Three-Day Losing Streak: Amsterdam Stock Exchange In Freefall

Table of Contents

Impact of Global Economic Uncertainty on the AEX

The AEX's decline is inextricably linked to prevailing global economic uncertainty. Rising inflation, aggressive interest rate hikes by central banks worldwide, and escalating geopolitical instability have created a perfect storm for market volatility. The ongoing war in Ukraine, the persistent energy crisis, and growing recession fears all contributed significantly to the AEX's downward spiral.

- Rising Inflation: Soaring inflation rates erode purchasing power and dampen consumer spending, impacting corporate profits and investor confidence.

- Interest Rate Hikes: Central banks' efforts to curb inflation through interest rate hikes increase borrowing costs for businesses, potentially slowing economic growth and impacting investment decisions.

- Geopolitical Instability: The war in Ukraine and its ramifications, including energy supply disruptions and increased uncertainty, have negatively affected global markets, including the AEX.

- Recession Fears: Growing concerns about a potential global recession further fueled investor anxiety and triggered widespread selling in various sectors.

These global economic headwinds particularly affected specific sectors within the AEX. The energy sector, for example, experienced significant volatility due to fluctuating gas prices. Technology stocks also suffered, as investors became more risk-averse in anticipation of a potential economic slowdown. Financial institutions faced pressure due to concerns about increased loan defaults and reduced profitability. Keywords used in this section include: global economy, inflation, interest rates, recession, geopolitical risk, energy crisis.

Internal Factors Contributing to the AEX's Decline

While global factors played a dominant role, internal issues within the Dutch economy also exacerbated the AEX's decline. Several AEX-listed companies reported disappointing corporate earnings, further dampening investor sentiment. Furthermore, the announcement of significant bankruptcies in key sectors added to the negative market sentiment. Regulatory changes impacting certain industries also played a part.

- Disappointing Corporate Earnings: Several large Dutch companies released less-than-stellar earnings reports, underscoring the challenges faced by businesses in the current economic climate.

- Significant Bankruptcies: The failure of prominent companies further eroded confidence in the market, triggering a wave of panic selling.

- Regulatory Changes: New regulations in specific sectors introduced uncertainty and impacted the performance of related companies listed on the AEX.

Analyzing the performance of individual AEX-listed companies reveals a complex picture. While some companies weathered the storm relatively well, others suffered significant losses, contributing to the overall market decline. Keywords: Dutch economy, corporate earnings, bankruptcies, regulatory changes, AEX performance.

Investor Sentiment and Market Volatility

The three-day losing streak was characterized by a dramatic shift in investor sentiment. Panic selling became prevalent as investors sought to reduce their exposure to risk. Decreased investor confidence further fueled the downturn, creating a vicious cycle of selling pressure. Media coverage played a significant role, amplifying fears and influencing investor behavior. Negative news reports contributed to the overall sense of panic and market volatility.

- Panic Selling: Fearful investors rushed to sell their holdings, exacerbating the market's decline.

- Decreased Investor Confidence: The rapid drop in the AEX eroded trust in the market, leading to further selling.

- Media Influence: Negative media coverage amplified anxieties and contributed to the market's downward spiral. Keywords: investor sentiment, market volatility, panic selling, investor confidence, media influence.

Conclusion: Navigating the Amsterdam Stock Exchange Freefall

The AEX's three-day freefall resulted from a combination of global economic headwinds and internal factors within the Dutch economy. Rising inflation, interest rate hikes, geopolitical instability, disappointing corporate earnings, and bankruptcies all contributed to a significant market downturn with substantial investment losses. The impact on investors and the broader Dutch economy is considerable, demanding careful navigation in the coming weeks and months.

While the AEX's future remains uncertain, a cautious and data-driven approach is crucial. Stay informed about the Amsterdam Stock Exchange and its fluctuations by subscribing to reputable financial newsletters, diligently following financial news, and consulting with qualified financial advisors before making any investment decisions. Don't let this market downturn dictate rash choices; informed decisions are key to navigating the Amsterdam Stock Exchange successfully.

Featured Posts

-

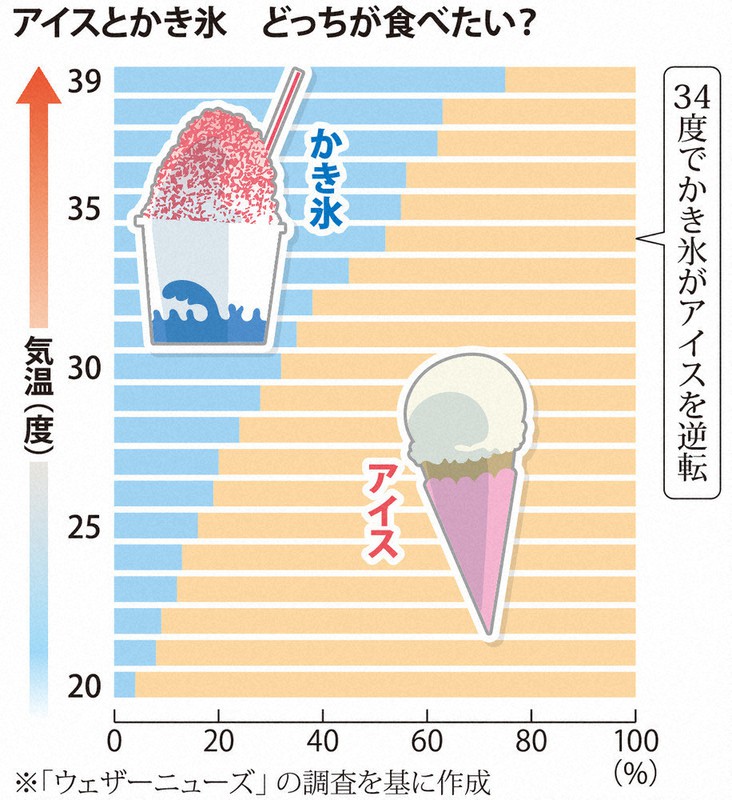

Ueberraschung In Essen Diese Eissorte Ist Der Nrw Favorit

May 24, 2025

Ueberraschung In Essen Diese Eissorte Ist Der Nrw Favorit

May 24, 2025 -

Analyzing The Net Asset Value Of The Amundi Msci World Ex Us Ucits Etf Acc

May 24, 2025

Analyzing The Net Asset Value Of The Amundi Msci World Ex Us Ucits Etf Acc

May 24, 2025 -

Lyudi Lyubyat Schekotat Nervy Fedor Lavrov O Pavle I Trillerakh I Refleksii

May 24, 2025

Lyudi Lyubyat Schekotat Nervy Fedor Lavrov O Pavle I Trillerakh I Refleksii

May 24, 2025 -

Us Band Hints At Glastonbury Performance Before Official Announcement

May 24, 2025

Us Band Hints At Glastonbury Performance Before Official Announcement

May 24, 2025 -

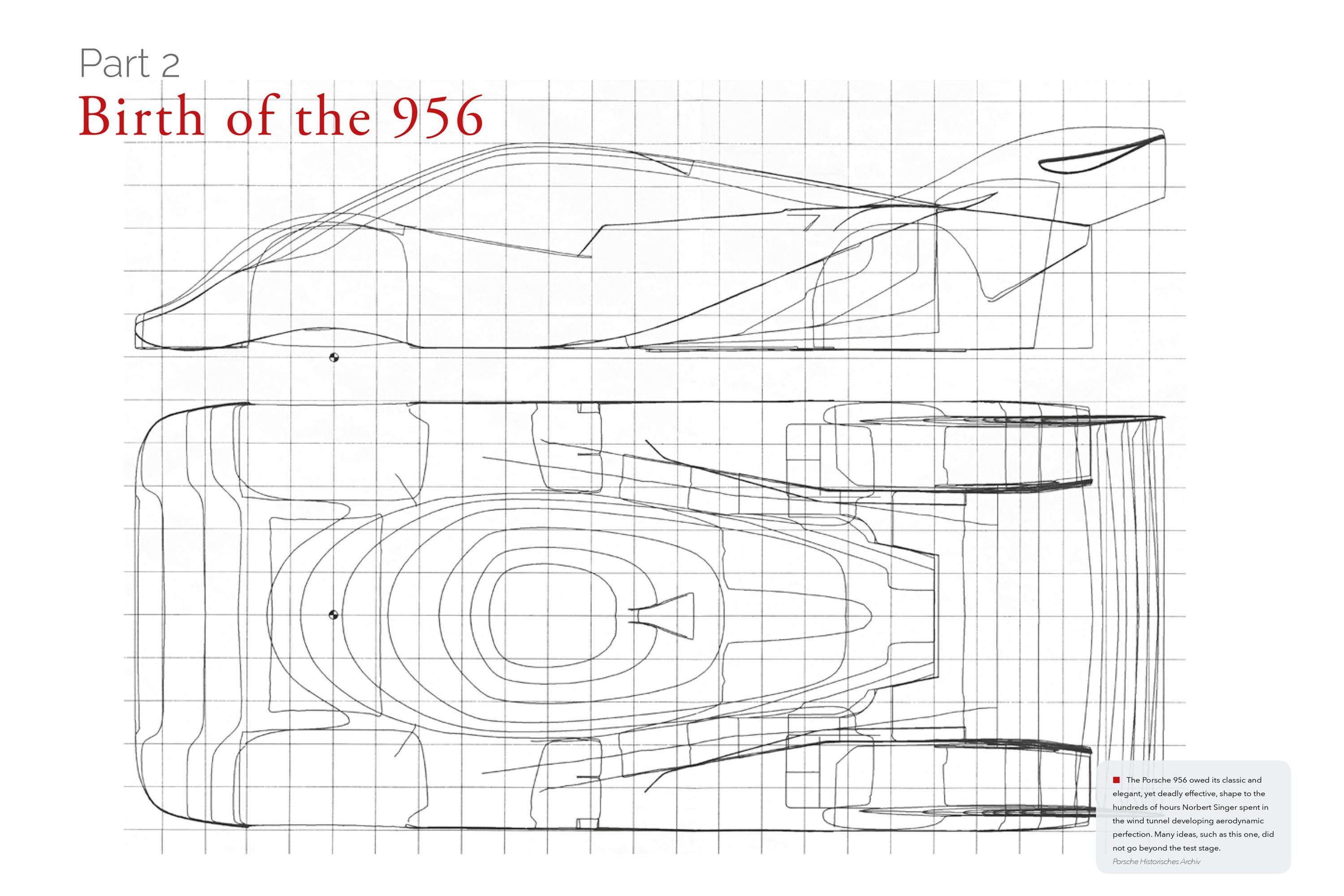

Porsche 956 Nin Asili Sergilenmesinin Arkasindaki Gercekler

May 24, 2025

Porsche 956 Nin Asili Sergilenmesinin Arkasindaki Gercekler

May 24, 2025

Latest Posts

-

Sean Penn Casts Doubt On Woody Allens Alleged Abuse Of Dylan Farrow

May 24, 2025

Sean Penn Casts Doubt On Woody Allens Alleged Abuse Of Dylan Farrow

May 24, 2025 -

Apples Future A 254 Price Target And What It Means For Investors

May 24, 2025

Apples Future A 254 Price Target And What It Means For Investors

May 24, 2025 -

Sean Penns Doubts On Woody Allen And Dylan Farrows Allegations

May 24, 2025

Sean Penns Doubts On Woody Allen And Dylan Farrows Allegations

May 24, 2025 -

Mia Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 24, 2025

Mia Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 24, 2025 -

Analysts Bold Prediction Apple Stock To Reach 254 Investment Advice

May 24, 2025

Analysts Bold Prediction Apple Stock To Reach 254 Investment Advice

May 24, 2025