To Buy Or Not To Buy Palantir Stock Before May 5th: A Detailed Look

Table of Contents

Palantir's Recent Financial Performance and Future Projections

Q4 2022 Earnings Report Analysis

Palantir's Q4 2022 earnings report offered a mixed bag for investors. While the company exceeded revenue expectations, profitability remained a concern. Let's break down the key figures:

- Revenue: [Insert actual Q4 2022 revenue figure]. This represents a [percentage]% increase/decrease compared to Q4 2021.

- Earnings Per Share (EPS): [Insert actual Q4 2022 EPS figure]. This is [higher/lower] than analyst expectations.

- Operating Margin: [Insert actual Q4 2022 operating margin figure]. This indicates [positive/negative] progress in profitability.

Analyst ratings following the report were varied, with some maintaining a "buy" rating while others expressed concerns about the company's path to profitability. Price targets ranged from [lowest price target] to [highest price target], reflecting the uncertainty surrounding Palantir stock. The impact of the earnings report on the stock price was initially [positive/negative], but the long-term effects remain to be seen.

Growth Prospects and Market Opportunity

Palantir operates in two key markets: government contracting and commercial. The government sector provides a stable revenue stream, while the commercial sector offers significant growth potential. Future growth drivers include:

- Expansion into AI and data analytics: Palantir is actively developing AI-powered solutions to enhance its offerings.

- Strategic partnerships: Collaborations with major technology companies and government agencies are crucial for expansion.

- New product launches: [Mention any planned product launches and their potential market impact].

The competitive landscape is fierce, with established players and emerging startups vying for market share. However, Palantir possesses several competitive advantages: its strong reputation for data security, its proprietary software platforms, and its deep relationships within the government sector.

Upcoming Events and Catalysts Affecting Palantir Stock Before May 5th

Significant Company Announcements (if any)

[This section should be updated with any significant announcements expected before May 5th. For example:] * "Palantir is expected to announce a new partnership with [Company Name] on [Date], potentially boosting investor confidence and driving up Palantir stock prices." * "An investor call is scheduled for [Date], where management will likely discuss Q1 2023 performance and future outlook." These are hypothetical examples and should be replaced with actual, confirmed information.

Macroeconomic Factors and Market Sentiment

The broader macroeconomic environment will significantly influence Palantir stock. Factors to consider include:

- Interest rate hikes: Rising interest rates can impact investor sentiment towards growth stocks like Palantir.

- Inflation: High inflation erodes purchasing power and can lead to reduced spending on software solutions.

- Recessionary fears: A potential recession could dampen demand for Palantir's products, particularly in the commercial sector.

- Market sentiment towards technology stocks: The overall market sentiment towards tech companies plays a crucial role in Palantir's stock performance.

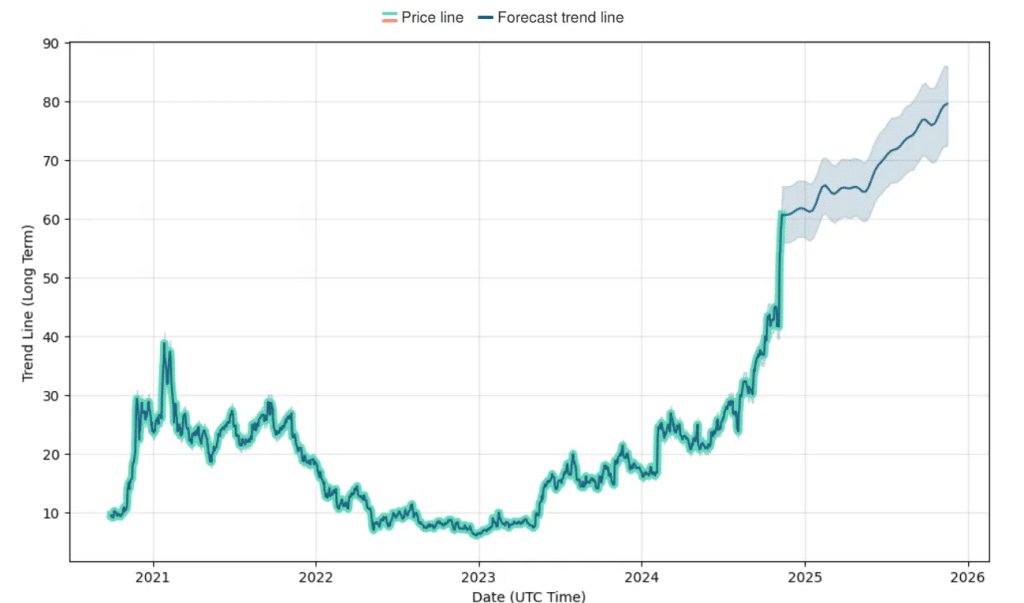

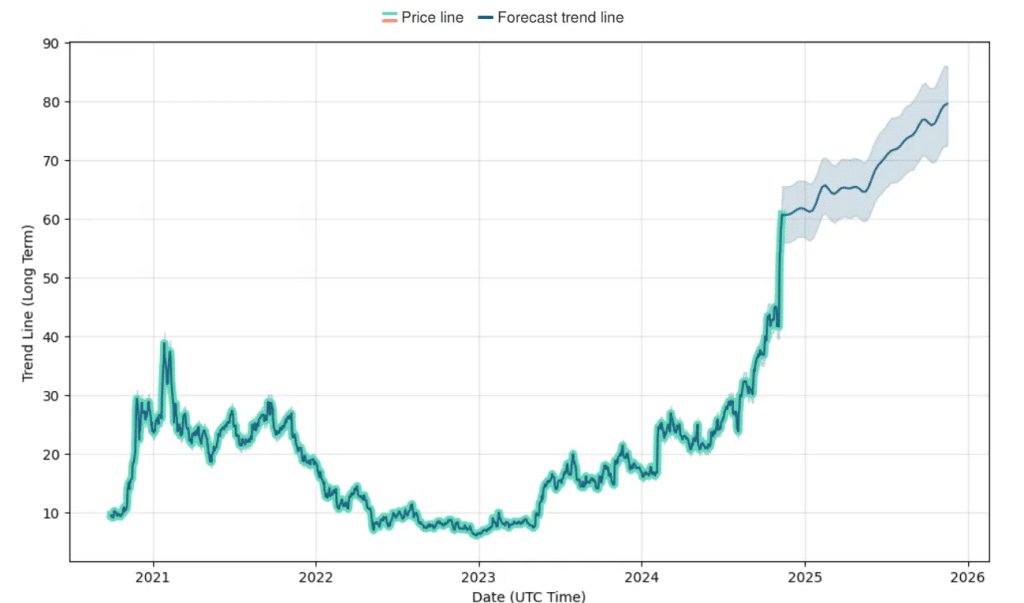

Technical Analysis of Palantir Stock Chart

[This section would ideally include a chart showing recent price movements, support and resistance levels, and any discernible patterns. Describe chart patterns (e.g., head and shoulders, flags, triangles) and their potential implications for the price of Palantir stock. Include disclaimers about the limitations of technical analysis.]

Risks and Considerations Before Investing in Palantir Stock

Valuation Concerns

Palantir's current valuation is a key consideration. Comparing its price-to-sales ratio (P/S) to its competitors and historical performance is essential to determine whether it is overvalued or undervalued.

- P/S ratio: [Insert Palantir's current P/S ratio and compare it to industry averages].

- Historical performance: Analyze Palantir's stock price performance over the past few years to understand its volatility and growth trajectory.

Dependence on Government Contracts

A significant portion of Palantir's revenue comes from government contracts. This dependence presents risks:

- Contract delays: Delays in contract awards can negatively impact revenue.

- Contract cancellations: Cancellation of contracts can severely impact Palantir's financial performance.

- Government budget constraints: Changes in government spending can affect future contract awards.

Competition and Market Saturation

The data analytics and government contracting markets are highly competitive. Palantir faces competition from established players and emerging startups. Analyzing the competitive landscape and understanding Palantir's competitive advantages is crucial before investing in PLTR stock.

Conclusion

Deciding whether to buy Palantir stock before May 5th requires a careful assessment of its recent financial performance, upcoming events, and the inherent risks. While Palantir demonstrates potential for growth in the AI and data analytics sectors, its reliance on government contracts and the volatile nature of the technology market present significant challenges. The macroeconomic environment and investor sentiment will also play a vital role in determining the future trajectory of Palantir shares. Make an informed decision about whether to buy Palantir stock before May 5th by carefully considering the factors discussed in this article. Remember to conduct your own thorough due diligence before making any investment choices regarding Palantir stock or any other stock. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

New Strategy From Edmonton Unlimited Scaling Tech Innovation Globally

May 10, 2025

New Strategy From Edmonton Unlimited Scaling Tech Innovation Globally

May 10, 2025 -

Novoe Oboronnoe Soglashenie Frantsiya I Polsha Ukreplyayut Pozitsii V Evrope

May 10, 2025

Novoe Oboronnoe Soglashenie Frantsiya I Polsha Ukreplyayut Pozitsii V Evrope

May 10, 2025 -

Dakota Johnson With Family At Los Angeles Materialist Screening

May 10, 2025

Dakota Johnson With Family At Los Angeles Materialist Screening

May 10, 2025 -

Dakota Johnson Kraujingos Plintos Nuotraukos Kas Nutiko

May 10, 2025

Dakota Johnson Kraujingos Plintos Nuotraukos Kas Nutiko

May 10, 2025 -

Nottingham Attacks Survivors Break Silence Detailing The Events

May 10, 2025

Nottingham Attacks Survivors Break Silence Detailing The Events

May 10, 2025