To Buy Or Not To Buy Palantir Stock Before May 5th: A Wall Street Perspective

Table of Contents

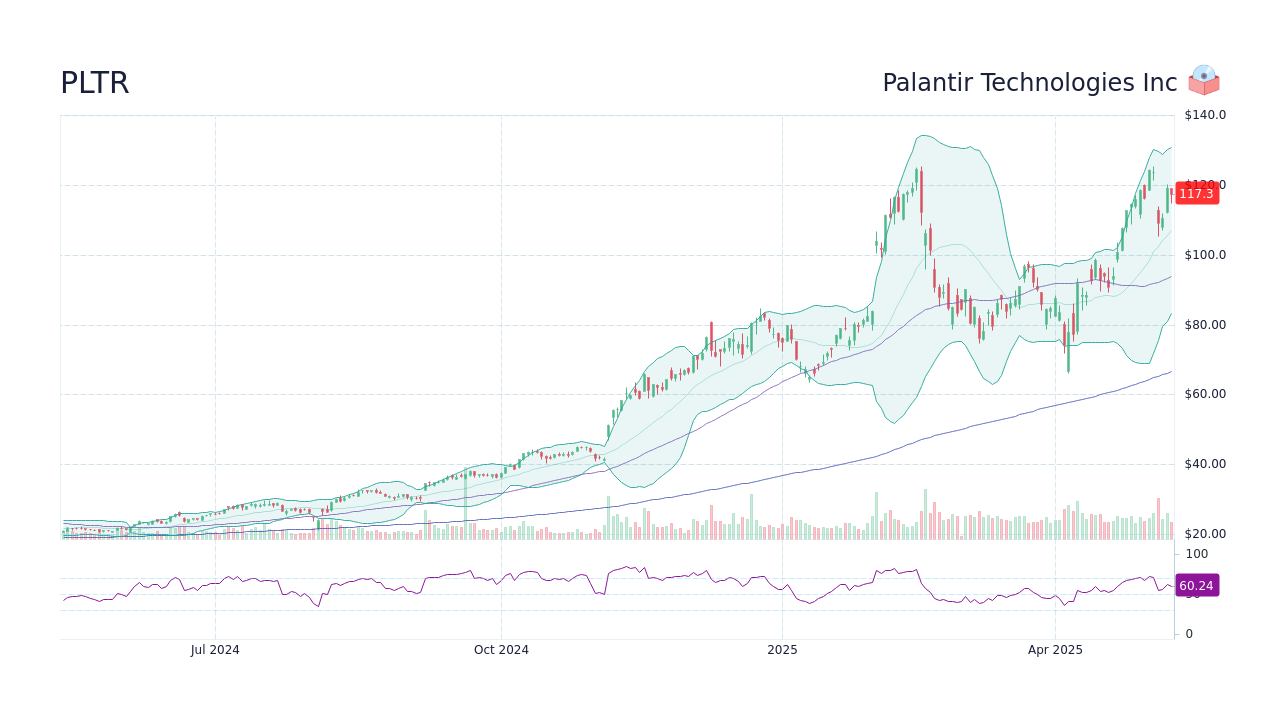

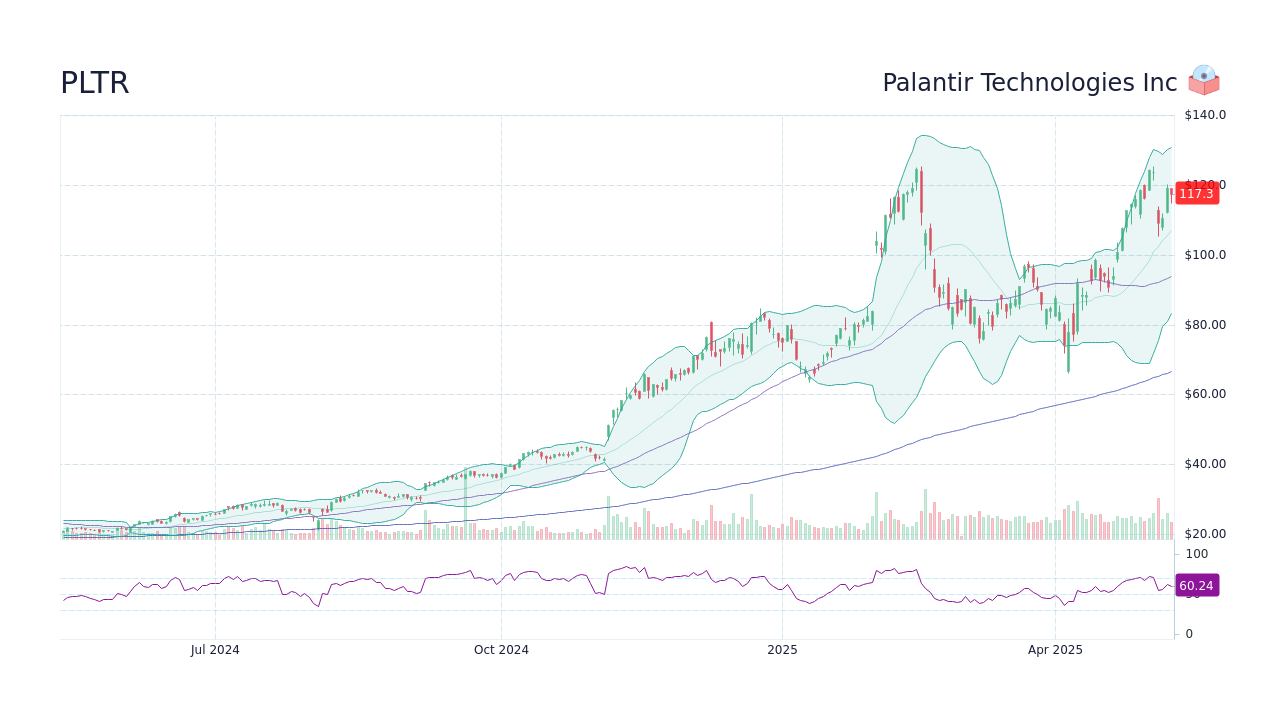

Palantir's Recent Performance and Market Sentiment

Leading up to May 5th, Palantir's stock performance has shown [insert actual data on stock performance here, e.g., a percentage change over the last few months, highlighting significant highs and lows]. This volatility reflects the broader uncertainty surrounding the company's future growth and profitability. Understanding the current market sentiment is crucial for making informed investment decisions.

- Analyst Ratings and Price Targets: Recent analyst ratings for PLTR have been [insert summary of analyst ratings – buy, hold, sell recommendations and average price targets]. This divergence of opinions highlights the uncertainty surrounding the stock's future performance.

- Market Sentiment: The overall market sentiment towards Palantir and the broader tech sector is currently [insert description of market sentiment – bullish, bearish, or neutral, supporting with relevant market indices or news]. This broader context influences investor behavior and can impact Palantir's stock price.

- Recent Partnerships and Contracts: Palantir has recently [mention any significant partnerships or contracts secured, highlighting their potential impact on revenue and future growth]. These developments can significantly influence investor confidence and stock valuation.

- Key Risks and Uncertainties: Investors should be aware of key risks, such as [mention key risks, e.g., competition, reliance on government contracts, regulatory hurdles, and potential for slower-than-expected revenue growth]. A thorough understanding of these risks is paramount before making any investment decisions.

Analyzing Palantir's Upcoming Earnings Report (May 5th)

The May 5th earnings report is a crucial event for Palantir investors. The results will significantly impact the stock price, potentially triggering substantial market reactions.

- Key Metrics to Watch: Investors will closely scrutinize key metrics including revenue growth, operating margins, customer acquisition cost, and the overall guidance for the coming quarters. Strong performance in these areas could boost investor confidence.

- Market Reactions to Earnings: A positive earnings surprise (exceeding analyst expectations) could lead to a significant price increase, while a negative surprise could trigger a sell-off. Understanding the potential range of market reactions is key to formulating a trading strategy.

- Impact of Guidance: Palantir's guidance for future quarters will be particularly crucial. Positive guidance suggesting strong future growth will likely boost investor sentiment, while negative or cautious guidance could lead to a decline in the stock price.

- Potential Catalysts: Several factors could influence the stock price beyond the earnings report itself. These include potential new product launches, strategic acquisitions, or announcements of major new contracts. Keeping an eye on these potential catalysts is important.

Government Contracts and Revenue Diversification

Palantir's revenue stream has historically relied significantly on government contracts. This presents both opportunities and risks for investors.

- Stability of Government Contracts: Government contracts offer a degree of stability and predictability. However, they are often subject to lengthy procurement processes and potential budget constraints.

- Commercial Sector Diversification: Palantir's efforts to diversify into the commercial sector are critical for long-term growth. Progress in this area will be a key indicator for investors.

- Risks of Over-Reliance: Over-dependence on a single revenue source always carries substantial risk. A decline in government spending or a failure to secure new contracts could significantly impact Palantir's revenue and profitability.

Competitive Landscape and Technological Innovation

Palantir operates in a competitive landscape of big data analytics and AI companies. Its ability to maintain a competitive edge will be a key factor driving its future performance.

- Key Competitors: Palantir competes with established players such as [list key competitors and briefly describe their strengths and weaknesses]. Understanding the competitive dynamics is crucial.

- Innovation Pipeline: Palantir's investments in research and development are vital for staying ahead of the competition. The company's innovation pipeline and potential for disruptive technologies will significantly influence its long-term prospects.

- Impact of Emerging Technologies: The rapid evolution of AI and big data technologies poses both opportunities and challenges. Palantir's ability to adapt and leverage emerging technologies will determine its success.

Valuation and Investment Strategy

Determining Palantir's fair value is crucial for investors. Various valuation metrics can be employed, providing different perspectives.

- Key Valuation Metrics: Analyzing Palantir's price-to-earnings ratio (P/E), price-to-sales ratio (P/S), and other relevant metrics provides insights into its current valuation relative to its peers and historical trends.

- Investment Strategies: Investors may choose a long-term buy-and-hold strategy, betting on Palantir's growth potential, or a short-term trading strategy, attempting to profit from price fluctuations.

- Potential Entry and Exit Points: Technical and fundamental analysis can help identify potential entry and exit points for different investment strategies. However, it's crucial to remember that no investment strategy guarantees success.

- Risk Management and Diversification: Diversifying your investment portfolio to reduce risk is always recommended. Never invest more than you can afford to lose in any single stock.

Conclusion

The decision to buy, sell, or hold Palantir stock before May 5th requires careful consideration of several factors. While Palantir's potential in the big data and AI markets is significant, its reliance on government contracts and competitive pressures present challenges. Thorough analysis of the upcoming earnings report, the competitive landscape, and the company's long-term strategy is crucial. Remember to conduct your own research and consult a financial advisor before making any investment decisions. Only invest in Palantir stock if it aligns with your individual risk tolerance and financial goals. Monitor the Palantir stock price closely after the May 5th earnings report to adjust your investment strategy if needed.

Featured Posts

-

Singer Wynne Evans Reveals Health Battle Hints At Stage Return

May 10, 2025

Singer Wynne Evans Reveals Health Battle Hints At Stage Return

May 10, 2025 -

Palantir Technologies Should You Buy Before May 5th A Detailed Look At The Stock

May 10, 2025

Palantir Technologies Should You Buy Before May 5th A Detailed Look At The Stock

May 10, 2025 -

Trumps Houthi Truce Shippers Remain Wary

May 10, 2025

Trumps Houthi Truce Shippers Remain Wary

May 10, 2025 -

Rising Tensions A Uk City Grapples With A Surge In Caravan Dwellers

May 10, 2025

Rising Tensions A Uk City Grapples With A Surge In Caravan Dwellers

May 10, 2025 -

Edmonton School Construction 14 Projects On The Fast Track

May 10, 2025

Edmonton School Construction 14 Projects On The Fast Track

May 10, 2025