Today's D-Wave Quantum (QBTS) Stock Spike: A Comprehensive Look

Table of Contents

The D-Wave Quantum (QBTS) stock experienced a significant price surge today, leaving many investors wondering about the reasons behind this unexpected jump. This article delves into the potential factors contributing to this volatility, examining recent company news, market trends, and the broader implications for the burgeoning quantum computing sector. We will analyze the contributing factors and offer insights into what investors should consider when evaluating QBTS stock.

Recent D-Wave Quantum News and Announcements

Several recent developments at D-Wave Quantum may explain the QBTS stock spike. Understanding these announcements is crucial for assessing the sustainability of this price increase and the long-term prospects of the company.

New Partnerships and Collaborations

Strategic partnerships often signal a company's growth potential and can significantly influence investor sentiment. D-Wave's recent collaborations could be a key driver behind today's QBTS stock rise.

- Partnership with [Company Name 1]: This collaboration focuses on [specific area of collaboration, e.g., applying D-Wave's quantum annealing technology to optimize logistics]. This partnership is significant because it provides D-Wave with access to [mention key resources or markets]. See the official press release [link to press release].

- Collaboration with [Company Name 2]: This agreement involves [specific details of the collaboration, e.g., joint research and development in quantum machine learning]. The potential impact on D-Wave's revenue streams is substantial, projecting an estimated [estimated percentage or value] increase in the next fiscal year. This is further evidenced by [mention specific data or quotes from the press release].

- Strategic Alliance with [Company Name 3]: This partnership expands D-Wave's reach into the [industry sector, e.g., financial services] market, opening new avenues for revenue generation and market penetration. The long-term implications of this alliance could lead to a substantial increase in QBTS stock valuation.

The combined effect of these partnerships suggests a positive outlook for D-Wave's future growth and profitability, potentially driving investor confidence and the subsequent QBTS stock price increase.

Technological Advancements and Breakthroughs

Innovation in quantum computing technology is vital for attracting investment. Any significant breakthroughs by D-Wave could justify the spike in QBTS stock.

- Improved Quantum Annealing Performance: D-Wave recently announced improvements in the performance of its quantum annealers, achieving [quantifiable improvement, e.g., a 20% reduction in solve time for specific problem sets]. This advancement could significantly expand the applicability of its technology. [Link to relevant scientific paper or publication].

- New Hybrid Quantum-Classical Algorithms: The development of more efficient hybrid algorithms combining classical and quantum computing capabilities could broaden the range of problems solvable by D-Wave's systems, attracting new customers and partners.

- Increased Qubit Count: A higher qubit count in their latest generation of quantum computers signifies an important milestone in scaling quantum computing technology, making the system more powerful and capable of tackling complex problems previously out of reach.

These advancements showcase D-Wave's commitment to innovation and could have instilled confidence in investors, leading to a surge in QBTS stock.

Financial Results and Earnings Reports

Strong financial results are another factor influencing stock prices. A recent positive earnings report could be a major contributing factor to today’s QBTS stock spike.

- Increased Revenue: D-Wave's recent earnings report may have shown a significant increase in revenue compared to previous quarters, indicating strong market demand for its quantum computing solutions.

- Improved Profit Margins: Better profit margins suggest improved efficiency and cost management, signifying a healthy financial state for the company.

- Positive Future Guidance: Positive projections about future revenue growth and profitability can significantly boost investor confidence and drive stock prices upwards.

A detailed analysis of the financial figures and their comparison to previous periods is essential for accurately assessing the implications of the report on the QBTS stock price.

Market Trends and Investor Sentiment

Beyond company-specific news, broader market conditions and investor sentiment significantly impact stock prices.

Overall Market Conditions

The overall market climate plays a crucial role in influencing individual stock performance.

- Positive Tech Sector Sentiment: A generally positive trend in the technology sector could have contributed to the increased investor appetite for quantum computing stocks, including QBTS.

- Increased Interest in Quantum Computing: Growing interest and investment in the broader quantum computing sector may have spilled over into D-Wave's stock price.

- Low Interest Rates: Low interest rates can encourage investors to seek higher returns in riskier assets, such as quantum computing stocks.

Analyzing overall market indices and investor confidence levels provides crucial context for interpreting the QBTS stock spike.

Investor Speculation and Hype

Speculation and hype can significantly influence stock prices, sometimes leading to short-lived price increases.

- Social Media Influence: Positive news and discussions on social media platforms regarding QBTS and the quantum computing sector might have amplified investor enthusiasm.

- News Media Coverage: Favorable news coverage highlighting D-Wave's advancements and partnerships could have attracted more attention from retail investors.

- Short-Squeezes: Short squeezes, where short-sellers are forced to buy shares to cover their positions, can also contribute to dramatic price increases.

While speculation can drive short-term gains, it’s essential to distinguish between sustainable growth driven by fundamental factors and fleeting hype.

Analyzing the Sustainability of the QBTS Stock Spike

The sustainability of today's QBTS stock surge depends on the long-term prospects of D-Wave and the overall quantum computing market.

Long-Term Growth Potential of D-Wave Quantum

D-Wave's long-term growth hinges on several factors:

- Market Size of Quantum Computing: The potential market size for quantum computing is vast, with applications across various industries. D-Wave's success will depend on its ability to capture a significant share of this expanding market.

- Competitive Landscape: Intense competition exists in the quantum computing space, with other companies developing different quantum computing technologies. D-Wave's competitive advantages, such as its existing customer base and established technology, will play a key role in its future success.

- Technological Advancements: Continued innovation and technological breakthroughs are crucial for maintaining D-Wave's competitive edge and driving future growth.

A comprehensive analysis of these factors provides a more accurate assessment of QBTS's future trajectory.

Risks and Challenges for D-Wave Quantum

Despite the positive news, several risks and challenges could impact D-Wave's performance:

- Technological Hurdles: Significant technological challenges remain in developing and scaling quantum computing technology. D-Wave needs to continue making advancements to overcome these hurdles.

- Competition: Competition from other players in the quantum computing market, both in hardware and software, could limit D-Wave's market share and revenue growth.

- Financial Risks: The quantum computing industry is still developing. Financial risks, such as securing sufficient funding and achieving profitability, are significant challenges.

- Regulatory Uncertainty: The evolving regulatory landscape for quantum computing technologies could present both opportunities and challenges for D-Wave.

Understanding these risks is crucial for investors evaluating the long-term viability of QBTS.

Conclusion

Today's surge in D-Wave Quantum (QBTS) stock price reflects the growing interest and potential of the quantum computing sector. While several factors, including new partnerships, technological advancements, and market sentiment, contributed to this spike, investors need to carefully assess both the opportunities and risks associated with QBTS and the broader quantum computing landscape before making investment decisions. Further research into D-Wave Quantum's technological advancements, financial performance, and competitive positioning, combined with a thorough understanding of market trends, is crucial for navigating this dynamic investment environment. Stay informed about future developments in D-Wave Quantum (QBTS) stock to make well-informed investment choices. Thorough due diligence is essential before investing in QBTS stock or any other quantum computing-related investment.

Featured Posts

-

Railroad Bridge Accident Two Adults Killed Childrens Fate Unknown

May 20, 2025

Railroad Bridge Accident Two Adults Killed Childrens Fate Unknown

May 20, 2025 -

Dywan Almhasbt Ykshf En Mkhalfat Rdwd Afeal Alnwab W Alkhtwat Altalyt

May 20, 2025

Dywan Almhasbt Ykshf En Mkhalfat Rdwd Afeal Alnwab W Alkhtwat Altalyt

May 20, 2025 -

Ferrari Risks Leclercs Loyalty By Focusing On Hamiltons Comfort

May 20, 2025

Ferrari Risks Leclercs Loyalty By Focusing On Hamiltons Comfort

May 20, 2025 -

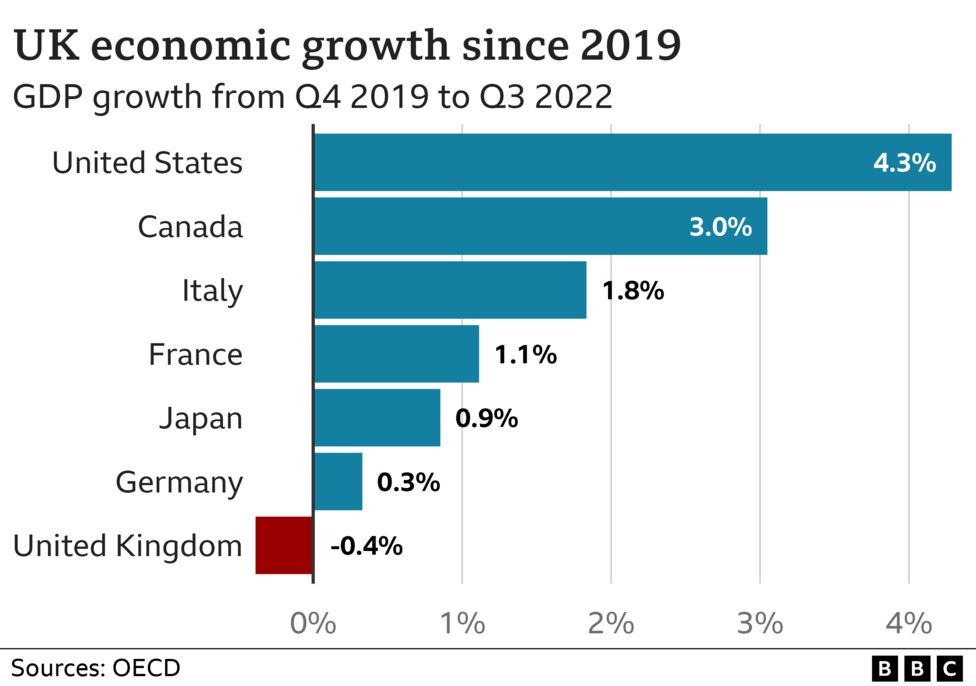

Uk Luxury Lobby Brexit Impact On Eu Exports

May 20, 2025

Uk Luxury Lobby Brexit Impact On Eu Exports

May 20, 2025 -

Stav Dedushkoy Novye Podrobnosti O Semeynoy Zhizni Mikhaelya Shumakhera

May 20, 2025

Stav Dedushkoy Novye Podrobnosti O Semeynoy Zhizni Mikhaelya Shumakhera

May 20, 2025