Today's Best Personal Loan Interest Rates: Compare & Save (Under 6%)

Table of Contents

Understanding Personal Loan Interest Rates

Understanding personal loan interest rates is crucial for making informed financial decisions. The interest rate is the cost of borrowing money, expressed as a percentage of the loan amount. A lower personal loan interest rate means you'll pay less overall. Two key terms to grasp are:

- APR (Annual Percentage Rate): This represents the total cost of borrowing, including the interest rate and any fees. Always compare APRs when comparing different loan offers, not just the stated interest rate.

- Fixed vs. Variable Rates: A fixed interest rate remains the same throughout the loan term, providing predictability in your monthly payments. A variable rate fluctuates based on market conditions, potentially leading to higher or lower payments over time.

Several factors influence your personal loan interest rates:

-

Credit Score: Your credit score is a major determinant. A higher credit score (generally above 700) typically qualifies you for lower personal loan interest rates. Lenders view individuals with a strong credit history as less risky.

-

Loan Amount: Larger loan amounts often come with slightly higher interest rates, as they represent a greater risk for lenders.

-

Loan Term: The length of your loan (e.g., 36 months, 60 months) affects your monthly payments and the total interest paid. Shorter terms mean higher monthly payments but lower overall interest, while longer terms mean lower monthly payments but higher overall interest.

-

Lender Type: Different lenders—banks, credit unions, and online lenders—have varying lending criteria and interest rate structures. Credit unions often offer more competitive rates to their members.

-

Bullet points:

- Higher credit score = lower interest rate.

- Shorter loan terms generally mean higher monthly payments but lower overall interest.

- Different lenders offer varying rates. Shop around!

Finding the Best Personal Loan Interest Rates (Under 6%)

Securing a personal loan with an interest rate under 6% requires diligent comparison shopping. Here's how to find the best deals:

- Compare Offers from Multiple Lenders: Don't settle for the first offer you receive. Compare rates, fees, and terms from several banks, credit unions, and online lenders.

- Use Online Comparison Tools: Many websites allow you to compare personal loan interest rates from various lenders simultaneously, saving you time and effort. These tools often provide pre-qualification options that won't impact your credit score.

- Check Pre-qualification Offers: Many lenders offer pre-qualification, which lets you see what interest rate you might qualify for without a formal credit check. This is a great way to shop around without affecting your credit score.

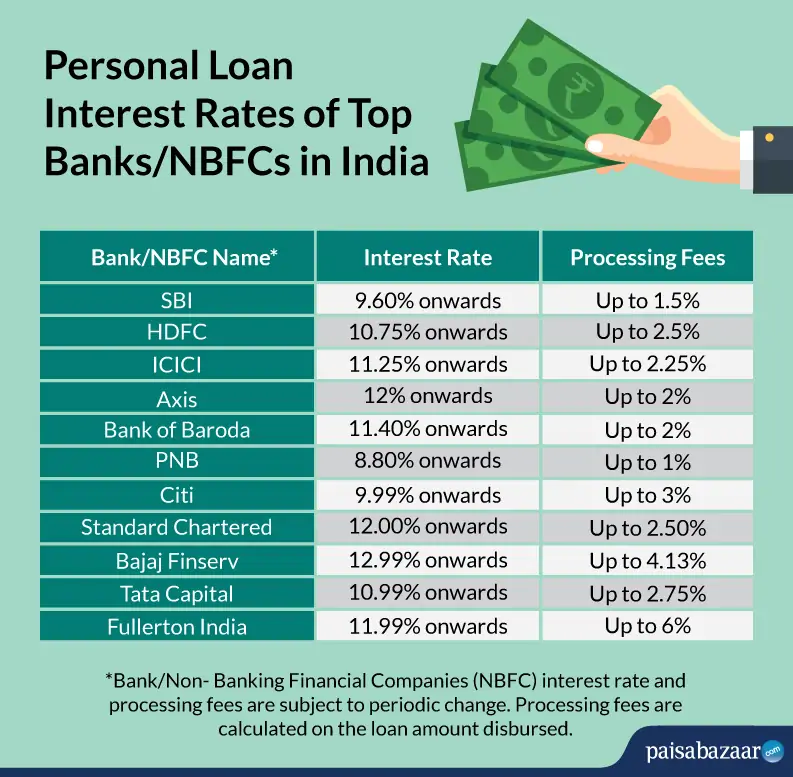

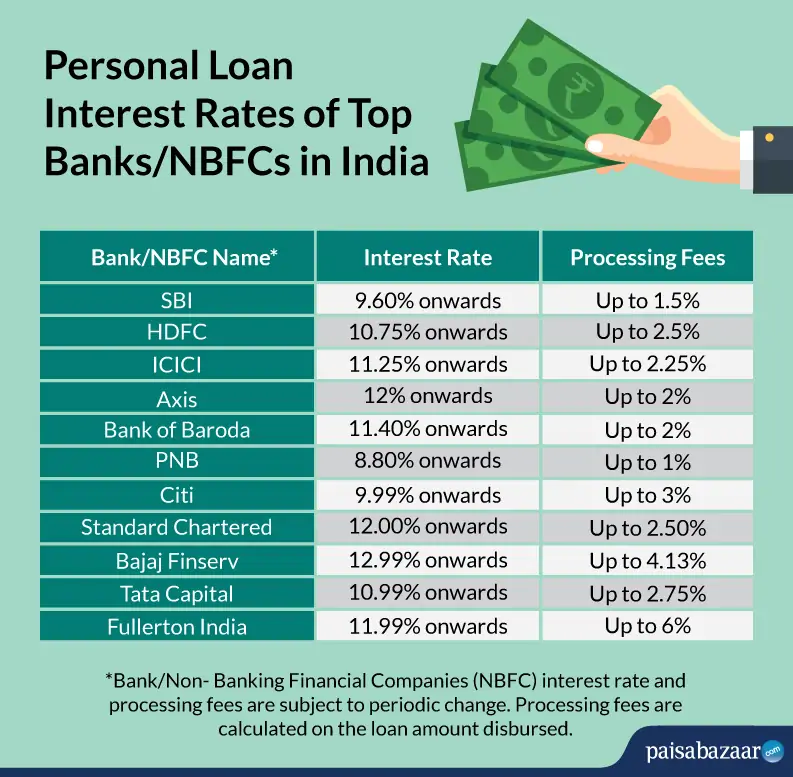

Lenders that frequently offer competitive personal loan interest rates include:

-

Credit Unions: Often provide lower rates to their members.

-

Online Lenders: These lenders can offer more competitive rates due to lower overhead costs.

-

Bullet points:

- Use online loan comparison websites.

- Check your credit report for accuracy. Errors can lower your credit score.

- Negotiate with lenders for a better rate. Sometimes, lenders are willing to negotiate, especially if you have multiple offers.

Factors Affecting Your Eligibility for Low Interest Rates

Your eligibility for low personal loan interest rates hinges on several key factors:

-

Credit Score: As mentioned earlier, a high credit score significantly improves your chances of securing a lower rate. Aim for a score above 700 for the most favorable terms.

-

Stable Income and Debt-to-Income Ratio: Lenders assess your ability to repay the loan. A stable income and a low debt-to-income ratio (DTI) demonstrate your financial responsibility.

-

Loan Purpose: The purpose of your loan can influence the interest rate. Some purposes, such as debt consolidation, may be viewed more favorably by lenders than others.

-

Bullet points:

- Improve your credit score before applying. Pay bills on time and keep credit utilization low.

- Maintain a healthy debt-to-income ratio. Reduce debt where possible before applying for a loan.

- Choose a loan purpose that lenders view favorably. Clearly articulate your reasons for needing the loan.

Avoiding Hidden Fees and Charges

Hidden fees can significantly increase the total cost of your personal loan. Be aware of:

- Origination Fees: These fees are charged by lenders to process your loan application.

- Prepayment Penalties: Some loans charge a fee if you pay off the loan early.

Always read the fine print carefully before signing any loan agreement. Compare the APR (Annual Percentage Rate), which includes all fees and interest, to ensure you're getting the best overall deal. Don't focus solely on the interest rate; consider the total cost of the loan.

- Bullet points:

- Compare APRs (Annual Percentage Rate) carefully.

- Look out for origination fees.

- Understand prepayment penalty clauses.

Secure Your Ideal Personal Loan Interest Rates Today

Securing the best personal loan interest rates involves careful comparison shopping, understanding the factors influencing rates, and avoiding hidden fees. Remember to focus on securing a rate under 6% by improving your credit score, maintaining a healthy debt-to-income ratio, and comparing offers from multiple lenders. Don't wait any longer to secure the best personal loan interest rates! Use the tips and resources mentioned above to compare offers and find the perfect loan for your needs. Start saving today by finding a personal loan with an interest rate under 6%.

Featured Posts

-

Bali Belly Causes Symptoms And Effective Treatments

May 28, 2025

Bali Belly Causes Symptoms And Effective Treatments

May 28, 2025 -

Rayan Cherki Transfer News Liverpool And Man Utds Pursuit Of Lyon Star Continues

May 28, 2025

Rayan Cherki Transfer News Liverpool And Man Utds Pursuit Of Lyon Star Continues

May 28, 2025 -

The Justin Baldoni Lawsuit Hugh Jackmans Show Of Support For Blake Lively And Ryan Reynolds

May 28, 2025

The Justin Baldoni Lawsuit Hugh Jackmans Show Of Support For Blake Lively And Ryan Reynolds

May 28, 2025 -

New Baseball Book Released On Opening Day A Must Read

May 28, 2025

New Baseball Book Released On Opening Day A Must Read

May 28, 2025 -

Understanding Bali Belly Causes Prevention And Treatment Options

May 28, 2025

Understanding Bali Belly Causes Prevention And Treatment Options

May 28, 2025

Latest Posts

-

Un Tenista Argentino Revela Su Admiracion Por El Dios Del Tenis Marcelo Rios

May 30, 2025

Un Tenista Argentino Revela Su Admiracion Por El Dios Del Tenis Marcelo Rios

May 30, 2025 -

Marcelo Rios La Opinion De Un Tenista Argentino Que Lo Odiaba

May 30, 2025

Marcelo Rios La Opinion De Un Tenista Argentino Que Lo Odiaba

May 30, 2025 -

Confesion De Un Tenista Argentino Marcelo Rios Una Leyenda

May 30, 2025

Confesion De Un Tenista Argentino Marcelo Rios Una Leyenda

May 30, 2025 -

El Chino Rios Un Dios Del Tenis Segun Un Tenista Argentino

May 30, 2025

El Chino Rios Un Dios Del Tenis Segun Un Tenista Argentino

May 30, 2025 -

Odiado Tenista Argentino Su Impactante Confesion Sobre Marcelo Rios

May 30, 2025

Odiado Tenista Argentino Su Impactante Confesion Sobre Marcelo Rios

May 30, 2025