Three More Rate Cuts Predicted By Desjardins For Bank Of Canada

Table of Contents

Desjardins' Rationale Behind the Rate Cut Prediction

Desjardins bases its prediction of three further Bank of Canada rate cuts on a careful analysis of several key economic indicators. The financial institution points to a confluence of factors suggesting a need for continued monetary easing.

-

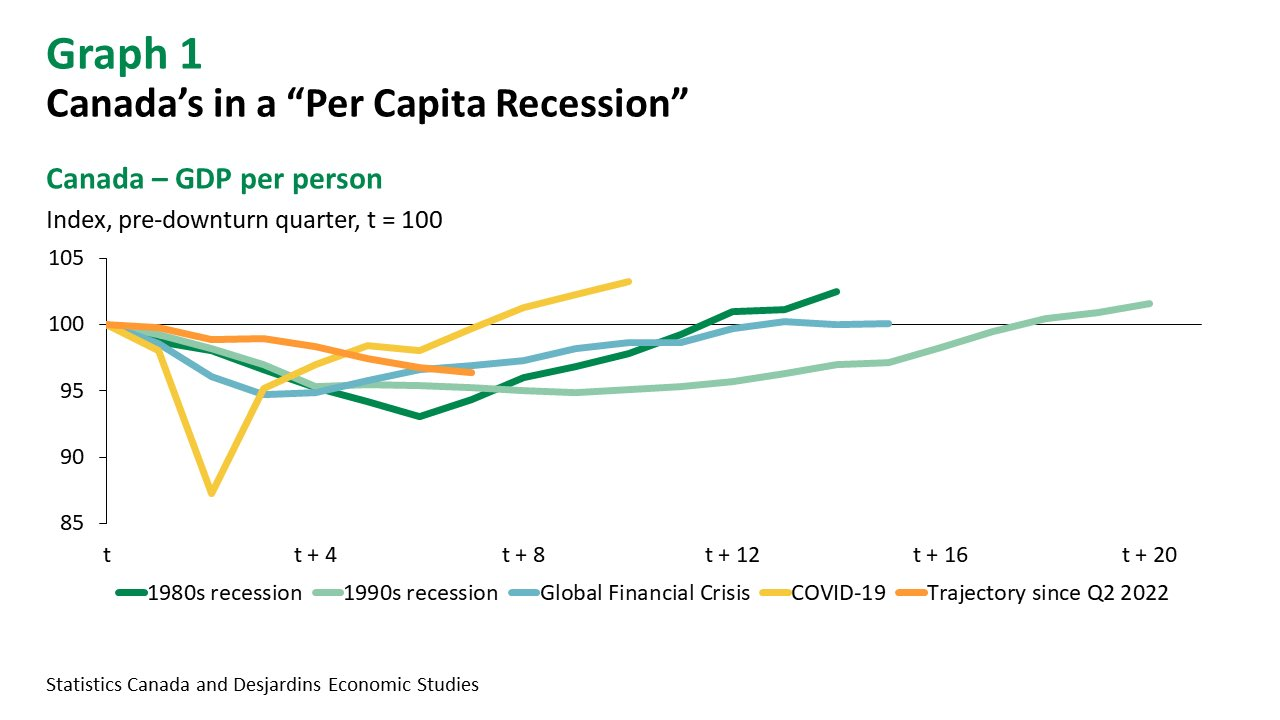

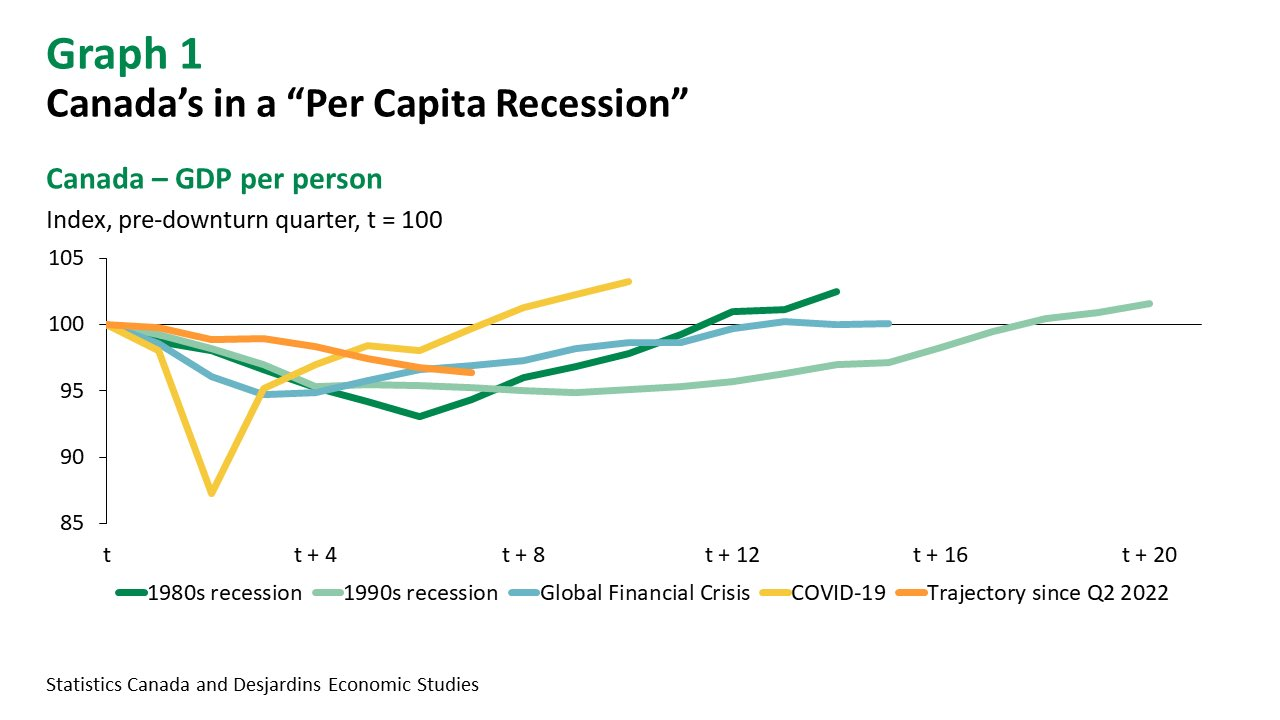

Slowing GDP Growth and Potential Recessionary Concerns: Recent GDP growth figures have shown a significant slowdown, raising concerns about a potential recession. Desjardins' analysis suggests this weakening growth is likely to persist, necessitating further intervention from the Bank of Canada. This is supported by falling business confidence and weakening consumer sentiment.

-

Easing Inflation, but Not Yet at the Bank of Canada's Target: While inflation has eased from its peak, it remains above the Bank of Canada's target range of 1-3%. Desjardins argues that further rate cuts are necessary to ensure inflation returns to the target level without triggering a sharp economic downturn. Their models suggest the current rate of decline in inflation isn't sufficient.

-

Concerns About the Housing Market and Consumer Spending: The Canadian housing market is showing signs of weakening, with reduced sales and price adjustments. This, combined with cautious consumer spending in response to high inflation and interest rates, paints a picture of subdued economic activity. Desjardins notes that lower interest rates could help stimulate both sectors.

-

Analysis of Global Economic Uncertainty: Global economic headwinds, including geopolitical instability and persistent supply chain disruptions, add to Desjardins' concerns. They believe these factors necessitate a more cautious approach to monetary policy, favouring further rate cuts to safeguard the Canadian economy.

Potential Impact of Further Rate Cuts on the Canadian Economy

The predicted three rate cuts would likely have a multifaceted impact on the Canadian economy, with both positive and negative consequences.

-

Lower Mortgage Rates and Increased Affordability for Homebuyers: Lower interest rates directly translate into lower mortgage payments, making homeownership more affordable for Canadians and potentially stimulating the housing market. This could help alleviate some of the pressure from recent increases in housing costs.

-

Reduced Borrowing Costs for Businesses, Potentially Stimulating Investment: Lower borrowing costs make it cheaper for businesses to access credit, potentially leading to increased investment in expansion, new equipment, and job creation. This could help boost economic growth in the longer term.

-

Potential Boost to Consumer Spending Due to Increased Disposable Income: Lower interest rates on credit cards and loans can free up disposable income for consumers, potentially leading to increased spending and economic activity. This can act as a catalyst for increased consumer confidence.

-

Risks Associated with Potentially Fueling Inflation Again: A downside risk is that further rate cuts could inadvertently reignite inflationary pressures. If consumer spending increases too sharply, it could drive up demand and put upward pressure on prices, negating the intended benefits of the rate cuts. This represents a delicate balancing act for the Bank of Canada.

Alternative Perspectives and Market Reactions

While Desjardins' prediction of three more Bank of Canada rate cuts is significant, it's not universally shared. Other economic forecasters hold varying perspectives, highlighting the complexity of predicting economic trends.

-

Summary of Views from Other Financial Institutions or Economists: Some analysts believe that inflation remains a more pressing concern than a potential recession, arguing against further rate cuts. They suggest waiting to see the full impact of existing rate changes before implementing additional easing.

-

Analysis of the Stock Market and Bond Market Responses: The stock and bond markets often reflect the prevailing sentiment towards future rate changes. A positive response might suggest confidence in the prediction, while a negative reaction could indicate skepticism. Monitoring these market movements is crucial in assessing the overall impact of the forecast.

-

Discussion of the Potential Impact on the Canadian Dollar: Further rate cuts could weaken the Canadian dollar relative to other currencies, potentially impacting imports and exports. This necessitates a careful evaluation of the potential impact on the trade balance.

Conclusion

Desjardins' prediction of three additional Bank of Canada rate cuts highlights the ongoing uncertainty surrounding the Canadian economy. The predicted rate cuts aim to stimulate economic growth by addressing slowing GDP growth, easing inflation (though still above target), and providing support to the housing market and consumer spending. However, potential risks exist, including the possibility of reigniting inflation. It's essential to monitor the views of other economic forecasters and market reactions to gain a more comprehensive understanding of the situation.

Stay updated on future Bank of Canada rate cuts and learn more about the impact of interest rate changes on the Canadian economy. Monitor our site for the latest analysis on Bank of Canada rate predictions to make informed financial decisions.

Featured Posts

-

Kermit The Frog Inspires University Of Maryland Graduates

May 23, 2025

Kermit The Frog Inspires University Of Maryland Graduates

May 23, 2025 -

Canada Posts New Offers Before Potential Strike

May 23, 2025

Canada Posts New Offers Before Potential Strike

May 23, 2025 -

Shooting Outside Jewish Museum In Washington Israeli Embassy Casualties

May 23, 2025

Shooting Outside Jewish Museum In Washington Israeli Embassy Casualties

May 23, 2025 -

Just In Time Jonathan Groffs Broadway Show And Its Tony Award Chances

May 23, 2025

Just In Time Jonathan Groffs Broadway Show And Its Tony Award Chances

May 23, 2025 -

Tutumlu Olmak Isteyenler Icin 3 Burc Oernegi

May 23, 2025

Tutumlu Olmak Isteyenler Icin 3 Burc Oernegi

May 23, 2025

Latest Posts

-

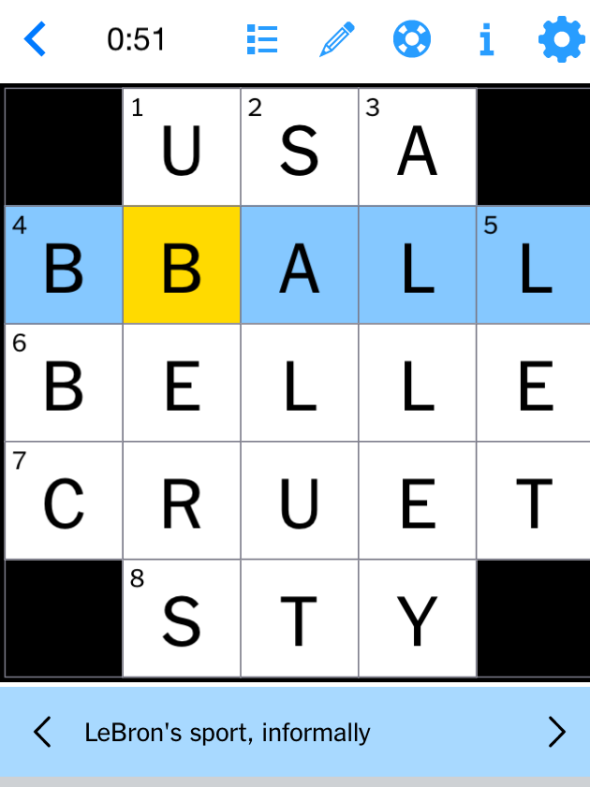

Nyt Mini Crossword Puzzle Solutions For March 3 2025

May 23, 2025

Nyt Mini Crossword Puzzle Solutions For March 3 2025

May 23, 2025 -

Solve The Nyt Mini Crossword Sunday May 11 Hints And Solutions

May 23, 2025

Solve The Nyt Mini Crossword Sunday May 11 Hints And Solutions

May 23, 2025 -

March 3 2025 Nyt Mini Crossword Solutions And Clues

May 23, 2025

March 3 2025 Nyt Mini Crossword Solutions And Clues

May 23, 2025 -

April 6 2025 Nyt Mini Crossword Puzzle Hints And Answers

May 23, 2025

April 6 2025 Nyt Mini Crossword Puzzle Hints And Answers

May 23, 2025 -

Nyt Mini Crossword Sunday May 11 Hints And Answers

May 23, 2025

Nyt Mini Crossword Sunday May 11 Hints And Answers

May 23, 2025