To Buy Or Not To Buy BigBear.ai Stock? A Data-Driven Approach

Table of Contents

Understanding BigBear.ai's Business Model and Financial Performance

BigBear.ai operates in the rapidly expanding fields of artificial intelligence (AI) and big data analytics, focusing primarily on providing advanced technology solutions to government and commercial clients. Understanding their business model and financial health is crucial to evaluating BigBear.ai stock.

Revenue Streams and Growth Potential

BigBear.ai's revenue is derived from a mix of government contracts and commercial clients. Government contracts represent a significant portion of their revenue, focusing on areas like national security and defense. Their commercial clients span various sectors, leveraging BigBear.ai's AI and data analytics capabilities for improved efficiency and decision-making. The company has demonstrated a fluctuating growth trajectory, influenced by the size and timing of large government contracts. Analyzing their year-over-year revenue growth is essential for assessing their long-term potential.

- Breakdown of revenue by sector: Government (approximately X%), Commercial (approximately Y%). (Note: Replace X and Y with actual percentages from financial reports)

- Projected revenue growth for the next few years: While specific projections are inherently uncertain, analysts [cite source] forecast a [percentage]% average annual growth rate over the next three years, driven by [mention key growth drivers].

- Key contracts and their impact on revenue: Securing major government contracts like [mention specific contract names if available] significantly impacts BigBear.ai’s revenue stream, providing short-term stability but introducing reliance on these large deals.

Profitability and Financial Health

BigBear.ai's profitability is a key factor in evaluating BigBear.ai stock. Examining their net income, operating margins, balance sheet, and key financial ratios provides a deeper understanding of their financial health. A detailed analysis of their debt levels, cash flow, and price-to-earnings ratio (P/E ratio) is necessary to assess the company's long-term sustainability and compare it with industry peers.

- Comparison of key financial metrics to industry peers: BigBear.ai's P/E ratio of [insert current P/E ratio] compares to [insert P/E ratios of competitors], suggesting [insert interpretation – e.g., undervaluation, overvaluation, or alignment with industry averages].

- Assessment of the company’s long-term financial sustainability: Based on their current financial performance and growth trajectory, BigBear.ai's long-term financial sustainability appears [insert assessment – e.g., strong, moderate, weak, etc.]. This assessment requires careful consideration of their dependence on government contracts.

- Discussion of any potential risks related to financial performance: Fluctuations in government spending and the competitive nature of the AI and data analytics market pose significant risks to BigBear.ai's financial performance.

Evaluating BigBear.ai's Competitive Landscape and Market Position

BigBear.ai operates in a dynamic and competitive market. Analyzing its position within this landscape is crucial to evaluating BigBear.ai stock.

Key Competitors and Market Share

BigBear.ai faces competition from established players and emerging startups in the AI and big data analytics market. Understanding their competitive advantages is vital. Key competitors include [list key competitors, e.g., Palantir, Booz Allen Hamilton]. A thorough comparison of their strengths and weaknesses relative to BigBear.ai is necessary to determine their market share and growth potential.

- List of key competitors with brief descriptions: [Provide a concise description of each competitor and their market focus.]

- Market share comparison: While precise market share data may be difficult to obtain, an estimate based on [mention sources, e.g., industry reports, financial statements] suggests BigBear.ai holds approximately [percentage]% of the [specify market segment] market.

- Analysis of BigBear.ai's competitive advantages: BigBear.ai's competitive advantages include [mention specific advantages like expertise in specific AI algorithms, strong government relationships, innovative technologies].

Industry Trends and Future Outlook

The AI and big data analytics market is experiencing rapid growth and technological advancements. Understanding these industry trends and their potential impact on BigBear.ai is crucial.

- Discussion of emerging technologies and their potential impact: The rise of [mention relevant technologies like generative AI, quantum computing] could either pose threats or create opportunities for BigBear.ai.

- Analysis of government regulations and their effect on the industry: Government regulations regarding data privacy and security significantly influence the AI and data analytics market and could affect BigBear.ai's operations.

- Assessment of the long-term growth potential of the AI and big data market: The long-term growth prospects for the AI and big data market remain exceptionally strong, presenting substantial opportunities for BigBear.ai, but also increasing competition.

Assessing the Risks and Rewards of Investing in BigBear.ai Stock

Investing in BigBear.ai stock presents both potential risks and rewards. A balanced assessment of both is crucial for informed decision-making.

Potential Risks

Investing in BigBear.ai stock involves several inherent risks. The company's reliance on government contracts introduces volatility due to fluctuating government budgets and procurement cycles. Competition from established and emerging players also presents a challenge. Financial performance and market volatility also contribute to the risk profile.

- Detailed explanation of each identified risk: [Explain each risk in detail, including its potential impact on the company's performance and stock price.]

- Assessment of the likelihood and potential impact of each risk: [Assess the probability and potential severity of each identified risk.]

- Mitigation strategies (if any) to address the identified risks: [Discuss any strategies BigBear.ai might employ to mitigate these risks – e.g., diversification of clients, innovation in technology.]

Potential Rewards

Despite the inherent risks, investing in BigBear.ai stock also presents significant potential rewards. The company's focus on cutting-edge AI and data analytics technologies positions it for growth in a rapidly expanding market. Long-term growth in the AI market offers substantial upside potential.

- Potential return on investment (ROI) scenarios: While predicting ROI is impossible, different scenarios considering varying growth rates can be modeled to illustrate potential returns.

- Discussion of the company’s growth prospects and future potential: BigBear.ai's growth prospects are tied to its ability to secure new contracts, develop innovative technologies, and adapt to the evolving competitive landscape.

- Potential benefits of long-term investment in the company: A long-term investment in BigBear.ai could yield significant returns if the company successfully capitalizes on the growing demand for AI and big data solutions.

Conclusion: Should You Buy BigBear.ai Stock? A Final Verdict

This data-driven analysis of BigBear.ai stock reveals a company operating in a high-growth market with significant potential but also facing considerable risks. The company's dependence on government contracts and the competitive landscape require careful consideration. Based on the available data, a decision to invest in BigBear.ai stock should be made cautiously, acknowledging the potential for both substantial gains and significant losses.

Ultimately, the decision of whether to buy BigBear.ai stock depends on your individual risk tolerance, investment horizon, and financial goals. We strongly recommend conducting thorough independent research, including reviewing BigBear.ai's financial statements, industry analyses, and consulting with a financial advisor before making any investment decisions regarding BigBear.ai shares or any other investment. Remember, this article is for informational purposes only and does not constitute financial advice. Consider all the factors discussed above before deciding whether to pursue a BigBear.ai investment.

Featured Posts

-

Michael Strahans Interview Strategy Winning In The Ratings War

May 20, 2025

Michael Strahans Interview Strategy Winning In The Ratings War

May 20, 2025 -

Post La Fire Housing Crisis Landlords Accused Of Exploitative Practices

May 20, 2025

Post La Fire Housing Crisis Landlords Accused Of Exploitative Practices

May 20, 2025 -

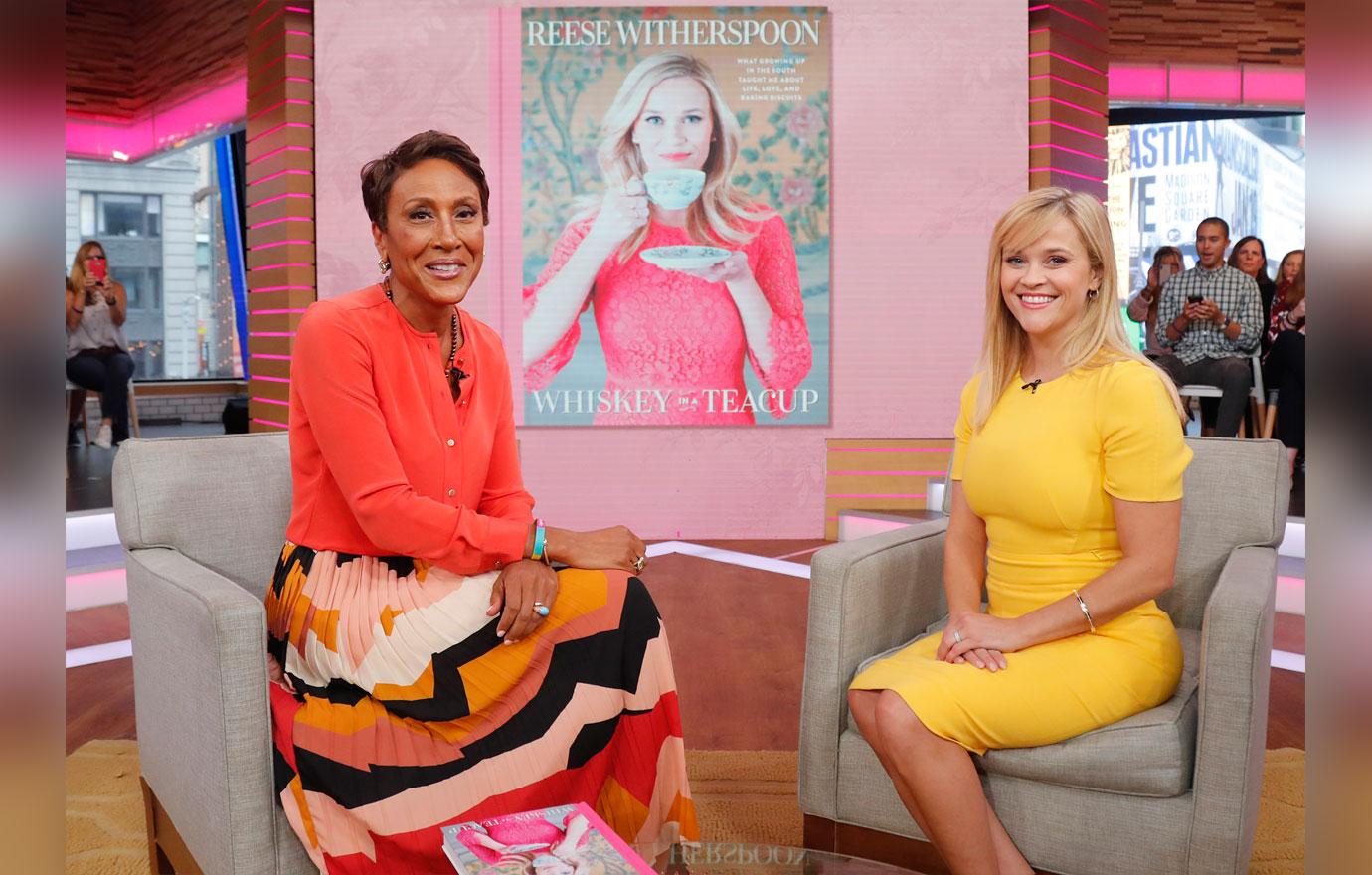

Robin Roberts Welcomes New Family Member On Good Morning America

May 20, 2025

Robin Roberts Welcomes New Family Member On Good Morning America

May 20, 2025 -

Hamilton Leclerc Crash Impact On Ferraris Chinese Gp

May 20, 2025

Hamilton Leclerc Crash Impact On Ferraris Chinese Gp

May 20, 2025 -

Raw Results May 19 2025 Wwe Winners Grades And Recap

May 20, 2025

Raw Results May 19 2025 Wwe Winners Grades And Recap

May 20, 2025