film And Television

Apr 23, 2025

Hollywood Shut Down Double Strike Impacts Film And Television

Apr 23, 2025 -

Auto Dealers Push Back Against Mandatory Electric Vehicle Sales

Apr 23, 2025

Auto Dealers Push Back Against Mandatory Electric Vehicle Sales

Apr 23, 2025 -

Exec Office365 Breach Crook Makes Millions Feds Say

Apr 23, 2025

Exec Office365 Breach Crook Makes Millions Feds Say

Apr 23, 2025 -

Emission Good Morning Business Du 24 Fevrier Points Cles Et Analyses

Apr 23, 2025

Emission Good Morning Business Du 24 Fevrier Points Cles Et Analyses

Apr 23, 2025